China Movie Market, Size, Forecast 2023-2028, Industry Trends, Growth, Impact of Inflation, Opportunity Company Analysis

Buy NowChina Movie Market Analysis

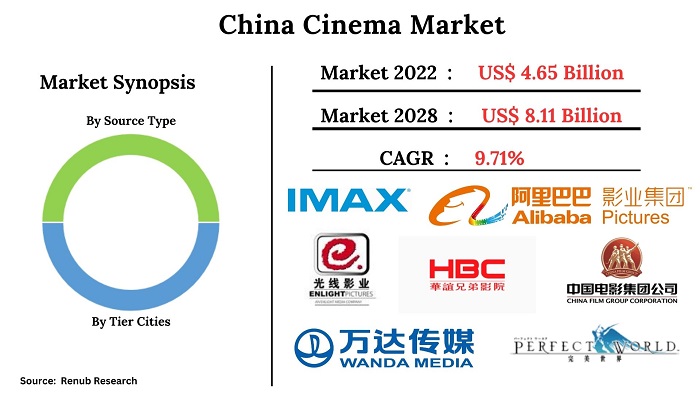

China Movie Market is expected to reach US$ 8.11 Billion by 2028, according to our latest report. China's film industry has witnessed a golden period, with growing cinema screens, film admissions, and box office. China is the world's second-largest economy and the oldest documented continuous civilization on the planet. It is also home to the largest and most dynamic global film industries. Mainland films began to sprout in the early 20th century, and foreign filmmakers increased their involvement in the Chinese movie industry by working with Chinese studios. Factors driving China's film industry growth is the government's focus on promoting and supporting the development, which includes measures such as providing tax breaks for film production and investing in modern film studios and equipment.

China Movie Market is projected to grow with a staggering CAGR of 9.71% from 2022 to 2028

Ticket prices will be low due to the offer and discounts by E-commerce ticketing platforms. Such rapid growth is attributable to the following factors: The pursuit of lifestyle change by the younger generation, fast expansion of shopping malls, acceleration of urbanization, increased penetration of film broadcasting into lower-tier regions, and online ticketing platforms offering low prices and convenience. As per our research report, the China Film Industry was US$ 4.65 Billion in 2022.

Millions of Movie and Hundreds of New Screens will come in Upcoming Years

The China cinema screens have increased almost 20-fold since 2007. The rise of 3D film showings has also increased the number of digital 3D cinema screens. The number of cinema screens increased to 82,248 in 2021 from 60,079 in 2018. Also, in 2021, about 1.17 billion tickets were sold at movie theaters in China. Hollywood blockbusters found it hard to compete with Chinese domestically produced films.

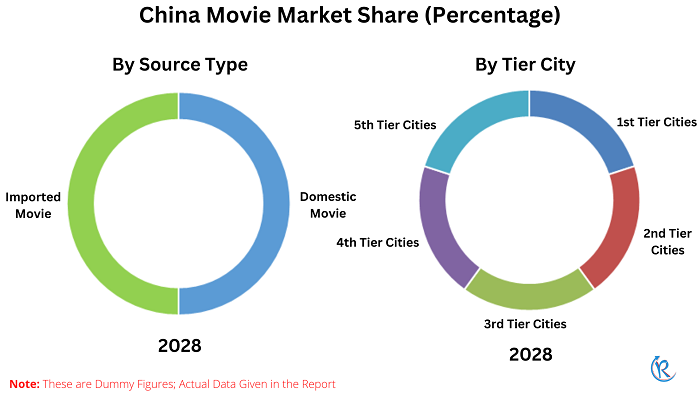

Domestic Chinese Movies will Capture more Revenue in Forecast Period

By Type Analysis: The China movies an industry is further bifurcated based into domestic and imported. With more exposure to Hollywood big-budget films, Chinese audiences had an increasing appetite for fast-paced, exciting entertainment. The local Chinese industry started producing successful blockbusters to meet such consumer demand. Chinese movies outperformed the US as the world's largest theatrical film market. The Chinese domestic film industry is infrastructural expansion relatively young and has witnessed a massive over the past two decades. With an increasingly capable China film industry that has churned out high-quality films one after another in recent years, filmmakers are able and willing to tell China's stories. Chinese people’s now also expect to see more stories that represent them.

Furthermore, China is quietly allowing more foreign films to be imported to enable greater access to the world's fastest-growing film market has stalled. China is trying to keep the market growing, and there are not enough domestic films being produced to meet audience demand. Revenue-sharing films helped drive the upgrade of film distribution infrastructure in China. In 2001, the Chinese government enacted regulations requiring theaters to meet specific criteria to exhibit revenue-sharing titles. In recent years, the Chinese market for imported films has flourished so much that Chinese movie consumer demand is already affecting the content of Hollywood's creative output.

