China Ice Cream Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowChina Ice Cream Market Trends & Summary

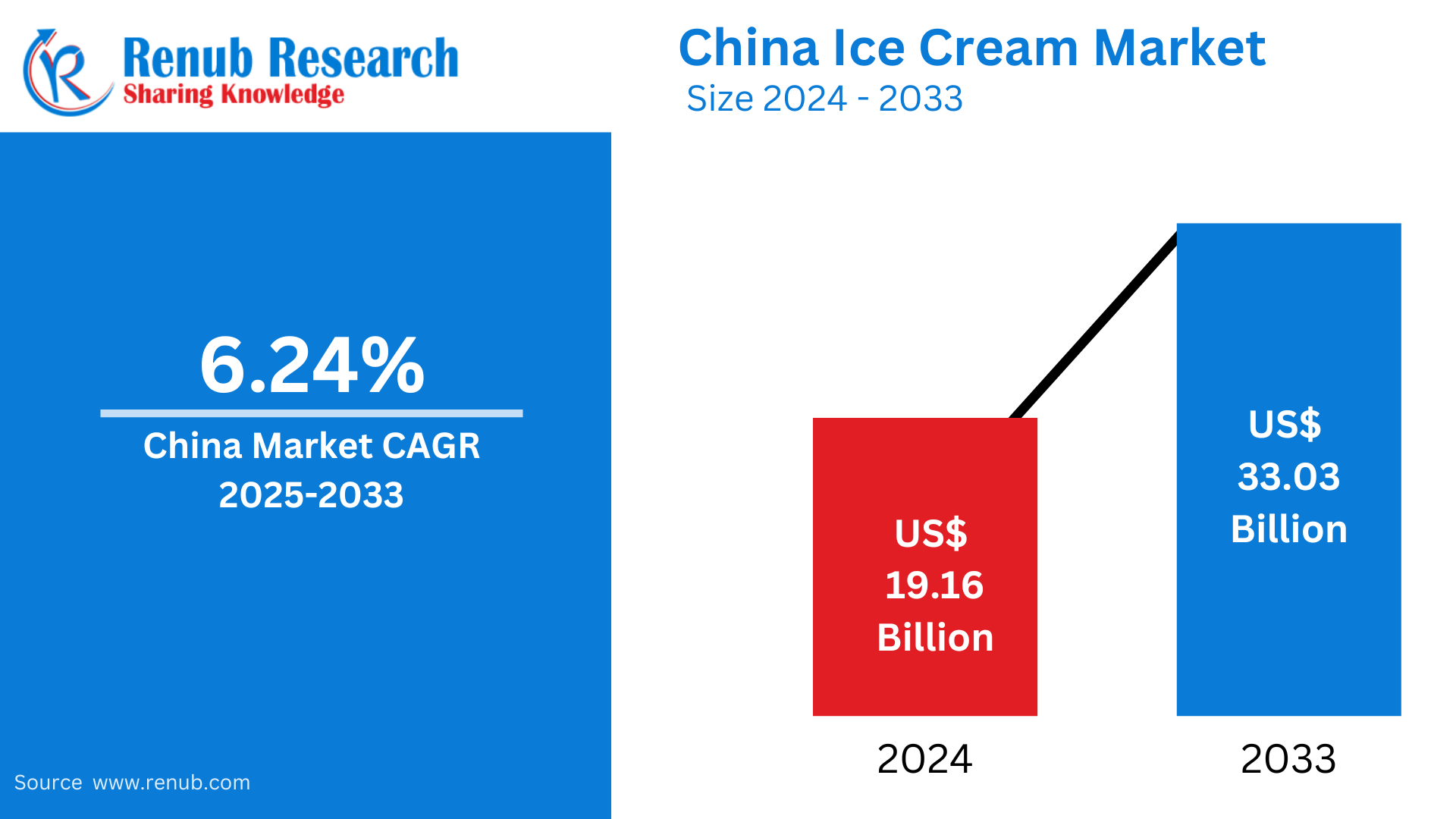

The China ice cream market is expected to grow significantly, reaching an estimated US$ 33.03 billion by 2033, up from US$ 19.16 billion in 2024. This growth represents a compound annual growth rate (CAGR) of 6.24% from 2025 to 2033. Increasing consumer demand for premium flavors, innovative packaging, and rising disposable incomes fuel this expansion in China's dynamic ice cream sector.

