Africa Air Conditioner Market Forecast Report by Type (Window, Single Split, Multi-Splits, Precision Air Conditioning, Variable Refrigerant Flow (VRF), End User (Residential, Commercial, Industrial), Country and Company Analysis 2025-2033

Buy NowAfrica Air Conditioner Market Size

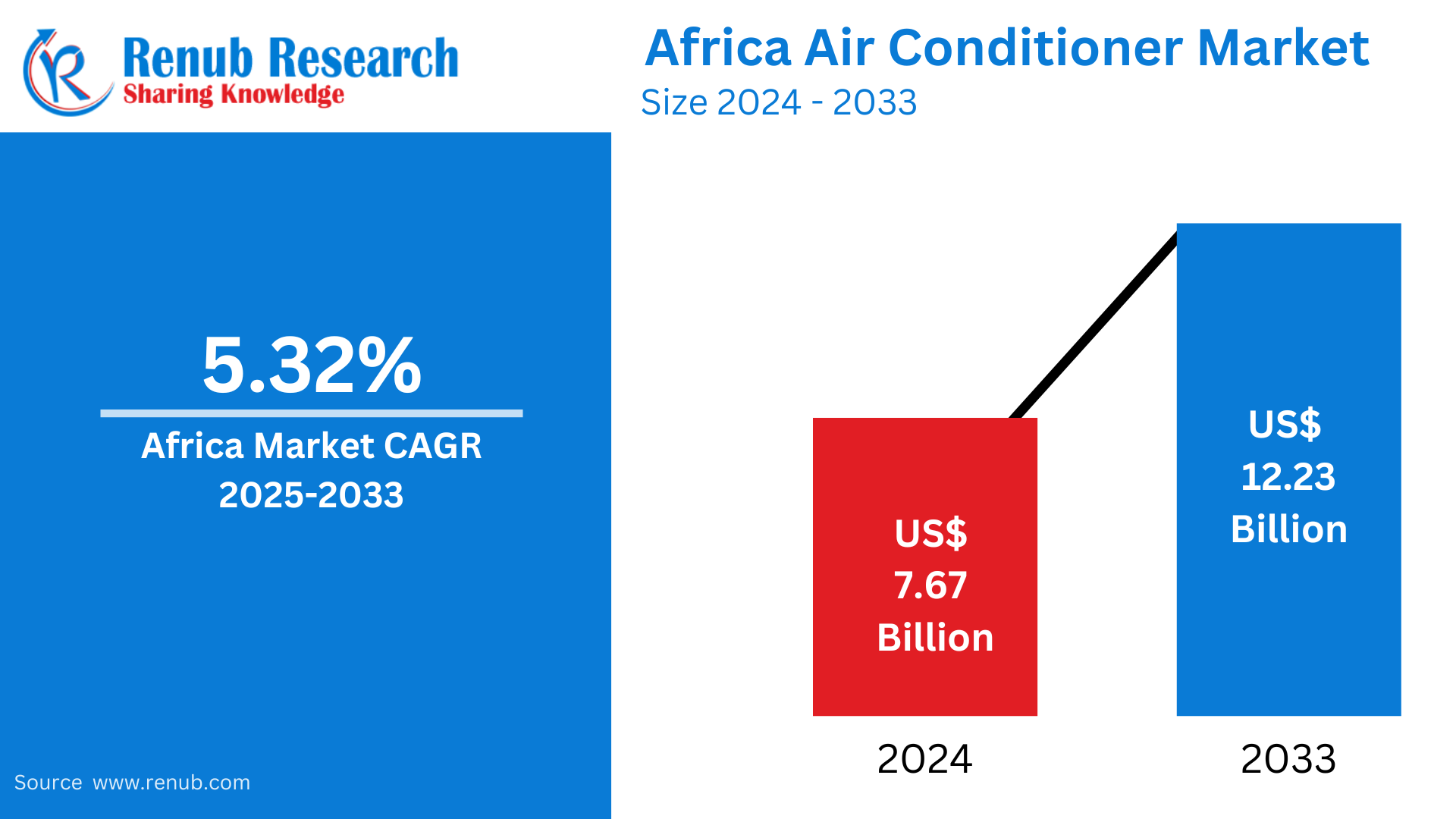

Africa air conditioner market size is at USD 7.67 billion in 2024, growing at a compound annual growth rate of 5.32% through the forecast period to reach USD 12.23 billion by 2033. This stable growth is observed due to growth in demand caused by increasing urbanization, elevated living standards, and expanding regional infrastructure development.

