Balloon Catheter Market Global Report by Product Type (Normal, Drug Eluting, Cutting, Scoring, Stent Graft, and Others), Indication (Coronary Artery Disease and Peripheral Vascular Disease), Raw Materials (Polyurethane, Nylon, and Others), End-User (Hospitals, Clinics, Ambulatory Surgical Centers, and Diagnostic Centers), Countries and Company Analysis 2025-2033

Buy NowGlobal Balloon Catheter Market Size

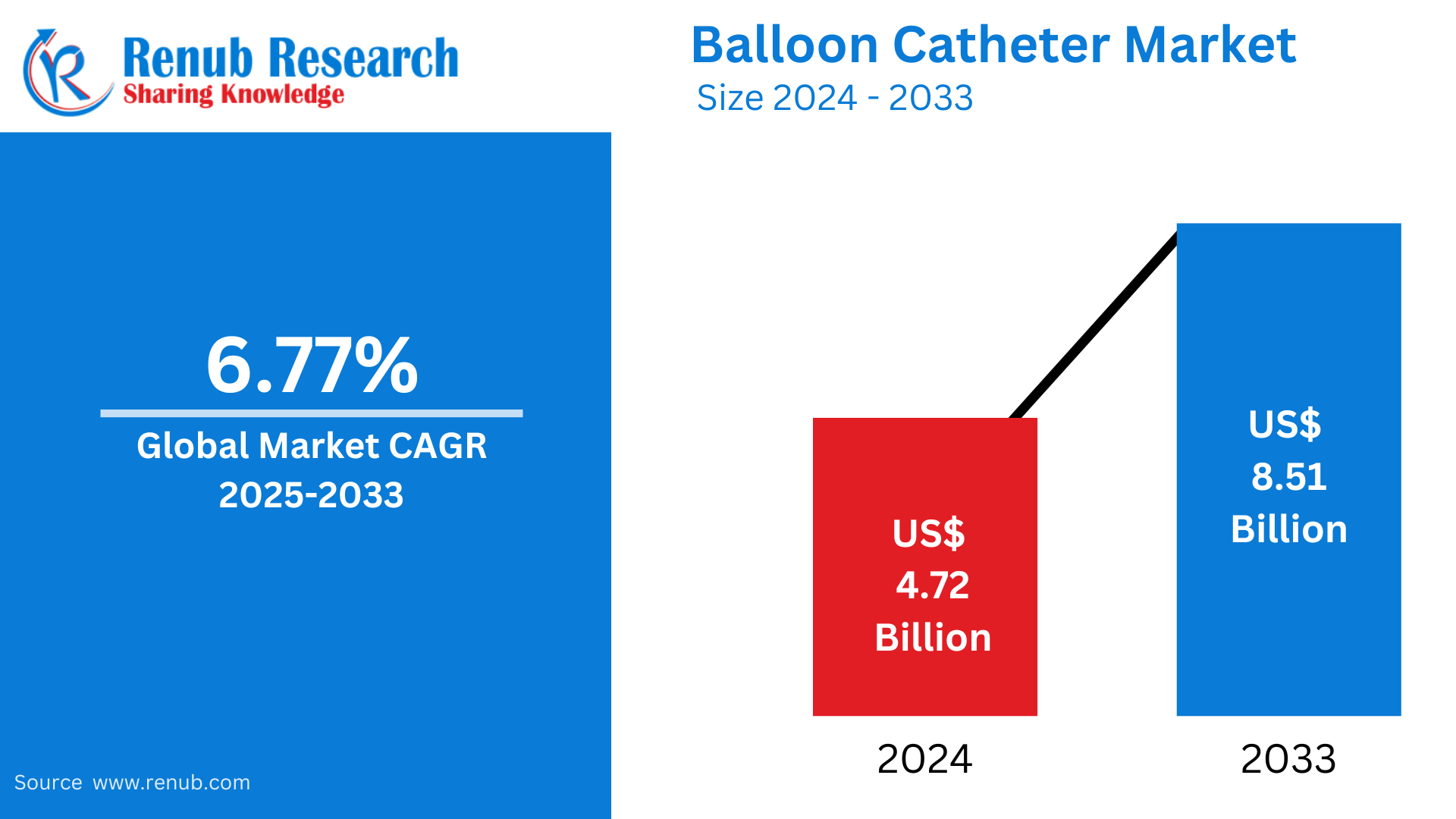

The global balloon catheter market is expected to reach US$8.51 billion in 2033, which is growing from US$4.72 billion in 2024 at a CAGR of 6.77% from 2025 to 2033. This growth will be driven by the rise in incidences of cardiovascular and peripheral vascular diseases, increasing adoption of minimally invasive procedures, and advancements in catheter technology. Also, the growing aging population along with the demand for efficient diagnostic and therapeutic tools increase the market.

