Saudi Arabia Hotel Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowSaudi Arabia Hotel Market Share & Summary

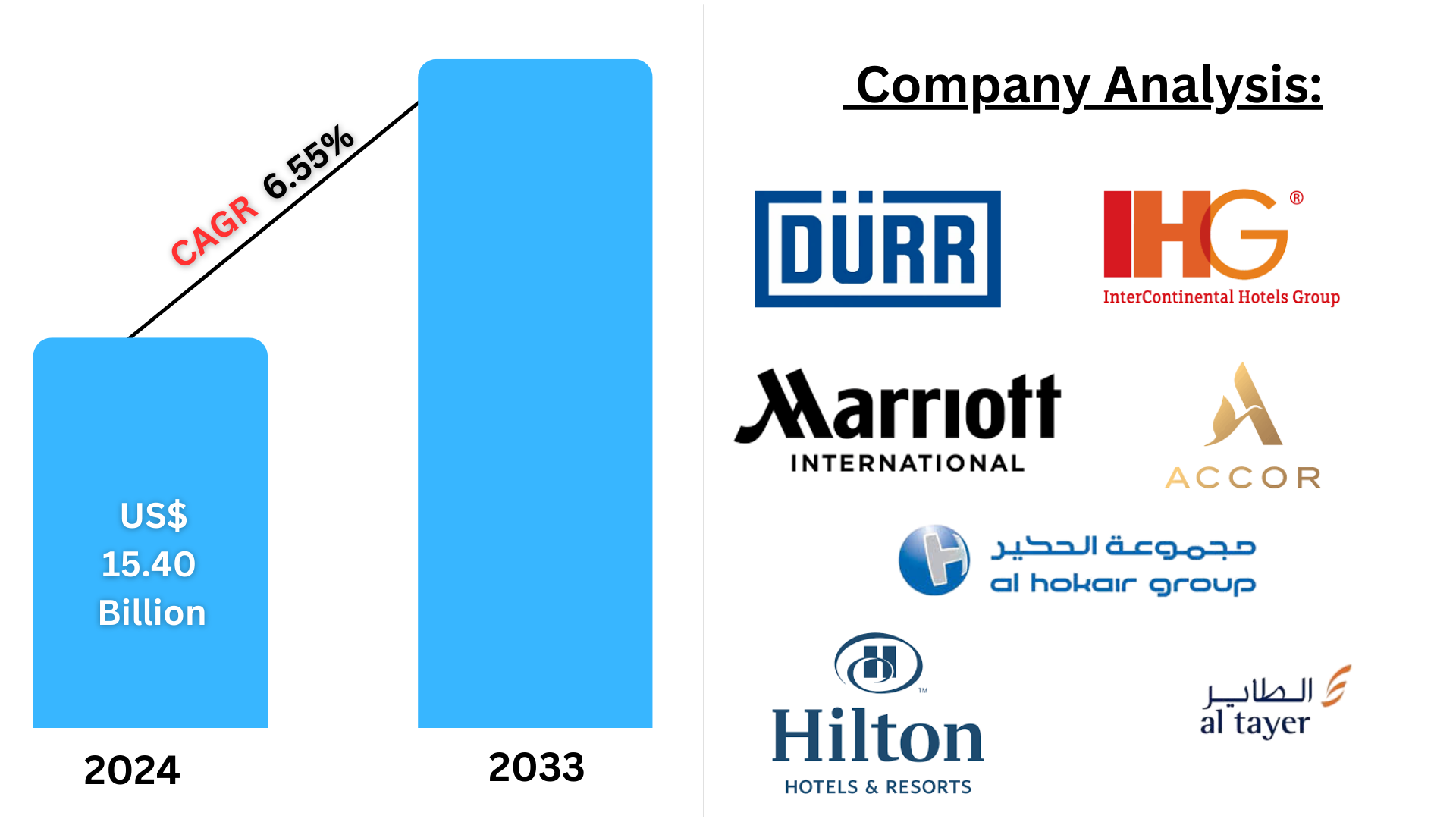

The Saudi Arabian hotel sector is expected to expand strongly, rising from an estimated worth of US$ 15.40 billion in 2024 to US$ 27.26 billion in 2033. This is at a compound annual growth rate (CAGR) of 6.55% during 2025-2033. The major drivers for this market expansion are the establishment of high-end hotel facilities and the roll-out of supportive regulations by government agencies to ease the process of applying for visas.

