Australia Diabetes Market Forecast Report by Type (Self-Monitoring Devices, Continuous Glucose-Monitoring Devices, Insulin Pumps, Insulin Pens), End User (Hospitals, Diagnostics Centers, Homecare) and Company Analysis 2024-2032

Buy NowAustralia Diabetes Devices Market Size

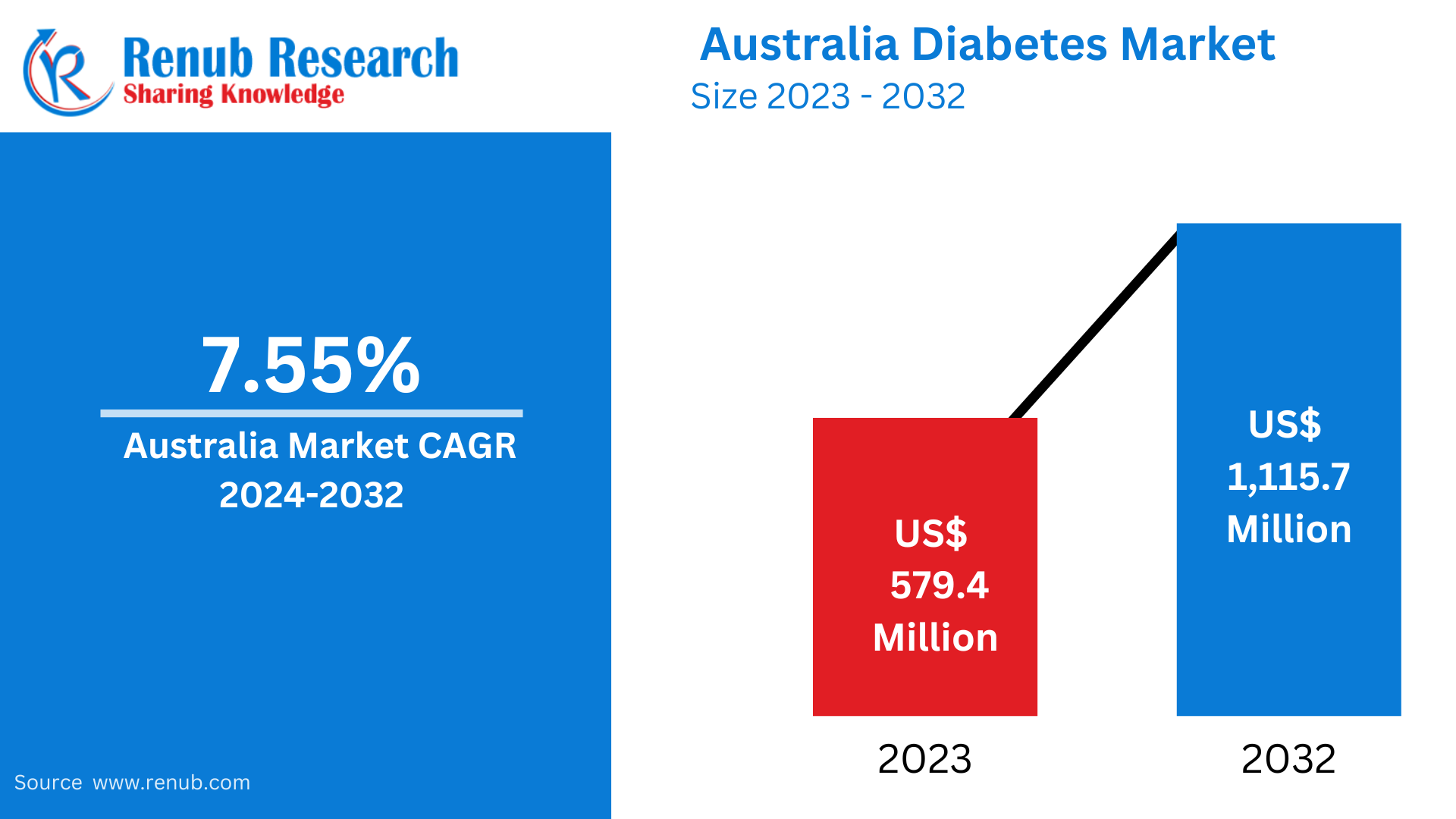

Australia Diabetes Devices market is expected to reach US$ 579.4 Million in 2023 to US$ 1,115.7 Million by 2032, with a CAGR of 7.55 % from 2024 to 2032. The market is mainly driven by rising obesity rates, increased use of insulin delivery devices, increasing prevalence of diabetes, and improved technology. To capture a sizable share of the market, major manufacturers are focusing on technological innovation and the development of cutting-edge products.

