Brazil Tire Market, Size, Forecast 2022-2027, Industry Trends, Share, Growth, Impact of COVID-19, Opportunity Company Analysis

Buy NowGet Free Customization in this Report

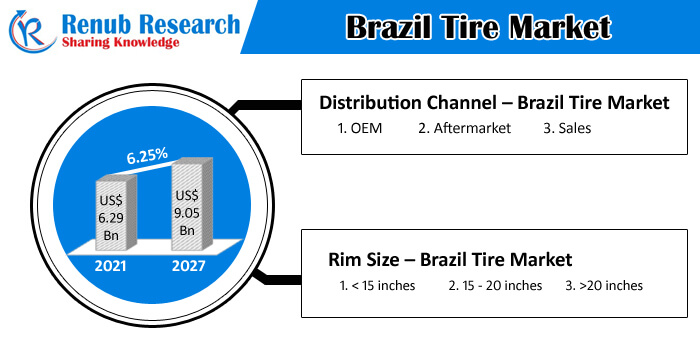

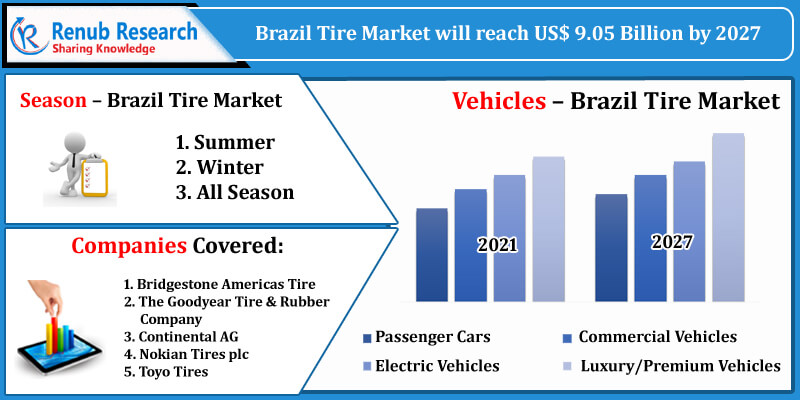

Brazil's automotive industry has become the most significant market globally, and tire is the circular vehicle component in Brazil automotive market. Since the tire is manufactured from rubber, it also provides a flexible cushion, reducing the impact of the vibrations and absorbing the vehicle's shock. The primary function of the tire is to protect the wheel rim and offer attractive force between the road surface and the vehicle. Brazil is amongst the ten countries where the most number of cars was registered in 2020. Brazil Motor Vehicles Sales was 155,081 Units in September 2021, compared to 172,778 units in August 2021, as per CEIC data. As per Renub Reseaerch research findings, Brazil Tire Market will reach US$ 9.05 Billion by 2027.

Covid-19 impact on Brazilin Tire Industry

COVID-19 has created an oblique impact on the Brazil tire manufacturing industry resulting in production shut down. The automotive sales have been reduced, resulting in enormous losses for manufacturing industries. Major tire companies are facing the unavailability of skilled labour due to which the production has been affected. Since the pandemic, the world has been suffering economic turbulence, decreasing new investments in tire production projects in Brazil.

Brazil Tire Industry is expected to grow with a CAGR of 6.25% from 2021 to 2027

Notwithstanding, backed by increasing per capita income, the growing demand for automobiles, and implementing favorable government schemes are all driving demand for tires in Brazil. Increase safety concerns; the governments are developing stringent tire performance regulations, wet grip-related braking distance reduction, and fuel-saving. Thus, creating ample opportunities for tire manufacturing companies to launch tires that address the Brazilin government regulations. However, factors such as developments in the industry of retreading tires and volatile values of raw elements are anticipated to hinder the growth of the tire market in Brazil.

Demand for 15-20 Inches Tires to Expand at a High Growth Rate due to Increasing Preference for SUVs

On the basis of distribution channel, Brazil tire market includes OEM, Aftermarket and Sales. The demand for replacement of tires and new tires through aftermarket channels is increasing due to different platforms, such as authorized dealers, online, and third-party dealers. Furthermore, rim size such as < 15 inches, 15 - 20 inches and >20 inches is usually used in vehicles. 15-20 inches is expected to expand at a high growth rate owing to an increase in preference for large wheels in SUVs, fueling the demand for 18 inches tires. All-season and summer tires have high market potential due to their extensive usage across all vehicles, such as passenger and commercial.

Brazil Tire Market Size was US$ 6.29 Billion in 2021

Based on vehicle type, the Brazil tire market is sub-segmented into Passenger Cars, Commercial Vehicles, Electric Vehicles and Luxury/Premium Vehicles. The rise in the purchasing power of consumers and improvements in the standard of living are the determinants that increase the sale of luxurious and premium vehicle tires in Brazil. Recently, the vehicle industry has been experiencing rapid growth due to speedy industrialization, which has led to an increase in commercial vehicle tire sales such as tractors, trucks, and trailers in Brazil.

