China Organic Food Market Report By Segments (Organic Baby Formula, Organic Baby Food, Organic Dairy, Organic Oils & Fats, Organic Beverages and Organic Fresh Products), Distribution Models (Hypermarkets, Supermarkets, Independent Small Grocers, Internet Retailing, Direct Selling, Forecourt Retailers and Others Grocery Retailers), and Company Analysis 2023-2028

Buy NowChina Organic Food Market Analysis

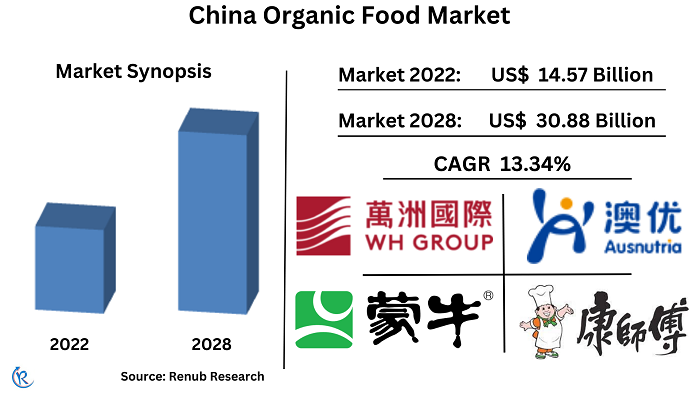

China Organic Food Market Size will reach US$ 30.88 Billion by 2028 compared to US$ 14.57 Billion in 2022, as per Renub Research. As the fourth largest organic market in the world and the first in Asia, China is an increasingly important buyer of organic products. Looking at the evolution of the market, organic food in China has huge potential in international and domestic markets. Most Chinese consumers are price sensitive and look for value when buying organic food. China's demand for Organic Food has grown at a fast pace in the past decade. In the next decade, both production and demand will continue to grow. The Chinese economy maintains a high speed growth which has been stimulated by the consecutive increases of industrial output, imports & exports, consumer consumption and capital investment for over two decades.

China Organic Food Industry will grow at a CAGR of 13.34% during 2022-2028

Organic farming continues to show a rapid development world-wide. China is one of the world’s largest agriculture producers and consumer of the agriculture products. Agriculture is one of the most important economic sectors in China, which employs over 295 million Chinese farm workers. Despite the agricultural output is the largest in the world, less than 7% of the world land area can be cultivated, which fed over 18% of the world population, in 2023.

China ranks the first in worldwide agricultural producer of rice, and principal sources of wheat, corn, tobacco, soybeans, peanuts, cotton, potatoes, sorghum, peanuts, tea, dairy, millet, barley, oilseed, pork and fish which provide China with a small portion of its foreign trade revenue. The main factors driving the purchase of organic products, also during the pandemic, reflect the attention of Chinese consumers towards physical health, food safety and its benefits on the maintenance of a healthy physical condition. More than 2.95 million hectares of land were farmed organically at the end of 2022 in China. Moreover, a series of food scandals occurred in China over the last years, emphasized the shift of interest of Chinese consumers towards foreign imported products, even at higher prices, better satisfy consumers’ needs in terms of quality and safety.

Organic Food Production Models in China: the System Production is the main Force

In China, most organic foods are cultivated by organized systems, not like other countries where organic foods are supplied by individuals. There are three main organic food production models in China: the first one is that big company leases land from farmer and pays them. The second model is that under the permission of local governments, big companies sign an organic food production contract with farmers. The third one is the organic producer association. Farmers set up an association by themselves to conduct large-scale organic food production.

Organic Dairy Industry in China has been growing steadily in recent years, driven by increasing demand for Healthy and Safe Food Products

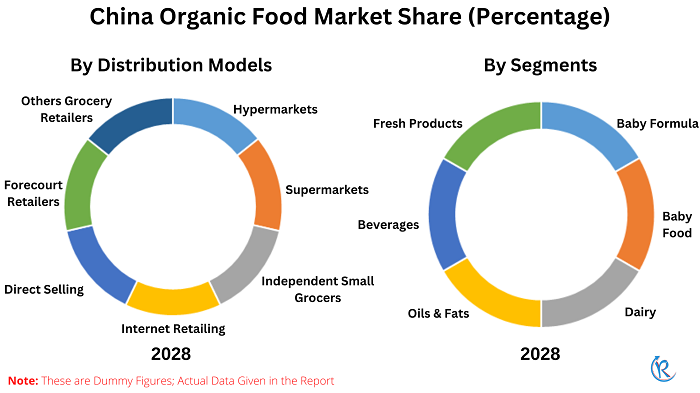

Based on China Organic Food segment, organic dairy accounts for the majority of the market share. China is becoming one of the largest organic dairy consumers in the world. The increasing demand for organic dairy products in China can be attributed to several factors, including the rising awareness about the use of fertilizers, pesticides, and bovine growth hormone in conventional dairy farming practices, which has led consumers to opt for healthier and organic products.

