Global Atherectomy Devices Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Atherectomy Devices Market Trends & Summary

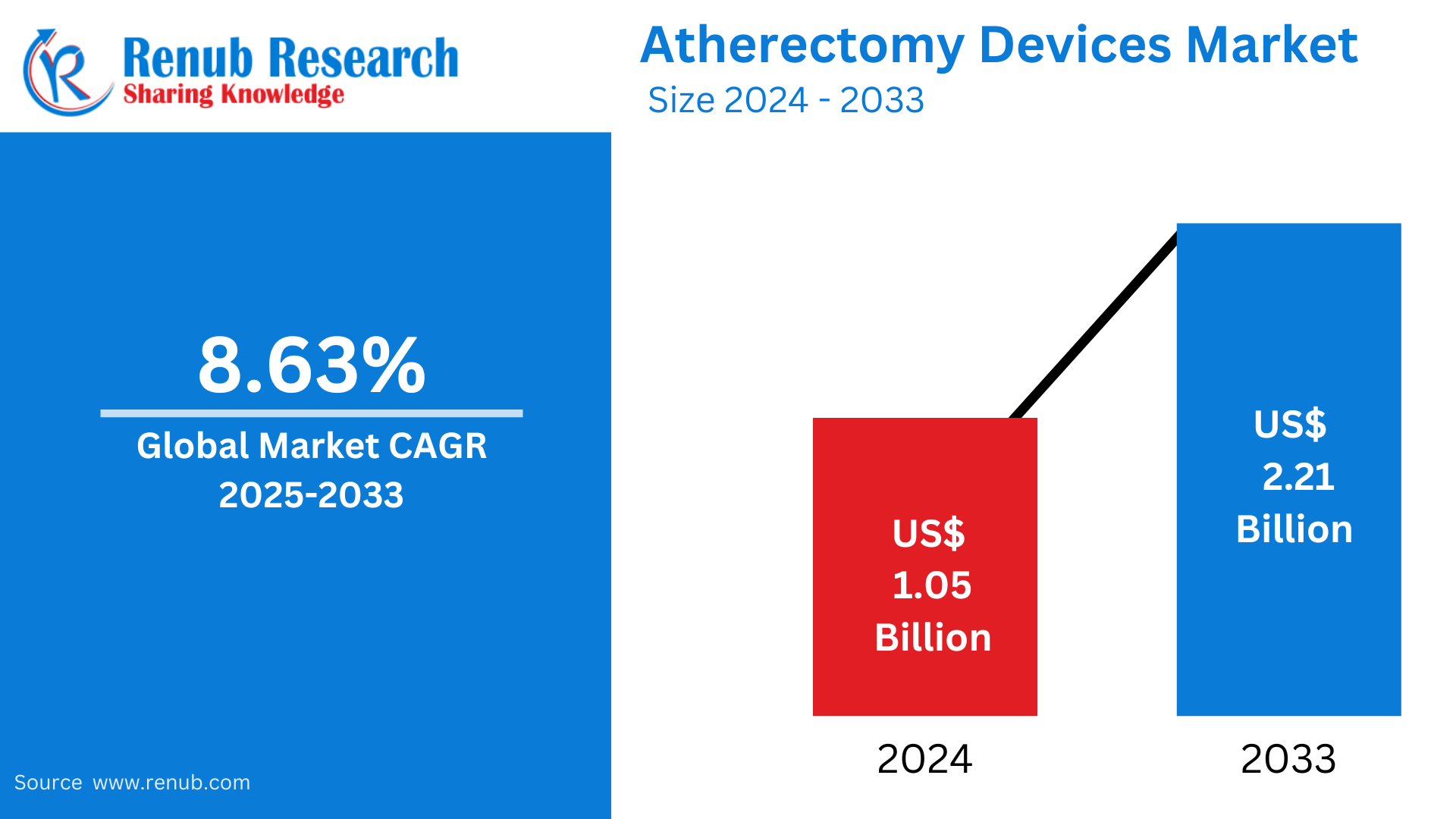

Atherectomy Devices Market is expected to reach US$ 2.21 billion 2033 from US$ 1.05 billion in 2024, with a CAGR of 8.63% from 2025 to 2033. Some of the major factors propelling the atherectomy market's growth include the rise in peripheral artery disease (PAD), notable technological advancements, an aging population, the introduction of minimally invasive surgeries, the development of healthcare infrastructure, and reimbursement policies in emerging economies.

Atherectomy Devices Market Global Report by Product Type (Directional, Rotational, Orbital, Laser), Application (Cardiovascular, Neurovascular, Peripheral Vascular), End User (Hospitals, Ambulatory Care Service, Medical Research Institutes), Countries and Company Analysis 2025-2033.