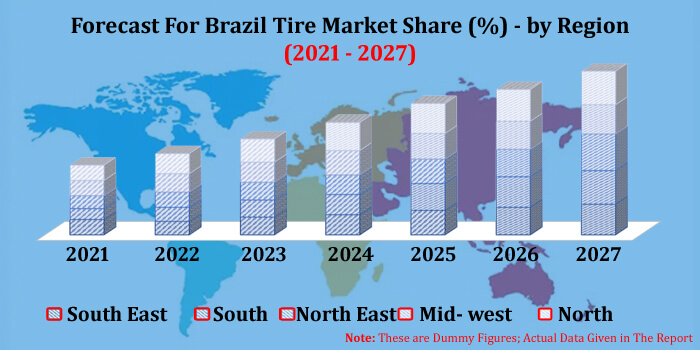

Thus, the increase in the demand for electric vehicles across the South and South East region in Brazil still makes up a small business of electric vehicle tires; the country has vast potential in developing and producing new electric vehicle technologies. For instance, Hankook Tire has launched Dynapro AT2 for on & off-road SUVs in Brazil.

Players in the Brazilian Tire Industry

Key players such as Bridgestone Americas Tire, The Goodyear Tire & Rubber Company, Continental AG, Nokian Tires plc, and Toyo Tires are developing advanced technologies and launching new products to stay competitive in the Brazil tire market. Other rival strategies include new product developments and mergers and acquisitions. These players operating in the market are improving R&D capabilities while enhancing operational efficiency to register positive growth.

Renub Research latest report "Brazil Tire Market By Distribution Channel (OEM, Aftermarket and Sales), Rim Size (15 inches, 15 - 20 inches and >20 inches), Season (Summer, Winter and All Season), Vehicles (Passenger Cars, Commercial Vehicles, Electric Vehicles and Luxury/Premium Vehicle), Region (South East, South, North East, Mid- west, North), Company Analysis (Bridgestone Americas Tire, The Goodyear Tire & Rubber Company, Continental AG, Nokian Tires plc, and Toyo Tires)" provides a detailed analysis of Brazil Tire Market

Distribution Channel – Brazil Tire Market

1. OEM

2. Aftermarket

3. Sales

Rim Size – Brazil Tire Market

1. < 15 inches

2. 15 - 20 inches

3. >20 inches

Season – Brazil Tire Market

1. Summer

2. Winter

3. All Season

Vehicles – Brazil Tire Market

1. Passenger Cars

2. Commercial Vehicles

3. Electric Vehicles

4. Luxury/Premium Vehicles

Region – Brazil Tire Market

1. South East

2. South

3. North East

4. Mid- west

5. North

Company Insights

• Overview

• Recent Development & Strategies

• Financial Insights

Company Analysis

1. Bridgestone Americas Tire

2. The Goodyear Tire & Rubber Company

3. Continental AG

4. Nokian Tires plc

5. Toyo Tires

Report Details:

| Report Features | Details |

| Base Year | 2020 |

| Historical Period | 2017 - 2021 |

| Forecast Period | 2022-2027 |

| Market | US$ Billion |

| Segment Covered | Distribution Channel, Rim Size, Season, Vehicles, Region |

| Regions Covered | South East, South, North East, Mid- west, North |

| Companies Covered | Bridgestone Americas Tire, The Goodyear Tire & Rubber Company, Continental AG, Nokian Tires plc, and Toyo Tires |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Brazil Tire Market

6. Market Share – Brazil Tire Analysis

6.1 By Distribution Channel

6.2 By Rim Size

6.3 By Season

6.4 By Vehicle

6.5 By Region

7. Distribution Channel – Brazil Tire Market

7.1 Oem

7.2 Aftermarket

7.3 Sales

8. Rim Size - Brazil Tire Market

8.1 < 15 inches

8.2 15 - 20 inches

8.3 >20 inches

9. Season – Brazil Tire Market

9.1 Summer

9.2 Winter

9.3 All Season

10. Vehicles – Brazil Tire Market

10.1 Passenger Cars

10.2 Commercial Vehicles

10.3 Electric Vehicles

10.4 Luxury/Premium Vehicles

11. Region – Brazil Tire Market

11.1 South East

11.2 East

11.3 North East

11.4 Mid- west

11.5 North

12. Porters Five Forces

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13. Company Analysis

13.1 Bridgestone Americas Tire

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 The Goodyear Tire & Rubber Company

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 Continental AG

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

13.4 Nokian Tyres plc.

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue

13.5 Toyo Tires

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue

List Of Figures:

Figure-01: Brazil Tire Market – Market (Million US$), 2017 – 2021

Figure-02: Brazil Tire Market – Forecast for Brazil Tire Market Market (Million US$), 2022 – 2027

Figure-03: Distribution Channel – Oem Market (Million US$), 2017 – 2021

Figure-04: Distribution Channel – Forecast for Oem Market (Million US$), 2022 – 2027

Figure-05: Distribution Channel – Aftermarket Market (Million US$), 2017 – 2021

Figure-06: Distribution Channel – Forecast for Aftermarket Market (Million US$), 2022 – 2027