The Saudi Arabia hotel market forecast report is a detailed analysis within various hotel categories, such as high-end, mid-scale, and budget accommodations. The report analyzes the dynamics of ordering platforms in terms of both online and offline channels. The report also bifurcates the market by prominent regions like Riyadh, Jeddah, Makkah, Madinah, Al Khobar, and Dammam. It also features an extensive Saudi Arabian cities overview and company performance analysis with forecasted trends and developments from 2025 to 2033.

Saudi Arabia Hotel Industry Overview

Due to a number of significant government efforts aimed at growing the hotel business and raising the country's overall tourist goals, the hospitality sector in Saudi Arabia has experienced a significant expansion in recent years. According to the G20, Saudi Arabia has the world's fastest-growing travel destination. According to the UNWTO, international visitor visits to the Kingdom increased by 125% to pre-pandemic levels last year, drawing almost 94 million visitors and surpassing the recovery of the worldwide tourism sector.

Over the next six years, Saudi Arabia intends to invest more than USD 550 billion in new vacation destinations, making it the largest tourism investor globally. Its endeavors to expand its tourism and hospitality industries are the reason behind this. With almost 20 million visitors over the first three quarters of the previous year, Saudi Arabia topped the Arab rankings for inbound tourism. The industry aspires to attain the target of 100 million annual tourist visits and contribute 10% of GDP in the next six years with the recent passage of the Act. Travel restrictions are removed, allowing a plethora of tourists to enter the Kingdom. The new visa laws, such as e-visas and visas-on-arrival for travelers from 49 countries, are to blame for the expansion of the hotel sector.

Growth Driver in the Saudi Arabia Hotel Market

Religious Tourism Boom Fuelling Demand

Saudi Arabia's expanding religious tourism industry, led by Makkah and Madinah, remains a key driver of hotel market expansion. The Kingdom welcomes millions of pilgrims each year for Hajj and Umrah, generating steady demand for accommodations from luxury to affordable hotels. Government initiatives under Vision 2030 to expand pilgrim capacity and enhance infrastructure are driving hotel development and expansion, especially around sacred places. This growth not only improves occupancy levels but also stimulates global hotel chains to invest in the Saudi market, making the industry more competitive and diversified. In 2024, Saudi Arabia hosted a record 18.5 million pilgrims to Makkah and Madinah, reflecting its commitment to enhancing the spiritual experience for Muslims globally.

Vision 2030 and Economic Diversification

Saudi Arabia's Vision 2030 program has spurred economic diversification by encouraging tourism and hospitality as major industries. Gigantic projects such as NEOM, the Red Sea Project, and Qiddiya are rebranding the Kingdom as a world tourism hub. These are driving hotel demand in the high-end, resort, and business segments. Government promotions of foreign investment and simplified licensing procedures also attract hotel operators into the market. International events and conference promotion are driving business travel and MICE tourism further, boosting year-round hotel occupancy. October 2024, the New Murabba Development Company, a member of Saudi Arabia's Public Investment Fund, confirmed its platinum sponsorship of Future Hospitality Summit in Dubai from September 30 to October 2. CEO Michael Dyke disclosed plans for a 27 million square meter development housing 18 communities, more than 100,000 homes, 9,000 hotel rooms, and the Mukaab—a 400-meter tower combining modern Najdi architecture with digital technologies—intended to make New Murabba a top tourism and hospitality destination.

