Global 4k Medical Imaging Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal 4k Medical Imaging Market Trends & Summary

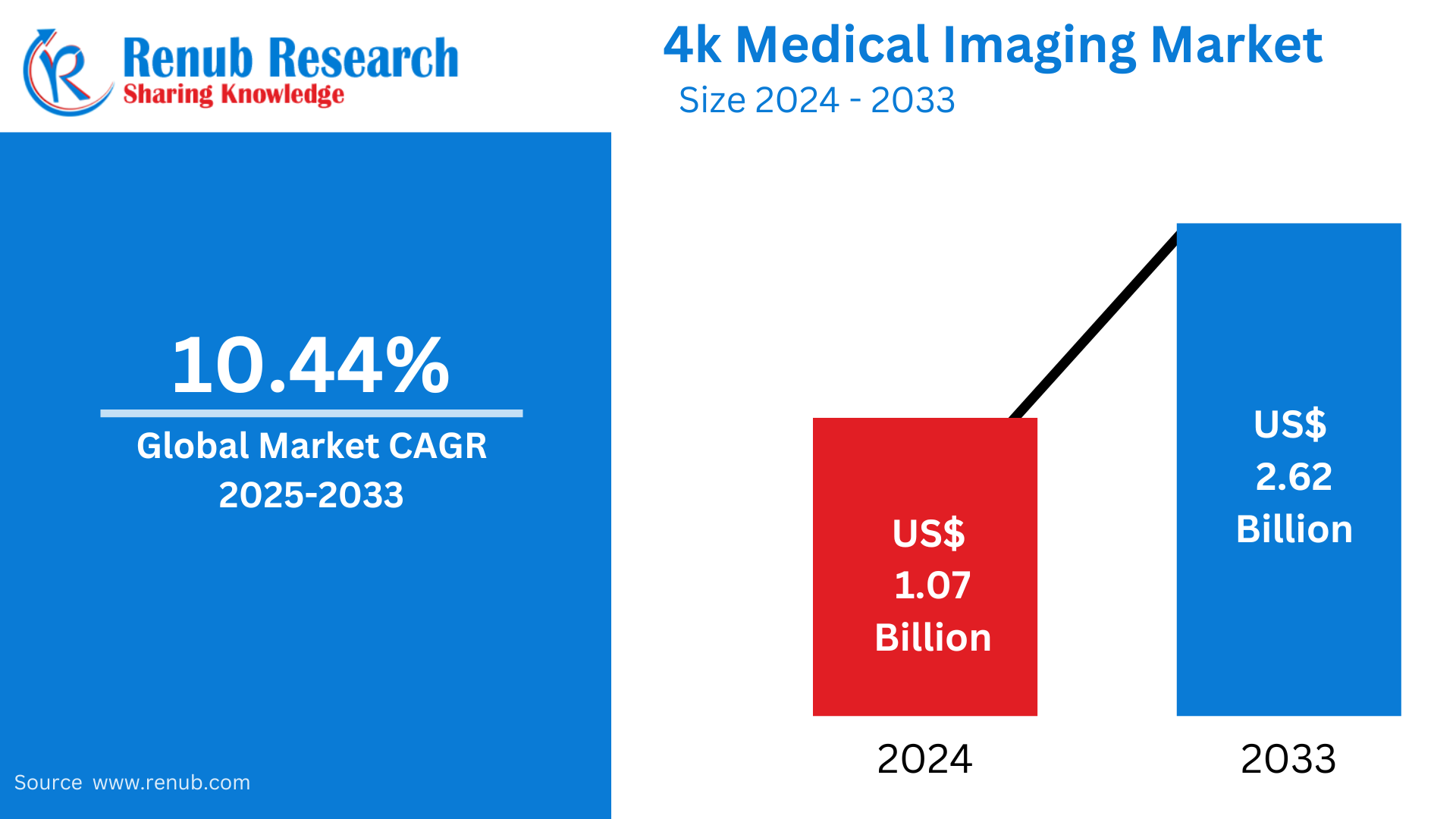

4k Medical Imaging Market is expected to reach US$ 2.62 billion 2033 from US$ 1.07 billion in 2024, with a CAGR of 10.44% from 2025 to 2033. Technological developments, the growing need for high-resolution imaging, rising healthcare expenditures, aging populations, and the expanding use of minimally invasive surgeries are all factors propelling the 4K medical imaging market.

4k Medical Imaging Market Global Report by Type (Magnetic Resonance Imaging, Computed Tomography, X-ray, Ultrasound, Others), End User (Hospitals, Diagnostic Imaging Centers, Specialty Clinics, Others), Countries and Company Analysis 2025-2033.

