Assortment and Space Optimization (ASO) Market Global Forecast Report by Component (Solutions, Services), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), Countries and Company Analysis 2025-2033

Buy NowAssortment and Space Optimization (ASO) Market Size

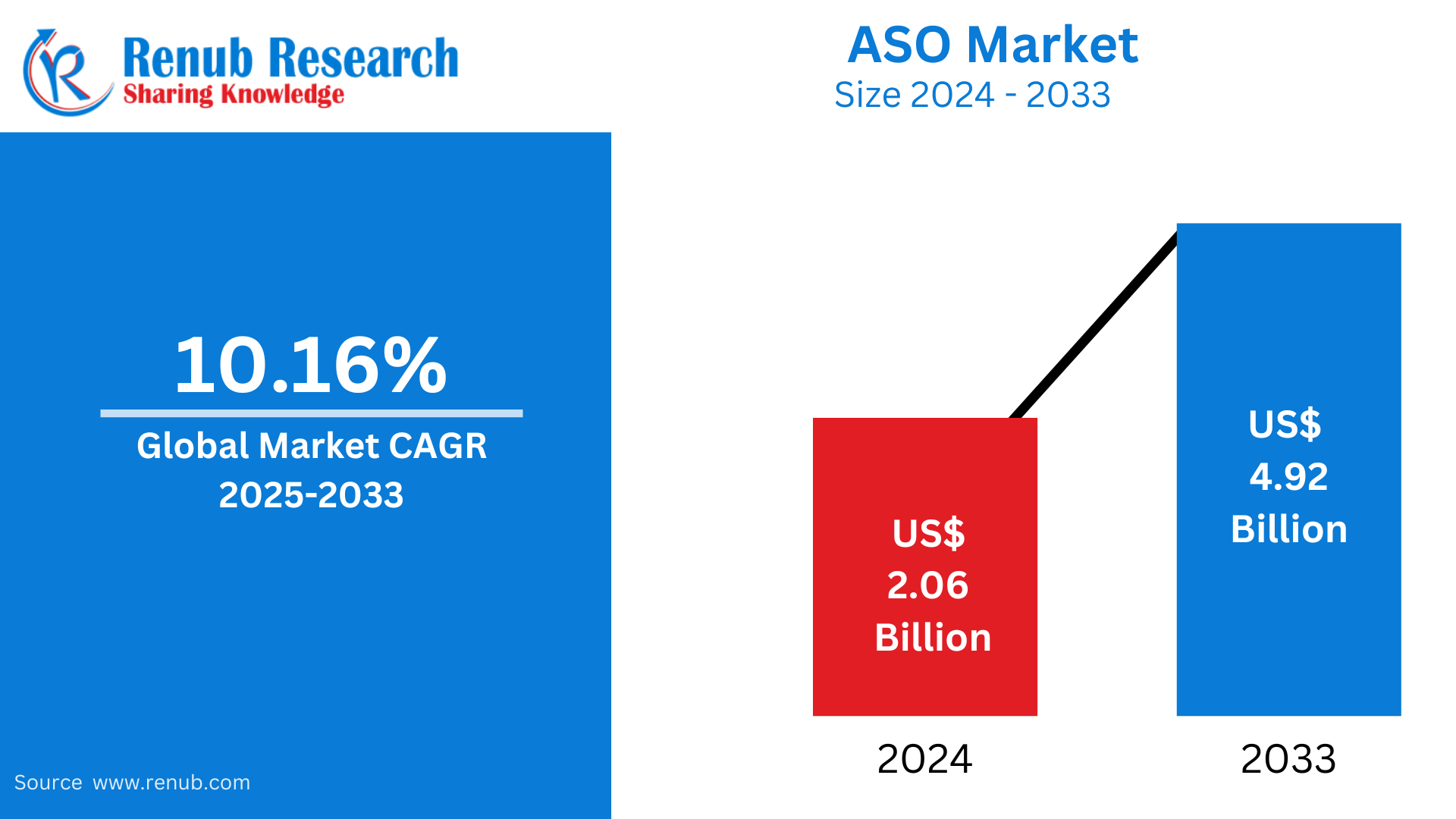

The Assortment and Space Optimization (ASO) market is expected to reach US$ 2.06 billion in 2024 to US$ 4.92 billion by 2033, with a CAGR of 10.15 % from 2025 to 2033. Growing retail rivalry, the demand for individualized shopping experiences, developments in analytics technology, and the growing significance of effective inventory management to boost consumer satisfaction and sales are the main factors propelling the Assortment and Space Optimization (ASO) market.

