China Cancer Drug Market to reach US$ 35.24 Billion by 2027, due to a change in food habits & lifestyle, the aging population, tobacco smoking etc.

15 Nov, 2022

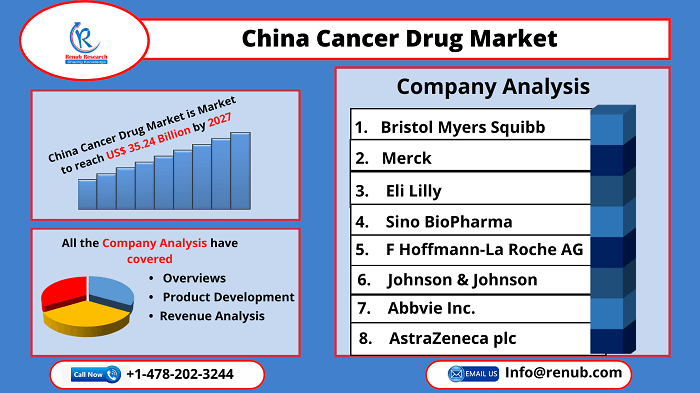

According to Renub Research latest report "China Oncology Drugs Market, Size, Forecast 2022-2027, Industry Trends, Growth, Impact of COVID-19, Opportunity Company Analysis" China Cancer Drug Market is estimated to reach US$ 35.24 Billion by 2027. An estimated 9.6 million people died from cancer in 2018, making it the second highest cause of death worldwide. Approximately 1 in 6 deaths worldwide are attributed to cancer, according to figures released by the WHO. China, the most populated nation in the world, is experiencing a marked increase in cancer rates. According to the Global Cancer Observatory 2018, China has 4,285,033 new cancer cases yearly. After regulatory measures to streamline and encourage drug development, which also opened the way for increased investment by foreign pharmaceutical firms, China seems destined to become a major developer of cancer treatments within a few years.

China cancer drug market will grow significantly with 6.84% CAGR during the forecast period 2022 to 2027:

The growth of China cancer drug market is driven by rise in the incidence of various cancer conditions, an increase in the popularity of advanced therapies, ageing population, increased R&D investment, changing sedentary lifestyle, and westernized diet. Additionally, increased cancer awareness and cancer drug availability are anticipated to boost market expansion. Furthermore, an increase in pipeline products is expected to provide new prospects for market participants in the future.

Targeted Therapy dominates the Market:

Based on therapy, China cancer drug market is divided into Chemotherapy, Targeted Therapy, Immunotherapy, and Hormonal therapy. Targeted therapy holds the largest market share since targeted medicines have higher efficacy and survival rates as they can only eliminate malignant cells. Furthermore, Immunotherapy will also grow during the forecast period since immunotherapy medications may be harmless to the body's other living cells, making them less toxic than other cancer treatments.

Lung Cancer and Breast Cancer hold a significant share by indication:

By indication, the breast cancer category contributed a significant market share. Furthermore, it is projected that this trend will continue throughout the forecast period due to the hike in the number of people affected by the disease due to early detection. On the other hand, lung cancer is anticipated to experience the fastest market growth during the forecast period because of an increase in the geriatric population, changes in people's lifestyles, and an increase in tobacco use, including passive smoking, which can cause lung cancer.

China Cancer Drug Market was US$ 23.70 Million in 2021

Due to the growth in the prevalence of severe cancer pain, the increased use of opioids in the treatment of cancer pain, and the significant presence of pipeline pharmaceuticals Opioids segment holds the significant market share. Furthermore, Anti-emetics and Bisphosphonates will grow during the forecast period due to the launch of more affordable generic alternatives and rise in investment by key players in these segments.

Key Players Analysis:

Bristol Myers Squibb, Merck, Eli Lilly, Sino BioPharma, F Hoffmann-La Roche AG, Johnson & Johnson, and Abbvie Inc. are the leading players in the surgical imaging market. These competitors are continuously adopting various strategies for increasing their market share. These include collaborations, product approval, development, and acquisition to expand their geographic reach.

Covid-19 impact on China Cancer Drug Market:

The coronavirus epidemic has significantly impacted all sectors of society. Consequently, the healthcare industry has been particularly affected, including cancer treatment and the development of new drugs. Throughout the pandemic, many clinical cancer experiments were halted in China. For patients with advanced cancer, some of these experimental medicines represented their final hope.

Furthermore, the pandemic directly impacted the supply of oncology drugs to patients, due to which China cancer drug market declined. Remarkably, the pandemic negatively influenced China's oncology drugs industry, which depended on quick testing and diagnosis as well as prompt and coordinated multimodal treatment. However, the initial and long-lasting impacts of the COVID-19 pandemic on the use of cancer drugs diminished during the post-pandemic period in China.

Therapy

1. Chemotherapy

2. Targeted Therapy

3. Immunotherapy (Biologic Therapy)

4. Hormonal Therapy

Indication

1. Blood Cancer

2. Breast Cancer

3. Gastrointestinal Cancer

4. Prostate Cancer

5. Lung Cancer

6. Skin Cancer

7. Ovarian Cancer

8. Cervical Cancer

9. Kidney Cancer

10. Other Cancers

Drugs

1. ESAs (Erythropoiesis Stimulating Agents)

2. G-CSFs (Granulocyte-colony Stimulating Factors)

3. Anti-emetics

4. Bisphosphonates

5. Opioids

6. NSAIDs & Others

Key Players

1. Bristol Myers Squibb

2. Merck

3. Eli Lilly

4. Sino BioPharma

5. F Hoffmann-La Roche AG

6. Johnson & Johnson

7. Abbvie Inc.

8. AstraZeneca plc

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com