Asia Pacific Dairy Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowAsia Pacific Dairy Market Size & Summary

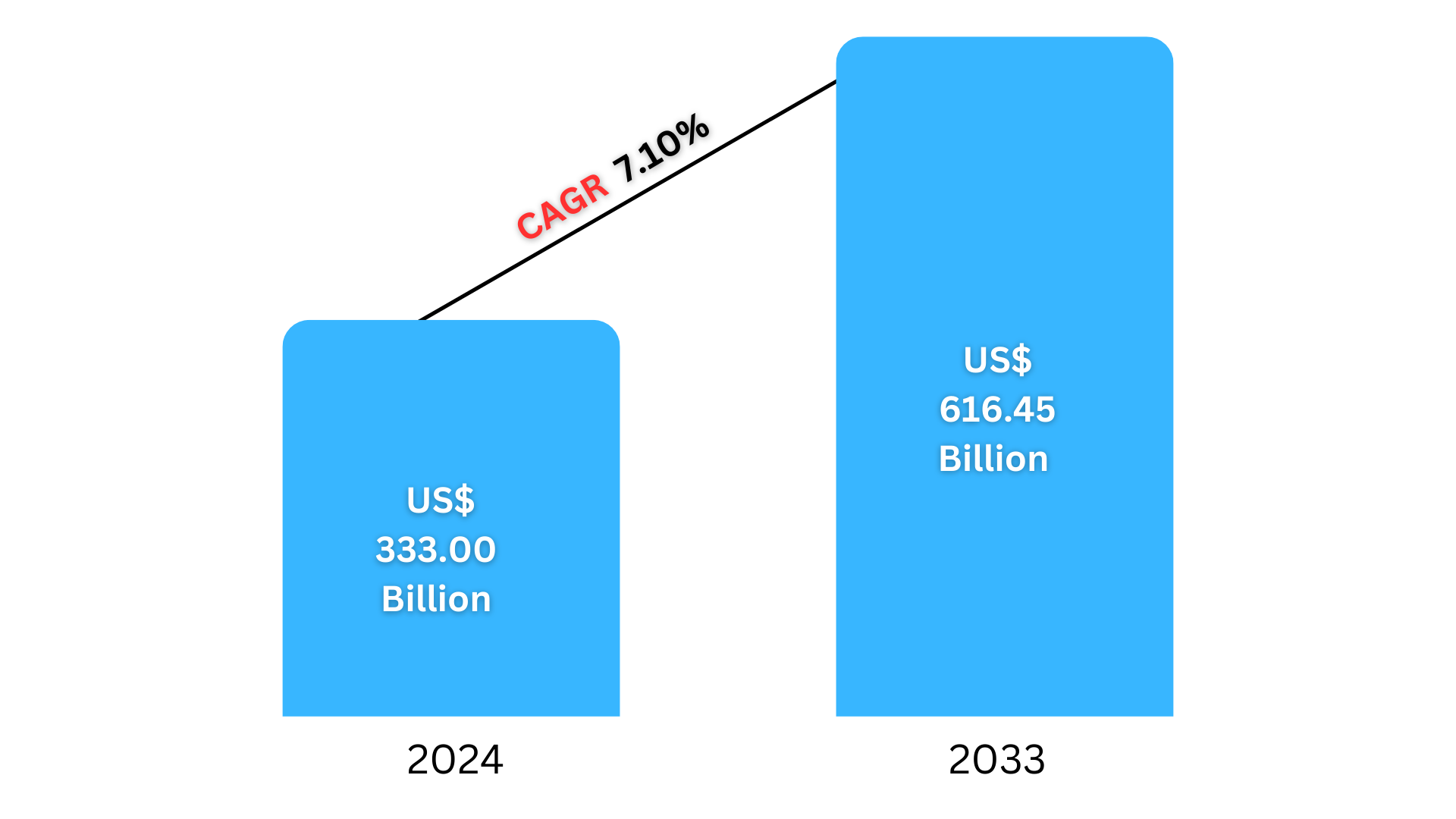

Asia Pacific Dairy market is expected to reach US$ 616.45 billion by 2033 from US$ 333.00 billion in 2024, with a CAGR of 7.10% from 2025 to 2033. Rising disposable incomes, urbanization, and changing dietary habits—particularly the adoption of Western-style diets—are the main drivers of the Asia Pacific dairy market's expansion. The region's market is expanding due to factors like growing plant-based substitutes, increased demand for functional dairy products, and more health consciousness.

