Anticoagulants Market Global Forecast Report by Drug Class (Novel Oral Anticoagulants (NOACs), Heparin and Low Molecular Weight Heparin (LMWH), Vitamin K Antagonist, Others), Route of Administration (Oral Anticoagulant, Injectable Anticoagulant), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Stores, Others), Application (Atrial Fibrillation and Heart Attack, Stroke, Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Others), Countries and Company Analysis 2025-2033

Buy NowAnticoagulants Market Size

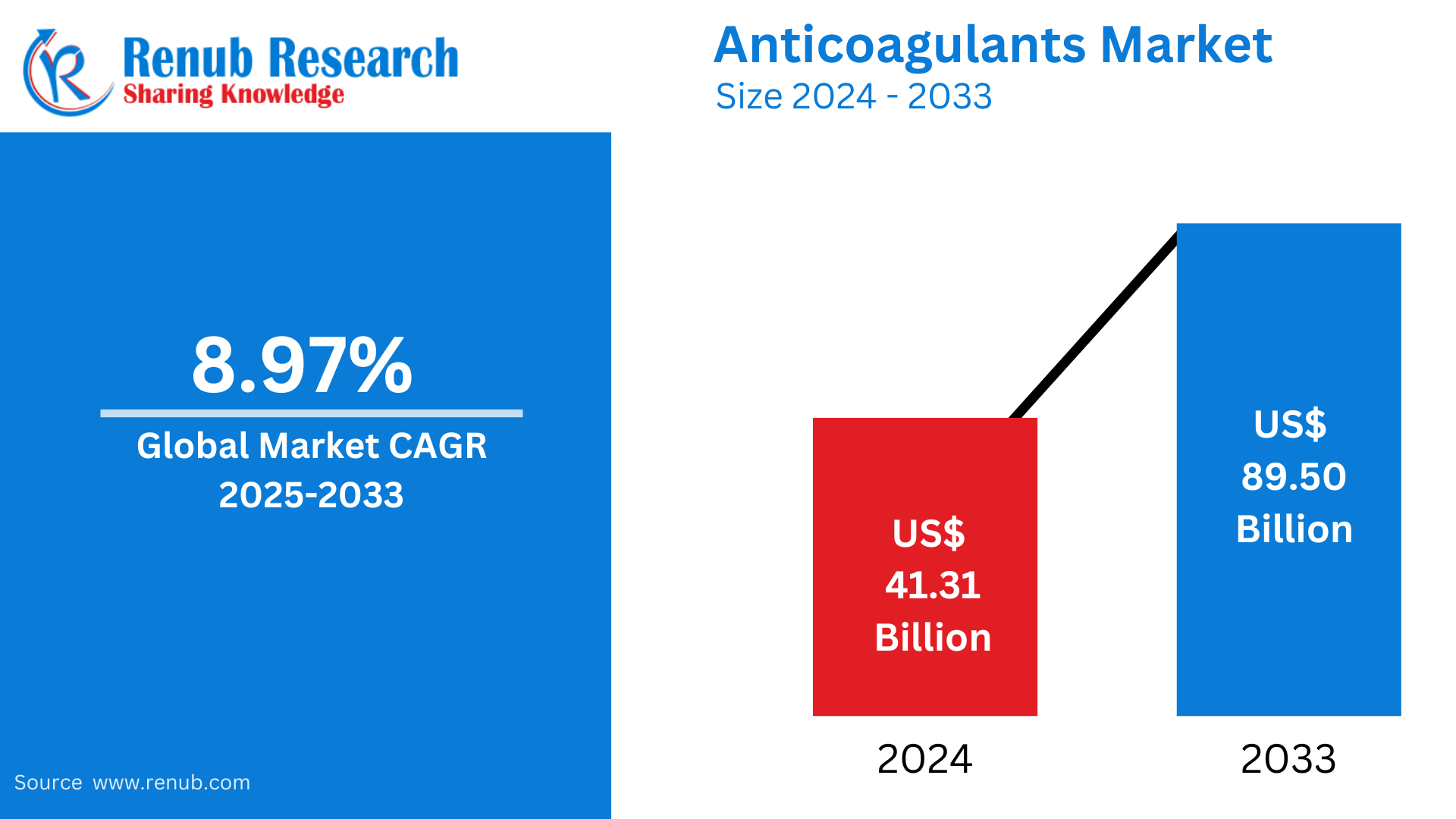

Anticoagulants market is expected to reach US$ 41.31 billion in 2024 to US$ 89.50 billion by 2033, with a CAGR of 8.97 % from 2025 to 2033. Sedentary lifestyles, a better healthcare system, and an increase in thrombotic disease instances are some of the major drivers propelling the market.

Global Anticoagulants Industry Overview

Anticoagulants, also referred to as blood thinners, are drugs that slow down or stop blood from coagulating, which lengthens the clotting time. They are essential in the treatment of a number of cardiovascular conditions, such as stroke, pulmonary embolism (PE), deep vein thrombosis (DVT), and atrial fibrillation. End-use industries, government laws, market statistics, private and public investments, and major industry activities like mergers, acquisitions, partnerships, agreements, expansions, and innovations all have an impact on the global anticoagulant market.