The report China Ice Cream Market & Forecast covers by Product Type (Artisanal, Impulse, and Take Home), Flavor Type (Vanilla, Chocolate, Fruit, and Others), Age-group (Kids & Babies, Tweens & Early Teens, Early Young Adults, Older Young Adults, Pre-Mid-Lifers, Mid-Lifers, and Older Consumers), Category (Sticks/Bars, Cones & Cups, Tubs & Bricks), Distribution Channel (Supermarkets and Hypermarkets, Convenience Store, Specialist Retailers, Online Retail Stores), Regions and Company Analysis 2025-2033.

China Ice Cream Market Outlook

Ice cream is a frozen dessert made primarily from milk, cream, sugar, and flavorings, with air whipped into the mixture for texture. It is available in various forms, such as cones, cups, bars, and tubs, and comes in numerous flavors, ranging from traditional vanilla and chocolate to unique regional and innovative options. In China, ice cream consumption has grown significantly over the years, reflecting the nation's evolving dietary preferences and increasing disposable incomes. Traditionally considered a seasonal treat, ice cream is consumed year-round, driven by expanding product availability and the development of premium and healthier options.

China is among the largest markets for ice cream globally, with consumers showing a preference for both traditional flavors and new, innovative tastes inspired by local ingredients like matcha, red bean, and black sesame. Urbanization, rising demand for convenience foods, and younger generations seeking indulgent experiences contribute to the popularity of ice cream, making it a staple in China's dessert culture.

Growth Drivers in the China Ice Cream Market

Rising Disposable Income

The increasing disposable income among Chinese consumers is a significant growth driver in the ice cream market. As households have more spending power, demand for indulgent and premium products has surged. Consumers will spend more on high-quality ice cream featuring unique flavors, organic ingredients, or innovative packaging. This trend is especially pronounced in urban areas, where middle- and upper-class families seek luxury and convenience in their food choices. Disposable Personal Income in China increased to 51821 CNY in 2023 from 49282.94 CNY in 2022.

Innovation in Flavors and Formats

Innovation in flavors and formats has transformed ice cream consumption in China. Brands are creating unique products incorporating traditional Chinese ingredients like matcha, red bean, and black sesame, appealing to local tastes. Additionally, healthier options like low-fat, low-sugar, or plant-based ice creams attract health-conscious consumers. Novel formats, such as mochi ice cream and artisanal popsicles, are also gaining traction, keeping the market dynamic and competitive. In 2024, Wansheng Food Additives (Shanghai) Co., Ltd., which has been deeply engaged in the food industry for many years, will bring the latest products, technologies, innovative achievements, and more wonderful displays.

Expanding Retail Channels

The proliferation of retail channels, including online platforms, is another key growth driver. E-commerce platforms and food delivery services provide consumers convenient access to ice cream products. Supermarkets, convenience stores, and specialty ice cream shops offer various options, enhancing availability. Seasonal promotions, bundled deals, and targeted marketing through social media also drive higher sales and brand loyalty.

Challenges in the China Ice Cream Market

Rising Competition

The China ice cream market is highly competitive, with numerous domestic and international players vying for market share. Local brands often have the advantage of catering to regional tastes and affordability, while global brands bring premium offerings and established reputations. This intense competition pressures companies to continuously innovate in flavors, packaging, and marketing strategies. Smaller players may need help competing with larger corporations' marketing budgets and supply chain efficiencies, making sustaining growth in such a crowded marketplace challenging.

Health and Wellness Trends

Chinese consumers' growing emphasis on health and wellness challenges traditional ice cream brands. High sugar, fat, and calorie levels in conventional products have led to a shift toward healthier alternatives. Consumers increasingly seek low-calorie, low-sugar, or plant-based ice creams, forcing brands to reformulate recipes and introduce new products. However, achieving the right balance between taste and health benefits can take time and effort, especially for smaller manufacturers with limited resources.