The report Asia Pacific Dairy Market Covers by {Category (Butter-Cultured Butter, Uncultured Butter), (Cheese-Natural Cheese, Processed Cheese), (Cream-Double Cream, Single Cream, Whipping Cream, Others), (Dairy Desserts-Cheesecakes, Frozen Desserts, Ice Cream, Mousses, Others), (Milk-Condensed milk, Flavored Milk, Fresh Milk, Powdered Milk, UHT Milk), Sour Milk Drinks, (Yogurt-Flavored Yogurt, Unflavored Yogurt)}, Distribution Channel (Off-Trade, Convenience Stores, Online Retail, Specialist Retailers, Supermarkets and Hypermarkets, Others (Warehouse clubs, gas stations, etc.), On-Trade, Country (Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, South Korea, Rest of Asia Pacific) and Company Analysis 2025-2033

Asia Pacific Dairy Industry Overview

Rising disposable incomes, urbanization, and shifting dietary habits are all contributing to the Asia Pacific dairy industry's notable expansion. The rising demand for milk, cheese, yogurt, and other dairy products, especially in nations like China, India, and Indonesia, has led to an increase in dairy consumption in the region. With a population of more than 4.5 billion, Asia Pacific offers a sizable market where rising dairy product consumption has been fueled by a growing middle class and a move toward Western diets. The industry has grown even more as a result of the increase in health-conscious consumers looking for probiotic, nutrient-rich, and fortified dairy products.

Developments in dairy processing technology are also occurring in the area, enhancing the quality of the final product and increasing production efficiency. Dairy products are now more widely available in both urban and rural regions thanks to advancements in packaging, delivery, and storage. Additionally, the market dynamics are being shaped by the growing acceptance of plant-based dairy substitutes like soy and almond milk. A competitive environment is being created as a result of dairy producers diversifying their portfolios to accommodate these shifting consumer preferences. Even though the Asia Pacific dairy business faces obstacles like shifting milk prices and problems with the supply chain, the industry is nevertheless well-positioned for growth and expansion thanks to the continuous trend toward health and wellness and technology advancements.

With off-trade channels controlling the market structure, the distribution landscape of the Asia-Pacific dairy sector is undergoing a dramatic change. Due to their wide range of products and solid penetration of well-known retail chains as Maruetsu, Aldi, and Woolworths Group, supermarkets and hypermarkets have become the main distribution channel, holding 57.9% of the off-trade value share in 2022. Distribution patterns have also changed as a result of the digital revolution; in 2022, e-commerce sales reached USD 6028.7 million, indicating the region's increasing preference for the ease of online purchasing. Major retailers have been forced by this change to create omnichannel strategies, which combine a strong online presence with physical storefronts to increase consumer happiness and reach.

Production capacities and dairy manufacturing processes are being significantly modernized in this sector. This trend is best illustrated by Japanese dairy farms, which had a 10% increase in facilities housing 200 or more cows in 2022. The average herd size was 103 heads, indicating a definite shift toward larger, more efficient operations. Initiatives like Aquila Sustainable Farming Ltd.'s conversion of four farms to A2 organic production in New Zealand demonstrate how this modernization goes beyond traditional farming to encompass sustainable and organic techniques. The industry's dedication to satisfying rising consumer demand while upholding environmental responsibility and product quality is shown in these advancements.

Growth Drivers for the Asia Pacific Dairy Market

Ethics and Sustainability in Sourcing

Growing concerns about ecologically friendly methods have made sustainability a key determinant of customer behavior in the Asia Pacific dairy business. Concerns about climate change have led people to seek out dairy products with less environmental impact. This covers eco-friendly packaging alternatives, lower carbon footprints, and sustainable farming methods. For example, in partnership with Sea Forest, Ashgrove introduced Ashgrove Eco-Milk, the first commercially available low-emission milk in history, in March 2024. This product uses methane-reducing feed technology to reduce emissions by up to 90%.

Furthermore, because customers are more conscious of the production methods of the food they buy and the humane treatment of animals, demand for organic and hormone-free sources has increased. Dairy companies are responding with tactics like regenerative agriculture, which promotes products with recyclable packaging to reduce waste and restores soil health. The adoption of green projects is being driven by the promotion of sustainable practices by governments and industry standards. These elements are influencing how the dairy market develops in the future as consumer values move toward environmental responsibility.

Innovations in Dairy Production Technology

The Asia Pacific dairy market is undergoing a transformation due to recent developments in production methods. By preserving product uniformity and homogeneity, modern farming methods including highly effective pasteurization and sophisticated milking equipment have increased the efficiency of general dairy farming. More dairy product lines are now available, along with flavors and textures that are enhanced by nutritional benefits thanks to advancements in milk fermentation and processing. Additional possibilities for the production of dairy products, such as those based on milk and cheese, that are intended to satisfy growing dietary preferences are made possible by precision fermentation and biotechnology. Advances in packaging, such as vacuum-sealed materials and bioplastics, offer improved preservation and longer shelf life, which reduce waste. These technical developments help the region become more efficient and sustainable in its dairy production while also meeting the growing demand from customers for high-quality, varied dairy products.