The market for anticoagulants is greatly impacted by the fact that they are widely used in a variety of healthcare settings, including clinics, hospitals, and ambulatory surgery centers. Its growth is mostly driven by the rising incidence of cardiovascular illnesses, which are the leading cause of death worldwide, accounting for around 17.9 million deaths each year, according to the World Health Organization. This emphasizes how crucial anticoagulants are to contemporary medicine, particularly in avoiding consequences from cardiovascular diseases.

Growth Drivers for the Anticoagulants Market

Growing Requirement for Innovative and Potent Medicines

The high incidence of cardiovascular diseases (CVD) worldwide and the growing need for better blood thinners are important motivators. Since anticoagulants were first made available to the general public, significant R&D advancements have been made. Since then, a number of innovative treatments have been introduced to the world market with great success, including novel oral anticoagulants (NOACs). Eliquis and Xarelto are currently the two main anticoagulants that make up the worldwide market landscape. The market may suffer from an increase in generics and other planned anticoagulant generic launches. However, the nature of cardiovascular diseases (CVD) has made them nearly incurable, and their increasing frequency is making patient treatment prospects even worse. This is expected to be one of the main major drivers propelling the global market, with a number of unmet therapeutic demands.

Increasing Increased Knowledge and Development of Blood Thinners

The rising awareness of cardiovascular health and the accompanying rise in the introduction of innovative treatments are two of the key factors propelling the global market's expansion. Therapeutic treatment for cardiovascular disease involves a multifaceted approach that may involve the use of several medications; however, blood thinners are an essential part of that treatment regimen. Several anticoagulants have been introduced by major market leaders to meet the urgent treatment needs related to blood clot prevention. For example, Bristol-Myers Squibb Company and Pfizer Inc. introduced an anticoagulant named Eliquis (apixaban). When compared to other medications in the worldwide context, the medicine has shown greater risk reductions and has significant sales.

Increased Cardiovascular Disease (CVD) Prevalence

One of the main factors propelling the market for anticoagulants is the increasing incidence of cardiovascular diseases (CVDs). The prevalence of diseases including pulmonary embolism (PE), deep vein thrombosis (DVT), and atrial fibrillation (AF) is rising as a result of aging populations, unhealthy lifestyles, and rising risk factors like diabetes and hypertension. Anticoagulants lower the risk of stroke, heart attack, and other consequences by preventing and treating blood clots linked to these disorders. The need for efficient anticoagulant treatments, both for prevention and therapy, is anticipated to increase dramatically as the prevalence of CVDs rises worldwide.

Anticoagulants Market Overview by Regions

The market for anticoagulants is expanding globally, with North America and Europe leading the way because of their aging populations and easy access to healthcare. The rise in cardiovascular disorders and the development of healthcare infrastructure are driving the Asia-Pacific region's rapid growth. Demand is also consistent across the Middle East and Latin America. An overview of the market by region is given below:

United States Anticoagulants Market

Due to the high prevalence of cardiovascular conditions such atrial fibrillation, deep vein thrombosis, and pulmonary embolism, the US market for anticoagulants is among the biggest in the world. Strong demand for oral and injectable anticoagulants is a defining feature of the industry, and leading companies provide medications such as low-molecular-weight heparins, warfarin, and direct oral anticoagulants (DOACs). The market is growing because of the aging population, rising awareness, and improvements in healthcare. Anticoagulant use is also growing as a result of advancements in medication formulations and the move toward home-based therapy. Market expansion is further supported by changing treatment standards and government reimbursement regulations.

For example, The US Food and Drug Administration authorized Boehringer Ingelheim's dabigatran etexilate (Pradaxa) oral anticoagulant pellets in June 2021, making them the first oral anticoagulant to treat venous thromboembolism in children ages 3 months to under 12 years following at least five days of treatment with an injection blood thinner.

United Kingdom Anticoagulants Market

The growing prevalence of cardiovascular conditions including atrial fibrillation and thrombosis is driving the demand for anticoagulants in the United Kingdom. The need for injectable and oral anticoagulants is rising as the population ages and people become more aware of the advantages of anticoagulation treatment. Because they are easier to use and have fewer dietary restrictions than traditional warfarin, direct oral anticoagulants (DOACs) like apixaban and rivaroxaban are becoming more and more popular. The UK's robust regulatory framework and well-established healthcare system further encourage market expansion. In the upcoming years, it is also anticipated that further research and clinical trials will spur innovation and increase the range of available treatments.

India Anticoagulants Market

India's market for animal parasiticides is expanding quickly due to rising livestock production and rising pet ownership. The need for better animal productivity and health increases the demand for efficient parasite control methods. Antihelminthics and ectoparasiticides, which deal with problems including worms, fleas, and ticks, are important sections. Government programs to improve veterinary care and livestock management can have an impact on the market. The necessity for preventive measures is further fueled by growing awareness of zoonotic illnesses. The market for parasiticides in India is changing due to advancements in product formulations and more R&D expenditures.

