Global Bakery Products Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowBakery Products Market Trends & Summary

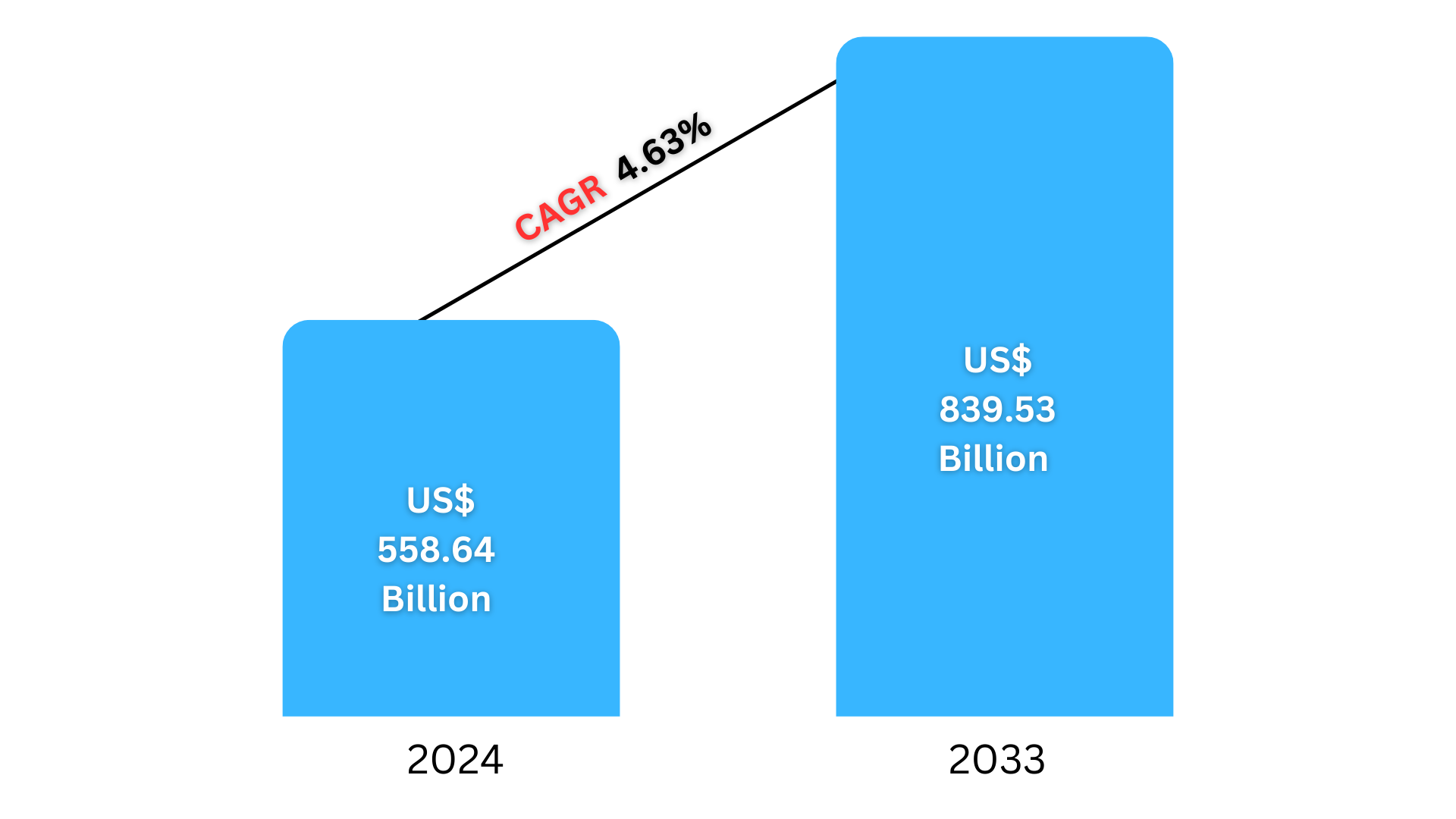

Global Bakery Products Market is anticipated to reach US$ 839.53 billion by 2033, up from US$ 558.64 billion in 2024, at a CAGR of 4.63% from 2025 to 2033. Excessive consumer demand for ready-to-eat, convenient baked foods, rising health-focused product developments, and the growth of gluten-free and organic bakery products are primary market drivers across different regions of the world.

