Aerostat Systems Market, Growth & Forecast, COVID-19 Impact, Industry Trends, By Product, Application, Opportunity Company Analysis

Buy NowAerostat Systems Market Outlook

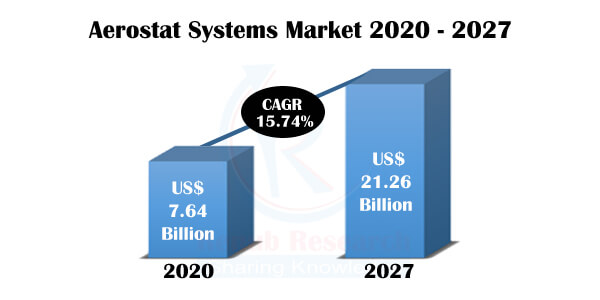

An aerostat is essentially an aerodynamically shaped balloon that is tethered to the ground. They are made of large fabric envelopes filled with helium or hot air and have an optimal reach of around 4,600 m in height. Aerostat systems are used for various applications, including information gathering, surveillance and scientific research. They are durable, eco-friendly and cost-effective, as well as have high structural integrity. According to Renub Research, Aerostat Systems Market is projected to reach US$ 21.26 Billion by 2027.

Coronavirus Pandemic Impact on Aerostats Systems

However, the outbreak of the coronavirus disease (COVID-19) and the imposition of lockdown in several countries have disrupted operations at the production units of aerostat systems globally. It has negatively affected the market because of the temporary closures of several manufacturing units and the disruption of the supply chain.

Factors Driving Aerostat Industry

Further, increasing territorial tensions, terrorism, and border infiltrations worldwide are propelling the militaries to enhance their battlefield data-sharing capabilities. This has resulted in several countries adopting the aerostatic system as an alternative. Aerostat systems work 24/7 for weeks or even months at a time, offering persistent surveillance.

That is why governments all over the globe have started promoting the utilization of aerostat systems for different military applications, including surveillance and border security. Aerostat systems are increasingly being used for communicating signs that indicate natural disasters, civil unrest and crimes within a country. As per our research findings, Aerostat Systems Market Size was US$ 7.64 Billion in 2020.

The Military and Law Enforcement Segment has the Largest Market Share

Based on Application, The aerostat systems market includes Military, Law Enforcement, Commercial and Environmental Research. The military and law enforcement segment has the largest market share. This is primarily due to increased demand for aerostat systems products like Airship, Balloons and Hybrid to support intelligence, surveillance, reconnaissance missions and enhance network communications capabilities in land and sea platforms.

Additionally, aerostats are also becoming popular for commercial applications, like internet connectivity. Aerostats are promptly expanding LTE networks and 5G technology in remote areas at a significantly low cost and energy. As per our Report, Aerostat Systems Industry is likely to grow at a double digit CAGR of 15.74% during (2020- 2027).

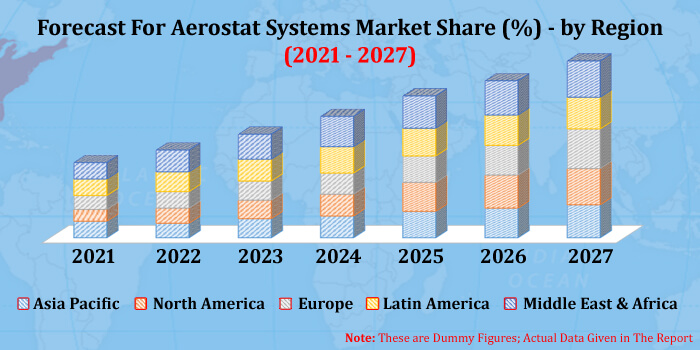

Regional Analysis of Aerostats Systems Market Size

North America is the most comprehensive market for aerostat systems globally and is also spending heavily on aerostat systems for surveillance and communication purposes. In 2019, a sum of US$ 300,000 was granted by the Federal Department of Homeland Security to Las Vegas Police Department to enhance the city's surveillance. The rising Application of aerostat in military operations and homeland security significantly demand aerostat systems in the North American region.