These products are known to have higher levels of beneficial nutrients such as vitamins, omega-3 fatty acids, antioxidants, and conjugated linoleic acid (CLA). Additionally, the growth of the organic dairy market in China is being driven by factors such as rapid urbanization, rising disposable incomes, and concerns about food safety due to widespread food adulteration practices in the country.

China's organic fresh products industry, which includes fruits, vegetables, meat, poultry, and seafood, has experienced significant growth in recent years due to increasing demand for healthy and safe food products, as well as rising awareness of environmental sustainability and animal welfare concerns among consumers. Organic fruits and vegetables are particularly popular, accounting for over 70% of the market share.

Consumers are willing to pay a premium for organic products that are free from harmful pesticides, herbicides, and synthetic fertilizers, driven by health consciousness, food safety, and environmental sustainability concerns. The Chinese government has been promoting the industry's development by providing subsidies for organic farming and certification and encouraging sustainable agriculture practices.

Chinese Supermarkets' Organic Food Market is expected to grow as Chinese Consumers Continue to demand Healthy, Safe, and Sustainable Food Products

On the basic of Distribution, China Organic Food industry has been divided into Hypermarkets, Supermarkets, Independent Small Grocers, Internet Retailing, Direct Selling, Forecourt Retailers and Others Grocery Retailers. In China, the market for organic food products in supermarkets has experienced significant growth in recent years, fueled by consumers' heightened health awareness, rising disposable incomes, and growing concerns over the environmental and health impacts of conventional food production methods. Leading supermarkets in the country, including Walmart, Carrefour, and Alibaba'sHema Fresh, have responded to the increasing demand for organic products by expanding their offerings.

China is by far the largest Internet Retailing market in the world. Thus, online retail and O2O models are the most efficient sales channels for organic food in China. As the largest consumer market for organic packaged foods and beverages and the fastest growing organic food market in Asia, China’s organic market offers many opportunities for foreign B2B investors. Geographically, the consumption of organic products is mainly concentrated within the high-tier cities, therefore big cities as Peking, Shanghai, Guangzhou, identifying the upper class as the main destination target. Moreover, online grocery shopping platforms like JD.com and Taobao have also entered the market, making organic food products more convenient and accessible to consumers.

Key Company

The report profiles several key market players in the industry, including China Mengniu Dairy Company Limited, Abbot China, Ausnutria Dairy (China) Company Ltd, TINGYI (CAYMAN ISLANDS) HOLDING CORP, and WH Group Limited.

Renub Research report titled “China Organic Food Market by Segments (Organic Baby Formula, Organic Baby Food, Organic Dairy , Organic Oils & Fats , Organic Beverages and Organic Fresh Products), Distribution Models (Hypermarkets, Supermarkets, Independent Small Grocers, Internet Retailing, Direct Selling, Forecourt Retailers and Others Grocery Retailers), Company (China Mengniu Dairy Company Limited, Abbot China, Ausnutria Dairy (China) Company Ltd, TINGYI (CAYMAN ISLANDS) HOLDING CORP, and WH Group Limited.)” provides a complete analysis of Chinese Organic Food Industry.

Segments - Market Breakup from 6 viewpoints

1. Organic Baby Formula

2. Organic Baby Food

3. Organic Dairy

4. Organic Oils & Fats

5. Organic Beverages

6. Organic Fresh Products

Distribution Models - Market Breakup from 7 viewpoints

1. Hypermarkets

2. Supermarkets

3. Independent Small Grocers

4. Internet Retailing

5. Direct Selling

6. Forecourt Retailers

7. Others Grocery Retailers

All companies have been covered from 3 viewpoints

• Overviews

• Recent Developments

• Revenues

Company

1. China Mengniu Dairy Company Limited

2. Abbot China

3. Ausnutria Dairy (China) Company Ltd

4. TINGYI (CAYMAN ISLANDS) HOLDING CORP

5. WH Group Limited

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2019 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Segments, and Distribution Models |

| Companies Covered | China Mengniu Dairy Company Limited, Abbot China, Ausnutria Dairy (China) Company Ltd, TINGYI (CAYMAN ISLANDS) HOLDING CORP, and WH Group Limited. |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. PESTLE Analysis

