Africa Confectionery Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowAfrica Confectionery Market Trends & Summary

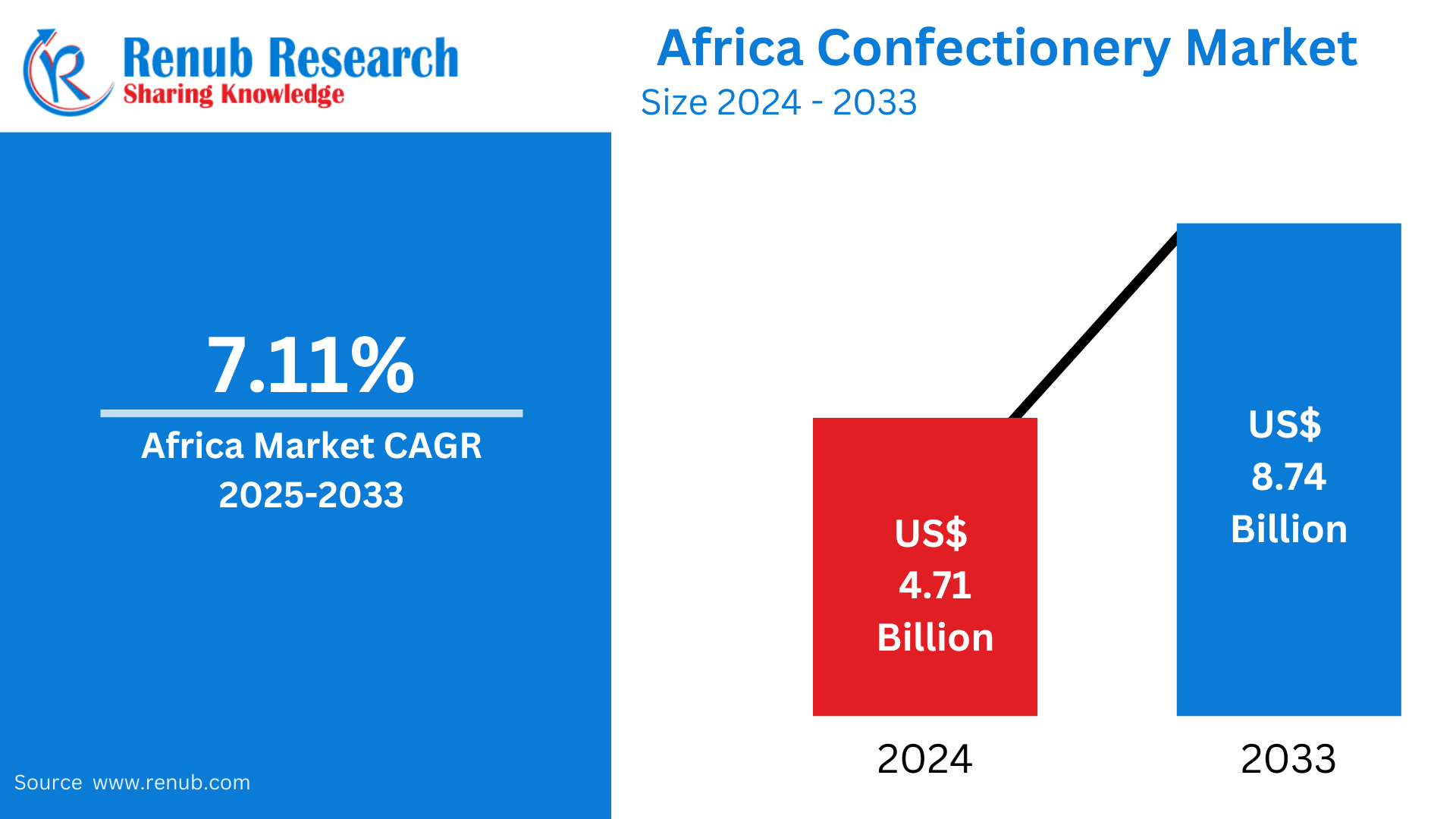

The Africa Confectionery Market was valued at US$ 4.71 billion in 2024 and is anticipated to reach US$ 8.74 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.11% from 2025 to 2033. The market is boosted by growing consumer demand for chocolates, candies, and gum, coupled with growing urbanization and disposable incomes in the region.

The report Africa Confectionery Market Forecast covers by Confections (Chocolate, Dark Chocolate, Milk and White Chocolate), Gums (Bubble Gum, Chewing Gum, Sugar Chewing Gum, Sugar-free Chewing Gum), Snack Bar (Cereal Bar, Fruit & Nut Bar, Protein Bar), Sugar Confectionery (Hard Candy, Lollipops, Mints, Pastilles, Gummies, and Jellies, Toffees and Nougats, Others), Distribution Channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others), Country and Company Analysis 2025-2033.

Africa Confectionery Market Outlooks

Confectionery is a generic term for sweet-based food items, such as chocolates, candies, toffees, chewing gum, and sugar confectionery. These items are popularly consumed as indulgent snacks, festive foods, and gifts in various cultures. Confectionery can be classified into sugar confectionery, chocolate confectionery, and gum confectionery, addressing various consumer tastes.