Atherectomy Devices Industry Overview

Medical devices called atherectomy devices are used to remove plaque from arteries, usually in patients who have coronary artery disease (CAD) or peripheral arterial disease (PAD). By manually removing, grinding, or vaporizing the plaque, these devices help to restore blood flow and lessen symptoms like chest or leg pain. Because atherectomy techniques are less intrusive than traditional surgery and need less recovery time, they are frequently chosen. Rotational, directional, laser, and orbital atherectomy systems are among the several types of atherectomy equipment. These tools are essential for enhancing patient outcomes, especially for patients who are not suitable candidates for stent insertion or balloon angioplasty.

The market for atherectomy devices is expanding due to a number of causes, including an aging population, the growing prevalence of cardiovascular illnesses, and growing awareness of less invasive procedures. Improved device designs and efficacy, among other technological developments, have increased the use of these treatments for arterial blockages. Further driving market expansion are advantageous reimbursement policies and expanding access to healthcare in developing nations. The demand for atherectomy devices as a preferred therapeutic option for the management of arterial disease is increased by these variables taken together.

Growth Drivers for the Atherectomy Devices Market

Peripheral Artery Disease (PAD) Cases Are Increasing

The market for atherectomy devices is expanding because to the rise in diabetes, obesity, and PAD patients worldwide brought on by an aging population. Eight to twelve million Americans suffer from PAD, particularly those over fifty. Of these, 6.5 million people over 40 have a PAD diagnosis. As a significant alternative in vascular procedures, atherectomy devices offer a minimally invasive method of removing arterial plaque. The gadget improves blood flow and lessens symptoms like exhaustion and leg pain. These devices assist restore arterial patency by vaporizing or physically cutting away the plaque, which greatly improves patient outcomes for those with severe cases of PAD.

Technological Advancements

The market for atherectomy devices is growing significantly due to technological improvements. Device design advancements have increased their effectiveness in treating artery blockages by increasing their efficiency, accuracy, and safety. For example, improvements in orbital, laser, and rotational atherectomy technologies have improved the ability to remove plaque with the least amount of damage to vessels. By combining real-time imaging techniques like optical coherence tomography (OCT) and intravascular ultrasonography (IVUS), doctors can more easily see and navigate arterial blockages. Further driving the market's expansion are newer, easier-to-use gadgets with superior ergonomic designs that enable speedier treatments and better patient results.

In Aug 2022, AngioDynamics, Inc. announced that the Auryon Atherectomy System has gained 510(k) clearance for an expanded indication that includes arterial thrombectomy.

Expansion into Emerging Markets

For atherectomy devices, entering emerging markets is a major growth driver. Advanced medical technology are becoming more and more in demand as healthcare infrastructure in places like the Middle East, Asia-Pacific, and Latin America improves. Atherectomy devices are becoming more popular as a result of growing knowledge of cardiovascular disorders and more disposable income in these places. Atherectomy procedures are also becoming more popular in these areas due to advantageous government initiatives, better healthcare legislation, and easier access to cutting-edge treatments.

Challenges in the Atherectomy Devices Market

Lack of Skilled Operators

One major issue facing the market for atherectomy devices is the shortage of qualified operators. To guarantee accuracy and reduce problems, these operations call for specific training and experience. High degrees of skill are required due to the difficulty of employing various atherectomy technologies, such as rotating or laser systems. The adoption of these devices may be limited by a lack of qualified personnel, which could result in less than ideal results. Further impeding the widespread adoption of atherectomy devices, particularly in underserved areas, is the time-consuming and expensive nature of the training process.

High Costs

One of the biggest obstacles to the market for atherectomy devices is their high cost, which prevents many people from using them, especially in areas with low and intermediate incomes. Healthcare providers may be discouraged from investing in these devices due to the high production and procurement costs associated with their sophisticated technology. Additionally, patients may find the procedure's cost—which includes hospital costs and gadget usage—to be unaffordable, particularly in places with less advantageous reimbursement policies. Even while atherectomy therapies are successful in controlling cardiovascular problems, access to them may be limited by this price barrier.

Atherectomy Devices Market Overview by Regions

The market for atherectomy devices is growing internationally, with North America leading the way because of its sophisticated healthcare system and strong demand for minimally invasive procedures. Europe comes in second, primarily due to the rise in incidence of cardiovascular disease. The Asia-Pacific region is expanding quickly as a result of increased awareness, better access to healthcare, and economic prosperity. Due to rising healthcare spending and the need for cutting-edge medical technology, markets in Latin America and the Middle East are also expanding.

United States Atherectomy Devices Market

The growing geriatric population in the United States is the main factor driving the growth of the atherectomy devices market. The predicted number of elderly Americans is 55.8 million, or 16.8% of the overall population, based on census data released in May 2023. The need for these devices is growing since atherectomy is a treatment for peripheral artery disease (PAD), which is more common in older people.

Additionally, the market is expanding due to the rise in chronic conditions including PAD and atherosclerosis. High cholesterol, obesity, and diabetes all contribute to atherosclerosis, which results in artery blockages that frequently necessitate atherectomy treatments. About 25 million adults in the United States have excessive cholesterol, which raises the risk of atherosclerosis, according to a May 2024 CDC research. Since atherectomy devices provide a successful, minimally invasive therapy option for restoring blood flow and lowering problems in affected individuals, it is anticipated that the rising prevalence of cardiovascular disorders will continue to drive the demand for these devices.