5.1 Political

5.2 Economic

5.3 Social

5.4 Technological

5.5 Legal

5.6 Environmental

6. China Organic Food Market Analysis

6.1 Organic Food Market

6.2 Organic Agricultural Land

7. Market Share – China Organic Food Analysis

7.1 By Segments

7.2 By Distribution Models

8. Segments – China Organic Food Market

8.1 Organic Baby Formula

8.2 Organic Baby Food

8.3 Organic Dairy

8.4 Organic Oils & Fats

8.5 Organic Beverages

8.6 Organic Fresh Products

9. Distribution Models - China Organic Food Market

9.1 Hypermarkets

9.2 Supermarkets

9.3 Independent Small Grocers

9.4 Internet Retailing

9.5 Direct Selling

9.6 Forecourt Retailers

9.7 Others Grocery Retailers

10. Mergers and Acquisitions

11. Company Analysis

11.1 China Mengniu Dairy Company Limited

11.1.1 Overviews

11.1.2 Recent Developments

11.1.3 Revenues

11.2 Abbot China

11.2.1 Overviews

11.2.2 Recent Developments

11.2.3 Revenues

11.3 Ausnutria Dairy (China) Company Ltd

11.3.1 Overviews

11.3.2 Recent Developments

11.3.3 Revenues

11.4 TINGYI (CAYMAN ISLANDS) HOLDING CORP.

11.4.1 Overviews

11.4.2 Recent Developments

11.4.3 Revenues

11.5 WH Group Limited

11.5.1 Overviews

11.5.2 Recent Developments

11.5.3 Revenues

List of Figures:

Figure-01: China – Organic Food Market (Billion US$), 2019 – 2022

Figure-02: China – Forecast for Organic Food Market (Billion US$), 2023 – 2028

Figure-03: China – Organic Agricultural Land (Million Hectares), 2019 – 2022

Figure-04: China – Forecast for Organic Agricultural Land (Million Hectares), 2023 – 2028

Figure-05: Segments – Organic Baby Formula Market (Million US$), 2019 – 2022

Figure-06: Segments – Forecast for Organic Baby Formula Market (Million US$), 2023 – 2028

Figure-07: Segments – Organic Baby Food Market (Million US$), 2019 – 2022

Figure-08: Segments – Forecast for Organic Baby Food Market (Million US$), 2023 – 2028

Figure-09: Segments – Organic Dairy Market (Million US$), 2019 – 2022

Figure-10: Segments – Forecast for Organic Dairy Market (Million US$), 2023 – 2028

Figure-11: Segments – Organic Oils & Fats Market (Million US$), 2019 – 2022

Figure-12: Segments – Forecast for Organic Oils & Fats Market (Million US$), 2023 – 2028

Figure-13: Segments – Organic Beverages Market (Million US$), 2019 – 2022

Figure-14: Segments – Forecast for Organic Beverages Market (Million US$), 2023 – 2028

Figure-15: Segments – Organic Fresh Products Market (Million US$), 2019 – 2022

Figure-16: Segments – Forecast for Organic Fresh Products Market (Million US$), 2023 – 2028

Figure-17: Distribution Models – Hypermarkets Market (Million US$), 2019 – 2022

Figure-18: Distribution Models – Forecast for Hypermarkets Market (Million US$), 2023 – 2028

Figure-19: Distribution Models – Supermarkets Market (Million US$), 2019 – 2022

Figure-20: Distribution Models – Forecast for Supermarkets Market (Million US$), 2023 – 2028

Figure-21: Distribution Models – Independent Small Grocers Market (Million US$), 2019 – 2022

Figure-22: Distribution Models – Forecast for Independent Small Grocers Market (Million US$), 2023 – 2028

Figure-23: Distribution Models – Internet Retailing Market (Million US$), 2019 – 2022

Figure-24: Distribution Models – Forecast for Internet Retailing Market (Million US$), 2023 – 2028

Figure-25: Distribution Models – Direct Selling Market (Million US$), 2019 – 2022

Figure-26: Distribution Models – Forecast for Direct Selling Market (Million US$), 2023 – 2028

Figure-27: Distribution Models – Forecourt Retailers Market (Million US$), 2019 – 2022

Figure-28: Distribution Models – Forecast for Forecourt Retailers Market (Million US$), 2023 – 2028

Figure-29: Distribution Models – Others Grocery Retailers Market (Million US$), 2019 – 2022

Figure-30: Distribution Models – Forecast for Others Grocery Retailers Market (Million US$), 2023 – 2028

Figure-31: China Mengniu Dairy Company Limited – Global Revenue (Million US$), 2019 – 2022

Figure-32: China Mengniu Dairy Company Limited – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-33: Abbot China – Global Revenue (Million US$), 2019 – 2022

Figure-34: Abbot China – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-35: Ausnutria Dairy (China) Company Ltd – Global Revenue (Million US$), 2019 – 2022

Figure-36: Ausnutria Dairy (China) Company Ltd – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-37: TINGYI (CAYMAN ISLANDS) HOLDING CORP. – Global Revenue (Million US$), 2019 – 2022

Figure-38: TINGYI (CAYMAN ISLANDS) HOLDING CORP. – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-39: WH Group Limited – Global Revenue (Million US$), 2019 – 2022

Figure-40: WH Group Limited – Forecast for Global Revenue (Million US$), 2023 – 2028

List of Tables:

Table-01: China – Organic Food Market Share by Segments (Percent), 2016 – 2022

Table-02: China – Forecast for Organic Food Market Share by Segments (Percent), 2023 – 2028

Table-03: China – Organic Food Market Share by Distribution Models (Percent), 2016 – 2022

Table-04: China – Forecast for Organic Food Market Share by Distribution Models (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com