4k Medical Imaging Industry Overview

Ultra-high-definition (UHD) imaging technology applied in medical operations and diagnostics is referred to as 4K medical imaging. Compared to conventional HD photos, 4K imaging provides more clarity and detail because to its resolution of 3840 x 2160 pixels. Healthcare practitioners may more precisely view tissues, organs, and anomalies because to this improved resolution, which enhances surgical results and diagnostic precision. In disciplines where sharp images are essential, such as radiology, endoscopy, and surgery, 4K imaging is very useful. The technology is a useful tool in contemporary healthcare settings since it facilitates improved decision-making, lowers the possibility of errors, and improves patient care.

The market for 4K medical imaging is expanding due to improvements in imaging technology, which provide better clarity and precision for precise diagnosis. Adoption is accelerated by the growing need for high-resolution images in radiology, endoscopy, and surgery. The market is expanding due to the increased investments in healthcare infrastructure and the popularity of minimally invasive procedures. The market is expanding quickly because of the need for improved diagnostic tools due to the aging of the world's population and the need of medical professionals for better imaging to improve patient outcomes.

Growth Drivers for the 4k Medical Imaging Market

Growing Need in Healthcare for Improved Visualization

The need for better diagnosis and treatment results drives the demand for more sophisticated imaging technology. 4K imaging, on the other hand, provides fine-grained images that enable medical practitioners to spot problems early and provide more precise and individualized care. For example, Stryker's 1788 sophisticated imaging platform, which offers 4K high-resolution imaging for better surgical viewing, was introduced in India in September 2024. By improving fluorescence-guided surgery, the platform makes it possible to see vital anatomy and perfusion more clearly. On the other hand, this platform has an OLED display, a high dynamic range, and a larger color gamut. It also supports sophisticated imaging agents.

Developments in Video Recording Systems and Data Management

As healthcare environments demand more efficient workflows, 4K medical imaging devices now come with better video recording capabilities and sophisticated data management tools. The entire operational efficiency of medical facilities is also increased by these developments, which guarantee improved organization, safe storage, and simple retrieval of vital patient imaging data. For example, MediCapture introduced the MVR 4K, a cutting-edge 4Kp60 surgical recording system for digital operating rooms, in July 2024. With its dual 4K input, multi-input recording, sophisticated data management, and 1TB storage, this small system improves workflow flexibility and video security for clinics and hospitals performing intricate surgery.

Increasing Use of 4K Imaging in Accurate Surgery

As the precision of medical operations increases, so does the demand for high-resolution imaging. Additionally, 4K technology offers surgeons increased clarity and detail, which helps them see anatomical features more clearly and make better decisions during intricate surgeries. For example, Olympus introduced the 4K CH-S700-08-LB camera head for gynecological and urological treatments in September 2024. By combining 4K white light, 4K NBI, and blue light imaging, this cutting-edge equipment improves visibility during endoscopic procedures. Additionally, it enhances the results of diagnosis and therapy, particularly in the detection and resection of bladder cancer, which raises the demand for 4K medical imaging.

Challenges in the 4k Medical Imaging Market

High maintenance cost

For healthcare providers, the expense of maintaining 4K medical imaging devices is a major obstacle. These sophisticated systems need specialist technical assistance, software upgrades, and routine calibration, all of which can be costly. The long-term financial burden is further increased by the need to upgrade equipment to meet new standards as technology advances. Some institutions may find this continuous maintenance expense prohibitive, especially smaller or healthcare facilities with fewer resources.

Integration Issues

One of the biggest obstacles facing the 4K medical imaging business is integration. The newest 4K technology may not work with many healthcare facilities' outdated systems, necessitating expensive infrastructure changes. Furthermore, it might be difficult and time-consuming to integrate 4K imaging systems seamlessly with current electronic health records (EHR) and other diagnostic tools. In certain healthcare settings, these obstacles may cause a delay in the adoption of 4K imaging.

4k Medical Imaging Market Overview by Regions

The market for 4K medical imaging is expanding rapidly in all regions. North America is in the lead due to its high adoption rates and sophisticated healthcare infrastructure. Europe comes next, investing more in medical technology. The Asia Pacific region is expanding quickly as a result of better healthcare facilities, growing awareness, and increased healthcare demands. Although adoption is slower in Latin America and the Middle East and Africa because of infrastructural and cost issues, these regions are still developing markets.

United States 4k Medical Imaging Market

Advances in healthcare technology and the growing need for accurate, high-resolution imaging in surgery and diagnostics have made the US 4K medical imaging market a major participant. The United States is still at the forefront of 4K imaging system adoption thanks to large investments in healthcare infrastructure. Viseon Inc. took a significant step in August 2023 when it commercialized the 4K MaxView System, which was the first clinical application of this cutting-edge visualization technology for minimally invasive spine surgery. This invention, which improves visualization and precision, demonstrates the rising need for 4K imaging in specialist surgical operations. The U.S. market is anticipated to continue growing and innovating as the healthcare industry embraces 4K technology more and more.