Germany Atherectomy Devices Market

The growing frequency of cardiovascular disorders, especially peripheral artery disease (PAD), among the elderly population is driving growth in the German market for atherectomy devices. The adoption of atherectomy devices is being driven by Germany's well-established healthcare system as well as growing awareness of minimally invasive therapies. Favorable reimbursement rules and technological developments in device design further support market expansion. Furthermore, the demand for atherectomy treatments is supported by the increased prevalence of risk factors such as diabetes, obesity, and high cholesterol.

India Atherectomy Devices Market

Due to the rising incidence of cardiovascular disorders, especially peripheral artery disease (PAD), among the vast population of India, the market for atherectomy devices is expanding significantly. The need for atherectomy treatments is being driven by an aging population and rising risk factors like obesity, diabetes, and high cholesterol. Market acceptance is also being aided by India's developing healthcare system and rising awareness of minimally invasive procedures. In the upcoming years, the market is anticipated to grow even more due to favorable government regulations, expanding access to healthcare, and technological advancements in atherectomy devices.

Saudi Arabia Atherectomy Devices Market

The market for atherectomy devices is expanding in Saudi Arabia as a result of an aging population and an increase in cardiovascular disorders, particularly peripheral artery disease (PAD). Demand is being driven by improvements in healthcare access, atherectomy technology breakthroughs, and increased awareness of minimally invasive procedures. The healthcare system in Saudi Arabia is also making investments in cutting-edge medical technology, which encourages the use of atherectomy tools for the efficient treatment of arterial blockages.

Atherectomy Devices Market Segments

Product Type

- Directional

- Rotational

- Orbital

- Laser

Application

- Cardiovascular

- Neurovascular

- Peripheral Vascular

End User

- Hospitals

- Ambulatory Care Service

- Medical Research Institutes

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Rest of the World

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key Persons

- Product Portfolio

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Boston Scientific Corporation, Inc.

- Abbott Laboratories

- Medtronic plc

- Cardinal Health

- Terumo Corporation

- Integer Holdings Corporation

- Becton, Dickinson and Company

- AngioDynamics Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product Type, By Application, By End User and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

-

What is the current size and projected growth of the global atherectomy devices market from 2025 to 2033?

-

What are the major factors driving the demand for atherectomy devices worldwide?

-

Which type of atherectomy device (directional, orbital, rotational, laser) holds the largest market share?

-

How is the rise in peripheral artery disease (PAD) and cardiovascular diseases influencing market growth?

-

What are the key technological advancements shaping the future of atherectomy procedures?

-

Which application segment (cardiovascular, neurovascular, peripheral vascular) is expected to dominate the market?

-

Who are the leading players in the global atherectomy devices market and what are their strategies?

-

What are the major challenges and risks faced by the atherectomy devices industry?

-

How do regional trends vary across North America, Europe, Asia-Pacific, and other regions?

-

What are the future opportunities and investment trends in the global atherectomy devices market?

-

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. Global Atherectomy Devices Market

6. Market Share Analysis

6.1 By Product Type

6.2 By Application

6.3 By End User

6.4 By Countries

7. Product Type

7.1 Directional

7.2 Rotational

7.3 Orbital

7.4 Laser

8. Application

8.1 Cardiovascular

8.2 Neurovascular

8.3 Peripheral Vascular

9. End User

9.1 Hospitals

9.2 Ambulatory Care Service

9.3 Medical Research Institutes

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

10.6 Rest of the World

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1.1 Strength

12.1.2 Weakness

12.1.3 Opportunity

12.1.4 Threat

13. Key Players Analysis

13.1 Boston Scientific Corporation, Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Product Portfolio

13.1.4 Recent Development & Strategies

13.1.5 Revenue Analysis

13.2 Abbott Laboratories

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Product Portfolio

13.2.4 Recent Development & Strategies

13.2.5 Revenue Analysis

13.3 Medtronic plc

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Product Portfolio

13.3.4 Recent Development & Strategies

13.3.5 Revenue Analysis

13.4 Cardinal Health

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Product Portfolio

13.4.4 Recent Development & Strategies

13.4.5 Revenue Analysis

13.5 Terumo Corporation

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Product Portfolio

13.5.4 Recent Development & Strategies

13.5.5 Revenue Analysis

13.6 Integer Holdings Corporation

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Product Portfolio

13.6.4 Recent Development & Strategies

13.6.5 Revenue Analysis

13.7 Becton, Dickinson and Company

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Product Portfolio

13.7.4 Recent Development & Strategies

13.7.5 Revenue Analysis

13.8 AngioDynamics Inc.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Product Portfolio

13.8.4 Recent Development & Strategies

13.8.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com