China Online Education Market Forecast By Segment, (Early Childhood K12+Steam Education) and (Corporate, Vocational, Language) Training & Company Analysis

Buy NowGet Free Customization in this Report

The market of online education in China has a raging fire development in recent years; as a result, novel products have been springing up gaining more customers’ as well as recognition and attracting more developers and investors. A famous English Novelist, “Dickens” wrote in his famous book “A Tale of Two Cities”. "It was the best time and it was the worst times." The same goes for Chinese practitioners in today’s China’s internet world.

Government more spending on education and with the influx of huge number of capital investments, online education industries number in China showed geometric growth in the year 2013. At the beginning of the year 2014, leaders of internet giants most commonly called BAT (Baidu, Alibaba, Tencent) has began to seize the online education industry in China. As per Renub Research Analysis, China Online Education Market will be an opportunity of US$ 100 Billion by 2026.

How COVID-19 is driving the Digital Education Market in China

China’s economy has been walloped due to the outbreak of coronavirus. Since, many businesses have been shut temporarily due to the quarantine rules. But this lockdown came as an unexpected boon for the online education sector. According to our research, DingTalk, software developed by Alibaba has been installed 1.1 Billion times in China due to Covid-19, and it is being used extensively by schools and students. Approximately 220 Million Chinese students – primary, secondary and tertiary were homebound during Lunar New Year holiday because of the current epidemic. This pandemic offers an enormous opportunity for the companies operating in online education space.

The factors that are helping the China E-learning Market to grow are as follows:

• Increasing government spending on education

• Propelled by conducive environment favourable policies and capital inflows

• Accelerated revision of the laws on private education and supporting policies

• Shift from PC to Mobile Client

• Huge development potential of K12 online education market

However, the factors like Lack of supervision of online platforms may hinder the growth of China online education market during the forecast period.

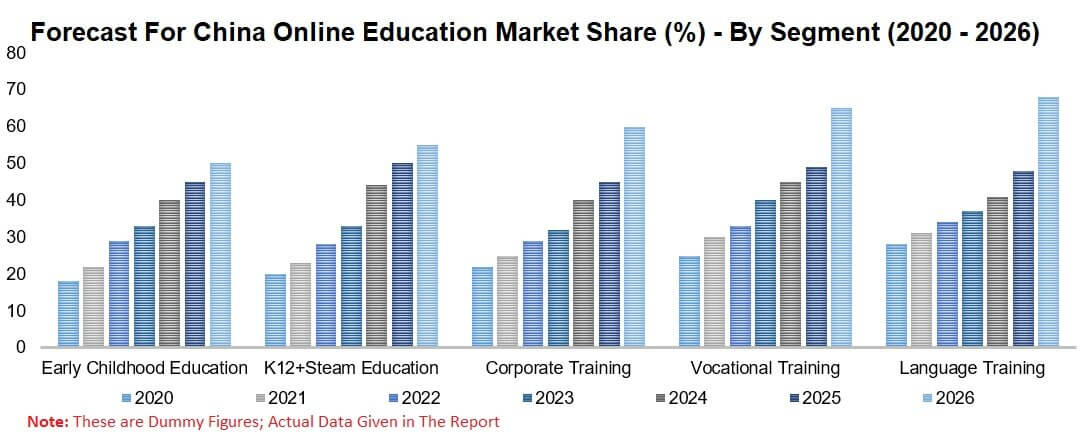

In this report, we have studied, China online education market by segment- Early Childhood Education, K12+Steam Education, Corporate Training, Vocational Training, Language Training. The K12+Steam Education market is growing at a rapid pace.

Renub Research report titled “China Online Education Market By Segment (Early Childhood Education, K12+Steam Education, Corporate Training, Vocational Training, Language Training) Education Investment, Private Education, Online Education Policy Company (Neworiental Corporation (XDF), Tomorrow Advancing Life (TAL), Baidu Jiaoyu, NetEase Cloud Classroom, Tarena International, Inc. (TEDU)”. This report captures an all-encompassing detail of the key growth drivers and restraining factors, demand, and their projections for the upcoming years.

K12+Steam Education leads the China Online Education Market

The market for K12+Steam Education is rising among all other segments. We have studied China online education market by segments by Early Childhood Education, Corporate Training, Vocational Training, and Language Training.