Figure-07: Distribution Channel – Sales Market (Million US$), 2017 – 2021

Figure-08: Distribution Channel – Forecast for Sales Market (Million US$), 2022 – 2027

Figure-09: Rim Size – < 15 inches Market (Million US$), 2017 – 2021

Figure-10: Rim Size – Forecast for < 15 inches Market (Million US$), 2022 – 2027

Figure-11: Rim Size – 15 - 20 inches Market (Million US$), 2017 – 2021

Figure-12: Rim Size – Forecast for 15 - 20 inches Market (Million US$), 2022 – 2027

Figure-13: Rim Size – >20 inches Market (Million US$), 2017 – 2021

Figure-14: Rim Size – Forecast for >20 inches Market (Million US$), 2022 – 2027

Figure-15: Season – Summer Market (Million US$), 2017 – 2021

Figure-16: Season – Forecast for Summer Market (Million US$), 2022 – 2027

Figure-17: Season – Winter Market (Million US$), 2017 – 2021

Figure-18: Season – Forecast for Winter Market (Million US$), 2022 – 2027

Figure-19: Season – All Season Market (Million US$), 2017 – 2021

Figure-20: Season – Forecast for All Season Market (Million US$), 2022 – 2027

Figure-21: Vehicles – Passenger Cars Market (Million US$), 2017 – 2021

Figure-22: Vehicles – Forecast for Passenger Cars Market (Million US$), 2022 – 2027

Figure-23: Vehicles – Commercial Vehicles Market (Million US$), 2017 – 2021

Figure-24: Vehicles – Forecast for Commercial Vehicles Market (Million US$), 2022 – 2027

Figure-25: Vehicles – Electric Vehicles Market (Million US$), 2017 – 2021

Figure-26: Vehicles – Forecast for Electric Vehicles Market (Million US$), 2022 – 2027

Figure-27: Vehicles – Luxury/Premium Vehicles Market (Million US$), 2017 – 2021

Figure-28: Vehicles – Forecast for Luxury/Premium Vehicles Market (Million US$), 2022 – 2027

Figure-29: South East – Tire Market Market (Million US$), 2017 – 2021

Figure-30: South East – Forecast for Tire Market Market (Million US$), 2022 – 2027

Figure-31: South East – Tire Market Market (Million US$), 2017 – 2021

Figure-32: South East – Forecast for Tire Market Market (Million US$), 2022 – 2027

Figure-33: North East – Tire Market Market (Million US$), 2017 – 2021

Figure-34: North East – Forecast for Tire Market Market (Million US$), 2022 – 2027

Figure-35: Mid- west – Tire Market Market (Million US$), 2017 – 2021

Figure-36: Mid- west – Forecast for Tire Market Market (Million US$), 2022 – 2027

Figure-37: North – Tire Market Market (Million US$), 2017 – 2021

Figure-38: North – Forecast for Tire Market Market (Million US$), 2022 – 2027

Figure-39: Bridgestone Americas Tire – Global Revenue Market (Million US$), 2017 – 2021

Figure-40: Bridgestone Americas Tire – Forecast for Global Revenue Market (Million US$), 2022 – 2027

Figure-41: The Goodyear Tire & Rubber Company – Global Revenue Market (Million US$), 2017 – 2021

Figure-42: The Goodyear Tire & Rubber Company – Forecast for Global Revenue Market (Million US$), 2022 – 2027

Figure-43: Continental AG – Global Revenue Market (Million US$), 2017 – 2021

Figure-44: Continental AG – Forecast for Global Revenue Market (Million US$), 2022 – 2027

Figure-45: Nokian Tyres plc. – Global Revenue Market (Million US$), 2017 – 2021

Figure-46: Nokian Tyres plc. – Forecast for Global Revenue Market (Million US$), 2022 – 2027

Figure-47: Toyo Tires – Global Revenue Market (Million US$), 2017 – 2021

Figure-48: Toyo Tires – Forecast for Global Revenue Market (Million US$), 2022 – 2027

List Of Tables:

Table-01: Brazil – Tire Market Share by Distribution Channel (Percent), 2017 – 2021

Table-02: Forecast for – Brazil Tire Market Share by Distribution Channel (Percent), 2022 – 2027

Table-03: Brazil – Tire Market Share by Rim Size (Percent), 2017 – 2021

Table-04: Forecast for – Brazil Tire Market Share by Rim Size (Percent), 2022 – 2027

Table-05: Brazil – Tire Market Share by Season (Percent), 2017 – 2021

Table-06: Forecast for – Brazil Tire Market Share by Season (Percent), 2022 – 2027

Table-07: Brazil – Tire Market Share by Vehicle (Percent), 2017 – 2021

Table-08: Forecast for – Brazil Tire Market Share by Vehicle (Percent), 2022 – 2027

Table-09: Brazil – Tire Market Share by Region (Percent), 2017 – 2021

Table-10: Forecast for – Brazil Tire Market Share by Region (Percent), 2022 – 2027

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com