North America Snack Bar Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Snack Bar Market Trends & Summary

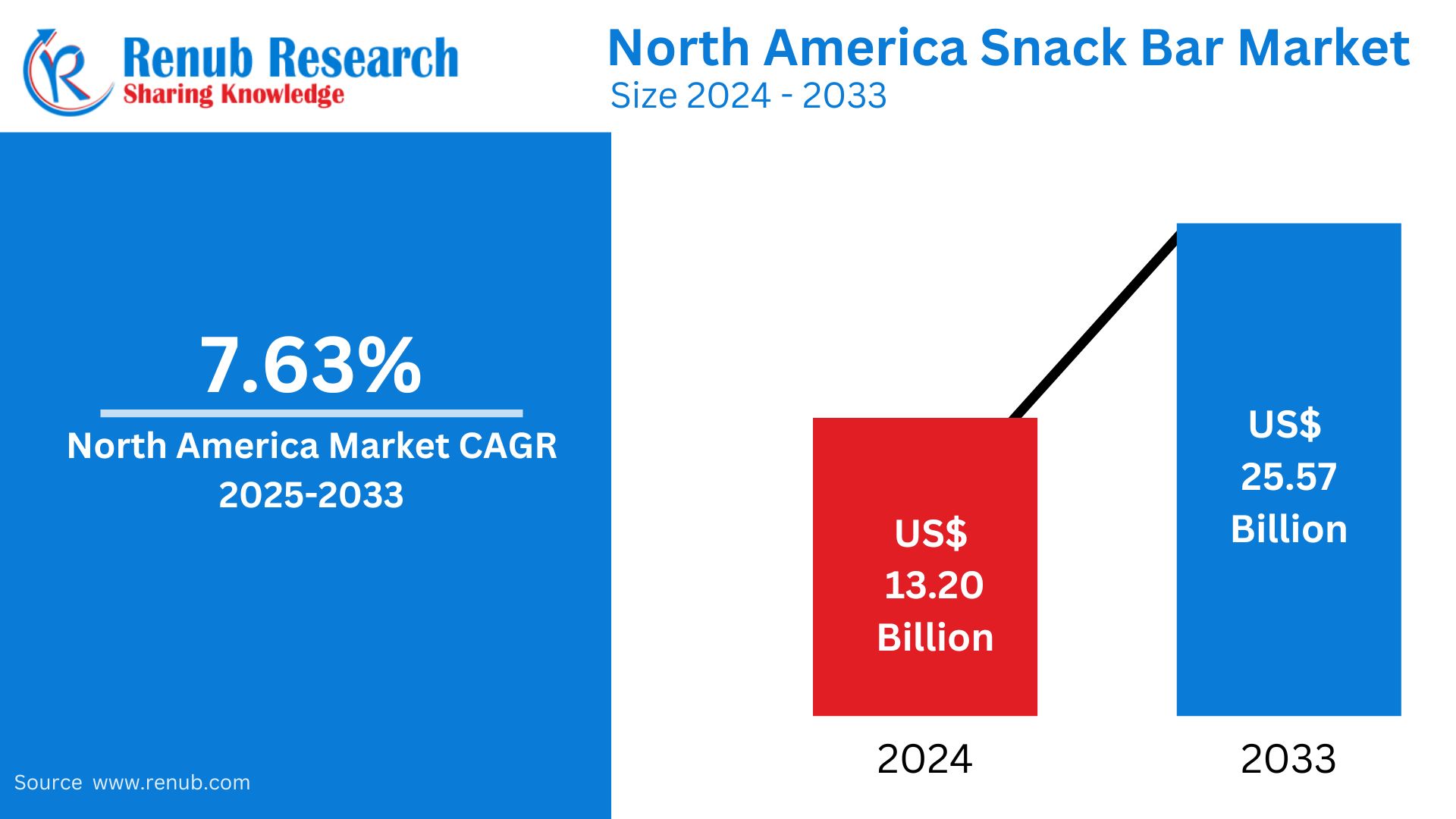

North America Snack Bar market is expected to reach US$ 25.57 billion by 2033 from US$ 13.20 billion in 2024, with a CAGR of 7.63% from 2025 to 2033. Busy lives, the need for healthy, convenient meal alternatives, the popularity of plant-based diets, growing awareness of clean ingredients, and a greater emphasis on functional advantages like immune and energy support are all driving factors in the snack bar market in North America.

North America Snack Bar Market Report by Confectionery Variant (Granola/Muesli Bars, Energy Bars, Nutrition Bars, Cereal Bars, Fruit and Nut Bars, Others), Distribution Channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others), Country (Canada, Mexico, United States, Rest of North America) and Company Analysis 2025-2033

North America Snack Bar Industry Overview

The growing desire from consumers for quick, wholesome, and portable snack options has led to a notable expansion in the snack bar market in North America. Snack bars have emerged as the preferred option for consumers looking for portable meals without sacrificing health advantages as more people lead hectic, fast-paced lives. The market is changing as customers seek for bars that meet particular dietary requirements, such as high-protein, gluten-free, keto, and vegan options, as well as those made with natural, clean ingredients. The industry has also grown since snack bars are being promoted more and more for their practical advantages, such improving digestion, boosting energy, or bolstering immunity.