Emergence of Inbound and Outbound Domestic and Regional Tourism

Travel behavior changed following the COVID-19 pandemic, as people started flooding into domestic destinations within the Saudi territory. Citizens and residents started discovering AlUla, Abha, and Red Sea coast destinations, which meant a heightened need for accommodations around the region. Regional tourism in Saudi Arabia is becoming more attractive following Saudi initiatives to discover new cultural, heritage, and natural attractions. Targeted marketing, eased visa policies, and investment in domestic transport infrastructure have been key factors. This increasing domestic and regional demand has boosted the overall hotel ecosystem of the Kingdom. Saudi Arabia's domestic tourism market recorded a staggering 44% boost in bookings in 2024, representing more than 40% of overall travel activity within the country. Interestingly, 35% of total room nights booked were in 3-star or lower hotels, indicating increased demand for value accommodations. Families and groups propelled this action, with family stays rising 90% and group bookings by 60%. Alternative accommodations such as holiday rentals and hotel apartments also gained popularity due to their convenience and affordability.

Challenges in the Saudi Arabia Hotel Market

High Operational Costs and Workforce Challenges

Managing a hotel in Saudi Arabia is very costly in terms of staffing, maintenance, and energy use—particularly for high-end hotels. The industry also sees a challenge in workforce localization under the Saudization policy that requires hiring Saudi nationals. Although this is local employment, this can incur greater recruitment and training costs. A lack of competent hospitality professionals in the country puts pressure on hotel operators, tending to compromise service quality and operational efficiency. Balancing Saudization compliance with high service standards is a significant challenge that calls for ongoing investment in local skills development.

Market Saturation in Major Cities

With fast hotel development in major cities such as Riyadh, Jeddah, and Makkah, market saturation concerns are increasing. The arrival of global and domestic hotel chains has been met with heightened competition, especially in the upscale and mid-scale sectors. This breeds price pressures and watered-down occupancy levels, especially in low seasons. Without corresponding increases in tourist volumes, these segments face the danger of oversupply. Strategic diversification into virgin zones and niche hospitality niches is critical to match supply with demand and propel sustainable growth in the Saudi hotel market.

Saudi Arabia High-End Hotel Market

Saudi Arabia's high-end hotel market is experiencing robust growth due to the arrival of foreign travelers, luxury-oriented religious travelers, and business travelers. Riyadh and Jeddah host international luxury brands like Ritz-Carlton, Four Seasons, and Marriott, whereas Makkah and Madinah offer premium pilgrimage accommodations. Vision 2030’s mega-projects, such as NEOM and The Red Sea Project, are expected to further boost this segment by creating world-class resorts and ultra-luxury experiences. High-end hotels are also benefiting from growing demand for wellness, spa, and fine dining experiences among affluent guests.

Saudi Arabia Mid-Scale Hotel Market

Mid-scale hotels play a pivotal role in accommodating both domestic tourists and budget-conscious international visitors. Brands like Holiday Inn, Novotel, and Park Inn are growing aggressively in secondary cities and around religious sites. The segment is appealing to pilgrims, corporate travelers, and domestic tourists looking for comfort at affordable prices. Domestic travel, coupled with the government's tourism diversification program, is driving demand in this space. These hotels typically present standardized services, prime locations, and price-for-value experiences that make them an integral part of the Kingdom's developing hospitality framework.

Saudi Arabia Online Hotel Market

Saudi Arabia's online hotel market is growing significantly with high internet penetration, mobile phone adoption, and web-based travel behaviour. Shoppers use online venues for comparing rates, reading reviews, and conveniently booking accommodation. International OTAs such as Booking.com and local players like Almosafer are still leading the way. Hotels are also optimizing their own websites and mobile apps to provide direct booking benefits. The boom in domestic and regional tourism after COVID has further strengthened the need for online presence. With travelers insisting on flexibility and real-time confirmations, digital channels will continue to be a part of the hotel booking process.