Moreover, the increasing terrorist activities and territorial tension between different countries in the Asia Pacific region result in the rising need for high surveillance units and the growing intelligence among countries. Aerostats systems are used in these regions to extend the nation's intelligence and police investigation capabilities.

Key Players Performance in Aerostat Systems Industry

Leading manufacturers such as ILC Dover, LP, Lockheed Martin Corporation, Raven Industries Inc., Raytheon Company and Thales Group are collaborating with telecommunication service providers to improve the telecommunication network quality. For instance, Raven Industries received a US$ 10.4 Million contract in 2019 for its TIF-25K aerostat systems to be deployed in Afghanistan.

Renub Research latest report “Aerostat Systems Market by Product (Airship, Balloons and Hybrid), Application (Military, Law Enforcement, Commercial and Environmental Research), End User (Government, Private Sector), Region (Asia Pacific, North America, Latin America, Europe, Middle East & Africa), Company Analysis (ILC Dover, LP, Lockheed Martin Corporation, Raven Industries Inc., Raytheon Company and Thales Group)” provides a detailed analysis Aerostat Systems Industry.

Product – Aerostat Systems Market have been covered from 3 Viewpoints:

1. Airship

2. Balloons

3. Hybrid

Application – Aerostat Systems Market have been covered from 4 Viewpoints:

1. Military

2. Law Enforcement

3. Commercial

4. Environmental Research

End User – Aerostat Systems Market have been covered from 2 Viewpoints:

1. Government

2. Private Sector

Region – Aerostat Systems Market have been covered from 5 Viewpoints:

1. Asia Pacific

2. North America

3. Europe

4. Latin America

5. Middle East & Africa

Company Insights:

• Overview

• Company Initiatives

• Sales Analysis

Companies Covered:

1. ILC Dover, LP

2. Lockheed Martin Corporation

3. Raven Industries Inc.

4. Raytheon Company

5. Thales Group

Report Details:

| Report Features | Details |

| Base Year | 2020 |

| Historical Period | 2017 - 2020 |

| Forecast Period | 2021 - 2027 |

| Market | US$ Billion |

| Segment Covered | Product, Application, End User, Region |

| Region Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Companies Covered | ILC Dover, LP, Lockheed Martin Corporation, Raven Industries Inc., Raytheon Company, Thales Group |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Aerostat Systems Market

6. Market Share – Aerostat Systems Market

6.1 By Product

6.2 By Application

6.3 By End User

6.4 By Region

7. Product – Aerostat Systems Market

7.1 Airship

7.2 Balloons

7.3 Hybrid

8. Application – Aerostat Systems Market

8.1 Millitary

8.2 Law Enforcement

8.3 Commercial

8.4 Environmental Research

9. End User – Aerostat Systems Market

9.1 Government

9.2 Private Sector

10. Region – Aerostat Systems Market

10.1 Asia Pacific

10.2 North America

10.3 Europe

10.4 Latin America

10.5 Middle East & Africa

11. Company Analysis

11.1 ILC Dover, LP

11.1.1 Overview

11.1.2 Recent Development

11.1.3 Financial Insights

11.2 Lockheed Martin Corporation

11.2.1 Overview

11.2.2 Recent Development

11.2.3 Financial Insights

11.3 Raven Industries Inc.

11.3.1 Overview

11.3.2 Recent Development

11.3.3 Financial Insights

11.4 Raytheon Company

11.4.1 Overview

11.4.2 Recent Development

11.4.3 Financial Insights

11.5 Thales Group

11.5.1 Overview

11.5.2 Recent Development

11.5.3 Financial Insights

List Of Figures:

Figure-01: Global Aerostat Systems Market (Billion US$), 2017 – 2020

Figure-02: Forecast for – Global Aerostat Systems Market (Billion US$), 2021 – 2027