Africa Air Conditioners Market Outlooks

Air Conditioners tends to regulate the temperature, humidity, and air quality indoors to allow people to live or work inside in comfort. An AC removes heat and moisture from the indoor air and supplies cooler, drier air instead. There are now many styles, including window units, split systems, central air systems, and portable ACs, depending on the diverse needs of residential, commercial, and industrial applications.

In Africa, air conditioners are a saving grace in enhancing comfort and production in regions with hot and humid climates. Beyond mere temperature regulation, air conditioners help cleans the air by removing dust, allergens, and pollutants indoors, which is important in urban areas where air could be poor. ACs have become necessary equipment in most sectors in Africa. They enhance living conditions at homes, especially in extreme weather. In offices and other businesses, air conditioners enhance productivity through optimal temperature conditions for workers. Healthcare facilities depend on ACs in regulating environments for patient care and medical equipment. Air conditioners also benefit Africa's advancing tourism and hospitality industry by ensuring guests have a comfortable stay. With the development of this continent, there will be a tremendous increase in demand for energy-efficient and sustainable cooling solutions.

Growth Driver in the African Air Conditioners Marke

Rising Urbanization and Infrastructure Development

Africa is urbanizing rapidly. As cities grow in size and modernize, residential and commercial building construction increases, and with that, there is a huge demand for cooling solutions. Urban areas are becoming hubs for economic activities, with businesses and shopping complexes requiring climate control systems. Additionally, government initiatives to improve infrastructure, including housing and smart city projects, further boost the market. The rising middle class in urban areas and higher disposable incomes have led to growing affordability and adoption of air conditioners, making urbanization a critical market driver. The percentage of Africans living in urban areas was around 36% in the year 2010 and is projected to reach 50% and 60% by 2030 and 2050, respectively. Urbanization in Africa has been quickening its pace and brings along both opportunities and challenges. Cities are likely to become conduits of economic growth and innovation because urban populations are projected to double by the year 2050. The African Union Commission, UN-Habitat, and UNECA authored the Harmonized Regional Framework for Implementing the New Urban Agenda in Africa, which serves as a guide in discussing issues at the Africa Urban Forum to ensure the agenda of Africa 2063 is addressed.

Increasing Temperature and Climate Changes

Africa's rising temperatures and climate changes greatly influence the demand for air conditioners. In 2023, Average temperatures in Africa have increased by 1.4 degrees centigrade since the pre-industrial period, as compared to + 1.1 °C worldwide. Therefore, Africa is warming faster than the global average. Heat waves and long-duration high temperatures are becoming more common, so cooling measures are necessary to maintain comfort and health. It is expected that this trend will be pronounced in regions like North and Sub-Saharan Africa. With the need for temperature regulation in offices and public spaces, the demand will continue to increase for workplaces and public facilities in hot climates, and in the light of increased awareness in relation to health risks due to heat, the market will continue to grow with increased demand, whether for residential or commercial applications.

Growth in the Tourism and Hospitality Sector

Tourism industry in Africa remains another driver for growth in the air conditioner market. Millions of tourists visit Egypt, South Africa, Kenya, and Morocco annually. Therefore, they must have state-of-the-art cooling in hotels, resorts, and recreational facilities. It becomes important for the hospitality industry to provide luxurious experiences, hence air conditioning. Additionally, growing airport infrastructures and shopping malls are creating an increased demand. As governments and private investors are investing highly in tourism-related developments, the air conditioner market is likely to grow constantly with the sector's growth. Tourism arrivals in South Africa grew positively from 2021 to 2023. According to Statistics South Africa, 3.5 million travelers entered the country in December 2023, up from 2.6 million in November 2023 and 2.9 million in December 2022. The number of tourists in Egypt is expected to reach around 15.3 million at the end of 2024, up 5% from 2023, Tourism and Antiquities Minister said.

Egypt Air Conditioners Market: Dominating North Africa with Strong Urban Demand

Egypt leads the air conditioner market in North Africa due to its massive population, urbanization, and searing summer temperatures. The New Administrative Capital and other new cities for residence, which are currently under construction, are demanding the most significant supply of cooling systems. Egypt's tourism industry is also booming, with hotels and resorts investing heavily in air conditioning. The emphasis from the government on energy-efficient buildings, with an increasing focus on renewable energy, has accelerated the adoption of green cooling technologies. The air conditioner market of Egypt is expected to grow steadily with rising disposable incomes and expanding commercial infrastructure. In July 2024, LG announced a partnership with Raya Electric to manufacture LG-branded air conditioners in Egypt. This deal is the first in the Middle East and Africa, enabling Raya Electric to produce over 100,000 units every year.