The snack bar market has grown as a result of product development innovations such the use of plant-based proteins, superfoods, and low-sugar formulations. Snack bars have become a popular choice for busy professionals, fitness enthusiasts, and people searching for healthier meal options due to the increased emphasis on health and wellbeing among consumers and the growing acceptance of alternative diets. The market is confronted with obstacles, nonetheless, including fierce brand competition, the growing price of natural components, and shifting customer tastes. Notwithstanding these obstacles, it is anticipated that the snack bar market in North America will keep growing as more customers give sustainability, convenience, and health top priority when selecting snacks.

Convenient, wholesome snack options are strongly preferred, according to consumer behavior trends. According to recent studies, 51% of US consumers explicitly consumed regular, all-purpose snack bars in 2022, while over 90% of people consumed snacks, including snack bars. In order to meet this demand, the industry has diversified its product offerings, with manufacturers launching a range of formulas that cater to distinct consumer needs. With 36% of customers choosing protein bars, 35% choosing fiber bars, and 22% choosing nutrition bars, it is clear that consumer tastes are segmented and that the industry can accommodate a range of dietary needs.

With the industry seeing an unparalleled rise in health-conscious customers, the fitness and wellness trend remains a major market driver. About 64.19 million Americans, or almost 19% of the total population, were enrolled as members of gyms or health clubs as of 2023. Demand for functional snack bars has surged as a result of this generational transition, especially in the protein market, where 60% of customers in 2022 said that high-protein claims were significant when making judgments about what to buy. In response, producers are creating goods that complement these wellness-focused lifestyle preferences.

Growth Drivers for the North America Snack Bar Market

Health-Conscious Consumers

The demand for snack bars created with natural, clean ingredients has increased as more people place a higher priority on leading healthy lives. More and more consumers are searching for snacks with more nutrients and no artificial additives, sweets, or preservatives. Since these nutrients aid in weight management, muscle repair, and digestive health, protein, fiber, and healthy fats have emerged as major selling factors for many snack bars. Additionally, producers have been compelled to produce bars that reflect these ideals due to the growth of wellness trends and a greater understanding of the advantages of mindful eating. As more people look for nutrient-dense, well-balanced foods to go along with their active, health-conscious routines, there will likely be a continued need for better snack options.

Convenience and On-the-Go Consumption

Customers are looking for short, portable snack options that fit easily into their hectic schedules because modern life moves quickly. For people who need a quick and filling meal replacement when working out, traveling, or working out, snack bars are the perfect answer. They are ideal for people who are constantly on the road because of their lightweight packaging and low preparation requirements. Snack bars satisfy the requirement for convenience and nutrition, whether they are consumed as a mid-morning snack, post-workout fuel, or an afternoon pick-me-up. More snack bar businesses are concentrating on providing time-conscious consumers with wholesome, convenient bars as a result of the increased desire for ready-to-eat, hassle-free meals.

Rise in Plant-Based and Alternative Diets

The snack bar industry has had to change to accommodate a greater variety of dietary preferences as a result of the growing popularity of plant-based, gluten-free, keto, and low-sugar diets. Snack bars are being created to meet the specific nutritional requirements of these specialty diets as more people adopt them. For instance, plant-based snack bars include plant proteins like hemp or peas, whereas keto bars emphasize components that are high in fat and low in carbohydrates. Low-sugar bars appeal to consumers who are health-conscious and trying to control their blood sugar levels, while gluten-free bars serve people with dietary restrictions. Snack bar producers are experimenting with novel tastes, ingredients, and formulas to satisfy the demand from specialized markets as these dietary trends continue to expand.

Challenges in the North America Snack Bar Market

High Production Costs

Higher production costs are frequently the result of the growing demand for premium, organic, and clean-label ingredients in snack bars. Compared to traditional alternatives, ingredients like organic nuts, plant-based proteins, and superfoods are more costly to procure and process. The final cost of the product may rise dramatically as a result of these increased ingredient costs as well as the requirement for environmentally friendly packaging and production methods. Manufacturers still face the difficulty of striking a balance between competitive cost and product quality, even as customers place a greater value on solutions that are ethically sourced and healthier. This is especially challenging in a market where a lot of customers are price sensitive and searching for convenient, reasonably priced snack options. Without losing market share, manufacturers need to figure out how to absorb or balance these increased expenses.

Intense Market Competition

The snack bar industry in North America is extremely competitive, with several well-known brands and a steady stream of new competitors fighting for consumers' attention. Because of this overabundance, it is difficult for individual companies to stand out in a crowded market. Brands need to make large investments in marketing, creative product creation, and brand uniqueness if they want to remain competitive. Gaining customer loyalty in the face of so many options necessitates constant innovation in flavors, ingredients, and packaging. Price wars between rivals can also result in lower pricing, which would further reduce profit margins. In this fiercely competitive industry, smaller or more recent firms may find it challenging to compete with bigger, more established businesses that have better distribution and marketing expenditures.