Ice Cream Consumption Rise in China

In 2022, 98.9% of Chinese consumers enjoyed ice cream, with many preferring it in summer. Notably, 27.3% consume ice cream daily and 37.8% every 2 or 3 days. Ice cream consumption has expanded beyond summer, with over 70% of consumers now buying it in winter. Various flavors and marketing strategies, such as nostalgia marketing and co-branding, have increased ice cream consumption in China.

China Impulse Ice Cream Market

The impulse section is significant in leading market trends, particularly single-serving items typically packaged in small quantities or sold on sticks. These products specifically cater to the fast-paced lifestyles of Chinese consumers. As urbanization grows and schedules become increasingly busy, the demand for quick and satisfying snack options rises. Impulse ice cream products, in particular, offer immediate gratification that makes them ideal for unplanned purchases and helps satisfy cravings. Additionally, the widespread availability of these items in various retail outlets and their affordability enhance their popularity across different age groups in China.

China Vanilla Ice Cream Market

Vanilla ice cream is a classic flavor that resonates with consumers of various ages and cultural backgrounds. Its neutral taste profile is an adaptable base for many toppings, mix-ins, and flavor combinations, offering countless customization possibilities. Additionally, vanilla's association with high-quality brands enhances its appeal among discerning consumers who seek indulgent and satisfying ice cream experiences. This solidifies vanilla’s position as a Chinese ice cream market staple flavor.

China Tweens and Early Teens Ice Cream Market

The market share of tweens and early teens is increasingly significant as they transition from childhood to their formative years. This demographic seeks greater independence in their food choices, preferring indulgent treats like ice cream. Ice cream's appeal as a fun, social snack resonates well with their desire for novelty and the need for peer approval. Advertising campaigns targeting this age group often focus on specific trends, flavors, and packaging that align with their preferences. This strategic approach reinforces their influence on the evolving patterns of ice cream consumption in China.

China Cones and Cups Ice Cream Market

Cones provide a convenient and portable snack option that aligns well with the fast-paced lifestyle prevalent in China. Similarly, cups allow for a manageable and transportable serving size, making them suitable for various consumption environments. Both formats accommodate diverse flavors and toppings, enhancing the ice cream experience. Additionally, the widespread availability of cones and cups in numerous retail outlets, from street vendors to supermarkets, ensures easy access and plays a significant role in their popularity within the Chinese ice cream market.

China Supermarkets and Hypermarkets Ice Cream Market

Supermarkets and hypermarkets are anticipated to increase their market share in the retail sector. In China, these retail formats significantly drive ice cream consumption and foster innovations within the industry. They provide various product selections, including various ice cream manufacturers, flavors, and formats, catering to diverse consumer preferences. Their extensive distribution networks ensure that a large customer base can access their offerings, effectively covering urban and rural areas. Additionally, supermarkets and hypermarkets implement strategic promotional activities, including discounts and special offers, to attract customers and enhance sales performance.

East China Ice Cream Market

East China is experiencing notable growth in its ice cream market, primarily due to the economic vitality of cities such as Shanghai and Hangzhou. This region has a large population with increasing disposable incomes, leading to higher spending on premium indulgences like ice cream. Additionally, the urbanization and modernization of East China have resulted in a rise in supermarkets, convenience stores, and specialty dessert shops, providing consumers with easy access to a wide variety of ice cream products. The diverse culinary landscape and the region's openness to global trends have also stimulated demand for innovative flavors and high-quality offerings, further driving the expansion of the ice cream market.

Key Players

Meiji Co., Ltd., General Mills Inc., Yili Group, Unilever, Mondelez International Inc., and Nestlé S.A. are all in the Chinese ice cream market.