Figure-03: Product – Airship Market (Billion US$), 2017 – 2020

Figure-04: Product – Forecast for Airship Market (Billion US$), 2021 – 2027

Figure-05: Product – Balloons Market (Billion US$), 2017 – 2020

Figure-06: Product – Forecast for Balloons Market (Billion US$), 2021 – 2027

Figure-07: Product – Hybrid Market (Billion US$), 2017 – 2020

Figure-08: Product – Forecast for Hybrid Market (Billion US$), 2021 – 2027

Figure-09: Application – Millitary Market (Billion US$), 2017 – 2020

Figure-10: Application – Forecast for Millitary Market (Billion US$), 2021 – 2027

Figure-11: Application – Law Enforcement Market (Billion US$), 2017 – 2020

Figure-12: Application – Forecast for Law Enforcement Market (Billion US$), 2021 – 2027

Figure-13: Application – Commercial Market (Billion US$), 2017 – 2020

Figure-14: Application – Forecast for Commercial Market (Billion US$), 2021 – 2027

Figure-15: Application – Environmental Research Market (Billion US$), 2017 – 2020

Figure-16: Application – Forecast for Environmental Research Market (Billion US$), 2021 – 2027

Figure-17: End-User – Government Market (Billion US$), 2017 – 2020

Figure-18: End-User – Forecast for Government Market (Billion US$), 2021 – 2027

Figure-19: End-User – Private Sector Market (Billion US$), 2017 – 2020

Figure-20: End-User – Forecast for Private Sector Market (Billion US$), 2021 – 2027

Figure-21: Asia Pacific – Aerostat Systems Market (Billion US$), 2017 – 2020

Figure-22: Asia Pacific – Forecast for Aerostat Systems Market (Billion US$), 2021 – 2027

Figure-23: North America – Aerostat Systems Market (Billion US$), 2017 – 2020

Figure-24: North America – Forecast for Aerostat Systems Market (Billion US$), 2021 – 2027

Figure-25: Europe – Aerostat Systems Market (Billion US$), 2017 – 2020

Figure-26: Europe – Forecast for Aerostat Systems Market (Billion US$), 2021 – 2027

Figure-27: Latin America – Aerostat Systems Market (Million US$), 2017 – 2020

Figure-28: Latin America – Forecast for Aerostat Systems Market (Million US$), 2021 – 2027

Figure-29: Middle East and Africa – Aerostat Systems Market (Million US$), 2017 – 2020

Figure-30: Middle East and Africa – Forecast for Aerostat Systems Market (Million US$), 2021 – 2027

Figure-31: ILC Dover, LP – Global Revenue (Billion US$), 2017 – 2020

Figure-32: ILC Dover, LP – Forecast for Global Revenue (Billion US$), 2021 – 2027

Figure-33: Lockheed Martin Corporation – Global Revenue (Billion US$), 2017 – 2020

Figure-34: Lockheed Martin Corporation – Forecast for Global Revenue (Billion US$), 2021 – 2027

Figure-35: Raven Industries Inc. – Global Revenue (Million US$), 2017 – 2020

Figure-36: Raven Industries Inc. – Forecast for Global Revenue (Million US$), 2021 – 2027

Figure-37: Raytheon Company – Global Revenue (Billion US$), 2017 – 2020

Figure-38: Raytheon Company – Forecast for Global Revenue (Billion US$), 2021 – 2027

Figure-39: Thales Group – Global Revenue (Billion US$), 2017 – 2020

Figure-40: Thales Group – Forecast for Global Revenue (Billion US$), 2021 – 2027

List Of Tables:

Table-1: Global – Aerostat Systems Market Share by Product (Percent), 2017 – 2020

Table-2: Global – Forecast for Aerostat Systems Market Share by Product (Percent), 2021 – 2027

Table-3: Global – Aerostat Systems Market Share by Application (Percent), 2017 – 2020

Table-4: Global – Forecast for Aerostat Systems Market Share by Application (Percent), 2021 – 2027

Table-5: Global – Aerostat Systems Market Share by End-User (Percent), 2017 – 2020

Table-6: Global – Forecast for Aerostat Systems Market Share by End-User (Percent), 2021 – 2027

Table-7: Global – Aerostat Systems Market Share by Region (Percent), 2017 – 2020

Table-8: Global – Forecast for Aerostat Systems Market Share by Region (Percent), 2021 – 2027

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com