Emphasis on Health and Wellbeing

In the Asia Pacific dairy industry, there is a growing need for dairy products that provide customers who are health-conscious with more than just basic nutrients. Growing awareness of the importance of eating a balanced diet has led to a movement toward functional dairy products that also contain probiotics, vitamins, and minerals for added health advantages. This improves immunity, intestinal health, and overall well-being. Additionally, there is a great demand for dairy products with decreased sugar, low fat, and low calories; customers particularly favor low-fat cheese, yogurt, and milk. The market for plant-based dairy substitutes is seeing an increase in demand as customers seek out goods that meet their dietary requirements, such as being lactose-free or vegan. Young, urban buyers who respect their health and are prepared to pay more for products that are both ethically and nutritionally acceptable stand out among these new consumers.

Challenges in the Asia Pacific Dairy Market

Competition from Plant-Based Alternatives

The traditional dairy market in Asia Pacific faces fierce competition from the growing demand for plant-based milk substitutes such soy, almond, oat, and coconut milk. Customers are increasingly choosing plant-based solutions as they grow more morally, environmentally, and health-conscious. Compared to cow's milk, these substitutes are thought to be healthier since they contain less cholesterol and saturated fat. Additionally, consumers looking for more sustainable options are drawn to plant-based milks because of their environmental impact, which usually involves less resources and lower carbon emissions. This change is also influenced by the rise of lactose intolerance and veganism. Dairy farmers are therefore under pressure to expand their product lines to include plant-based substitutes in order to preserve market share and satisfy changing customer demands.

Lactose Intolerance

Since many people in nations like China, Japan, and Southeast Asia are unable to properly digest lactose, lactose intolerance poses a serious problem for the Asia Pacific dairy business. Many people suffer from this disorder, which causes digestive distress and restricts their ability to ingest traditional dairy products like milk and cheese because the body lacks the enzyme lactase, which is necessary to break down lactose. Because of this, a large number of consumers in these areas steer clear of dairy, which reduces the use of dairy products overall. The market for lactose-free dairy products has grown as a result of greater knowledge of lactose intolerance, but manufacturers still face the difficulty of meeting dietary requirements without sacrificing product quality or flavor.

Asia Pacific Dairy Market Overview by Regions

By countries, the Asia Pacific Dairy market is divided into Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, South Korea, Rest of Asia Pacific.

India Dairy Market

Strong local demand for milk and dairy products has made India's dairy market one of the biggest and fastest-growing in the world. With a sizable section of the populace depending on dairy as their main source of sustenance, India is the world's largest producer and consumer of milk. Dairy goods including milk, curd, butter, ghee, and cheese are all available in the market, but processed and value-added dairy products are becoming more and more popular. The demand for packaged and branded dairy products has increased due to urbanization, the expanding middle class, and shifting lifestyles. The dairy industry is still growing because to government regulations and growing consumer knowledge of the health advantages of dairy products, despite obstacles such shifting milk prices, problems with the supply chain, and regional differences.

The demand for cheese has grown in India as a result of shifting eating patterns and the country's increasing acceptance of Western culture. The fast-food sector also has high demand, and international foodservice operators are proactively growing their footprint. There were 14,095 Domino's Pizza locations in India in 2021, up from 830 in 2014.

In India, yogurt is called curd. Since Indians usually eat plain yogurt as part of their daily routine as a meal or as a refreshment, its consumption is considerable. India's per capita yogurt consumption grew by 5.2% in 2023–2024, whereas Australia's increased by 1.2% during the same time frame. Asia's ice cream business is expanding, and companies are capitalizing on rising trends that center on enjoyment and health consciousness. For instance, in 2023–2024, India's per capita ice cream consumption increased by 5.90%. Some of the main reasons influencing ice cream consumption include rising consumer spending in the food and beverage sector, the launch of new flavors, an increase in impulsive buying, and a strong consumer desire for healthier ice cream products.

Australia Dairy Market

The dairy industry in Australia is well-established and plays a significant role in the agricultural sector of the nation. Australia is one of the biggest exporters of dairy products globally, especially to Asia and the Middle East, and is well-known for producing high-quality dairy products. Dairy products such milk, cheese, butter, yogurt, and powdered milk are widely available on the market, and demand for premium and organic goods is rising. Low-fat, lactose-free, and functional dairy products are becoming more and more popular as consumer preferences change toward healthier options. Despite obstacles including shifting milk prices, a lack of workers, and problems with the supply chain, the business is resilient. Growth in both domestic and foreign markets is being propelled by robust government support, technological developments in dairy processing, and an emphasis on sustainability.