In May 2022, Maotai partnered with Mengniu to launch the first Maotai ice cream flagship store at the Maotai International Hotel. On its opening day, the store sold over 5,000 ice creams for 200 thousand RMB within 7 hours. By July 9th, the ice cream had expanded to nine cities and seven provinces, with more than 660 thousand cups sold.

In March 2022, Chinese dairy giant Yili introduced “3D traditional fan ice cream,” which features 3.8 times more protein milk and unique designs with poetic names to stand out from competitors.

Product Type – Market breakup in 3 viewpoints:

1. Artisanal

2. Impulse

3. Take Home

Flavor Type – Market breakup in 4 viewpoints:

1. Vanilla

2. Chocolate

3. Fruit

4. Others

Age-group – Market breakup in 7 viewpoints:

1. Kids & Babies

2. Tweens & Early Teens

3. Early Young Adults

4. Older Young Adults

5. Pre-Mid-Lifers

6. Mid-Lifers

7. Older Consumers

Category – Market breakup in 4 viewpoints:

1. Sticks/Bars

2. Cones & Cups

3. Tubs & Bricks

4. Others

Distribution Channel – Market breakup in 5 viewpoints:

1. Supermarkets and Hypermarkets

2. Convenience Store

3. Specialist Retailers

4. Online Retail Stores

5. Others

Region – Market breakup in 6 viewpoints:

1. East China

2. South China

3. North China

4. West China

5. Central China

6. Northeast China

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Developments

• Revenue Analysis

Company Analysis:

1. Meiji co ltd.

2. General Mills Inc.

3. Yili Group

4. Unilever Group

5. Mondelez International, Inc.

6. Nestlé SA

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Flavor Type, Age Group, Category, Distribution Channel and Region |

| Region Covered | 1. East China 2. South China 3. North China 4. West China 5. Central China 6. Northeast China |

| Companies Covered | 1. Meiji co ltd. 2. General Mills Inc. 3. Yili Group 4. Unilever Group 5. Mondelez International, Inc. 6. Nestlé SA |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research& Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. China Ice Cream Market

6. Market Share

6.1 By Product Type

6.2 By Flavor Type

6.3 By Age Group

6.4 By Category

6.5 By Distribution Channel

6.6 By Region

7. Product Type

7.1 Artisanal

7.2 Impulse

7.3 Take Home

8. Flavor Type

8.1 Vanilla

8.2 Chocolate

8.3 Fruit

8.4 Others

9. Age Group

9.1 Kids & Babies

9.2 Tweens & Early Teens

9.3 Early Young Adults

9.4 Older Young Adults

9.5 Pre-Mid-Lifers

9.6 Mid-Lifers

9.7 Older Consumers

10. Category

10.1 Sticks/Bars

10.2 Cones & Cups

10.3 Tubs & Bricks

10.4 Others

11. Distribution Channel

11.1 Supermarkets and Hypermarkets

11.2 Convenience Store

11.3 Specialist Retailers

11.4 Online Retail Stores

11.5 Others

12. Region

12.1 East China

12.2 South China

12.3 North China

12.4 West China

12.5 Central China

12.6 Northeast China

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Rivalry

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threat

15. Key Players Analysis

15.1 Meiji co ltd.

15.1.1 Overview

15.1.2 Recent Development

15.1.3 Revenue Analysis

15.2 General Mills Inc.

15.2.1 Overview

15.2.2 Recent Development

15.2.3 Revenue Analysis

15.3 Yili Group

15.3.1 Overview

15.3.2 Recent Development

15.3.3 Revenue Analysis

15.4 Unilever Group

15.4.1 Overview

15.4.2 Recent Development

15.4.3 Revenue Analysis

15.5 Mondelez International, Inc.

15.5.1 Overview

15.5.2 Recent Development

15.5.3 Revenue Analysis

15.6 Nestlé SA

15.6.1 Overview

15.6.2 Recent Development

15.6.3 Revenue Analysis

15.7 Bright Dairy & Food Co. Ltd.

15.7.1 Overview

15.7.2 Recent Development

15.7.3 Revenue Analysis

15.8 Danone S.A.

15.8.1 Overview

15.8.2 Recent Development

15.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com