Global Bakery Products Market By Products (Cakes and Pastries, Biscuits, Bread, Morning Goods, Other), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Speciality Stores, Online Retail Stores, Other), Countries and Company Analysis 2025-2033

Global Bakery Products Market Outlooks

Bakery products are a broad category of food products produced from flour, water, and other materials, usually baked in an oven. Bakery products consist of bread, cakes, pastries, cookies, biscuits, muffins, and pies. They may be sweet or savory and are eaten as snacks, meals, or desserts. Bakery products are prepared through different processes such as fermentation, mixing, and baking, and may also include other ingredients like sugar, eggs, and fats to provide flavor and texture.

Bakery foods contribute extensively to day-to-day diets across the globe. Bread forms an integral part of most diets as a major source of carbohydrates and energy. Cakes and pastries are regularly consumed for festivals and occasions, whereas biscuits and cookies serve as convenient snack items. Also, value-added bakery products like gluten-free, whole-grain, and organic food products address health-conscious customers. In the foodservice sector, bakery products are used extensively in restaurants, cafes, and convenience stores, offering convenient and versatile food to consumers.

Growth Drivers in the Global Bakery Products Market

Increased Demand for Convenient and Ready-to-Eat Products

The modern lifestyle has resulted in a growing demand for quick, ready-to-eat bakery products. Working professionals and students are the major consumers of on-the-go snacks such as biscuits, pastries, and muffins because of their busy schedules. Moreover, pre-packaged bakery products provide longer shelf life and convenience, hence a more desirable option compared to traditional homemade products. The increasing popularity of e-commerce and online food delivery has also increased accessibility, enabling consumers to buy bakery products with ease. This convenience demand continues to fuel innovation in packaging, product range, and healthier alternatives, growing the global bakery market. February 2024: Base Culture, one of the popular frozen bakery foods manufacturers, announced the introduction of its new simply bread line to increase its gluten-free product portfolio. The new product line is reported to be a clean label and gluten-free product line.

Growing Consumer Demand for Healthier Options

Health-conscious consumers are moving towards whole grain, gluten-free, organic, and fortified bakery foods. Growing consciousness toward the advantages of fiber-based, sugar-free, and protein-enhanced baked food has contributed toward growth in product development in the segment. Responding to dietary needs, producers are adding natural ingredients, vegetable proteins, and functional additives into their products. The trend for vegan and keto-friendly baked goods is also increasingly popular. Demand for fortified bakery products with additional vitamins, minerals, and probiotics is also increasing market growth, especially in the developed world of North America and Europe. April 2023: India-based Britannia, one of the leading manufacturers of bakery products, launched its millet bread, which is free of refined flour. With this launch, the company is the first company to introduce health and wellness organic bread in India's regularized bread market.

Supermarket, Hypermarket, and Online Expansion

The presence of bakery items in supermarkets, hypermarkets, and online retailers has greatly fueled market growth. Freshly baked products from in-store bakeries in supermarkets and convenience stores are preferred by customers, while packaged products still reign supreme on retail shelves. Increased availability of online shopping of groceries and e-commerce platforms has facilitated the easy exploration and procurement of bakery products with doorstep delivery facilities. Further, key bakery brands are placing investments in direct-to-consumer (DTC) business models, subscription-based delivery of specialty baked items, increasing market accessibility and reach. Feb 2025, The retail bakery products market is consolidating via acquisition for market expansion and innovation. Recently, Furlani Foods acquired Cole's Quality Foods to strengthen its position in frozen and specialty bread categories.