By Segment – Five Segments has been analyzed in the report

• Early Childhood Education

• K12+Steam Education

• Corporate Training

• Vocational Training

• Language Training

Development of China Online Industry

• Educational Investment

• Private Investment

• Online Education Policy

All the companies have been studied from two points

• Recent Developments

• Sales Analysis

Company Analysis

• Neworiental Corporation (XDF)

• Tomorrow Advancing Life (TAL)

• Baidu Jiaoyu

• NetEase Cloud Classroom

• Tarena International, Inc. (TEDU)

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. China Online Education Market Analysis

6. Education Media and Tools

6.1 Education Media

6.2 Education Tools

6.3 Teaching Models

6.3.1 Recorded Broadcast

6.3.2 Live Broadcast

6.3.3 Flipped Classroom

6.4 Overview of Teaching Platform

7. Market Share Analysis by Segment

8. Segment – China Online Education Market

8.1 Early Childhood Education

8.2 K12+Steam Education

8.3 Corporate Training

8.4 Vocational Training

8.5 Language Training

9. Development of China Education Industry

9.1 Education Investment

9.2 Private Education

9.3 Online Education Policy

10. Company Analysis

10.1 Baidu Jiaoyu

10.1.1 Business Overview

10.1.2 Recent Development & Strategy

10.1.3 Sales Analysis

10.2 Neworiental Corporation (XDF)

10.2.1 Business Overview

10.2.2 Recent Development & Strategy

10.2.3 Sales Analysis

10.3 Tomorrow Advancing Life (TAL)

10.3.1 Business Overview

10.3.2 Recent Development & Strategy

10.3.3 Sales Analysis

10.4 NetEase Cloud Classroom

10.4.1 Business Overview

10.4.2 Recent Development & Strategy

10.4.3 Sales Analysis

10.5 Tarena International, Inc. (TEDU)

10.5.1 Business Overview

10.5.2 Recent Development & Strategy

10.5.3 Sales Analysis

List of Figures:

Figure 1: China is the Biggest Importer whereas the European Union is the Largest Pork Exporter in the World in (Thousand Metric Ton)

Figure 2: United State is the Largest Pork Producing & Consumption Country (In Thousand Metric Tons), 2019-2026

Figure 3: China Online Education Market (Million US$), 2017 – 2019

Figure 4: China – Forecast for Online Education Market (Million US$), 2020 – 2026

Figure 5: China – Early Childhood Education Market (Million US$), 2017 – 2019

Figure 6: China – Forecast for Early Childhood Education Market (Million US$), 2020 – 2026

Figure 7: China – K12+Steam Education Market (Million US$), 2017 – 2019

Figure 8: China – Forecast for K12+Steam Education Market (Million US$), 2020 – 2026

Figure 9: China – Corporate Training Market (Million US$), 2017 – 2019

Figure 10: China – Forecast for Corporate Training Market (Million US$), 2020 – 2026

Figure 11: China – Vocational Training Market (Million US$), 2017 – 2019

Figure 12: China – Forecast for Vocational Training Market (Million US$), 2020 – 2026

Figure 13: Global Pork Volume Share by Import (Percent), 2016 – 2019

Figure 14: Global – Forecast for Pork Volume Share by Import (Percent), 2020 – 2026

Figure 15: Neworiental Corporation (XDF) – Global Revenue (Million US$), 2015 - 2019

Figure 16: Neworiental Corporation (XDF) – Forecast for Global Revenue (Million US$), 2020 - 2026

Figure 17: Tomorrow Advancing Life (TAL) – Global Revenue (Million US$), 2015 - 2019

Figure 18: Tomorrow Advancing Life (TAL) – Forecast for Global Revenue (Million US$), 2020 - 2026

Figure 19: Baidu Jiaoyu – Global Revenue (Million US$), 2015 - 2019

Figure 20: Baidu Jiaoyu) – Forecast for Global Revenue (Million US$), 2020 - 2026

Figure 21: NetEase Cloud Classroom – Global Revenue (Million US$), 2015 - 2019

Figure 22: NetEase Cloud Classroom – Forecast for Global Revenue (Million US$), 2020 - 2026

Figure 23: Tarena International, Inc. (TEDU)– Global Revenue (Million US$), 2015 - 2019

Figure 24: Tarena International, Inc. (TEDU)– Forecast for Global Revenue (Million US$), 2020 - 2026

List of Tables:

Table 1: China Online Education Market, 2017 - 2019

Table 2: Forecast For China Online Education Market, 2020 - 2026

Table 3: State of Early Childhood Education During, 2007-2016

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com