Global Assortment and Space Optimization (ASO) Industry Overview

The success of retail depends on choosing the appropriate product assortment. Understanding in-store conditions in relation to sales and space aids brands in increasing the productivity of stock-keeping units (SKUs). It helps increase retailer trust and yield a higher return on space investment. Techniques like space management and assortment help maintain the correct merchandise in the right location to improve client satisfaction and sales. The market growth is being positively impacted by the increasing demand for cloud-based assortment optimization solutions. The key element propelling the expansion of the global market is the retailers' adoption of a customer-centric, demand-driven assortment optimization strategy. The demand for space and assortment optimization solutions has further increased since the assortment influences total cost and influences inventory selections. The spread of emerging technologies, such as machine learning and artificial intelligence, enhances and automates the processes. Therefore, it is anticipated that the automation and intelligence offered by the cutting-edge technologies will propel the market's substantial expansion in the upcoming years. Retailers' increasing use of data-driven algorithms raises demand for assortment planning in stores. Demand for the ASO system would rise as a result of its capacity to improve opportunities, margins, and customer happiness.

Growth Drivers for the Assortment and Space Optimization (ASO) Market

Growing Retail Technology Integratio

To produce smooth end-to-end retail operations, assortment and space optimization solutions are frequently combined with other retail technology, including point-of-sale systems, inventory management software, customer relationship management (CRM) platforms, etc. Additionally, one of the latest opportunities in the assortment and space optimization (ASO) industry is that these platforms allow retailers to use data from several sources to improve decision-making throughout the retail value chain and obtain deeper insights into their business. For instance, one of the top suppliers of Client Intelligence products, Introhive, announced in October 2023 the release of a new platform that enables professional services organizations to discover, develop, and use their existing network of relationships.

In addition, the market is being strengthened by the growing popularity of customer relationship management (CRM) platforms, which enable industry participants to preserve and cultivate relationships with customers by gathering and evaluating data to enhance customer satisfaction and tailor marketing campaigns. For example, the multinational conglomerate Milliken & Company successfully launched Spark, an enterprise customer relationship management (CRM) system, in June 2023. Spark was developed with the assistance of Salesforce partner eVerge.

Need for Space Optimization

The requirement for an ASO solution, which is essential for optimizing efficiency, is increasing due to the tightening space constraints. In addition, they let retailers to examine consumer behavior, sales information, product characteristics, and other data to ascertain the best use of available space in their stores by utilizing optimization algorithms and advanced analytics. One of the top suppliers of software for space planning and merchandise operations, MerchLogix, for instance, introduced a Planogram in June 2021 to expand its space planning offering. This cloud-based solution promotes a cooperative strategy for integrating retailers, space planners, and merchants.

In addition, ASO solutions give retailers the ability to design dynamic and adaptable space plans that can instantly adjust to shifting market trends, seasonal variations, and promotional activities. This ensures that retail space is used as efficiently as possible to boost sales and return on investment. As a result, the market forecast for assortment and space optimization (ASO) is improving. For example, the SymphonyAI store and space planning was chosen in March 2024 by ROSSMANN Group, one of the top pharmacy retailers in Germany, to promote automation, scalability, and offer a high-quality shopping experience in Spain. Additionally, the shop design process for Mexican retailer Grupo Merza was transformed in April 2024 by CADS, a retail space planning specialist, using StoreSpace software.

Assortment and Space Optimization (ASO) Market Overview by Regions

Globally, the market for Assortment and Space Optimization (ASO) is expanding. Because of its sophisticated retail analytics, North America leads. Europe comes next, emphasizing efficiency. The modernization of retail is driving the Asia-Pacific region's rapid expansion. Emerging markets in the Middle East and Latin America are progressively implementing ASO tactics. An overview of the market by region is given below:

United States

The growing desire for retailers to increase efficiency and improve consumer experiences is fueling the Assortment and Space Optimization (ASO) market's rapid expansion in the United States. Retailers may improve inventory management and boost sales by optimizing product assortments and shelf space with the help of advanced analytics and machine learning technologies. Large retail chains are spending money on ASO solutions in order to tailor their products according to the tastes and purchasing habits of their customers. Additionally, companies are being forced to use ASO tactics in order to remain competitive due to the growth of e-commerce and omnichannel retailing. Innovative tools and technologies will significantly improve decision-making in retail settings as the market develops.

For instance, Canac partnered with ARISTID Retail Technology, a world leader in promotional messaging technology, in October 2023, making them the first retailer in North America to do so. Similarly, Follett Higher Education, the top supplier of collegiate retail and course materials in North America, announced in March 2024 that it had chosen GK Software as its new cloud-based point-of-sale provider. GK Software is a global leader in comprehensive retail applications for real-time omnichannel business systems.

United Kingdom

The market for assortment and space optimization, or ASO, is expanding in the UK as retailers look to improve operational effectiveness and accommodate shifting customer preferences. Businesses can now optimize product assortments and shelf layouts, which improves inventory management and increases sales, thanks to the growth of data-driven decision-making. Advanced analytics and artificial intelligence (AI) techniques are being used by UK merchants more and more to tailor their products and optimize shelf space. Additionally, companies are being compelled to integrate ASO tactics across several platforms by the move towards omnichannel retailing. The need for creative ASO solutions is growing as competition heats up, making the UK a major competitor in this sector.