5 Tiers Cities will rise in Upcoming Years

The China Cinema market is segmented into 1st Tier Cities, 2nd Tier Cities, 3rd Tier Cities, 4th Tier Cities and 5th Tier Cities. China has been consistently upholding cultural diversity, openness, and inclusiveness in importing good movies that reflect the splendid achievements of civilizations from across the world. China's smaller cities' consumption could triple by 2030, thanks to favorable government policies, a population boom, higher household income, and a more robust spending appetite. Another factor boosting the population in smaller (4-5 Tiers) cities is a greater willingness to have a second child compared with Tier-1 towns. The Shandong province is dominated by more miniature cities and has the highest birth rate in the nation.

Rising disposable incomes among the growing Chinese middle class also boost the movie industry in 1 and 2 tiers Cities. The increasing number of cinema screen expansions and the rising ticket prices has been instrumental in this growth for China's 1 and 2 tiers. China, which will eventually surpass the North American movie market at this growth rate, has become a significant market for global movie producers looking to pump up their box office collections. The country has become a target market for many big-budget Hollywood movies despite the country's limited quota for imported films and strict censorship.

Key Companies

Some key players are IMAX China Holding, Alibaba Pictures Group Limited, HuayiTencent Entertainment Company Limited, Perfect World, China Film Company Ltd, Beijing Enlight Media, and Wanda Film Holding Co Ltd.

Renub Research latest report "China Cinema Market by Movies (Domestic (Chinese) Movies, Imported Movies), Tier City (1st Tier Cities, 2nd Tier Cities, 3rd Tier Cities, 4th Tier Cities, 5th Tier Cities), Movie Industry (Movie Screens in China, Movie Admission in China), Movie Ticket Pricing Analysis by City, Company (IMAX China Holding, Alibaba Pictures Group Limited, HuayiTencent Entertainment Company Limited, Perfect World, China Film Company Ltd, Beijing Enlight Media, and Wanda Film Holding Co Ltd)" provides all-encompassing insights of China Cinema Industry.

China Movie Market covered from 2 viewpoints:

1. Domestic (Chinese) Movies

2. Imported Movies

Tier City – China Movie Market covered from 5 viewpoints:

1. 1st Tier Cities

2. 2nd Tier Cities

3. 3rd Tier Cities

4. 4th Tier Cities

5. 5th Tier Cities

China Movie Industry Analysis covered from 2 viewpoints:

1. Movie Screens in China

2. Movie Admission in China

Tier City – China Movie Ticket Pricing Analysis covered from 5 viewpoints:

1. 1st Tier Cities

2. 2nd Tier Cities

3. 3rd Tier Cities

4. 4th Tier Cities

5. 5th Tier Cities

Company Analysis has been covered from 3 viewpoints:

• Overview

• Recent Development

• Sales Analysis

Company Insights:

1. IMAX China Holding

2. Alibaba Pictures Group Limited

3. HuayiTencent Entertainment Company Limited

4. Perfect World

5. China Film Company Ltd

6. Beijing Enlight Media

7. Wanda Film Holding Co Ltd

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Movies, Tier City, Movie Industry, and Movie Ticket Pricing Analysis by City |

| Tier City Covered | 1st Tier Cities, 2nd Tier Cities, 3rd Tier Cities, 4th Tier Cities, and 5th Tier Cities |

| Companies Covered | IMAX China Holding, Alibaba Pictures Group Limited, HuayiTencent Entertainment Company Limited, Perfect World, China Film Company Ltd, Beijing Enlight Media, and Wanda Film Holding Co Ltd |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Frequently Asked Questions (FAQ):

1. How big is the China Cinema Market?

2. What will drive the market size of the China Cinema Market?

3. How did the ongoing coronavirus (COVID-19) pandemic impact the growth?

4. Which segment holds the largest market share?

5. How will the China Cinema Market perform in 2028?

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. PESTLE Analysis

5.1 Political

5.2 Economic

5.3 Social

5.4 Technological

5.5 Legal

5.6 Environmental

6. China Movie Market

7. Market Share

7.1 By Source Type

7.2 By Tier Cities

8. Source Type

8.1 Domestic Movie Market

8.2 Imported Movie Market

9. Tier City

9.1 1st Tier Cities

9.2 2nd Tier Cities

9.3 3rd Tier Cities

9.4 4th Tier Cities

9.5 5th Tier Cities

10. China Movie Industry Analysis

10.1 Movie Screens in China

10.2 Movie Admission in China

11. Tier City – China Movie Ticket Pricing Analysis

11.1 1st Tier Cities

11.2 2nd Tier Cities

11.3 3rd Tier Cities

11.4 4th Tier Cities

11.5 5th Tier Cities

12. Company Analysis

12.1 IMAX China Holding

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Sales Analysis

12.2 Alibaba Pictures Group Limited

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Sales Analysis

12.3 HuayiTencent Entertainment Company Limited

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Sales Analysis

12.4 Perfect World

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Sales Analysis

12.5 China Film Co. Ltd

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Sales Analysis

12.6 Mango Excellent Media

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Sales Analysis

12.7 Beijing Enlight Media

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Sales Analysis

12.8 Wanda Film Holding Co Ltd

12.8.1 Overview

12.8.2 Recent Development

12.8.3 Sales Analysis

List of Figures:

Figure-01: China – Movie Market (Billion US$), 2017 – 2022

Figure-02: China – Forecast for Movie Market (Billion US$), 2023 – 2028

Figure-03: Source Type – Domestic Movie Market Market (Million US$), 2017 – 2022

Figure-04: Source Type – Forecast for Domestic Movie Market Market (Million US$), 2023 – 2028

Figure-05: Source Type – Imported Movie Market Market (Million US$), 2017 – 2022

Figure-06: Source Type – Forecast for Imported Movie Market Market (Million US$), 2023 – 2028

Figure-07: 1st Tier Cities – Movie Market (Million US$), 2017 – 2022

Figure-08: 1st Tier Cities – Forecast for Movie Market (Million US$), 2023 – 2028

Figure-09: 2nd Tier Cities – Movie Market (Million US$), 2017 – 2022

Figure-10: 2nd Tier Cities – Forecast for Movie Market (Million US$), 2023 – 2028

Figure-11: 3rd Tier Cities – Movie Market (Million US$), 2017 – 2022

Figure-12: 3rd Tier Cities – Forecast for Movie Market (Million US$), 2023 – 2028

Figure-13: 4th Tier Cities – Movie Market (Million US$), 2017 – 2022

Figure-14: 4th Tier Cities – Forecast for Movie Market (Million US$), 2023 – 2028

Figure-15: 5th Tier Cities – Movie Market (Million US$), 2017 – 2022

Figure-16: 5th Tier Cities – Forecast for Movie Market (Million US$), 2023 – 2028

Figure-17: China – Movie Screens Volume (Unit), 2017 – 2022

Figure-18: China – Forecast for Movie Screens Volume (Unit), 2023 – 2028

Figure-19: China – Movie Admission Market (Million US$), 2017 – 2022

Figure-20: China – Forecast for Movie Admission Market (Million US$), 2023 – 2028

Figure-21: 1st Tier Cities – Movie Ticket Pricing Market (US$), 2017 – 2022

Figure-22: 1st Tier Cities – Forecast for Movie Ticket Pricing Market (US$), 2023 – 2028

Figure-23: 2nd Tier Cities – Movie Ticket Pricing Market (US$), 2017 – 2022

Figure-24: 2nd Tier Cities – Forecast for Movie Ticket Pricing Market (US$), 2023 – 2028

Figure-25: 3rd Tier Cities – Movie Ticket Pricing Market (US$), 2017 – 2022

Figure-26: 3rd Tier Cities – Forecast for Movie Ticket Pricing Market (US$), 2023 – 2028

Figure-27: 4th Tier Cities – Movie Ticket Pricing Market (US$), 2017 – 2022

Figure-28: 4th Tier Cities – Forecast for Movie Ticket Pricing Market (US$), 2023 – 2028

Figure-29: 5th Tier Cities – Movie Ticket Pricing Market (US$), 2017 – 2022

Figure-30: 5th Tier Cities – Forecast for Movie Ticket Pricing Market (US$), 2023 – 2028

Figure-31: IMAX China Holding – Global Revenue (Million US$), 2017 – 2022

Figure-32: IMAX China Holding – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-33: Alibaba Pictures Group Limited – Global Revenue (Billion US$), 2017 – 2022

Figure-34: Alibaba Pictures Group Limited – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-35: HuayiTencent Entertainment Company Limited – Global Revenue (Million US$), 2017 – 2022

Figure-36: HuayiTencent Entertainment Company Limited – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-37: Perfect World – Global Revenue (Million US$), 2017 – 2022

Figure-38: Perfect World – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-39: China Film Co. Ltd – Global Revenue (Million US$), 2017 – 2022

Figure-40: China Film Co. Ltd – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-41: Mango Excellent Media – Global Revenue (Million US$), 2017 – 2022

Figure-42: Mango Excellent Media – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-43: Beijing Enlight Media – Global Revenue (Million US$), 2017 – 2022

Figure-44: Beijing Enlight Media – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-45: Wanda Film Holding Co Ltd – Global Revenue (Billion US$), 2017 – 2022

Figure-46: Wanda Film Holding Co Ltd – Forecast for Global Revenue (Billion US$), 2023 – 2028

List of Tables:

Table-01: China – Cinema Market Share by Source Type (Percent), 2017 – 2022

Table-02: China – Forecast for Cinema Market Share by Source Type (Percent), 2023 – 2028

Table-03: China – Cinema Market Share by Tier Cities (Percent), 2017 – 2022

Table-04: China – Forecast for Cinema Market Share by Tier Cities (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com