Global Balloon Catheter Market Outlooks

A balloon catheter is a medical device that specifically is used in minimally invasive procedures to treat blockages or narrowings in blood vessels and other body pathways. It's a thin, flexible tube, with an inflatable balloon located at the tip, which gets inserted into the affected area then expanded to restore proper flow or create space. This device is a cornerstone in treating cardiovascular diseases, especially in procedures such as angioplasty, which helps widen narrowed or obstructed arteries, improving blood flow to the heart and reducing risks associated with coronary artery disease.

Balloon catheters are used for a variety of applications other than cardiology. They remove limb artery blockages in peripheral vascular procedures, thus ensuring adequate blood circulation. They also help in non-vascular applications like the dilation of urinary tract or esophagus strictures. Some balloon catheters are coated with therapeutic drugs that allow for the direct application of drugs to the affected region, thus improving treatment outcomes. The versatility, precision, and minimally invasive nature of balloon catheters make them indispensable in the practice of modern medicine.

Growth Driver in the Balloon Catheter Market

Increasing Prevalence of Cardiovascular Diseases

There is a growing prevalence of cardiovascular diseases (CVDs) worldwide. Most cardiovascular diseases like coronary artery disease and peripheral artery disease require minimally invasive treatments like angioplasty, where balloon catheters are critical. Increased levels of sedentary lifestyle, unhealthy diet, and growing population all have led to increased incidences of CVD, ensuring a constant demand for the related devices. Early diagnosis and treatment of CVD with evolving healthcare systems have expanded advanced balloon catheter technologies adoption worldwide and further spurred the market and improved patient outcomes. The 2022 National Health Survey estimated that around 1.3 million Australians aged 18 and above (6.7% of adults) reported one or more conditions related to heart, stroke, and vascular disease. This included 600,000 adults with coronary heart disease at 3.0%. Cardiovascular disease was more common in men (7.6%) than women (5.8%) and affected about 28% of adults aged 75 and over.

Advancements in Catheter Technology

Technological advancements in balloon catheter design and materials improve efficiency, safety, and range of applications. Innovations such as drug-coated balloon catheters, which deposit medication directly at the treatment site, have increased their ability to prevent restenosis. Improved flexibility, smaller diameters, and better imaging compatibility have also broadened their application in complex procedures. These advancements reduce complications, increase procedural success rates, and make balloon catheters more attractive to practitioners, which in turn spur market growth. In September 2024, Biotronik, Switzerland, rolled out the FlowGuide and Guidion Short guide extension catheters in selected countries that accept the CE Mark.

Increasing adoption of minimally invasive surgery techniques is the most relevant growth driver for the balloon catheter market. Increasing numbers of patients and healthcare providers choose such procedures due to short periods for recovery, low risk for complications, and shorter stays at hospitals. In such procedures as balloon angioplasty and other endovascular interventions, the balloon catheter is most relevant. Advances in imaging techniques as well as in the catheters' design improve the outcome and accessibility of the less invasive procedures, hence fostering the demand for balloon catheters across a broader array of medical conditions and wider geographic markets.

Challenges in the Balloon Catheter Market

High Costs and Limited Accessibility

The high cost of balloon catheters, especially advanced types such as drug-coated or cutting balloon catheters, is a significant challenge in the global market. These costs can limit accessibility, especially in low- and middle-income countries with constrained healthcare budgets. The expenses of training healthcare professionals and acquiring advanced imaging systems required for procedures further complicate adoption. The patients in the underserved areas may not have access to these devices, and hence, they cannot be treated on a large scale. Developing cost-effective alternatives and improving the healthcare infrastructure is important to overcome this barrier and ensure equitable access to these life-saving technologies.

Stringent Regulatory Approvals

The regulatory approval process for balloon catheters is long and complex because of the stringent testing required to ensure safety and efficacy. Manufacturers must comply with diverse regulatory standards across regions, which can delay product launches and increase development costs. Frequent updates to regulatory frameworks, such as changes in EU MDR guidelines, add additional compliance challenges. These hurdles can discourage smaller companies from entering the market and slow innovation. Addressing these challenges requires streamlined regulatory processes and enhanced collaboration between manufacturers and regulatory bodies to facilitate faster yet safer device approvals.

