China Online Gaming Market, Number of Users, Category (Mobile, PC Online Client Games, Web), Market based on Age Group, Segments & Companies

Buy NowGet Free Customization in This Report

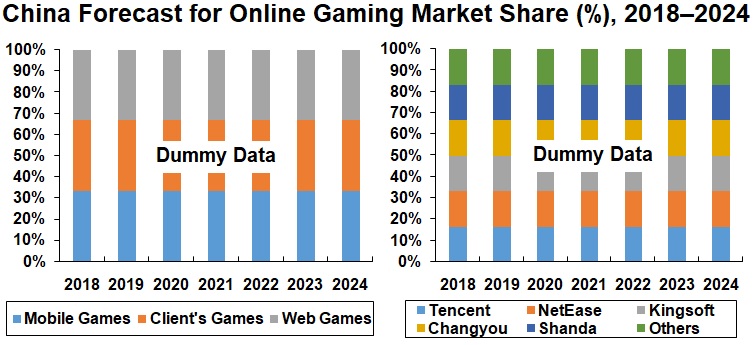

China online gaming market is expected to surpass US$ 75 Billion by the end of year 2024. China online gaming market is one of the biggest online gaming markets in the world, surpassing United States and Japan. The user of China online gaming is anticipated to cross 700 Million by the end of year 2024. According to Renub Research analysis, PC Online (Client Games) market share is contracting and mobile game market share is expanding continuously. Tencent captured the lion’s market share compared as compared to its competitors.

Follow the link for the latest report with detailed TOC and list of figures and tables: China Online Gaming Market By Number of Users, Category, Age Group, Segments, Company Analysis, Forecast By (2021 - 2027)

The rise of per capita income of Chinese online gamers has reinforced the china online gaming market to the great height. Due to convenient or well-developed payment systems, players would like to engage themselves on games and spend more money and time. The online mobile game is largest revenue contributors in China online gaming Market. There are numerous new games like “Knives Out” and “Love & Producer” are expected to outperform. Increasing consumer’s propensity to play online games and rising mobile games penetration are the major growth drivers of China online gaming market.

Request a free sample copy of the report: https://www.renub.com/contactus.php

Mobile Online Games Dominates the Online Games Market in China

China mobile online games are continuously rising at a rapid pace and expected to outperform in anticipated year. The report covers the market of Mobile Online Games, PC Online / Client Games, and Web Games.

Chinese Age Group of (19-25 Years) is highly Passionate about Online Gaming

Chinese youth (19-25) are spending more money on online games because they are considered to be working population and having high disposable income. The report covers following Age Bracket (Below 19 Years), Age Bracket (19 - 25 Years), Age Bracket 26+37

Large Client Games dominates the China Online Gaming Industry

Large client games are most popular in china online gaming industry because it played on PC’s and Mobile both. The report covers the following segment markets: Large Client Games, Platform Games, Social Games and Other Games.

Renub Research report titled “China Online Gaming Market, Number of Users, Category (Mobile, PC Online Client Games, Web), Market based on Age Group (below 19, 19-25, 26+) Years, Segments (Large Client Games, Platform Games, Social Games, Other Games), Companies (Tencent, NetEase, Kingsoft, Changyou, Shanda)” provides a comprehensive assessment of the fast–evolving, high–growth of online gaming market in China.

By Category – China Online Gaming Market

1. Mobile Online Games Market

2. PC Online / Client Games Market

3. Web Games Market

By Age Group – China Online Gaming Market

1. Age Bracket (Below 19 Years)

2. Age Bracket (19 - 25 Years)

3. Age Bracket 26+

Client can purchase this report in sections through Purchase by Chapter Tab given above

By Segments – China Online Gaming Market

1. Large Client Games

2. Platform Games

3. Social Games

4. Other Games

Number of Users – China Online Gaming

1. Online Gaming Users

2. Mobile Online Games Users

3. PC Online Client’s Games Users

Companies Sales (2011 – 2024):

1. Tencent

2. NetEase

3. Kingsoft

4. Changyou

5. Shanda

1. Executive Summary

2. China Online Gaming Market (2011 – 2024)

3. Market & Users Share – China Online Gaming (2011 – 2024)

3.1 Market Share

3.2 Users Share

3.3 Company Sales Share

3.4 China Online Gamers Share by Location

4. Category – China Online Game Market (2011 – 2024)

4.1 Mobile Online Games Market

4.2 PC Online / Client Games Market

4.3 Web Games Market

5. Age Group – China Online Gaming Market (2011 – 2024)

5.1 Age Bracket (Below 19 Years)

5.2 Age Bracket (19 - 25 Years)

5.3 Age Bracket 26+

6. Segments – China Online Gaming Market (2013 – 2024)

6.1 Large Client Games

6.2 Platform Games

6.3 Social Games

6.4 Other Games

7. Number of Users – China Online Gaming (2010 – 2024)

7.1 Online Gaming Users

7.2 Mobile Online Games Users

7.3 PC Online Client’s Games Users

8. Game Players Behavioral Features and Preferences

8.1 Mobile Game Players

8.1.1 Number of Years

8.1.2 Average Game Playing Duration

8.1.3 Payment for Mobile Games

8.1.4 Main Products of Mobile Games

8.1.5 Information Access and Download Channels

8.2 PC Client Game Players

8.2.1 Number of Years

8.2.2 Average Game Playing Duration

8.2.3 Payment for PC Online Games

8.2.4 Main Products of PC Online Games

8.2.5 Information Access and Download Channels

9. Regulatory Status on China Online Gaming Industry

9.1 Dual Approval Regime Remains Unchanged

9.2 Online Publishing Service License

9.3 No Foreign Investment

9.4 Prior Approval for Foreign Online Games

10. Government Initiatives to Promote China Online Gaming Industry

10.1 Development of Broadband Infrastructure and Broadband Connections

10.2 Ban on Foreign Online Games

10.3 Overseas Expansion of Online Games

11. Company Sales Analysis (2011 – 2024)

11.1 Tencent Online Games Sales

11.2 NetEase Online Games Sales

11.3 Kingsoft Online Games Sales

11.4 Changyou Online Games Sales

11.5 Shanda Online Games Sales

12. Growth Drivers

12.1 Increasing Consumers Propensity to Play Online Games

12.2 Increase in Mobile Games Penetration

13. Challenges

13.1 High Piracy Rate

List of Figures:

Figure 2‑1: China – Online Gaming Market (Million US$), 2011–2017

Figure 2‑2: China – Forecast for Online Gaming Market (Million US$), 2018–2024

Figure 3‑1: China – Online Gaming Market Share (Percent), 2011–2017

Figure 3‑2: China – Forecast for Online Gaming Market Share (Percent), 2018–2024

Figure 3‑3: China – Online Gaming Users Share (Percent), 2010–2017

Figure 3‑4: China – Forecast for Online Gaming Users Share (Percent), 2018–2024

Figure 3‑5: China – Online Gaming Company Sales Share (Percent), 2011–2017

Figure 3‑6: China – Forecast for Online Gaming Company Sales Share (Percent), 2018–2024

Figure 3‑7: China – Online Gamers Share by Location (Percent), 2014

Figure 4‑1: China – Mobile Online Games Market (Million US$), 2011–2017

Figure 4‑2: China – Forecast for Mobile Online Games Market (Million US$), 2018–2024

Figure 4‑3: China – PC Online (Client Games) Market (Million US$), 2011–2017

Figure 4‑4: China – Forecast for PC Online (Client Games) Market (Million US$), 2018–2024

Figure 4‑5: China – Web Games Market (Million US$), 2011–2017

Figure 4‑6: China – Forecast for Web Games Market (Million US$), 2018–2024

Figure 5‑1: China – Online Gaming Market by Age Group (Below 19) (Million US$), 2011-2017

Figure 5‑2: China – Forecast for Online Gaming Market by Age Group (Below 19) (Million US$), 2018-2024

Figure 5‑3: China – Online Gaming Market by Age Group (19-25) (Million US$), 2011-2017

Figure 5‑4: China – Forecast for Online Gaming Market by Age Group (19-25) (Million US$), 2018-2024

Figure 5‑5: China – Online Gaming Market by Age Group (26+) (Million US$), 2011-2017

Figure 5‑6: China – Forecast for Online Gaming Market by Age Group (26+) (Million US$), 2018-2024

Figure 6‑1: China – Online Games Market by Large Client Games (Million US$), 2013-2017

Figure 6‑2: China – Online Games Market by Platform Games (Million US$), 2013-2017

Figure 6‑3: China – Online Games Market by Social Games (Million US$), 2013-2017

Figure 6‑4: China – Online Games Market by Other Games (Million US$), 2013-2017

Figure 7‑1: China – Online Gaming Users (Million), 2010–2017

Figure 7‑2: China – Forecast for Online Gaming Users (Million), 2018–2024

Figure 7‑3: China – Mobile Online Games Users (Million), 2010–2017

Figure 7‑4: China – Forecast for Mobile Online Games Users (Million), 2018–2024

Figure 7‑5: China – PC Online Client’s Games Users (Million), 2010–2017

Figure 7‑6: China – Forecast for PC Online Client’s Games Users (Million), 2018–2024

Figure 8‑1: China – Game Playing Years of Mobile Game Users (Percent), 2015

Figure 8‑2: China – Average Mobile Online Game Playing Duration Everyday (Percent), 2015

Figure 8‑3: China – Payment for Mobile Games (Percent), 2015

Figure 8‑4: China – Access channels for Mobile Games Information (Percent), 2015

Figure 8‑5: China – Download Channels for Mobile Games (Percent), 2015

Figure 8‑6: China – Game Playing Years of PC Online Game Users (Percent), 2014

Figure 8‑7: China – Average PC Online Game Playing Duration Everyday (Percent), 2014

Figure 8‑8: China – Payment for PC Online Games (Percent), 2014

Figure 8‑9: China – Download Channels for PC Online Games (Percent), 2014

Figure 11‑1: Tencent Online Games Sales (Million US$), 2011–2017

Figure 11‑2: Forecast for Tencent Online Games Sales (Million US$), 2018–2024

Figure 11‑3: NetEase Online Games Sales (Million US$), 2011–2017

Figure 11‑4: Forecast for NetEase Online Games Sales (Million US$), 2018–2024

Figure 11‑5: Kingsoft Online Games Sales (Million US$), 2011–2017

Figure 11‑6: Forecast for Kingsoft Online Games Sales (Million US$), 2018–2024

Figure 11‑7: Changyou Online Games Sales (Million US$), 2011–2017

Figure 11‑8: Forecast for Changyou Online Games Sales (Million US$), 2018–2024

Figure 11‑9: Shanda Online Games Sales (Million US$), 2011–2017

Figure 11‑10: Forecast for Shanda Online Games Sales (Million US$), 2018–2024

Figure 12‑1: Average Online Duration of Mobile Game Playing Every Day (Percent), 2014

List of Tables:

Table 8‑1: China – Main Products of Mobile Games, 2009 – 2015

Table 8‑2: China – Main Products of PC Online Games, 2001– 2013

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com