Australia Meat Snacks Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowAustralia Meat Snacks Market Trends & Summary

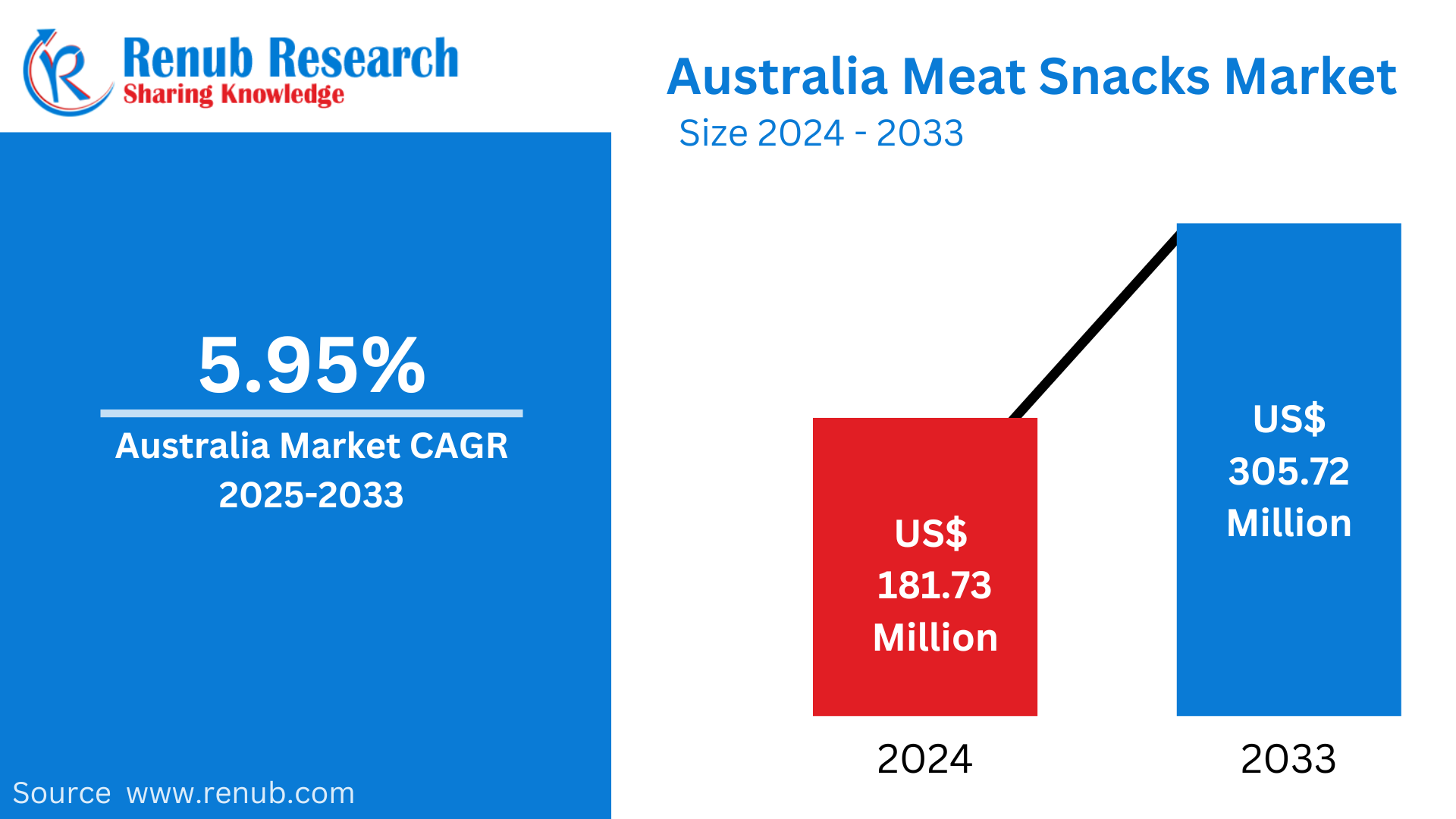

The Australian market for meat snacks was worth around US$ 181.73 million in 2024 and is expected to reach US$ 305.72 million by 2033, growing at a CAGR of 5.95% from 2025 to 2033. Expanding consumer demand for protein-rich, convenient snack foods drives market growth. Flavour innovation, packaging innovation, and healthier solutions drive sales while enhanced distribution in supermarkets, convenience stores, and online channels enables additional growth.

The report Australia Meat Snacks Market Forecast covers by Product (Jerky, Sticks, Sausages, Others), Nature (Conventional, Organic), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others), Company Analysis 2025-2033.