United States Balloon Catheter Market

United States balloon catheter market in North America is dominated by the United States, primarily due to high prevalence of cardiovascular diseases, better healthcare infrastructure, and increased usage of minimally invasive procedures. The presence of leading companies in medical devices and investments in R&D also drives the market. Rising awareness about heart health and access to advanced technologies make the U.S. a key market for innovations like drug-coated balloon catheters. However, high healthcare costs and regulatory challenges can impact market expansion. The ongoing focus on improving patient outcomes and expanding healthcare access ensures sustained U.S. balloon catheter market growth.

Germany Balloon Catheter Market

Germany leads the balloon catheter market in Europe, owing to its robust healthcare system and intense focus on medical innovation. The country’s aging population and increasing cardiovascular and peripheral vascular disease cases drive the demand for balloon catheters. Germany’s emphasis on adopting cutting-edge technologies, including drug-eluting catheters, has bolstered the market. Additionally, favorable reimbursement policies and collaboration between healthcare providers and manufacturers support growth. However, stringent EU MDR regulations are a challenge. But still, Germany is a central location for advanced medical devices; thus, it will maintain its dominance in the European balloon catheter market. Oct 2022 – Biosense Webster, a Johnson & Johnson MedTech company, introduced HELIOSTAR™ Balloon Ablation Catheter in Europe. It is the first catheter designed for catheter-based cardiac electrophysiological mapping and cardiac ablation when used with a compatible multi-channel RF generator.

China Balloon Catheter Market

The Asia-Pacific market for balloon catheters, especially China, is expected to see rapid growth in demand because of cardiovascular diseases from the current lifestyle and expanded healthcare availability. Government initiatives to enhance medical infrastructure, and promote domestic productions of the medical devices, are assisting in propelling the market towards growth. Local companies continue to make investments in cost-efficient balloon catheters to bridge the supply gap for the country's massive population. However, there exist challenges such as significant disparities between urban and rural healthcare facilities. With present reforms and technological advancements underway, China is expected to emerge as a major stakeholder in the global market for balloon catheters. In March 2024, TekniPlex Healthcare will present its new catheter design and manufacturing capabilities in China.

Brazil Balloon Catheter Market

Brazil is the balloon catheter market leader in Latin America. An increasing burden of cardiovascular diseases and growing awareness about minimally invasive procedures are driving the market. Public and private sector investments in healthcare infrastructure have improved access to advanced medical technologies. Angioplasty and related treatments have expanded the use of balloon catheters in Brazil. Economic instability and uneven healthcare distribution, however, remain challenges. Despite these obstacles, government efforts to enhance healthcare coverage and rising medical tourism are expected to fuel Brazil's balloon catheter market growth. For the first time, September 2023, Endovastec™'s Reewarm™ PTX Drug-Coated Balloon (DCB) Catheter was successfully implanted in Brazil and marks its growing presence in international markets.

Saudi Arabia Balloon Catheter Market

Balloon catheters in the Middle East and Africa find a promising emerging market in Saudi Arabia. Governmental efforts to enhance healthcare services through Vision 2030 form the backbone of the Saudi market. The increasing prevalence of cardiovascular diseases and obesity-related conditions boosts demand for minimally invasive treatments like angioplasty. Investments in advanced medical infrastructure and the growing adoption of innovative medical devices, including drug-coated balloon catheters, drive market expansion. However, reliance on imports and the high cost of advanced devices pose challenges. The healthcare reforms in continuous progress and partnerships with world-class manufacturers will further increase availability and lower the cost of balloon catheters in Saudi Arabia. March 2021, MicroPort Medical (Group) Co. Ltd., Shanghai recently got the approval for four products from the Saudi Food and Drug Authority- Firehawk Rapamycin Target Eluting Coronary Stent System, Firehawk Liberty Rapamycin Target Eluting Coronary Stent System, Firefighter PTCA Balloon Catheter, and Firefighter NC PTCA Balloon Catheter.