China Dairy Market

The rising demand for dairy products by consumers, especially in cities, has caused the China dairy market to expand quickly. China, one of the biggest dairy markets in the world, has seen a change in eating patterns due to increased milk consumption and a growing demand for dairy products like cheese, yogurt, and milk powders. The demand for dairy products is being driven mostly by the expanding middle class, rising disposable incomes, and increased health consciousness. The market is also being shaped by the growing demand for baby formula and functional dairy products, such as probiotic and lactose-free goods. Despite obstacles including shifting milk costs, worries about food safety, and competition from plant-based substitutes, the industry is nevertheless growing thanks to both domestic and foreign businesses.

Japan Dairy Market

High-quality dairy products like milk, cheese, yogurt, and butter define the well-established Japanese dairy market. Dairy is an essential component of the Japanese diet, especially in processed forms like yogurt and desserts, even though the country consumes comparatively less natural milk when compared to other nations. The market has grown steadily as a result of growing consumer demand for low-fat, lactose-free, and functional dairy products brought on by growing health consciousness. The demand for goods with health advantages, including probiotics, is also influenced by Japan's aging population. Among the difficulties are the dwindling rural population and the industry's dependence on imported milk, which leaves it open to changes in the world market. Nonetheless, robust domestic dairy farming methods and ongoing innovation support expansion.

Key Questions Answered in Report:

1. How big is the Asia Pacific Dairy industry?

The Asia Pacific Dairy market size was valued at US$ 333.00 billion in 2024 and is expected to reach US$ 616.45 billion in 2033.

2. What is the Asia Pacific Dairy growth rate?

The Asia Pacific Dairy market is expected to expand at a compound annual growth rate (CAGR) of 7.10% from 2025 to 2033.

3. Who are the key players in Asia Pacific Dairy industry?

Some key players operating in the Asia Pacific Dairy market includes China Mengniu Dairy Company Ltd, Dodla Dairy Ltd, Fonterra Co-operative Group Limited, Gujarat Co-operative Milk Marketing Federation Ltd, Hatsun Agro Product Ltd, Inner Mongolia Yili Industrial Group Co. Ltd, Karnataka Cooperative Milk Producers Federation Ltd, Meiji Dairies Corporation, Nestlé SA.

4. What are the factors driving the Asia Pacific Dairy industry?

Growing demand for dairy-based products, urbanization, increased disposable incomes, health consciousness, and technological developments in dairy processing are the main drivers of the Asia Pacific dairy business.

5. Which Region held the largest market share in the Asia Pacific Dairy industry?

India is expected to hold the largest market share in the industry.

6. What segments are covered in the Asia Pacific Dairy Market report?

Category, Distribution Channel, and Countries segment are covered in this report.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Asia Pacific Dairy Market

6. Market Share Analysis

6.1 By Category

6.2 By Distribution Channel

6.3 By Country

7. Category

7.1 Butter

7.1.1 Cultured Butter

7.1.2 Uncultured Butter

7.2 Cheese

7.2.1 Natural Cheese

7.2.2 Processed Cheese

7.3 Cream

7.3.1 Double Cream

7.3.2 Single Cream

7.3.3 Whipping Cream

7.3.4 Others

7.4 Dairy Desserts

7.4.1 Cheesecakes

7.4.2 Frozen Desserts

7.4.3 Ice Cream

7.4.4 Mousses

7.4.5 Others

7.5 Milk

7.5.1 Condensed milk

7.5.2 Flavored Milk

7.5.3 Fresh Milk

7.5.4 Powdered Milk

7.5.5 UHT Milk

7.6 Sour Milk Drinks

7.7 Yogurt

7.7.1 Flavored Yogurt

7.7.2 Unflavored Yogurt

8. Distribution Channel

8.1 Off-Trade

8.1.1 Convenience Stores

8.1.2 Online Retail

8.1.3 Specialist Retailers

8.1.4 Supermarkets and Hypermarkets

8.1.5 Others (Warehouse clubs, gas stations, etc.)

8.2 On-Trade

9. Country

9.1 Australia

9.2 China

9.3 India

9.4 Indonesia

9.5 Japan

9.6 Malaysia

9.7 New Zealand

9.8 Pakistan

9.9 South Korea

9.10 Rest of Asia Pacific

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 China Mengniu Dairy Company Ltd

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Dodla Dairy Ltd

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Fonterra Co-operative Group Limited

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Gujarat Co-operative Milk Marketing Federation Ltd

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Hatsun Agro Product Ltd

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Inner Mongolia Yili Industrial Group Co. Ltd

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Karnataka Cooperative Milk Producers Federation Ltd

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Meiji Dairies Corporation

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 Nestlé SA

12.9.1 Overviews

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com