Challenges in the Global Bakery Products Market

Increase in Raw Material Prices and Supply Chain Disruptions

The price of major bakery ingredients like flour, sugar, eggs, and dairy products has been fluctuating because of climate change, geopolitics, and supply chain disruptions. The COVID-19 pandemic and recent trends in global inflation have further added to the production cost. Furthermore, delays in the supply chain impact ingredient procurement, transportation, and packaging supplies, which would increase operational costs for producers. This has caused bakery producers to either pass on the costs or raise the product price, which will influence consumer purchasing habits.

Increased Competition from Alternative and Healthier Food Segments

Although the bakery space is transforming with healthier versions of products, it continues to suffer from intense competition from substitute snacking categories such as protein bars, plant-based snacks, and fresh fruit-based products. Low-carb, sugar-free, and high-protein diets are replacing traditional baked items among consumers. Furthermore, dietary issues surrounding gluten intolerance and diabetes have prompted some consumers to reduce bakery intake. The industry must continuously innovate and reformulate products to cater to changing dietary trends while maintaining taste and texture.

Global Bakery Biscuits Market

The global bakery biscuits market comprises a large number of sweet and savory biscuits, crackers, and cookies. All these products are extremely popular because they have a long shelf life, are affordable, and convenient to use. The market for healthy biscuits containing whole grains, nuts, and fiber is increasing, as well as indulgence products such as chocolate-coated and cream-filled biscuits. With growing urbanization and hectic lifestyles, biscuits are a convenient on-the-go food for consumers in all age groups. Moreover, premium and artisanal biscuit brands are growing, providing gourmet flavors and health-oriented ingredients to meet changing consumer tastes.

Global Bread Market

Bread is a food eaten globally, so the global bread market is among the largest sectors in the bakery market. Classic white and whole wheat bread reign supreme, but specialty breads such as sourdough, multigrain, gluten-free, and high-protein breads are increasingly in demand. Fortified bread with added nutrients and probiotics is also gaining popularity. Pre-sliced, packaged bread convenience and the proliferation of artisan bakeries drive market growth. Further, local bread types like baguettes in France, naan in India, and pita in the Middle East contribute to local and worldwide market expansion.

Global Specialty Stores Bakery Products Market

Specialty stores target customers seeking premium, artisanal, and customized baked products. These include gourmet pastries, organic bread, gluten-free foods, and hand-made cakes. Customers seeking distinct flavors, traditional baking methods, and high-quality ingredients opt for specialty stores over mass-market chains. The rising trend of health-oriented and allergen-free bakery products has further boosted growth in this segment. Several specialty bakeries also provide online ordering and home delivery facilities, improving accessibility and convenience.

Global Supermarkets/Hypermarkets Bakery Products Market

Supermarkets and hypermarkets are still the biggest distribution channel of bakery products, comprising a variety of fresh and packaged baked goods. In-store bakeries entice customers through fresh bread, cakes, and pastries, while convenience comes from packaged goods. Supermarkets also play an important role in launching new bakery innovations and seasonal and festive products. Discount offers and private-label bakery brands have also turned these shops into a first-choice shopping place.

United States Bakery Products Market

The U.S. bakery industry is fueled by convenience, health-oriented trends, and premium bakeries. Buyers are seeking lower-carb, organic, and higher-protein baked products more and more. Demand for specialty and artisan breads, gourmet pastries, and gluten-free products is on the increase. Furthermore, online grocery shopping and food delivery platforms have increased access. Café chains, bakeries, and supermarkets persist in being industry leaders with chains innovating packagings as well as reformulating ingredients. July 2024, Hometown Food Co.'s manufactured Pillsbury Baking brought about two new offerings: stuffed cookie kits with flavors caramel filled chocolate chip and raspberry filled chocolate; and moist supreme creamy cake mixes in vanilla and almond.

Italy Bakery Products Market

Italy has a reputation for traditional baked products, such as fresh bread, croissants, and specialty pastries like cannoli and panettone. The Italian bakery market depends on artisanal and locally produced products, focusing on high-quality ingredients and traditional recipes. Customers prefer freshly baked products from local bakeries, but packaged baked products are also increasing in demand, especially in supermarkets. Increasing demand for gluten-free and organic bakery products is an indication of changing consumer behavior.