Australia Meat Snacks Market Outlooks

Meat snacks are convenient, ready-to-consume products made of different kinds of meat such as beef, pork, chicken, and kangaroo. Types consumed include jerky, biltong, meat sticks, and protein bars with beef infusions. Meat snacks are seasoned, cured, or dried to add taste and improve shelf life. They cater to consumers in need of convenient, high-protein food for energy and nutrition on the move.

Meat snacks have become increasingly popular in Australia as the demand for high-protein, low-carbohydrate diets has grown, especially among health enthusiasts and fitness fanatics. Busy lifestyles, with an emphasis on convenient on-the-go snacking, also drive the market. Retailers such as supermarkets, convenience stores, and online shopping websites have increased the availability of products, which in turn has increased the availability of meat snacks. Also, growing interest in locally raised and sustainable meats, including kangaroo jerky, has led to market growth. With growing demand for healthier, preservative-free products, manufacturers are turning to organic, grass-fed, and naturally flavored meat snack items. As per the Department of Agriculture, Fisheries and Forestry (DAFF) projections, the value of beef, veal, and live cattle production is projected to increase by 25% in 2024-25, thereby enhancing the Australian meat snacks market growth.

Growth Drivers in the Australia Meat Snacks Market

Rising Demand for High-Protein and Healthy Snacks

The increasing trend towards high-protein, low-carb diets is a major growth driver for the Australian meat snacks market. Consumers increasingly seek healthier alternatives to traditional snack foods, such as chips and confectionery, opting for nutrient-dense options like jerky and biltong. Fitness-conscious individuals and those following ketogenic or paleo diets prefer meat snacks due to their protein content and natural ingredients. Additionally, manufacturers are responding to health trends by offering organic, grass-fed, and low-sodium meat snacks, further expanding the market. In Sept 2024, Australian plant-based meat company vEEF introduced four carbon-neutral products, all priced similarly to or less than their animal-equivalent options. The products include Plant Based on Beef Mince, Plant-Based Classic Sausages, Plant-Based Smokey Sausages, and Plant Based Chorizo Sausages. They are chef-developed and nutrient-dense, with 50% less plastic packaging compared to earlier vEEF offerings.

Convenience and On-the-Go Lifestyles

Busy lifestyles have driven demand for convenient, ready-to-eat snacks in Australia. Meat snacks provide a convenient, long-lasting, and healthy alternative for customers who require instant energy sources during the day. Packaged meat snacks are an on-the-go favorite among Australians with increasing work hours, traveling, and outdoor recreational activities. The widening availability of the product in supermarkets, convenience stores, and vending machines provides increased availability, fueling sustained market expansion. In 2024, Hungry Jack's introduced a new bite-sized snack product nationwide in Australia that presents a creative twist on the beloved burger. The new products are a follow-up to the gravy tattoos and pop'n chicken releases, both of which have become crowd-pleasing snack products.

Retail and Online Distribution Channel Expansion

Widespread distribution of meat snacks through several channels of retail such as supermarkets, convenience stores, and online retailers is an essential growth factor. Grocers such as Woolworths and Coles have increased their variety of meat snack offerings, and specialty health stores and online stores serve niche consumer needs. Internet platforms enable brands to access more consumers, offer convenience, and subscription-based shopping. Online sales expansion and efficient digital marketing have greatly increased consumer exposure and accessibility to different meat snack brands. Dec 2024, Go Snack is extending its range into all Viva Energy Australia, Reddy Express, and Coles Express outlets throughout Australia. The product range, in collaboration with Inghams Group, includes three products: Sweet Chilli Chicken Tenders, Chicken Chippies and Chicken Nuggets. All products are prepared from Australian hormone-free chicken and contain no artificial flavor or colors.

Challenges in the Australia Meat Snacks Market

Increased Production Costs and Supply Chain Problems

The price of raw materials, particularly quality meats, has risen in Australia because of inflation, supply chain issues, and climate conditions. Moreover, processing premium meat snacks, including grass-fed and organic products, increases overall costs. Transport and packaging costs also contribute to pricing difficulties, pushing meat snacks above ordinary snacks. Pricing strategies need to be balanced while ensuring product quality to compete effectively.

Strict Compliance with Regulations and Health Issues

The Australian market for meat snacks is under stringent food labeling and food safety regulation, posing an obstacle for companies. Firm processes are in place for processing procedures, ingredient clarity, and stability of shelf life. Consumer faith is affected by issues of concern regarding preservatives, salt content, and chemical additives. Manufacturers have to conform to laws and develop healthier products, like nitrates-free and lower-sodium alternatives, to respond to changing consumer requirements and keep market reputation intact.

