Biodegradable Plastic Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowBiodegradable Plastic Market Trends & Summary

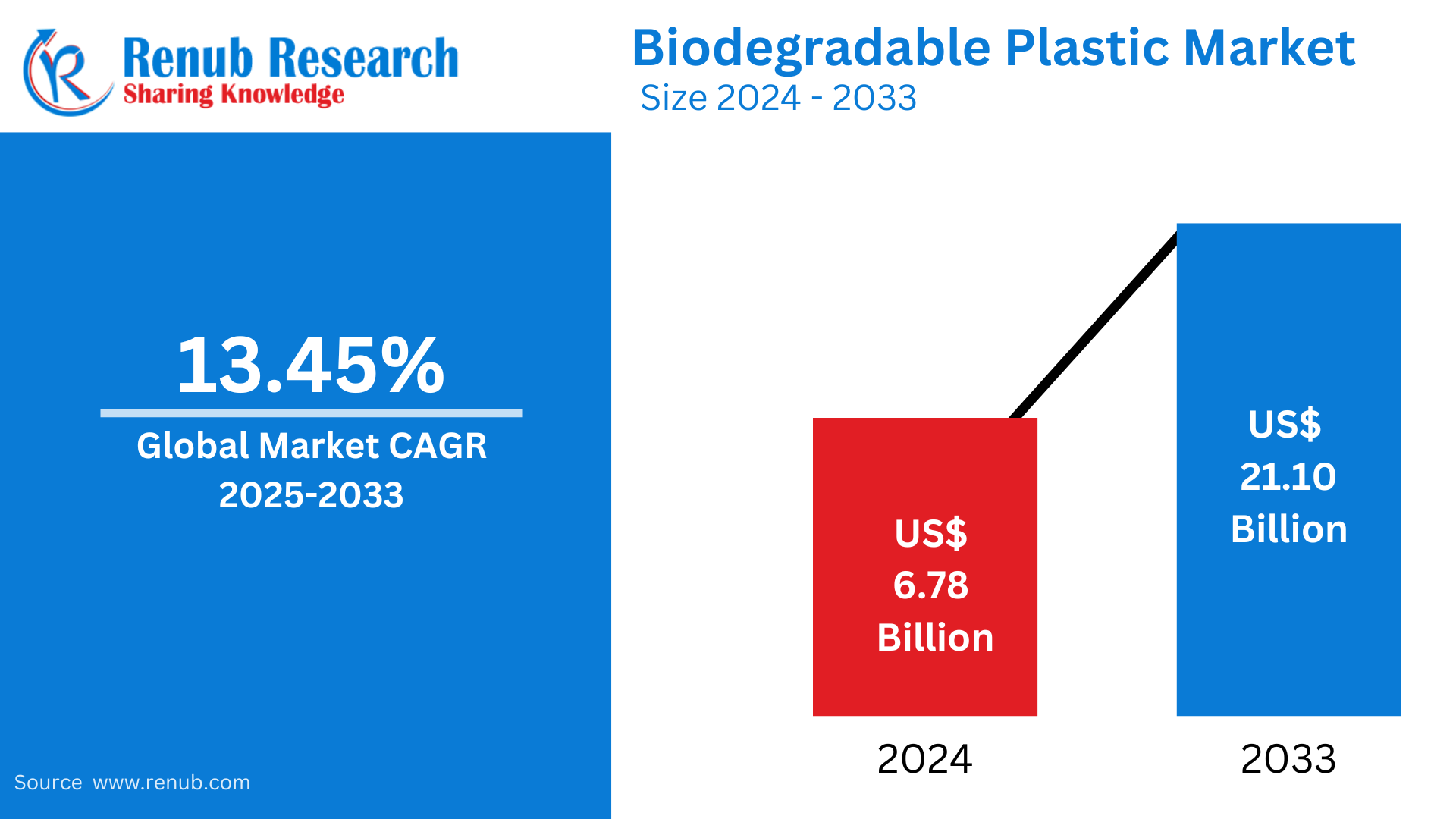

Biodegradable Plastic Market is expected to reach US$ 21.10 billion by 2033 from US$ 6.78 billion in 2024, with a CAGR of 13.45% from 2025 to 2033. Some of the main drivers propelling the market include the adoption of advantageous government regulations, the growing demand for eco-friendly packaging, and consumers' growing worries about the environment.