North America Snack Bar Market Overview by Regions

By countries, the North America Snack Bar market is divided into Canada, Mexico, United States, Rest of North America.

United States Snack Bar Market

The market for snack bars in the US is expanding rapidly due to rising customer desire for quick, wholesome, and portable food options. Snack bars are becoming more popular among customers as quick, portable solutions that offer protein, energy, and other useful advantages as lifestyles get busier. Snack bars comprised of natural, clean ingredients are in high demand among health-conscious consumers, who are increasingly choosing plant-based, gluten-free, and low-sugar varieties. Furthermore, snack bars are being promoted more and more with extra nutritional advantages like boosting immunity or improving digestive health. The U.S. snack bar market is predicted to keep growing despite the competitive environment and growing manufacturing costs, with innovations in tastes, ingredients, and packaging fueling consumer interest and market expansion.

Growing customer demands for quick nutrition options and healthy lifestyle choices are driving a major shift in the US snack bar business. In response to this trend, big-box stores like Walmart, Sprouts, and Kroger are setting out aisles specifically for low-sugar and keto-friendly goods, making shopping easier for customers who are health-conscious. Supermarkets and hypermarkets are preserving their dominant positions in the retail industry by offering a wide range of products and allocating shelf space strategically in response to these shifting consumer preferences. The increased emphasis on convenient nutrition solutions is evidenced by recent market data showing that about 39.1% of US customers typically buy nutritious snacks and healthy snacks to go.

Canada Snack Bar Market

The market for snack bars in Canada is expanding gradually due to rising consumer demand for quick, easy, and healthful snack options. Snack bars with natural, clean ingredients—such as high-protein, gluten-free, and plant-based options—are becoming more and more popular in Canada as people grow more health conscious. Furthermore, functional snack bars that promote immunity, energy, and digestive health are becoming more and more well-liked. Snack bars are a great option for people looking for quick yet wholesome meals because of the growing need for portable snacks due to busy lifestyles. Nonetheless, there are still issues including growing production costs and rivalry from domestic and foreign businesses. Notwithstanding these obstacles, innovation and changing customer preferences are predicted to fuel the snack bar market's continued growth in Canada.

Mexico Snack Bar Market

The market for snack bars is expanding significantly in Mexico due to rising customer desire for quick, wholesome, and useful snack options. Mexican customers are increasingly choosing snack bars with natural ingredients, high protein, and fiber as they become more health conscious. Additionally, consumers looking to meet particular dietary requirements are increasingly purchasing plant-based, gluten-free, and low-sugar bars. More people are gravitating toward portable, on-the-go snacks as a result of busy lifestyles and increased awareness of wellness and fitness trends. Price sensitivity and competition from conventional snacks are still issues, though. The market for Mexican snack bars is anticipated to grow in spite of these challenges, thanks to creative products that satisfy regional tastes and preferences and growing health consciousness.

North America Snack Bar Market Segments

Confectionery Variant

• Granola/Muesli Bars

• Energy Bars

• Nutrition Bars

• Cereal Bars

• Fruit and Nut Bars

• Others

Distribution Channel

• Convenience Store

• Online Retail Store

• Supermarket/Hypermarket

• Others

Country

• Canada

• Mexico

• United States

• Rest of North America

All the Key players have been covered from 4 Viewpoints

• Overview

• Key Persons

• Recent Development

• Revenue

Key Players Analysis

1. Abbott Laboratories

2. Core Foods

3. General Mills Inc.

4. Go Macro LLC

5. Jamieson Wellness Inc.

6. Kellogg Company

7. Mars Incorporated

8. Mondelēz International Inc.

9. PepsiCo Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Confectionery Variant, By Distribution Channel and By Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the North America snack bar market by 2033?

-

What is the expected CAGR of the snack bar market from 2025 to 2033?

-

What are the key factors driving the growth of the North America snack bar market?

-

How is the rise of plant-based and alternative diets influencing the snack bar industry?

-

What are the major challenges facing snack bar manufacturers in North America?

-

Which distribution channels are included in the market segmentation?

-

What percentage of U.S. consumers consumed snack bars in 2022?

-

How is the demand for functional snack bars impacting the market?

-

Which are the leading companies analyzed in the report?

-

How does market competition affect pricing strategies for snack bars?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. North America Snack Bar Market

6. Market Share Analysis

6.1 By Confectionery Variant

6.2 By Distribution Channel

6.3 By Country

7. Confectionery Variant

7.1 Granola/Muesli Bars

7.2 Energy Bars

7.3 Nutrition Bars

7.4 Cereal Bars

7.5 Fruit and Nut Bars

7.6 Others

8. Distribution Channel

8.1 Convenience Store

8.2 Online Retail Store

8.3 Supermarket/Hypermarket

8.4 Others

9. Country

9.1 Canada

9.2 Mexico

9.3 United States

9.4 Rest of North America

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Abbott Laboratories

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Core Foods

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 General Mills Inc.

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Go Macro LLC

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Jamieson Wellness Inc.

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Kellogg Company

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Mars Incorporated

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Mondelēz International Inc.

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 PepsiCo Inc.

12.9.1 Overviews

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com