Nigeria Air Conditioners Market: A Growing Hub for Affordable Cooling Solutions

Nigeria is the largest economy in West Africa, and rapid urbanization and economic growth have intensified demand for air conditioners. The tropical climate of this country requires cooling appliances for residence, offices, and public places. Access to electricity in the urban regions is promoting the growth of the affordable as well as energy-efficient air conditioners, thereby increasing the demand for air conditioners in retail, education, and health sectors, thus accelerating the growth of this market. Challenges include unstable electricity supply; however, new inventions like sun-powered air conditioners overcome the challenge, making Nigeria a hub for air conditioner manufacturers and suppliers. This October 2022, Daikin Industries, a Japanese air-conditioner manufacturer, will start assembling products in Nigeria to expand its African business and utilize a facility owned by one of its distributors.

South Africa Air Conditioners Market: A Mature Market with Green Cooling Focus

South Africa's air conditioner market is sophisticated with high commercial, residential as well as industrial demand. The region has different climates - hot summers to milder winters - that ensure consistent demand for HVAC systems. South Africa's infrastructure, comprising shopping malls, offices, and data centers, supports the market extensively. Energy-efficient and solar-powered air conditioners are gaining favor due to concerns about rising energy prices and environmental considerations. Further motivation for market growth is seen in government incentives toward green buildings and sustainability, putting South Africa in the midst of innovative cooling technologies in Africa. In November 2023, Hisense celebrated the opening of its first joint business office with Filibiz, their HVAC agent, that marked a successful beginning over 15 years after their brand was first introduced in South Africa.

Kenya Air Conditioners Market: Emerging Market with Expanding Commercial Demand

Kenya is an emerging market for air-conditioning in the East African economic hub with rising demand due to urbanization and industrialization. The country's hot climate and increasing disposable incomes have been pushing residential adoption. Overall, growth in Kenya's developing commercial sectors such as retail, tourism, and education have boosted the market. Demand is also boosted due to the government's focus on affordable housing and investment in infrastructure projects. Energy-efficient and environmentally friendly AC systems are gaining attention as the country addresses energy challenges. With continued economic growth, Kenya is well-positioned to be a significant player in the African air conditioner market. In June 2023, Kenya's Ministry of Environment, Climate Change, and Forestry formally launched the country's National Cooling Action Plan (NCAP). This plan comprises an overview of the present regulatory framework, studying national cooling sectors, and short- and medium-term action plans.

Morocco Air Conditioners Market: Driven by Urbanization and Tourism Growth

The air conditioner market in Morocco is on the rise, fueled by urbanization and tourism growth. Large cities such as Casablanca and Marrakech are experiencing increased demand for air conditioners from residential, commercial, and public buildings. In Morocco, a core economy pillar, hospitality needs present modern cooling systems to serve international visitors. The government initiatives that seek a renewable energy future and sustainable cooling technologies are influencing the market. Existing and planned infrastructures of malls, airports, and residential projects mean opportunities abound for air conditioner manufacturers. The development is focused on energy efficiency, and Morocco is expected to see sustained growth in this market. May 2024: Daikin Middle East and Africa FZE entered into a Memorandum of Understanding with Morocco's Office of Vocational Training and Employment Promotion (OFPPT) to develop the skilled HVAC-R workforce in the country.

Ethiopia Air Conditioners Market: Untapped Potential in Cooling Solutions

Still in its early stage, the air conditioner market in Ethiopia has a significant amount of untapped potential as a result of ongoing economic development and urbanization. Although adoption rates are still very low, primarily due to affordability issues and limited access to electricity, increased investment in infrastructure should drive demand for cooling solutions. The development of industrial parks and commercial projects in Ethiopia also provides an opportunity for air conditioner manufacturers. In addition, government efforts to increase electrification and enhance the quality of life will likely boost residential demand for air conditioning units. As awareness of energy-efficient systems grows, Ethiopia is likely to emerge as a new exciting market in the perspective of African air conditioner landscapes.