Dr. Reddy's Laboratories launched a biosimilar of Apixaban (Eliquis) in the Indian market in February 2024 with the goal of giving a more cost-effective option to a larger group of patients. As stated in their news statement, this action is in line with their strategy goal to increase accessibility and market reach.

Saudi Arabia Anticoagulants Market

The rising incidence of cardiovascular conditions such as atrial fibrillation, heart attacks, and strokes is propelling the growth of the anticoagulants market in Saudi Arabia. More people are receiving anticoagulant treatments and receiving diagnoses as healthcare awareness rises. Because they are more convenient and have fewer adverse effects than traditional warfarin, direct oral anticoagulants, or DOACs, are becoming more and more popular. Market expansion is aided by the nation's expanding healthcare system and government programs to increase access to cutting-edge therapies. Anticoagulant demand in Saudi Arabia is also anticipated to rise as a result of an aging population and a greater emphasis on managing chronic illnesses.

Drug Class- Industry is divided into 4 viewpoints:

- Novel Oral Anticoagulants (NOACs)

- Heparin and Low Molecular Weight Heparin (LMWH)

- Vitamin K Antagonist

- Others

Route of Administration- Industry is divided into 2 viewpoints:

- Oral Anticoagulant

- Injectable Anticoagulant

Distribution Channel- Industry is divided into 4 viewpoints:

- Hospital Pharmacies

- Retail Pharmacies

- Online Stores

- Others

Application- Industry is divided into 5 viewpoints:

- Atrial Fibrillation and Heart Attack

- Stroke

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Others

Countries- Industry is divided into 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All companies have been covered with 5 Viewpoints

- Overviews

- Key Person

- Recent Developments & Strategies

- Product Portfolio

- Financial Insights

Company Analysis

- Alexion Pharmaceuticals Inc

- Aspen Holdings

- Bayer AG

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company Limited

- Dr. Reddy’s Laboratories Ltd

- GlaxoSmithKline plc

- Johnson & Johnson Private Limited

- Pfizer Inc.

- Sanofi

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Drug Class, Route of Administration, Distribution Channel, Application and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the global anticoagulants market by 2033?

-

What is the growth rate (CAGR) of the anticoagulants market from 2025 to 2033?

-

Which drug class dominates the global anticoagulants market?

-

How do oral and injectable anticoagulants compare in terms of market share?

-

What are the major drivers fueling the growth of the anticoagulants market?

-

Which application segment holds the largest share in the anticoagulants market?

-

How is the market distributed across different distribution channels?

-

Which region leads the global anticoagulants market?

-

What is the market scenario for anticoagulants in the United States, United Kingdom, India, and Saudi Arabia?

-

Who are the key players in the global anticoagulants market and what are their strategic developments?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Anticoagulants Market

6. Market Share Analysis

6.1 Drug Class

6.2 Route of Administration

6.3 Distribution Channel

6.4 Application

6.5 Country

7. Drug Class

7.1 Novel Oral Anticoagulants (NOACs)

7.2 Heparin and Low Molecular Weight Heparin (LMWH)

7.3 Vitamin K Antagonist

7.4 Others

8. Route of Administration

8.1 Oral Anticoagulant

8.2 Injectable Anticoagulant

9. Distribution Channel

9.1 Hospital Pharmacies

9.2 Retail Pharmacies

9.3 Online Stores

9.4 Others

10. Application

10.1 Atrial Fibrillation and Heart Attack

10.2 Stroke

10.3 Deep Vein Thrombosis (DVT)

10.4 Pulmonary Embolism (PE)

10.5 Others

11. Country

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 Australia

11.3.5 South Korea

11.3.6 Thailand

11.3.7 Malaysia

11.3.8 Indonesia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 South Africa

11.5.2 Saudi Arabia

11.5.3 UAE

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 Alexion Pharmaceuticals Inc

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development & Strategies

14.1.4 Product Portfolio

14.1.5 Financial Insights

14.2 Aspen Holdings

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development & Strategies

14.2.4 Product Portfolio

14.2.5 Financial Insights

14.3 Bayer AG

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development & Strategies

14.3.4 Product Portfolio

14.3.5 Financial Insights

14.4 Bristol-Myers Squibb Company

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development & Strategies

14.4.4 Product Portfolio

14.4.5 Financial Insights

14.5 Daiichi Sankyo Company Limited

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development & Strategies

14.5.4 Product Portfolio

14.5.5 Financial Insights

14.6 Dr. Reddy’s Laboratories Ltd

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development & Strategies

14.6.4 Product Portfolio

14.6.5 Financial Insights

14.7 GlaxoSmithKline plc

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development & Strategies

14.7.4 Product Portfolio

14.7.5 Financial Insights

14.8 Johnson & Johnson Private Limited

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development & Strategies

14.8.4 Product Portfolio

14.8.5 Financial Insights

14.9 Pfizer Inc.

14.9.1 Overview

14.9.2 Key Persons

14.9.3 Recent Development & Strategies

14.9.4 Product Portfolio

14.9.5 Financial Insights

14.10 Sanofi

14.10.1 Overview

14.10.2 Key Persons

14.10.3 Recent Development & Strategies

14.10.4 Product Portfolio

14.10.5 Financial Insights

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com