Australia Diabetes Devices Overview

Diabetes devices are used to control blood sugar levels in the body, which are brought on by the creation of insulin. Patients with diabetes are given this gadget to track their blood glucose levels and improve their chances of recovery from this long-term illness. Patients with diabetes who are unable to manufacture insulin on their own administer insulin into their bodies using insulin pumps. Pens, pumps, and syringes are examples of insulin devices. Diabetes meters help determine blood sugar levels and provide an approximation of the process.

The Australian National Health Survey found that 5.3%, or one in twenty, had diabetes. The most frequent type of diabetes was found to be type 2 (85.5%), followed by type 1 (11.0%) and type not known to the person reporting (4.1%). Unbalances in blood glucose levels that do not correspond to normal blood glucose levels are the primary diagnosis for people with diabetes. Only doctors can use common lab diagnostic tests to assist diagnose a patient. Individuals whose blood glucose levels fluctuate more frequently should have it monitored daily. Patients who are giving themselves insulin must regularly monitor their blood glucose levels and, if needed, modify their prescription or insulin dosage.

Growth Drivers for the Australia Diabetes Device Market

Rising Rate of Diabetes

Diabetes Australia reports that diabetes is the chronic condition with the fastest rate of growth in Australia, outpacing the growth of other chronic illnesses like cancer and heart disease.

There are currently approximately 1.9 million diabetics in Australia, comprising approximately 1.5 million known and registered cases of all types of diagnosed diabetes and an estimated 500,000 cases of type 2 diabetes that are not yet identified. Diabetes is becoming more common among children and teenagers. Type 1 diabetes affects almost all children and young adults with the disease. Furthermore, type 2 diabetes is striking youngsters at younger ages. Diabetes therapies and related technology, as well as access to care from a multidisciplinary pediatric diabetes team, are among the special needs of children and young adults with type 1 and type 2 diabetes.

The maintenance of blood glucose levels within a given target range is one of the primary goals of diabetes treatment. It can be accomplished by striking a balance between diet, exercise, way of life, and diabetes medications. Readings from blood glucose monitors give the information needed to choose the most effective diabetes care plan. A person's risk of acquiring diabetes-related problems, such as diabetic retinopathy, heart disease, renal disease, etc., can be decreased by maintaining blood glucose levels within a target range.

Introduction of New and Technically Advanced Products to Fuel the Market Growth for Diabetes Devices

One of the key elements propelling the market expansion in Australia is the introduction of new products in the diabetes treatment and monitoring systems category. An increase in the prevalence of diabetes, coupled with changes in sedentary lifestyles and urbanization. The market is growing due to advancements in technology for diabetes devices as well as a rise in the number of people with diabetes.

The primary driver of the market expansion is the increase in funding for diabetes care made by both public and private entities. The market is growing due to advancements in digital health technology and the availability of software applications for diabetes management.

Additionally, the market is currently growing at an accelerated rate due to the rising demand for diabetes care devices. One of the main causes of diabetes in the general population is the growth in obesity. Men are more likely than women to be obese. Risk factors driving the market expansion include a rise in obesity incidence that is directly linked to an increase in diabetes prevalence.

Australia Diabetes Devices Company Analysis

The major participants in the Australia Diabetes Device market includes Novo Nordisk A/S, Eli Lilly, Roche, Abbott Laboratories, Insulet Corporation, Dexcom Inc, Medtronic, Ypsomed AG.

Australia Diabetes Devices Company News

In November 2023, The Australian government has authorized multiple healthcare providers, such as General Practitioners (GPs), diabetes educators, diabetic clinics, Registered Nurses (RNs), and specialists, to write prescriptions for continuous glucose monitoring (CGM) devices.

In November 2022, The Tempo Personalized Diabetes Management Platform, Eli Lilly and Company's first linked platform, was set to launch. With the use of data-backed insights, the system attempts to support doctors and people with type 1 or type 2 diabetes in managing treatment with Lilly insulins. The Tempo Smart Button, the connected app TempoSmart, and the prefilled insulin pen Tempo Pen make up the three main parts of the platform. Together, they provide persons with diabetes with tailored advice.

