China Autonomous Vehicles Market report by Level of Driving (L1, L2, L3, L4, L5), Hardware (Passive Components, Embedded Modem, Ultrasonic Sensors, Odometry Sensors, Other Electronics & Architecture, Actuators, HMI Hardware, Mapping Hardware, Embedded Controls Hardware, V2X Hardware, Cameras, Radar & Lidar), Software (HMI Software, Data Security Software, Mapping Software, Embedded Controls Software & V2X Software), Vehicle Type, Application, Propulsion, and Companies Analysis 2025-2033

Buy NowChina Autonomous Vehicles Market Size

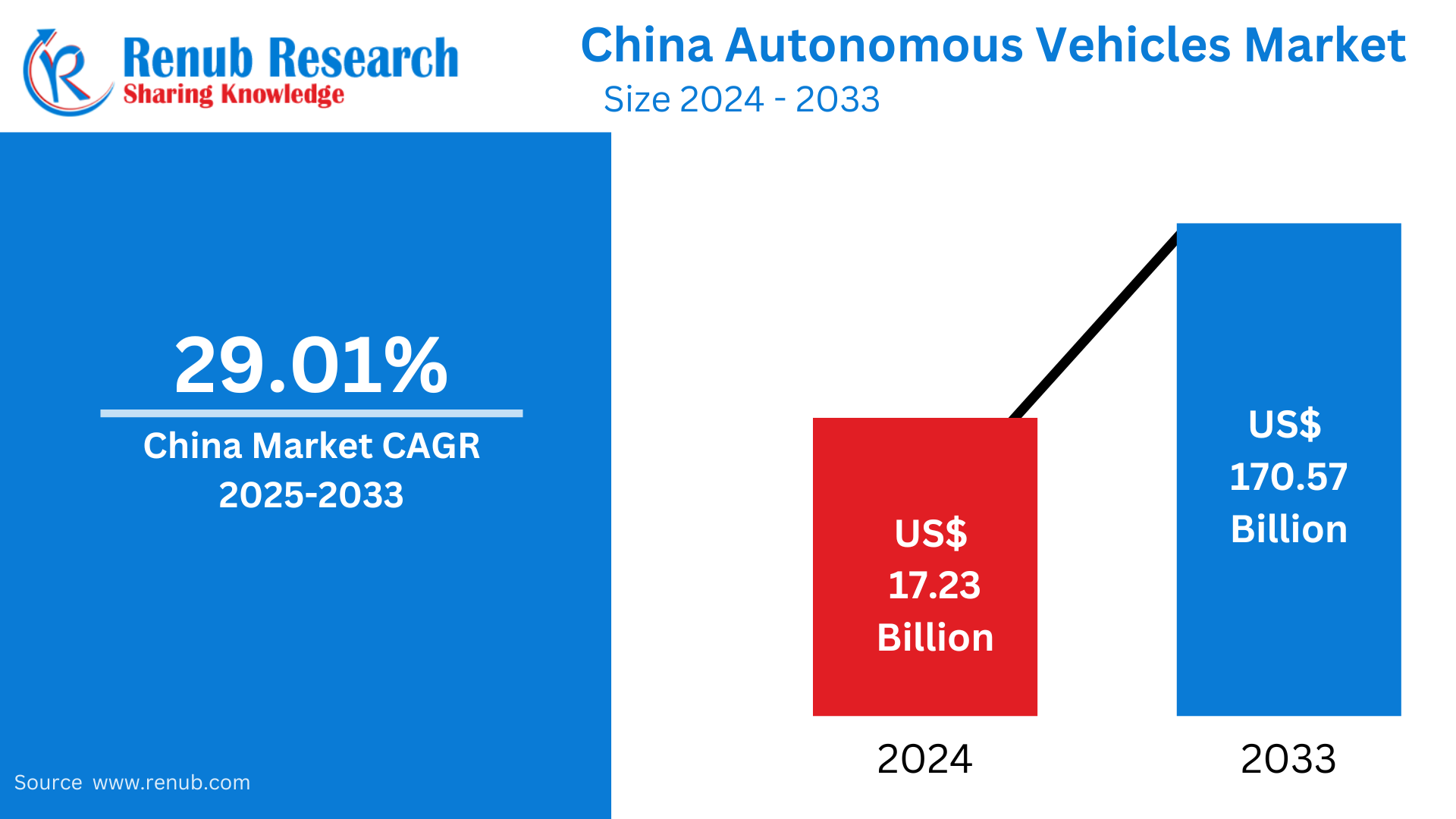

China autonomous vehicle market size is expected to grow exponentially and will reach US$ 170.57 billion by 2033 compared to US$ 17.23 billion in 2024 with the growth rate of 29.01% for the period between 2025 and 2033. The massive growth is due to the growing demand for self-driving technology mainly because of advancements in AI, government policies, and the focus on safer and more efficient transportation. China is going to become a key destination for the development and adoption of autonomous vehicles.