India

The Assortment and Space Optimization (ASO) market in India is rapidly evolving, driven by the growth of organized retail and increasing consumer demand for personalized shopping experiences. As retailers expand their offerings, the need for effective inventory management and optimal shelf space utilization becomes critical. Advanced analytics and AI technologies are being adopted to analyze consumer behavior and preferences, enabling businesses to tailor product assortments and enhance store layouts. The rise of e-commerce and omnichannel strategies further emphasizes the importance of ASO in maximizing sales and improving customer satisfaction. This dynamic market is poised for continued growth as competition intensifies.

Saudi Arabia

The retail industry's explosive growth and changing consumer tastes are driving the Assortment and Space Optimization (ASO) market in Saudi Arabia. Retailers are concentrating more on raising operational efficiency and improving consumer experiences as the nation diversifies its economy under Vision 2030. Businesses are using AI-driven tools and advanced analytics to improve product assortments and shelf space, enabling them to efficiently meet consumer requests. Saudi Arabia is becoming a major market in the region thanks to the expansion of e-commerce and the growing impact of omnichannel strategies, which emphasize the significance of ASO in optimizing sales and inventory management.

Assortment and Space Optimization (ASO) Company Analysis

The major participants in the Assortment and Space Optimization (ASO) market includes Accenture plc, Aptos LLC, Blue Yonder Group Inc. (Panasonic Holdings Corporation), Invent Analytics, McKinsey & Company, Nielsen Consumer LLC, Oracle Corporation, RELEX Solutions, SymphonyAI, TATA Consultancy Services Limited, etc.

Assortment and Space Optimization (ASO) Company News

In February 2024, the parent firm of well-known digital brands Zoho.com, ManageEngine, TrainerCentral, and Qntrl, Zoho Corporation, has introduced a new brand in India called Zakya, which is a point-of-sale system for retail establishments. With the help of this technology, the stores can monitor and streamline their daily operations from a single location.

In February 2024, in order to show that it can swiftly incorporate new stacks into its solution, Brevo, a prominent supplier of customer relationship management (CRM) solutions, announced the release of the Brevo Customer Data Platform (CDP) and mobile push after acquiring Octolis and WonderPush.

In January 2024, At the Big Retail Show in New York City, Lenovo showcased end-to-end, AI-powered retail solutions that provide safer, smarter, and more secure experiences for shoppers and retailers in any category.

Component - Industry is divided into 2 viewpoints:

- Solutions

- Services

Deployment Type- Industry is divided into 2 viewpoints:

- On-premises

- Cloud-based

Enterprise Size- Industry is divided into 2 viewpoints:

- Large Enterprises

- Small and Medium-sized Enterprises

Countries- Industry is divided into 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All companies have been covered with 5 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Company Analysis

- Accenture plc

- Aptos LLC

- Blue Yonder Group Inc. (Panasonic Holdings Corporation)

- Invent Analytics

- McKinsey & Company

- Nielsen Consumer LLC

- Oracle Corporation

- RELEX Solutions

- SymphonyAI

- TATA Consultancy Services Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2019 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Component, Deployment Mode, Enterprise Size and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

- How big is the Assortment and Space Optimization (ASO) industry?

- What is the Assortment and Space Optimization (ASO) growth rate?

- Who are the key players in Assortment and Space Optimization (ASO) industry?

- What are the factors driving the Assortment and Space Optimization (ASO) industry?

- Which Region held the largest market share in the Assortment and Space Optimization (ASO) industry?

- What segments are covered in the Assortment and Space Optimization (ASO) Market report?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Assortment and Space Optimization (ASO) Market

6. Market Share Analysis

6.1 Component

6.2 Deployment Mode

6.3 Enterprise Size

6.4 Country

7. Component

7.1 Solutions

7.2 Services

8. Deployment Mode

8.1 On-premises

8.2 Cloud-based

9. Enterprise Size

9.1 Large Enterprises

9.2 Small and Medium-sized Enterprises

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Company Analysis

13.1 Accenture plc

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Product Portfolio

13.1.5 Financial Insights

13.2 Aptos LLC

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Product Portfolio

13.2.5 Financial Insights

13.3 Blue Yonder Group Inc. (Panasonic Holdings Corporation)

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Product Portfolio

13.3.5 Financial Insights

13.4 Invent Analytics

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Product Portfolio

13.4.5 Financial Insights

13.5 McKinsey & Company

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Product Portfolio

13.5.5 Financial Insights

13.6 Nielsen Consumer LLC

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Product Portfolio

13.6.5 Financial Insights

13.7 Oracle Corporation

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Product Portfolio

13.7.5 Financial Insights

13.8 RELEX Solutions

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Product Portfolio

13.8.5 Financial Insights

13.9 SymphonyAI

13.9.1 Overview

13.9.2 Key Persons

13.9.3 Recent Development & Strategies

13.9.4 Product Portfolio

13.9.5 Financial Insights

13.10 TATA Consultancy Services Limited

13.10.1 Overview

13.10.2 Key Persons

13.10.3 Recent Development & Strategies

13.10.4 Product Portfolio

13.10.5 Financial Insights

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com