Type- Industry is divided into 4 viewpoints:

- Self-Monitoring Devices

- Continuous Glucose-Monitoring Devices

- Insulin Pumps

- Insulin Pens

End User - Industry is divided into 3 viewpoints:

- Hospitals

- Diagnostics Centers

- Homecare

All companies have been covered with 5 Viewpoints

- Overviews

- Key Person

- Recent Developments & Strategies

- Product Portfolio & Product Launch in Last 1 Year

- Revenue

Company Analysis

- Novo Nordisk A/S

- Eli Lilly

- Roche

- Abbott Laboratories

- Insulet Corporation

- Dexcom Inc

- Medtronic

- Ypsomed AG

Report Details:

| Report Features | Details |

| Base Year |

2023 |

| Historical Period |

2019 - 2023 |

| Forecast Period |

2024 - 2032 |

| Market |

US$ Million |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in the Report

-

What is the current size and projected growth of the Australia Diabetes Devices Market from 2023 to 2032?

-

Which factors are driving the rapid adoption of diabetes devices across Australia?

-

How is the increasing prevalence of diabetes and obesity impacting the demand for monitoring and insulin delivery devices?

-

What role do technological innovations and smart diabetes management platforms play in market expansion?

-

What are the major types of diabetes devices dominating the market (Self-Monitoring Devices, CGMs, Insulin Pumps, Pens)?

-

Which end-user segment—Hospitals, Diagnostic Centers, or Homecare—contributes the most to device usage and why?

-

Who are the key players in the Australian diabetes devices market and what are their recent strategies or innovations?

-

What government policies or healthcare initiatives are supporting the use of diabetes management devices in Australia?

-

How are children and young adults with Type 1 and Type 2 diabetes shaping product demand and device design?

-

What challenges or restraints could hinder the growth of diabetes device adoption in the Australian market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Australia Diabetes Devices Market

6. Australia Diabetes Population

6.1 Type 1 Diabetes

6.2 Type 2 Diabetes

7. Market Share Analysis

7.1 By Types

7.2 By End User

8. Types

8.1 Self-Monitoring Devices

8.1.1 Test Strips

8.1.2 Lancets

8.1.3 Blood Glucose Meters

8.2 Continuous Glucose-Monitoring Devices

8.2.1 Sensors

8.2.2 Transmitter

8.2.3 Receiver

8.3 Insulin Pumps

8.3.1 Patch Pumps

8.3.2 Tethered Pumps

8.3.3 Consumables

8.4 Insulin Pens

8.4.1 Disposable Insulin Pen

8.4.2 Reusable Insulin Pen

9. End User

9.1 Hospitals

9.2 Diagnostics Centers

9.3 Homecare

10. Porters Five Forces

10.1 Bargaining Power of Buyer

10.2 Bargaining Power of Supplier

10.3 Threat of New Entrants

10.4 Rivalry among Existing Competitors

10.5 Threat of Substitute Products

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Reimbursement Policies

12.1 CGM Devices in Australia

12.2 Blood Glucose Devices in Australia

12.3 Insulin Pump Products in Australia

12.4 Insulin Pen in Australia

13. Key Players Analysis

13.1 Novo Nordisk A/S

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments & Strategies

13.1.4 Product Portfolio & Product Launch in Last 1 Year

13.1.5 Revenue

13.2 Eli Lilly

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments & Strategies

13.2.4 Product Portfolio & Product Launch in Last 1 Year

13.2.5 Revenue

13.3 Roche

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments & Strategies

13.3.4 Product Portfolio & Product Launch in Last 1 Year

13.3.5 Revenue

13.4 Abbott Laboratories

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments & Strategies

13.4.4 Product Portfolio & Product Launch in Last 1 Year

13.4.5 Revenue

13.5 Insulet Corporation

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments & Strategies

13.5.4 Product Portfolio & Product Launch in Last 1 Year

13.5.5 Revenue

13.6 Dexcom Inc

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments & Strategies

13.6.4 Product Portfolio & Product Launch in Last 1 Year

13.6.5 Revenue

13.7 Medtronic

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments & Strategies

13.7.4 Product Portfolio & Product Launch in Last 1 Year

13.7.5 Revenue

13.8 Ypsomed AG

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments & Strategies

13.8.4 Product Portfolio & Product Launch in Last 1 Year

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com