Market Outlooks: China Autonomous Vehicles

Autonomous vehicles are the self-driving cars that are equipped with the latest advanced technologies such as AI, sensors, radar, and cameras to freely navigate and run without any human intervention. They can decide, detect obstacles, and communicate with their environment. This makes it the safest and most efficient transportation. The application of AVs in China has been increasingly integrated into many different fields, showing significant progress, both in urban and rural areas.

Among the main applications of autonomous vehicles in China, one is represented by ride-hailing services: for instance, Baidu's Apollo and Pony.ai are developing self-driving taxis. These services aim to reduce congestion, lower emissions, and improve mobility in densely populated cities. Logistics is another sector where AVs have gained employment as in the fact that autonomous delivery trucks and drones increase efficiency in the transportation of goods. Furthermore, AV technology is under test for public transit applications like autonomous buses and shuttles in order to enhance urban mobility and reduce traffic-related problems.

China Autonomous Vehicles Market Growth Driver

Government Support and Policy Initiatives

The Chinese government plays an important role in the growth of the AV market through strong policy support and ambitious goals. Two policies-the "Made in China 2025" plan-also focus on the intelligent and electric-vehicle sector, especially with self-driving and electric vehicles. Furthermore, regulatory frameworks are being developed to increase testing and deployment of AV technologies within China. The government cooperates through pilot programs in cities such as Beijing and Shanghai to test the conditions of the new technological endeavors, while incentives given to auto manufacturers encourage innovations in autonomous mobility. This will ultimately lead to China as a hub for autonomous mobility.

Technological Advancements in AI and Infrastructure

The autonomous vehicle market is witnessing rapid growth in China through its speedy advancements in artificial intelligence (AI) and the expansion of smart infrastructure. Artificial intelligence supports autonomous driving systems by allowing decisions in real-time and recognizing the environment. Chinese tech giants like Baidu, Tencent, and Alibaba are pouring funds into AI and machine learning, hence energizing self-driving technologies. Smart infrastructure, for example, is being developed in place-around 5G networks and connected road systems-to support AVs, making them more efficient and safer. The ecosystem encourages innovation and the rapid adoption of AV systems across various sectors. Nov 2024: Chinese autonomous driving developer DeepRoute AI has raised $100 million from an automaker to accelerate the adoption of its systems in vehicles, aiming to outpace Tesla in China.

Increasing demand for smart mobility solutions and growing environmental concerns

Driven by increasing demand for smart mobility solutions and growing environmental concerns, the Chinese AV market is on the move. Major cities are facing traffic congestion and air pollution issues with increasing populations. With the AV, emission reduction in these cities is possible through electric AVs, along with decongestion. Increased demand for shared mobility services and the significantly reduced dependence on private cars enhance demand for autonomous taxis and shuttle services. As Chinese consumers become increasingly conscious of sustainability, the transition to electric and autonomous vehicles aligns with national goals for sustainability, which accelerates market growth.

Challenge in the China Autonomous Vehicles Market

Regulatory and Safety Challenges

China faces significant regulatory and safety challenges in its autonomous vehicle market, including strong government support. There is no single national framework for testing and deployment of AV, causing variations by region. Local governments have varying regulations for trials of AVs; thus, its expansion is complicated for companies. Another challenge for safety remains, particularly in complex driving conditions. The regulatory hurdles that AV needs to overcome are the high safety standards and public skepticism surrounding their reliability.

Technological and Infrastructure Barriers

The technological and infrastructure barriers the Chinese AV market still faces in achieving full-scale application are that, although AI and sensors advancement continues, achieving precision and reliability at a level to promote safe autonomous driving in all environments is at a challenging rate. Another factor is that the overall road infrastructure in a country, especially its rural areas, may not be generally equipped to support AVs, as conditions there could be less favorable for navigation by AVs. Widespread smart infrastructure, including 5G networks and connected traffic systems, is deemed still an essential challenge toward enabling AVs to drive safely and efficiently in various environments.

Beijing Autonomous Vehicles Market

Beijing is set to significantly expand its high-level autonomous driving demonstration area to approximately 3,000 square kilometers, more than double the size of its six urban districts, between the fourth and sixth ring roads. This initiative follows the establishment of China’s first high-level autonomous driving demonstration zone in September 2020, which has successfully developed intelligent infrastructure across 600 square kilometers.

This expansion reflects Beijing's ambition to lead the development of autonomous driving technology. Currently, the demonstration zone has issued road test permits to 33 companies. Nearly 900 vehicles have been allowed to participate in testing, accumulating more than 32 million kilometers of autonomous driving test mileage. This represents over 25% of the total national mileage recorded for autonomous testing.