Biodegradable Plastic Global Market Report by Material Type (Polybutylene adipate Terephthalate (PBAT), Polybutylene Succinate (PBS), Polylactic Acid (PLA), Polyhydroxyalkanoate (PHA), Starch Blends, Others), Applications (Packaging, Agriculture, Consumer Goods, Others), Countries and Company Analysis, 2025-2033

Global Biodegradable Plastic Industry Overview

Biodegradable plastic breaks down into water, carbon dioxide, and biomass when bacteria, fungi, or other microorganisms break it down. Depending on the kind of plastic and the circumstances surrounding its disposal, it may decompose in a few months to a few years. Biodegradable polymers come in a wide variety, each with special characteristics and breakdown processes. While some of these are created from plant-based materials like sugarcane or cornstarch, others are made from synthetic polymers that are intended to break down under particular environmental circumstances like sunshine, heat, or oxygen. Biodegradable plastics are widely employed in consumer items, packaging, agriculture, and medicine.

One of the main factors propelling the market expansion is the shifting customer preferences toward eco-friendly products as a result of growing awareness of the negative environmental effects of regular plastic. Accordingly, the market is growing as a result of the broad product acceptance since it lowers the amount of plastic waste that ends up in landfills and the oceans as well as the total carbon footprint of plastic production. A positive picture for the market is also being created by the establishment of many government rules that forbid single-use plastic items like straws, cutlery, and food containers, among others, and encourage the usage of biodegradable plastics. The market is expanding as a result of the introduction of certification systems and the application of strict standards to control product quality.

Furthermore, the food and beverage (F&B) industry's growing need for environmentally friendly packaging options, like biodegradable plastic, is opening up significant market expansion prospects. At the same time, another important aspect driving growth is the growing use of the product in horticultural and agricultural applications, such as the production of plant pots and mulching films. Additionally, the market is expanding due to continuous technical improvements that allow for more affordable and long-lasting product variations as well as the easy availability of bio-based materials that are more sustainable and affordable than petroleum-based plastics. The market is expanding due to a number of other factors, including the increase in demand for ready-to-eat (RTE) and convenience food items, the growth of online meal delivery services, and the creative developments in waste management technology.

Businesses are launching new products, expanding, forming partnerships, and other strategic actions in response to the growing need for biodegradable plastic packaging. For example, the South Korean chemicals company SKC announced in May 2024 that it will construct the largest biodegradable plastic plant in the world in Hai Phong, Vietnam. The plant would have the capacity to produce 70,000 tons of polybutylene adipate terephthalate (PBAT) annually. Tree-derived nanocellulose will be added to this flexible bioplastic, which is already used in packaging and other products, to reinforce it for broader uses, such as personal hygiene items.

Growth Drivers for the Biodegradable Plastic Market

Rising Environmental Awareness

One of the main factors driving the increase in demand for biodegradable plastics is increased environmental consciousness. Businesses and consumers alike are actively looking for environmentally responsible solutions as worries about plastic pollution and its long-term effects on the environment grow. Conventional plastics pollute landfills, natural habitats, and oceans because they take hundreds of years to break down. Biodegradable polymers, which decompose faster and have a smaller environmental impact, are becoming more and more popular in response. Customers' desire to make eco-friendly decisions and companies' dedication to sustainability are driving this change. Biodegradable plastics are being used more and more in consumer goods, packaging, and agriculture as a result of growing public demand for environmentally friendly alternatives.

Consumer Demand for Sustainable Products

Demand for sustainable and biodegradable products is increasing as people get more environmentally concerned. Consumers are prioritizing eco-friendly options when making purchases as a result of growing knowledge of environmental challenges including resource depletion and plastic pollution. Because they have less of an impact on the environment than conventional plastics, biodegradable products—such as packaging, food containers, and household goods—are becoming more and more popular. As a result of consumers' increased propensity to select sustainable products, companies are increasingly providing more biodegradable options. The market for biodegradable plastic is expanding as a result of manufacturers' efforts to innovate and broaden their product lines in response to the increased demand for eco-friendly, biodegradable alternatives.