Saudi Arabia Hotel Occupancy Rate Market

Saudi hotel occupancy rates have recorded robust post-pandemic recovery, particularly in religious and business tourism-linked cities. Makkah and Madinah witness peak seasonal occupancy during Hajj and Umrah seasons, while Riyadh and Jeddah have consistent rates fueled by government events and corporate travel. Increased domestic tourism has also anchored off-season performance. Competition and new hotel supply, however, test year-round occupancy. Future tourism development projects and international events will be propelling long-term growth. Tracking occupancy rates enables investors and operators to balance strategy with fluctuating demand and maximize profitability.

Saudi Arabia Hotel Market Overview by Regions

Regional differences exist in Saudi Arabia's hotel industry; Mecca and Medina serve religious tourists, while Riyadh and Jeddah dominate the urban lodging market. The Red Sea and new initiatives like NEOM boost travel and draw a variety of hotel construction across the country. An overview of the market by region is given below:

Makkah Hotel Market

Serving the millions of pilgrims that go to Makkah for the Hajj and Umrah, religious tourism is the main driver of the city's hotel industry. For the convenience of worshippers, the area offers a variety of high-end and low-cost hotels, with a notable concentration close to the Haram. The visitor experience is being improved by ongoing investments in hospitality services and infrastructure. During the Hajj season, demand is at its highest, so there must always be rooms available. Furthermore, projects like the Makkah Royal Clock Tower are meant to improve the area's standing as a popular pilgrimage site worldwide. The market is expected to develop as a result of more pilgrims and more amenities.

Since Makkah is preparing for a new age in hospitality, Umm Al-Qura and GAA's joint efforts represent an important turning point. In line with Saudi Arabia's Vision 2030, the SAR2.5 billion investment in the hotel industry not only meets the urgent need for better lodging but also establishes the groundwork for Makkah's long-term economic and social growth.

Riyadh Hotel Market

Business travel, government programs, and rising tourism are the main drivers of the Riyadh hotel market, which is a significant part of Saudi Arabia's hospitality industry. The city offers a wide variety of lodging choices for both domestic and foreign tourists, ranging from upscale hotels to affordable choices. While business districts draw corporate tourists, major regions like Olaya and Al Malaz are home to a large number of upscale properties. The demand for hotel rooms is increasing due to continued urban expansion and events like conferences and fairs. In order to establish Riyadh as a top business and leisure destination, the government's Vision 2030 project promotes investment in infrastructure and hotels.

Saudi Arabia Hotel Company Analysis

The major participants in the Saudi Arabia Hotel market includes Dur Group, IHG Group, Marriot International, Accor, Hilton Hotels, Al Hokair Group, Altyaar Group, etc.

Saudi Arabia Hotel Company News

In May 2023, after purchasing the City Express brand portfolio from Hoteles City Express, Marriott International introduced its 31st brand, City Express by Marriott.

In April 2023, in return for new Taiba shares, the Saudi-based Taiba Investments Company purchased a 100% share in Dur Hospitality Company. It entails adhering to the agreement the two signed in December 2022 on a potential securities exchange transaction, which includes a non-binding agreement on share swap coefficient and structuring.

Saudi Arabia Hotel Market Segments

Hotel Type- Industry is divided into 3 viewpoints:

- High End Hotel

- Mid-Scale Hotel

- Budget Hotel

Ordering Platform- Industry is divided into 2 viewpoints:

- Online

- Offline

Region- Industry is divided into 6 viewpoints:

- Makkah

- Riyadh

- Madinah

- Jeddah

- Al Khobar

- Dammam

All companies have been covered with 4 Viewpoints

- Overview

- Key Person

- Recent Development

- Revenue Analysis

Company Analysis

- Dur Group

- IHG Group

- Marriot International

- Accor

- Hilton Hotels

- Al Hokair Group

- Altyaar Group

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2019 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Hotel Type, Ordering Platform and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

- How big is the Saudi Arabia Hotel industry?

- What is the Saudi Arabia Hotel growth rate?

- Who are the key players in Saudi Arabia Hotel industry?