Some key players like Baidu, Pony.ai, and JD.com are involved in this project, trialling various applications from passenger transport to unattended deliveries and autonomous patrol services. According to the Ministry of Public Security report, as of August 2024, the Chinese public security authorities have granted 16,000 test licenses for autonomous vehicles, and about 32,000 kilometers of roads were opened for the testing of autonomous vehicles across the nation.

Level of Driving – Market breakup from 5 viewpoints:

1. L1

2. L2

3. L3

4. L4

5. L5

Hardware – Market breakup from 13 viewpoints:

1. Passive Components

2. Embedded Modem

3. Ultrasonic Sensors

4. Odometry Sensors

5. Other Electronics & Architecture

6. Actuators

7. HMI Hardware

8. Mapping Hardware

9. Embedded Controls Hardware

10. V2X Hardware

11. Cameras

12. Radar

13. Lidar

Software – Market breakup from 5 viewpoints:

1. HMI Software

2. Data Security Software

3. Mapping Software

4. Embedded Controls Software

5. V2X Software

Vehicle Type- Market breakup from 2 viewpoints:

1. Passenger Vehicle

2. Commercial Vehicle

Application – Market breakup from 4 viewpoints:

1. Civil

2. Defense

3. Transportation & Logistics

4. Construction

Propulsion – Market breakup from 5 viewpoints:

1. Battery Electric Vehicle

2. Fuel Cell Electric Vehicles

3. Hybrid Electric Vehicle

4. Internal Combustion Engine

5. Plug-in Hybrid Electric Vehicle

All companies have been covered from 2 viewpoints:

• Overview

• Recent Development

Company Analysis:

1. AutoX

2. Baidu Apollo

3. Didi Chuxing

4. Pony.ai

5. TuSimple

6. WeRide

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Level of Driving, Hardware, Software, Vehicle Type, Application and Propulsion |

| Hardware Covered | 1. Passive Components 2. Embedded Modem 3. Ultrasonic Sensors 4. Odometry Sensors 5. Other Electronics & Architecture 6. Actuators 7. HMI Hardware 8. Mapping Hardware 9. Embedded Controls Hardware 10. V2X Hardware 11. Cameras 12. Radar 13. Lidar |

| Companies Covered | 1. AutoX 2. Baidu Apollo 3. Didi Chuxing 4. Pony.ai 5. TuSimple 6. WeRide |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Driving Factors

4.2 Challenges

5. China Autonomous Vehicles Market

6. Market Share

6.1 By Level of Driving

6.2 Hardware vs. Software

6.3 By Technology – Hardware Components

6.4 By Technology – Software Components

6.5 By Vehicle Type

6.6 By Application

6.7 By Propulsion

7. Level of Driving

7.1 Level 1

7.2 Level 2

7.3 Level 3

7.4 Level 4

7.5 Level 5

8. Technology

8.1 Hardware Components

8.2 Software Components

9. Hardware Components

9.1 Passive Components

9.2 Embedded Modem

9.3 Ultrasonic Sensors

9.4 Odometry Sensors

9.5 Other Electronics & Architecture

9.6 Actuators

9.7 HMI Hardware

9.8 Mapping Hardware

9.9 Embedded Controls Hardware

9.10 V2X Hardware

9.11 Cameras

9.12 Radar

9.13 Lidar

10. Software Components

10.1 HMI Software

10.2 Data Security Software

10.3 Mapping Software

10.4 Embedded Controls Software

10.5 V2X Software

11. Vehicle Type

11.1 Passenger Vehicle

11.2 Commercial Vehicle

12. Application

12.1 Civil

12.2 Defense

12.3 Transportation & Logistics

12.4 Construction

13. Propulsion

13.1 Battery Electric Vehicle

13.2 Fuel Cell Electric Vehicles

13.3 Hybrid Electric Vehicle

13.4 Internal Combustion Engine

13.5 Plug-in Hybrid Electric Vehicle

14. Porter’s Five Forces

14.1 Bargaining Power of Buyers

14.2 Bargaining Power of Suppliers

14.3 Degree of Competition

14.4 Threat of New Entrants

14.5 Threat of Substitutes

15. Company Analysis

15.1 AutoX

15.1.1 Overview

15.1.2 Recent Development

15.2 Baidu Apollo

15.2.1 Overview

15.2.2 Recent Development

15.3 Didi Chuxing

15.3.1 Overview

15.3.2 Recent Development

15.4 Pony.ai

15.4.1 Overview

15.4.2 Recent Development

15.5 TuSimple

15.5.1 Overview

15.5.2 Recent Development

15.6 WeRide

15.6.1 Overview

15.6.2 Recent Development

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com