Corporate Sustainability Initiatives

Adoption of biodegradable plastics is being fueled in large part by corporate environmental initiatives. Businesses are investing more in eco-friendly materials to lessen their environmental impact as they set ambitious sustainability goals. Large companies in a variety of industries, such as retail, food, and packaging, are implementing biodegradable plastics to show their commitment to the environment and to their green ambitions. This change not only satisfies legal requirements but also improves brand recognition by attracting environmentally concerned customers. Businesses are giving priority to eco-friendly products in order to stay competitive and show corporate responsibility as public pressure for sustainability increases. These programs are speeding up the switch to biodegradable plastics, which is helping the market expand and the larger sustainability movement.

Challenges in the Biodegradable Plastic Market

Limited Availability of Raw Materials

One of the biggest obstacles facing the market is the scarcity of raw materials for biodegradable polymers. Corn starch, sugarcane, and other plant-based resources are frequently used to make biodegradable polymers. However, a number of factors, including weather, crop yields, and price volatility, can affect agricultural production of these basic commodities. Manufacturers may find it challenging to sustain steady output levels as a result of supply chain interruptions brought on by this reliance on natural resources. Furthermore, the widespread demand for biodegradable plastics may strain agricultural supplies, posing questions regarding sustainability and food security. The market growth may be slowed by these problems, which may raise production costs and prevent biodegradable polymers from being widely used.

Performance Issues

Although biodegradable plastics have many advantages for the environment, they frequently perform worse than conventional plastics. Biodegradable polymers occasionally don't have the strength, resilience to moisture, and durability needed for particular uses. For instance, biodegradable plastics might not provide the same degree of durability and protection as traditional plastics in packaging, where goods must endure handling, transit, and storage. Similar to this, biodegradable polymers' weak strength and weather resilience may make them unsuitable for use in building, where materials must withstand challenging environmental conditions. The widespread use of biodegradable alternatives is hampered by these performance restrictions, which limit their adoption in sectors where conventional polymers have long been preferred.

United States Biodegradable Plastic Market

The market for biodegradable plastic in the US is expanding significantly due to growing consumer demand for sustainable products and environmental consciousness. Businesses and consumers alike are looking for environmentally suitable substitutes for conventional plastics, especially in consumer items, food containers, and packaging. The use of biodegradable plastics is being encouraged by government laws such as extended producer responsibility plans and prohibitions on single-use plastics. Large companies are investing more in biodegradable alternatives as a result of their commitment to sustainability goals. Notwithstanding these encouraging developments, obstacles including exorbitant manufacturing costs, restricted access to raw materials, and poor performance in comparison to traditional plastics could impede industry expansion. However, it is anticipated that the U.S. market for biodegradable plastic will continue to grow because to technical developments and growing infrastructure for recycling and composting.

United Kingdom Biodegradable Plastic Market

The market for biodegradable plastics in the UK is expanding quickly due to rising customer demand for environmentally friendly and sustainable substitutes for conventional plastics. The use of biodegradable polymers is being fueled by growing worries about plastic pollution and strict government requirements, such as extended producer responsibility and bans on plastic bags. The adoption of biodegradable materials is being spearheaded by sectors like packaging, foodservice, and agriculture. High production costs, a lack of readily available raw materials, and problems with performance in comparison to traditional plastics are still problems, nevertheless. Notwithstanding these challenges, the market is anticipated to rise thanks to developments in biodegradable plastic technology and a growing composting and recycling infrastructure. The market for biodegradable plastic in the UK is expected to grow further as sustainability gains more attention.

India Biodegradable Plastic Market

The market for biodegradable plastics in India is expanding steadily due to rising environmental consciousness and the desire for sustainable substitutes for conventional plastics. The Indian government is promoting the use of biodegradable plastics in sectors like packaging, agriculture, and food services by enacting stronger laws on plastic waste, including prohibitions on single-use plastics. Additionally, producers are being pushed to innovate and provide biodegradable solutions by the growing consumer demand for eco-friendly products. High production costs, a shortage of raw materials, and the requirement for improved waste treatment infrastructure are still obstacles, though. Notwithstanding these challenges, the market for biodegradable plastics in India is anticipated to rise rapidly due to technical developments and expanding corporate sustainability initiatives.