Product Type – Market breakup from 6 viewpoints:

1. Normal

2. Drug Eluting

3. Cutting

4. Scoring

5. Stent Graft

6. Others

Indication – Market breakup from 2 viewpoints:

1. Coronary Artery Disease

2. Peripheral Vascular Disease

Raw Materials – Market breakup from 3 viewpoints:

1. Polyurethane

2. Nylon

3. Others

End-User – Market breakup from 4 viewpoints:

1. Hospitals

2. Clinics

3. Ambulatory Surgical Centers

4. Diagnostic Centers

Country – Market breakup from 26 Country Global Balloon Catheter Industry viewpoints:

1. North America

1.1 United States

1.2 Canada

2. Europe

2.1 France

2.2 Germany

2.3 Italy

2.4 Spain

2.5 United Kingdom

2.6 Belgium

2.7 Netherland

2.8 Turkey

3. Asia Pacific

3.1 China

3.2 Japan

3.3 India

3.4 South Korea

3.5 Thailand

3.6 Malaysia

3.7 Indonesia

3.8 Australia

3.9 New Zealand

4. Latin America

4.1 Brazil

4.2 Mexico

4.3 Argentina

5. Middle East & Africa

5.1 Saudi Arabia

5.2 UAE

5.3 South Africa

6. Rest of the World

All companies have been covered from 3 viewpoints:

• Overview

• Recent Developments

• Revenue

Company Analysis:

1. Abbott Laboratories

2. Becton Dickinson and Company

3. Cardinal Health

4. Teleflex Incorporated

5. Medtronic Plc.

6. Johnson and Johnson

7. Edwards Lifesciences Corporation

8. Stryker Corporation

9. Smith & Nephew

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Lead Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the global balloon catheter market by 2033?

-

What are the major drivers propelling the growth of the balloon catheter market?

-

How is the increasing prevalence of cardiovascular diseases impacting market demand?

-

What role do technological advancements play in balloon catheter development?

-

What are the major challenges hindering the global balloon catheter market?

-

How does the regulatory environment affect balloon catheter market expansion?

-

Which product types dominate the global balloon catheter market?

-

Which raw materials are most commonly used in manufacturing balloon catheters?

-

What is the market share of different end-user segments like hospitals, clinics, and ambulatory centers?

-

Which countries are leading the balloon catheter market across different regions?

-

How is the adoption of minimally invasive procedures influencing balloon catheter usage?

-

What recent product launches or innovations have shaped the market landscape?

-

What is the future outlook for balloon catheters in non-vascular applications?

-

How are emerging markets like China, Brazil, and Saudi Arabia contributing to global market growth?

-

What competitive strategies are adopted by key players in the balloon catheter industry?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Balloon Catheter Market

6. Market Share

6.1 By Product Type

6.2 By Indication

6.3 By Raw Material

6.4 By End Users

6.5 By Countries

7. Product Type

7.1 Normal Balloon Catheter

7.2 Drug Eluting Balloon Catheter

7.3 Cutting Balloon Catheter

7.4 Scoring Balloon Catheter

7.5 Stent Graft Balloon Catheter

7.6 Others

8. Indication

8.1 Coronary Artery Disease

8.2 Peripheral Vascular Disease

9. Raw Material

9.1 Polyurethane

9.2 Nylon

9.3 Others

10. End Users

10.1 Hospitals

10.2 Clinics

10.3 Ambulatory Surgical Centers

10.4 Diagnostic Centers

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherland

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

11.6 Rest of the World

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1.1 Strength

13.1.2 Weakness

13.1.3 Opportunity

13.1.4 Threat

14. Key Players Analysis

14.1 Abbott Laboratories

14.1.1 Overview

14.1.2 Recent Development

14.1.3 Revenue

14.2 Becton Dickinson And Company

14.2.1 Overview

14.2.2 Recent Development

14.2.3 Revenue

14.3 Cardinal Health

14.3.1 Overview

14.3.2 Recent Development

14.3.3 Revenue

14.4 Teleflex Incorporated

14.4.1 Overview

14.4.2 Recent Development

14.4.3 Revenue

14.5 Medtronic Plc.

14.5.1 Overview

14.5.2 Recent Development

14.5.3 Revenue

14.6 Johnson & Johnson

14.6.1 Overview

14.6.2 Recent Development

14.6.3 Revenue

14.7 Edwards Lifesciences Corporation

14.7.1 Overview

14.7.2 Recent Development

14.7.3 Revenue

14.8 Stryker Corporation

14.8.1 Overview

14.8.2 Recent Development

14.8.3 Revenue

14.9 Smith & Nephew

14.9.1 Overview

14.9.2 Recent Development

14.9.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com