China Smart Home Market, Numbers, and Penetration by (Energy Management, Comfort and Lighting, Home Entertainment, Control and Connectivity, Security and Smart Appliances) Company Analysis

Buy NowChina Smart Home Market Outlook

China, as a country, offers enormous potential for the Smart home industry, also known as the home automation industry. China smart home market is expected to be close to USD 37 Billion by the end of the year 2025. China smart home market is growing due to factors such as the high internet penetration rate, growth in the awareness of fitness and healthy lifestyles owning to the high disposable income in Chinese middle-class population; supportive government policy for IoT devices, great importance of home monitoring from remote locations; growth in the demand for energy- saving and low carbon emission solutions due to climate change; rapid proliferation of smartphones and smart gadgets; existence of market players focusing on expanding their smart home product portfolios; widespread concern about safety, security, and convenience.

A home is defined as where appliances and devices are controlled via a smartphone application or web portal as user interface devices connected through the internet. Smart home systems, includes lighting control systems, security systems, entertainment systems (audio and video), home appliances, and others; and smart home devices, including speakers, in particular, are some of the most substantial segments of the smart home market.

Supportive policies by the Chinese Government for Smart Cities and the internet of things (IoT)

The Chinese government has taken proactive steps in making the policies for smart cities and the internet of things (IoT) that stimulates the China smart homes market. Projects for smart cities are not only an opportunity for domestic companies but also for MNC companies. Smart home is sub-part of IoT devices, means Chinese government policies will drive the China smart home market.

Renub Research report titled “China Smart Home Market, Numbers, and Penetration by (Energy Management, Comfort and Lighting, Home Entertainment, Control and Connectivity, Security and Smart Appliances) Company Analysis (Chuango Security Technology Corp, Heiman Co., Limited, Sichuan Changhong Electric Co Ltd, Hisense Co. Ltd, Xiaomi Inc, Alibaba Group, JD.com, Baidu, Haier)” provides a complete analysis of the market and its future forecast.

Product Category – Market, Household Penetration & Numbers

1. Control and Connectivity

2. Comfort and Lighting

3. Home Entertainment

4. Smart Appliances

5. Energy Management

6. Security

This research report studies the China smart home automation from 10 view points:

1. Numbers & Forecast

2. Market & Forecast

3. Household Penetration & Forecast

4. Market Share, Numbers Share, Penetration Share & Forecast

5. Market, Number, Penetration analysis by (Control and Connectivity, Comfort and Lighting, Home Entertainment, Smart Appliances, Energy Management and Security.)