- What are the factors driving the Saudi Arabia Hotel industry?

- Which Region held the largest market share in the Saudi Arabia Hotel industry?

- What segments are covered in the Saudi Arabia Hotel Market report?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenge

5. Saudi Arabia Hotel Market Analysis

5.1 Market

5.2 Current and Future Hotel Room Supply

5.2.1 Luxury

5.2.2 Upper Upscale

5.2.3 Upscale

5.2.4 Upper Midscale

5.2.5 Midscale

5.3 Hospitality Market Performance (2023)

5.3.1 ADR (average daily rent per night)

5.3.2 REVPAR (Per room per night)

5.3.3 Occupancy Rate

5.4 Giga Projects with Planned Hotel Keys in Holy Cities

5.4.1 NEOM

5.4.2 Ruaa Al Madinah

5.4.3 Knowledge Economic City

5.4.4 Masar Makkah

5.4.5 Dar Al Hijrah

5.4.6 Thakher Makkah

5.4.7 Red Sea Project

5.5 Supply breakdown by operator classification Keys

5.5.1 International Brand

5.5.2 Unbranded

5.5.3 Local Brand

5.6 Saudi Arabia's Top 6 Hotel Operators Supply breakdown by Operator Classification

5.6.1 Radisson Hotel Group

5.6.2 Hilton Worldwide

5.6.3 IHG Hotels & Resorts

5.6.4 Accor

5.6.5 Marriott International

6. Market Share Analysis

6.1 By Hotel Type

6.2 By Ordering Platform

6.3 By Region

7. Hotel Type

7.1 High End Hotel

7.1.1 Market

7.1.2 Volume

7.2 Mid-Scale Hotel

7.2.1 Market

7.2.2 Volume

7.3 Budget Hotel

7.3.1 Market

7.3.2 Volume

8. Ordering Platform

8.1 Online

8.2 Offline

9. Region

9.1 Makkah

9.1.1 Market

9.1.2 Number of Rooms

9.1.3 Room Average Daily Rate (ADR)

9.1.4 Revenue per Available Room (RevPAR)

9.1.5 Occupancy Rate

9.2 Riyadh

9.2.1 Market

9.2.2 Number of Rooms

9.2.3 Room Average Daily Rate (ADR)

9.2.4 Revenue per Available Room (RevPAR)

9.2.5 Occupancy Rate

9.3 Madinah

9.3.1 Market

9.3.2 Number of Rooms

9.3.3 Room Average Daily Rate (ADR)

9.3.4 Revenue per Available Room (RevPAR)

9.3.5 Occupancy Rate

9.4 Jeddah

9.4.1 Market

9.4.2 Number of Rooms

9.4.3 Room Average Daily Rate (ADR)

9.4.4 Revenue per Available Room (RevPAR)

9.4.5 Occupancy Rate

9.5 Al Khobar

9.5.1 Market

9.5.2 Number of Rooms

9.5.3 Room Average Daily Rate (ADR)

9.5.4 Revenue per Available Room (RevPAR)

9.5.5 Occupancy Rate

9.6 Dammam

9.6.1 Market

9.6.2 Number of Rooms

9.6.3 Room Average Daily Rate (ADR)

9.6.4 Revenue per Available Room (RevPAR)

9.6.5 Occupancy Rate

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1.1 Strength

11.1.2 Weakness

11.1.3 Opportunity

11.1.4 Threat

12. Key Players Analysis

12.1 Dur Group

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Development

12.1.4 Revenue Analysis

12.2 IHG Group

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Development

12.2.4 Revenue Analysis

12.3 Marriot International

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Development

12.3.4 Revenue Analysis

12.4 Accor

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Development

12.4.4 Revenue Analysis

12.5 Hilton Hotels

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Development

12.5.4 Revenue Analysis

12.6 Al Hokair Group

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Development

12.6.4 Revenue Analysis

12.7 Altyaar Group

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Development

12.7.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com