Australia Jerky Meat Snacks Market

The jerky meat snacks market in Australia is among the highest-growing sectors, influenced by the consumer trend towards protein-rich, high-flavor snacks. Jerky, produced through marinating and dehydrating meat, is favored because it has a long shelf life, it is convenient, and it is nutritious. Australian consumers are increasingly looking for grass-fed, organic, and minimally processed jerky. Local brands are launching new flavors, such as distinctive native ingredients like bush spices and kangaroo jerky, to attract adventurous consumers. Supermarkets, specialty health food stores, and online stores are increasing their jerky lines, making them more widely available to health-oriented and fitness-oriented consumers.

Australia Sausages Meat Snacks Market

Sausage-based meat snacks, like meat sticks and salami snack-sized, have become popular in Australia because of their intense flavor and convenience. These foods provide a protein-rich alternative to conventional snack foods, appealing to consumers who are fond of cured and smoked meat flavor. Pepperoni sticks and mini sausages are widely available in supermarkets and convenience stores, targeting casual snackers as well as individuals on high-protein diets. Manufacturers are, however, making efforts to cut down on sodium and preservative levels to meet increasingly health-conscious consumers. Growing gourmet and locally made sausage snack options will fuel additional market expansion.

Australia Organic Meat Snacks Market

Organic meat snacks are increasing in demand in Australia as consumers seek clean-label, ethically produced, and preservative-free items. Grass-fed, hormone-free, naturally processed meat snacks are gaining popularity, especially among health-oriented purchasers. Brands are launching organic jerky, biltong, and sausages made from free-range beef and kangaroo meat to meet this trend. Consumers also happily pay a premium for organic labels and sustainable packaging. With health benefits of organic food becoming more widely known, availability of organic meat snacks in specialty outlets and online stores increases, driving total market growth.

Australia Meat Snacks Convenience Stores Market

Meat snacks distribution in Australia largely depends on convenience stores. Most consumers like to take quick protein snacks on the go, so convenience stores are a key distribution channel. Some of the favorite items are single-serve jerky packets, meat sticks, and salami strips, appealing to workers, travelers, and gym-goers. Major convenience store chains, like 7-Eleven and NightOwl, have widened their range of meat snacks, including domestic and international players. Promotions, bundle sales, and sampling at the store further fuel sales, making convenience stores an important point of purchase among meat snack consumers.

Australia Meat Snacks Online Retail Stores Market

The online retail industry has immensely contributed to the meat snacks market in Australia by giving consumers higher accessibility and variety. E-commerce websites such as Amazon, Woolworths Online, and specialty health food web sites enable customers to discover various brands, flavors, and bulk buy options. Meat snacks delivered on a monthly basis as part of subscription-based services have also picked up steam. Online channels profit from digital advertising, influencer support, and direct-to-consumer initiatives to boost brand image. With a growing number of Australians adopting e-commerce, the meat snacks business expands with convenience at home along with tailored offerings of products.

Australia Meat Snacks Market Segments

Product

- Jerky

- Sticks

- Sausages

- Others

Nature

- Conventional

- Organic

Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Key Players Analysis

- Nestlé S.A.

- Hormel Foods

- Conagra Brands

- Bridgford Foods

- Hershey

- Associated British Foods plc

- Tyson Foods, Inc.

- Danish Crown

- Kerry Group plc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Product, Nature and Distribution Channel |

| Distribution Channel Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What is the projected market size of the Australian meat snacks industry by 2033?

- What is the expected CAGR of the Australian meat snacks market from 2025 to 2033?

- What are the key drivers fueling the growth of the meat snacks market in Australia?

- How is the demand for high-protein and low-carb snacks influencing market trends?

- What role does convenience and on-the-go consumption play in market expansion?

- How are supermarkets, convenience stores, and online retailers contributing to market growth?

- What challenges does the Australian meat snacks market face in terms of production costs?

- How do regulatory and health concerns impact the market for meat snacks in Australia?

- What are the emerging trends in jerky and sausage-based meat snacks in Australia?

Customization Services available

-

Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Australia Meat snacks Market

6. Market Share

6.1 Product

6.2 Nature

6.3 Distribution Channel

7. Product

7.1 Jerky

7.2 Sticks

7.3 Sausages

7.4 Others

8. Nature

8.1 Conventional

8.2 Organic

9. Distribution Channel

9.1 Supermarkets/Hypermarkets

9.2 Convenience Stores

9.3 Online Retail Stores

9.4 Others

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Nestlé S.A.

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Hormel Foods

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Conagra Brands

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Bridgford Foods

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Hershey

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Associated British Foods plc

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Tyson Foods, Inc.

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Danish Crown

12.8.1 Overview

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 Kerry Group plc.

12.9.1 Overview

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com