India Bakery Products Market

The bakery market in India is growing with the growth of urbanization, disposable income, and Western food trends. Demand for packaged bread, biscuits, and cake is on the rise, especially in tier 2 and tier 3 cities. Health-conscious products like whole wheat bread, ragi biscuits, and sugar-free cake are increasing their base. Growing dominance of café culture and online food ordering websites is also propelling market growth. Oct 2024, Grupo Bimbo's Indian arm, Bimbo Bakeries India, has rolled out a new campaign for its favorite item, CremTreat—a filled bun flavored. Saatchi Propagate India has created this digital-first campaign that looks to boost brand recall among 12-15-year-olds and mothers through CremTreat's unbeatable taste and softness. Named "Share Karne Ka Mann Kare, Aur Nahi Bhi," the campaign highlights how tasty CremTreat is so that you'd like to keep it to yourself and share it simultaneously.

Saudi Arabia Bakery Products Market

Saudi Arabia's bakery market is growing rapidly with shifting lifestyles of consumers, increasing disposable income, and a shift towards convenient food products. Conventional Arabic breads such as khubz, samoon, and maamoul remain in demand, with Western-style bread, croissants, and pastries increasingly popular. Healthy and fortified baked foods are becoming more popular, with consumers seeking low-calorie, sugar-free, and high-fiber products. Supermarkets and convenience stores are still the main distribution channels, although online sales of bakeries are also increasing.

Bakery Products Market Segments

Products

-

Cakes and Pastries

-

Biscuits

-

Bread

-

Morning Goods

-

Other

Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience/Grocery Stores

-

Speciality Stores

-

Online Retail Stores

-

Other

Countries

North America

-

United States

-

Canada

Europe

-

France

-

Germany

-

Italy

-

Spain

-

United Kingdom

-

Belgium

-

Netherlands

-

Turkey

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Malaysia

-

Indonesia

-

New Zealand

Latin America

-

Brazil

-

Mexico

-

Argentina

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

All the Key players have been covered from 4 Viewpoints:

-

Overview

-

Key Person

-

Recent Development

-

Revenue

Key Players Analysis

-

Finsbury Food Group Plc.

-

Grupo Bimbo SAB de CV

-

Associated British Foods Plc.

-

Mondelēz International Inc.

-

General Mills Inc.

-

Kellogg Company

-

Britannia Industries Ltd.

-

Walker's Shortbread Ltd.

-

Yıldız Holding

-

McKee Foods Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Products, By Distribution Cannel and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Bakery Products Market

6. Market Share Analysis

6.1 By Products

6.2 By Distribution Cannel

6.3 By Countries

7. Products

7.1 Cakes and Pastries

7.2 Biscuits

7.3 Bread

7.4 Morning Goods

7.5 Other

8. Distribution Channel

8.1 Supermarkets/Hypermarkets

8.2 Convenience/Grocery Stores

8.3 Speciality Stores

8.4 Online Retail Stores

8.5 Other

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia

9.3.5 South Korea

9.3.6 Thailand

9.3.7 Malaysia

9.3.8 Indonesia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 UAE

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Finsbury Food Group Plc.

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Development

12.1.4 Revenue

12.2 Grupo Bimbo SAB de CV

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Development

12.2.4 Revenue

12.3 Associated British Foods Plc.

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Development

12.3.4 Revenue

12.4 Mondelēz International Inc.

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Development

12.4.4 Revenue

12.5 General Mills Inc.

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Development

12.5.4 Revenue

12.6 Kellogg Company

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Development

12.6.4 Revenue

12.7 Britannia Industries Ltd.

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Development

12.7.4 Revenue

12.8 Walker's Shortbread Ltd.

12.8.1 Overview

12.8.2 Key Person

12.8.3 Recent Development

12.8.4 Revenue

12.9 Yıldız Holding

12.9.1 Overview

12.9.2 Key Person

12.9.3 Recent Development

12.9.4 Revenue

12.10 McKee Foods Corporation

12.10.1 Overview

12.10.2 Key Person

12.10.3 Recent Development

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com