The confectionery industry has experienced strong growth in Africa because of lifestyle changes, rising disposable incomes, and urbanization. The increasing youth population, expanding middle class, and Western consumption patterns have helped in fueling the demand for chocolates, sweets, and gums. Growing retail chains, supermarkets, and convenience stores have made confectionery products available to customers in different parts of the country. Seasonal demand, particularly during festivals and celebrations, also contributes to market growth. In addition, the rise of domestic confectionery brands and global players increasing their footprint in Africa are influencing the growth of the industry, making confectionery a very sought-after segment in the region.

Growth Drivers in the Africa Confectionery Market

Growing Urbanization and Disposable Incomes

Urbanization in Africa is growing very fast, which is transforming consumption patterns and providing increased access to retail markets. With increasing migration of people to cities, their disposable incomes increase, enabling them to buy premium and indulgent confectionery items. The growth of the middle class also fuels increased demand for chocolates, toffees, and other sweets, leading to the growth of the confectionery market. Urban city supermarkets and retail chains make confectionery items easily available to more people. The Africa Urban Forum has begun to tackle new solutions for developing African cities into livable ones as the population expands. Africa is undergoing considerable urbanization at an annual rate of 3.5% for the past 20 years, which is set to extend to 2050. The proportion of Africans in urban regions rose from approximately 36% in 2010 to a predicted 50% by 2030 and 60% by 2050.

Growing Dominance of Western Consumption Patterns

Globalization has been a major driver of food consumption patterns in Africa. The growing visibility and marketing efforts of Western confectionery brands have resulted in increased demand for chocolates, candies, and chewing gum. Social media and online advertising have also made younger consumers try out foreign confectionery products, which has increased sales. Also, international confectionery firms make investments in African markets, maintaining the availability of their products and new flavors in compliance with local consumers' tastes. In 2023, there are 43.48 million internet users in South Africa with a 72% penetration rate, considerably influencing confectionery buying. Social media with 25.80 million consumers (42.9% of total population) has revolutionized product discovery and promotions. Furthermore, 76% of the customers were acquainted with digital payment tools in 2022, thereby facilitating online purchases.

Expansion of Retail and E-commerce Channels

The growth of new retail formats such as supermarkets, convenience stores, and online stores has been a major contributor to the growth of the confectionery market. Online shopping has increased the availability of confectionery products, particularly in areas where there are few stores. Supermarkets and hypermarkets have also specialized confectionery displays featuring a variety of products. The growing presence of convenience stores in urban and semi-urban locations also supports impulse buying, a major impulse for confectionery sales. November 2022, South African confectionery company 1701 has entered the UAE via a partnership with Tashas Group. Nougat specialists, 1701 has just opened its online shop and is now available in Tashas cafés.

Challenges in the Africa Confectionery Market

Supply Chain and Distribution Challenges

One of the largest issues in the African confectionery industry is the inefficient supply chain and distribution system. Inefficient infrastructure, transportation problems, and poor storage facilities hinder efficient delivery of products. Most rural areas are deprived of confectionery products because of logistical challenges hindering market penetration. Having a well-networked supply chain is essential for producers who want to increase their global presence.

Increased Health Consciousness and Sugar Issues

Consumers are increasingly health-aware, and this is driving the move away from confectionery treats towards healthier alternatives. Increasing obesity, diabetes, and dental health concerns have affected demand for traditional confectionery products. Governments are also introducing tighter regulations and possible sugar taxes, which will impact sales. To counteract this, firms concentrate on making sugar-free, organic, and fortified confectionery products to appeal to health-aware consumers.

Africa Chocolate Market

The African chocolate industry is witnessing consistent growth as consumers increasingly opt for premium and indulgent chocolates. Global chocolate companies and domestic chocolates have picked up momentum, especially in urban areas. With rising disposable incomes and festival seasons fueling chocolate consumption, firms are launching new flavors and packaging to draw more consumers. Moreover, the cocoa production sector in Africa enables local players to produce value-added chocolate products for both domestic and export markets.

Africa Bubble Gum Market

Bubble gum is a widely popular confectionery category in Africa, especially among young consumers. Brand power, intense promotional campaigns, and the presence of low-priced gum products fuel the market. Local and global brands keep launching new flavors and packaging sizes to cater to various age groups. Nonetheless, health issues related to sugar content have triggered the growth of sugar-free gum products. Convenience stores and kiosks fuel sales, as bubble gum is usually an impulse buy.

Africa Cereal Bar Market

Africa's cereal bar market is expanding because consumers increasingly demand convenient and healthy food snacks. With growing health consciousness, cereal bars are being viewed as healthy substitutes for conventional confectionery goods. Cereal bars are fortified with vitamins, nuts, and dried fruit and suit urban consumers with active lifestyles. Global and domestic companies are seizing the opportunity by launching new flavors and ingredients that suit diet trends and lifestyle choices.