By Type – Market and Volume is divided into 5 viewpoints

- Window Type

- Single Split

- Multi-Splits

- Precision Air Conditioning

- Variable Refrigerant Flow (VRF)

End User- Market is divided into 3 viewpoints

- Residential

- Commercial

- Industrial

Country- Market is divided into 8 Countries Air Conditioning Revenue

- Morocco

- Algeria

- Libya

- Tunisia

- Egypt

- Nigeria

- South Africa

- Rest of Africa

Company Overview

- Overview

- Recent Development & Strategies

- Product Portfolio

- Financial Insight

Key Players Analysis

- LG Electronics Africa Logistics FZE

- Samsung Electronics SA (Pty) Limited

- AHI Carrier South Africa (Pty) Ltd.

- Daikin Airconditioning South Africa (Pty) Ltd

- Fujitsu General (Middle East) FZE

- MS Airconditioning Distributors (Pvt) Ltd

- Robert Bosch (Pty) Ltd

- Hisense S.A. (PTY) Ltd.

- Atlas Air Conditioning (Pty) Ltd

- Livance (PTY) Ltd. (Midea)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2032 |

| Market |

US$ Billion |

| Segment Covered |

Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the current market size of the Africa air conditioner industry in 2024?

-

What is the projected market value of Africa’s air conditioner market by 2033?

-

What is the expected compound annual growth rate (CAGR) of the market from 2025 to 2033?

-

Which factors are driving the growth of the air conditioner market in Africa?

-

How does urbanization impact the demand for air conditioners in Africa?

-

Which African countries have the highest demand for air conditioning systems?

-

What are the major challenges affecting the air conditioner market in Africa?

-

How is climate change influencing air conditioner adoption in Africa?

-

Which companies are the key players in the African air conditioner market?

-

What role does sustainability and energy efficiency play in shaping the future of air conditioning in Africa?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Africa Air Conditioner Market

6. Market Share

6.1 Type

6.2 End User

6.3 Country

7. By Type

7.1 Window Type

7.1.1 Market

7.1.2 Volume

7.2 Single Split

7.2.1 Market

7.2.2 Volume

7.3 Multi-Splits

7.3.1 Market

7.3.2 Volume

7.4 Precision Air Conditioning

7.4.1 Market

7.4.2 Volume

7.5 Variable Refrigerant Flow (VRF)

7.5.1 Market

7.5.2 Volume

8. End User

8.1 Residential

8.2 Commercial

8.3 Industrial

9. Country

9.1 Morocco

9.2 Algeria

9.3 Libya

9.4 Tunisia

9.5 Egypt

9.6 Nigeria

9.7 South Africa

9.8 Rest of Africa

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 LG Electronics Africa Logistics FZE

12.1.1 Overview

12.1.2 Recent Development & Strategies

12.1.3 Product Portfolio

12.1.4 Financial Insight

12.2 Samsung Electronics SA (Pty) Limited

12.2.1 Overview

12.2.2 Recent Development & Strategies

12.2.3 Product Portfolio

12.2.4 Financial Insight

12.3 AHI Carrier South Africa (Pty) Ltd.

12.3.1 Overview

12.3.2 Recent Development & Strategies

12.3.3 Product Portfolio

12.3.4 Financial Insight

12.4 Daikin Airconditioning South Africa (Pty) Ltd

12.4.1 Overview

12.4.2 Recent Development & Strategies

12.4.3 Product Portfolio

12.4.4 Financial Insight

12.5 Fujitsu General (Middle East) FZE

12.5.1 Overview

12.5.2 Recent Development & Strategies

12.5.3 Product Portfolio

12.5.4 Financial Insight

12.6 MS Airconditioning Distributors (Pty) Ltd

12.6.1 Overview

12.6.2 Recent Development & Strategies

12.6.3 Product Portfolio

12.6.4 Financial Insight

12.7 Robert Bosch (Pty) Ltd

12.7.1 Overview

12.7.2 Recent Development & Strategies

12.7.3 Product Portfolio

12.7.4 Financial Insight

12.8 Hisense S.A. (PTY) Ltd.

12.8.1 Overview

12.8.2 Recent Development & Strategies

12.8.3 Product Portfolio

12.8.4 Financial Insight

12.9 Atlas Air Conditioning (Pty) Ltd

12.9.1 Overview

12.9.2 Recent Development & Strategies

12.9.3 Product Portfolio

12.9.4 Financial Insight

12.10 Livance (PTY) Ltd. (Midea)

12.10.1 Overview

12.10.2 Recent Development & Strategies

12.10.3 Product Portfolio

12.10.4 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com