United Arab Emirates Biodegradable Plastic Market

Growing environmental concerns and government efforts to reduce plastic waste are driving growth in the United Arab Emirates' (UAE) biodegradable plastic market. In order to encourage the use of biodegradable plastics, especially in packaging and food services, the UAE has put in place a number of restrictions, such as prohibiting single-use plastic bags and promoting sustainable alternatives. Additionally, the demand for eco-friendly alternatives is being fueled by consumers' rising awareness of the negative environmental effects of traditional plastics. Despite this increase, obstacles like high production costs, scarce raw materials, and inadequate infrastructure for recycling and composting could impede market growth. However, the market for biodegradable plastic in the United Arab Emirates is expected to grow further due to increased investment in sustainable alternatives.

Biodegradable Plastic Market Segments

Material Type –Market breakup in 6 viewpoints:

- Polybutylene adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Polylactic Acid (PLA)

- Polyhydroxyalkanoate (PHA)

- Starch Blends

- Others

Application –Market breakup in 4 viewpoints:

- Packaging

- Agriculture

- Consumer Goods

- Others

Country –Market breakup in 24 viewpoints:

- United States

- Canada

- Germany

- United Kingdom

- France

- Italy

- Netherlands

- Spain

- China

- South Korea

- Japan

- India

- Indonesia

- Malaysia

- Argentina

- Brazil

- Mexico

- Colombia

- Saudi Arabia

- South Africa

- Israel

- Australia

- UAE

- Rest of the World

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Developments

- Financial Insights

Company Analysis:

- Total Corbion

- Mitsubishi Chemical Holding Corporation

- Toray Industries

- BASF SE

- GREEN DOT BIOPLASTICS

- Amcor Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Material Type, Application, and Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

-

What will be the market size of the biodegradable plastic industry by 2033?

-

What is the current market size of biodegradable plastics in 2024?

-

What is the expected CAGR for the biodegradable plastic market from 2025 to 2033?

-

Which factors are driving the growth of the biodegradable plastic market globally?

-

What are the key challenges faced by the biodegradable plastic industry?

-

Which material type holds the largest share in the biodegradable plastic market?

-

What are the main applications of biodegradable plastics across industries?

-

How are government regulations influencing the adoption of biodegradable plastics?

-

Which countries are the major markets for biodegradable plastics?

-

Who are the key players in the global biodegradable plastic market, and what are their recent developments?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Biodegradable Plastic

5.1 Market

5.2 Volume

6. Share Analysis

6.1 Market Share

6.1.1 By Material Type

6.1.2 By Application

6.1.3 By Country

6.2 Volume Share

6.2.1 By Material Type

7. Material Type

7.1 Polybutylene adipate Terephthalate (PBAT)

7.1.1 Market

7.1.2 Volume

7.2 Polybutylene Succinate (PBS)

7.2.1 Market

7.2.2 Volume

7.3 Polylactic Acid (PLA)

7.3.1 Market

7.3.2 Volume

7.4 Polyhydroxyalkanoate (PHA)

7.4.1 Market

7.4.2 Volume

7.5 Starch Blends

7.5.1 Market

7.5.2 Volume

7.6 Others

7.6.1 Market

7.6.2 Volume

8. Applications Market

8.1 Packaging

8.2 Agriculture

8.3 Consumer Goods

8.4 Others

9. Country Market

9.1 United States

9.2 Canada

9.3 Germany

9.4 United Kingdom

9.5 France

9.6 Italy

9.7 Netherlands

9.8 Spain

9.9 China

9.10 South Korea

9.11 Japan

9.12 India

9.13 Indonesia

9.14 Malaysia

9.15 Argentina

9.16 Brazil

9.17 Mexico

9.18 Colombia

9.19 Saudi Arabia

9.20 South Africa

9.21 Israel

9.22 Australia

9.23 UAE

9.24 Rest of the World

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Total Corbion

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Developments

12.1.4 Sales Analysis

12.2 Mitsubishi Chemical Holding Corporation

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Developments

12.2.4 Sales Analysis

12.3 Toray Industries

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Developments

12.3.4 Sales Analysis

12.4 BASF SE

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Developments

12.4.4 Sales Analysis

12.5 Green Dot Bioplastics

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Developments

12.5.4 Sales Analysis

12.6 Amcor Limited

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Developments

12.6.4 Sales Analysis

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com