Africa Toffees and Nougats Market

Toffees and nougats have wide acceptability all over Africa because they are cheap and have a long shelf life. They enjoy widespread consumption among both children and adults and are, therefore, a mainstay of the confectionery market. Companies have continued to launch new flavors and packaging sizes in order to keep the consumer engaged. Indigenous manufacturing has been on the rise, enhancing availability in supermarkets and smaller retail chains. But competition from chocolates and other confectioneries could put market growth at risk.

Africa Confectionery Convenience Store Market

Convenience stores play a crucial role in confectionery distribution in Africa, especially in cities. These stores serve impulse consumers who want quick snacks and treats. Chocolates, gum, toffees, and candies are among the top-selling confectionery items in this space. Expanding convenience stores in small towns and semi-urban areas has further increased market accessibility. Price sensitivity is still a dominant factor in buying decisions for consumers, though. As of 2023, Massmart has 287 stores in South Africa's nine provinces, and Carrefour has a strong footprint through franchises in seven African nations with more than 200 stores.

South Africa Confectionery Market

South Africa is a major confectionery market in Africa, led by a developing middle class and high urbanization levels. Shoppers are increasingly attracted to premium chocolate, sugar-free chewing gum, and creative candy flavors. Availability of global brands complemented with high local manufacturing ensures a range of products. Expansion of retailing and e-commerce has further supported easy access to confectionery products across the country. July 2023: Chocoladefabriken Lindt & Sprüngli AG entered South Africa's vegan chocolate market with a vegan chocolate range. The lines are present in two plant-based flavors – Lindt Vegan Smooth Chocolate (constructed using oats and almonds for a smooth and creamy taste) and Lindt Vegan Hazelnut Chocolate (constructed using roasted hazelnuts and high-quality plant-based chocolate for a nutty taste).

Egypt Confectionery Market

The confectionery market of Egypt is growing on the back of its high population and robust demand for confections. Domestic confectionery producers vie with global brands, providing affordable goods to suit all tastes. Old-fashioned sweets, as well as contemporary confectionery products, are still widely sought after. The retailing industry is also changing, with supermarkets and internet sites boosting the distribution of confectionery goods throughout the country. December 2023, Egyptian confectioner Eastern Co. (Covertina) will open a new factory later in 2024, for an investment of 200 million pounds (US$6.5M).

Africa Confectionery Market Segments

Confections

- Chocolate

- Dark Chocolate

- Milk and White Chocolate

Gums

- Bubble Gum

- Chewing Gum

- Sugar Chewing Gum

- Sugar-free Chewing Gum

Snack Bar

- Cereal Bar

- Fruit & Nut Bar

- Protein Bar

Sugar Confectionery

- Hard Candy

- Lollipops

- Mints

- Pastilles, Gummies, and Jellies

- Toffees and Nougats

- Others

Distribution Channel

- Convenience Store

- Online Retail Store

- Supermarket/Hypermarket

- Others

Country

- Egypt

- Nigeria

- South Africa

- Rest of Africa

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Key Players Analysis

- Afrikoa

- August Storck KG

- General Mills Inc.

- Kellogg Company

- Mars Incorporated

- Mondelēz International Inc.

- Nestlé SA

- PepsiCo Inc.

- The Hershey Company

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Confections, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the Africa Confectionery Market by 2033?

-

What is the compound annual growth rate (CAGR) of the market from 2025 to 2033?

-

What are the main factors driving the growth of the Africa Confectionery Market?

-

Which confectionery segments are covered in the report?

-

How is urbanization influencing the demand for confectionery products in Africa?

-

What role does e-commerce play in the growth of the confectionery market in Africa?

-

What are the major challenges faced by the confectionery industry in Africa?

-

How are health-conscious trends impacting the confectionery market?

-

Which countries are covered in the market analysis?

-

Who are the key players in the Africa Confectionery Market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Africa Confectionery Market

6. Market Share Analysis

6.1 By Confections

6.2 By Distribution Channel

6.3 By Country

7. Confections

7.1 Chocolate

7.1.1 Dark Chocolate

7.1.2 Milk and White Chocolate

7.2 Gums

7.2.1 Bubble Gum

7.2.2 Chewing Gum

7.2.3 Sugar Chewing Gum

7.2.4 Sugar-free Chewing Gum

7.3 Snack Bar

7.3.1 Cereal Bar

7.3.2 Fruit & Nut Bar

7.3.3 Protein Bar

7.4 Sugar Confectionery

7.4.1 Hard Candy

7.4.2 Lollipops

7.4.3 Mints

7.4.4 Pastilles, Gummies, and Jellies

7.4.5 Toffees and Nougats

7.4.6 Others

8. Distribution Channel

8.1 Convenience Store

8.2 Online Retail Store

8.3 Supermarket/Hypermarket

8.4 Others

9. Country

9.1 Egypt

9.2 Nigeria

9.3 South Africa

9.4 Rest of Africa

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Afrikoa

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 August Storck KG

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 General Mills Inc.

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Kellogg Company

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Mars Incorporated

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Mondelēz International Inc.

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Nestlé SA

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 PepsiCo Inc.

12.8.1 Overview

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 The Hershey Company

12.9.1 Overview

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com