Germany 4k Medical Imaging Market

Strong healthcare infrastructure, high demand for cutting-edge imaging technology, and an aging population are driving the growth of Germany's 4K medical imaging industry. In order to improve diagnostic accuracy, especially in areas like radiology and surgery, the nation's healthcare sector is progressively implementing 4K technologies. Additionally, Germany is a pioneer in the development of medical devices, which promotes market expansion. The industry is further supported by the incorporation of 4K imaging into endoscopic and minimally invasive surgical techniques. Germany continues to be a major player in Europe's 4K medical imaging market thanks to its consistent investments in healthcare and technology.

India 4k Medical Imaging Market

The economic system for 4K medical imaging in India is expanding quickly thanks to improvements in medical technology, higher patient awareness, and increased healthcare spending. High-resolution imaging is becoming more and more in demand, especially in fields where improved precision is essential, such as radiology, diagnostics, and minimally invasive surgery. The market is growing as a result of India's developing healthcare infrastructure and the rising number of private hospitals implementing state-of-the-art technologies. The adoption of 4K imaging equipment is further aided by an aging population and a rise in the prevalence of chronic illnesses, which makes India one of Asia's major growth markets for this technology.

Saudi Arabia 4k Medical Imaging Market

The market for 4K medical imaging in Saudi Arabia is expanding as a result of large investments in healthcare and a drive to update medical facilities. Advanced imaging technologies are becoming more and more in demand, especially in radiology, surgery, and diagnostics. Government programs like Vision 2030 seek to incorporate high-tech technologies and improve healthcare services. The nation's adoption of 4K imaging systems is being propelled by the growing emphasis on precision medicine and the quality of patient treatment.

4k Medical Imaging Market Segments

Type

- Magnetic Resonance Imaging

- Computed Tomography

- X-ray

- Ultrasound

- Others

End User

- Hospitals

- Diagnostic Imaging Centers

- Specialty Clinics

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key Persons

- Product Portfolio

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Stryker Corporation

- Zimmer Biomet Holdings,inc.

- Smith & Nephew Plc

- Conmed Corporation

- Medtronic plc

- Sony Group Corporation

- Fujifilm Holdings Corporation

- Hitachi Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By End User and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the global 4K medical imaging industry by 2033?

-

Which imaging technologies are driving the growth of 4K medical imaging?

-

How are advancements in video recording and data management systems influencing market growth?

-

What role does the rising demand for minimally invasive and image-guided surgeries play in market expansion?

-

Which end-user segment accounts for the largest market share in the 4K medical imaging market?

-

Which regional markets are leading the adoption of 4K medical imaging, and why?

-

What are the major challenges hindering the adoption of 4K medical imaging systems?

-

How are government initiatives like Saudi Arabia’s Vision 2030 influencing adoption in emerging markets?

-

What strategic moves are major players making in the 4K medical imaging space?

-

Which countries in Europe and Asia Pacific are most actively investing in 4K medical imaging technology?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. Global 4K Medical Imaging Market

6. Market Share Analysis

6.1 By Type

6.2 By End User

6.3 By Countries

7. Type

7.1 Magnetic Resonance Imaging

7.2 Computed Tomography

7.3 X-ray

7.4 Ultrasound

7.5 Others

8. End User

8.1 Hospitals

8.2 Diagnostic Imaging Centers

8.3 Specialty Clinics

8.4 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1.1 Strength

11.1.2 Weakness

11.1.3 Opportunity

11.1.4 Threat

12. Key Players Analysis

12.1 Stryker Corporation

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Product Portfolio

12.1.4 Recent Development & Strategies

12.1.5 Revenue Analysis

12.2 Zimmer Biomet Holdings,inc.

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Product Portfolio

12.2.4 Recent Development & Strategies

12.2.5 Revenue Analysis

12.3 Smith & Nephew Plc

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Product Portfolio

12.3.4 Recent Development & Strategies

12.3.5 Revenue Analysis

12.4 Conmed Corporation

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Product Portfolio

12.4.4 Recent Development & Strategies

12.4.5 Revenue Analysis

12.5 Medtronic plc

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Product Portfolio

12.5.4 Recent Development & Strategies

12.5.5 Revenue Analysis

12.6 Sony Group Corporation

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Product Portfolio

12.6.4 Recent Development & Strategies

12.6.5 Revenue Analysis

12.7 Fujifilm Holdings Corporation

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Product Portfolio

12.7.4 Recent Development & Strategies

12.7.5 Revenue Analysis

12.8 Hitachi Ltd.

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Product Portfolio

12.8.4 Recent Development & Strategies

12.8.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com