6. Funding in China Smart Homes Market

7. Recent Development in China Smart Home Market

8. China Smart City Pilot Projects and Financing

9. Policies, Trends and Standards & Government Role – China IoT / Smart Homes Market

10. Company Product Profiling of China Smart Homes

China Smart Homes 9 Company profile cover in this report

1. Chuango Security Technology Corp

2. HEIMAN CO., LIMITED

3. Sichuan Changhong Electric Co Ltd

4. Hisense Co. Ltd

5. Xiaomi Inc

6. Alibaba Group

7. JD.com

8. Baidu

9. Haier

All the Company in the report has been studied from 3 viewpoints

1. Company Overview

2. Smart Home Products

3. Initiatives / Development in IoT & Smart Homes

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research & Methodology

3. Executive Summary

4. China Smart Home Market Analysis to 2025

4.1 China Smart Home Market

4.2 Household Penetration

4.3 Active Household Number

5. Market Share – China Smart Home Analysis to 2025

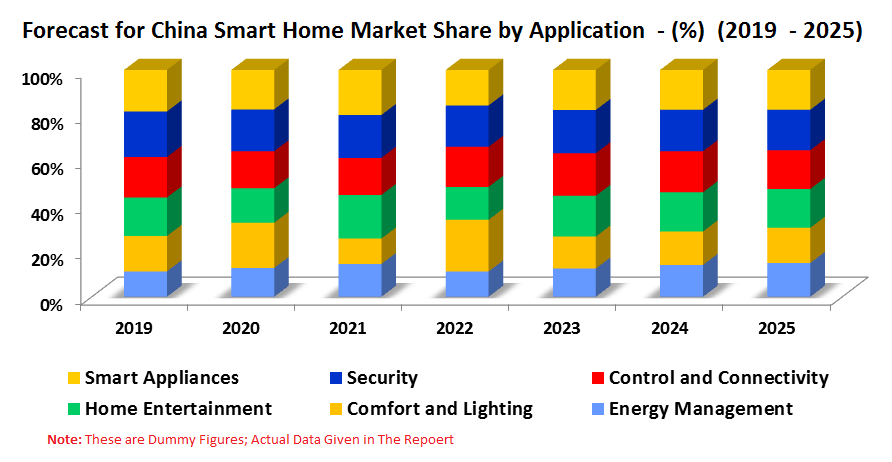

5.1 Market Share - By Application

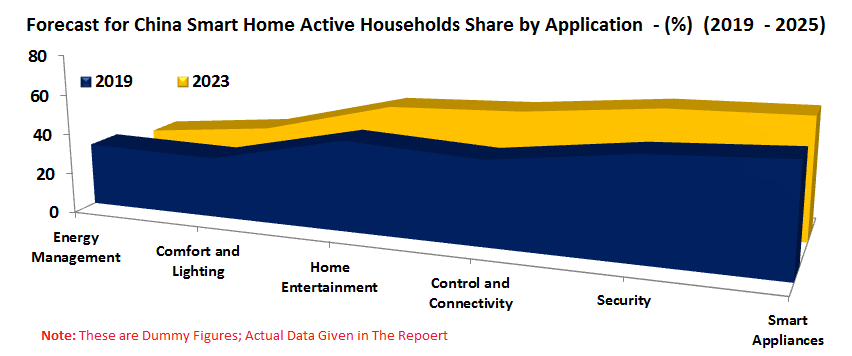

5.2 Smart Home Active Households Share - By Application

5.3 Households Penetration - By Application

6. Application – China Smart Home Market, Number of Active Households & Households Penetration

6.1 Energy Management

6.1.1 Energy Management Market

6.1.2 Application Household Penetration

6.1.3 Number of Active Households

6.2 Comfort and Lighting

6.2.1 Comfort and Lighting Market

6.2.2 Application Household Penetration

6.2.3 Number of Active Households

6.3 Home Entertainment

6.3.1 Home Entertainment Market

6.3.2 Application Household Penetration

6.3.3 Number of Active Households

6.4 Control and Connectivity

6.4.1 Control and Connectivity Market

6.4.2 Application Household Penetration

6.4.3 Number of Active Households

6.5 Security

6.5.1 Security Market

6.5.2 Application Household Penetration

6.5.3 Number of Active Households

6.6 Smart Appliances

6.6.1 Smart Appliances Market

6.6.2 Application Household Penetration

6.6.3 Number of Active Households

7. China Smart Home Market Funding

8. Recent Development – China Smart Home Market

8.1 China Smart City Pilot Projects and Financing

8.1.1 China’s ‘New-Type’ Urbanization

8.1.2 Smart City as a Big Effort for China’s New-type Urbanization

8.1.3 China’s Smart City Pilot Projects

8.2 Smart City Financing in China

9. Policies, Trends and Standards & Government Role – China IoT / Smart Homes Market

9.1 China IoT / Smart Homes Policies

9.2 China IoT Trends and Standards

9.3 Government’s Pivotal Role in China IoT Market

10. Company Analysis

10.1 Chuango Security Technology Corp

10.1.1 Company Overview

10.1.2 Smart Home Products

10.1.3 Recent Initiatives & Strategy in IoT and Smart Home

10.1.3.1 Point A

10.1.3.2 Point B

10.1.3.3 Point C

10.1.3.4 Point D

10.2 Heiman Co., Limited

10.2.1 Company Overview

10.2.2 Smart Home Products

10.2.3 Recent Initiatives & Strategy in IoT and Smart Homes

10.1.3.1 Point A

10.1.3.2 Point B

10.1.3.3 Point C

10.1.3.4 Point D

10.3 Sichuan Changhong Electric Co Ltd

10.3.1 Company Overview

10.3.2 Smart Home Products

10.3.2 Recent Initiatives & Strategy in IoT and Smart Homes

10.1.3.1 Point A

10.1.3.2 Point B

10.1.3.3 Point C

10.4 Hisense Co. Ltd

10.4.1 Company Overview

10.4.2 Smart Home Products

10.4.3 Recent Initiatives & Strategy in IoT and Smart Homes

10.5 Xiaomi Inc

10.5.1 Company Overview

10.5.2 Smart Home Products

10.5.3 Recent Initiatives & Strategy in IoT and Smart Homes

10.1.3.1 Point A

10.1.3.2 Point B

10.1.3.3 Point C

10.1.3.4 Point D

10.6 Alibaba Group

10.6.1 Company Overview

10.6.2 Smart Home Products

10.6.3 Recent Initiatives & Strategy in IoT and Smart Homes

10.7 JD.com

10.7.1 Company Overview

10.7.2 Smart Home Products

10.7.3 Recent Initiatives & Strategy in IoT and Smart Homes

10.8 Baidu

10.8.1 Company Overview

10.8.2 Smart Home Products

10.8.3 Recent Initiatives & Strategy in IoT and Smart Homes

10.9 Haier

10.9.1 Company Overview

10.9.2 Smart Home Products

11. Driving Factors

11.1 Policies & Initiatives Driving Smart Homes

11.2 IoT Drives Smart Home Market

11.3 Cost Savings Due to the Adoption of Energy Conservation Systems

11.4 Increasing Urbanization & Growing Awareness for Smart Home Technology

11.5 Development of Connected Innovative Products

11.6 Tech-Savvy Chinese Consumers

12. Challenges

12.1 Security and Privacy Breach Concern

12.2 Cyber Security Concerns

12.3 Lack of Standardization & Inter-Operability

List of Figures

Figure-01: China – Smart Home Market (Million US$), 2018 – 2025

Figure-02: China – Smart Home Penetration (Percent), 2018 – 2025

Figure-03: China – Smart Home Numbers (Million), 2018 – 2025

Figure-04: China – Smart Home Market (Million US$), 2017 – 2018

Figure-05: China – Forecast for Smart Home Market (Million US$), 2019 – 2025

Figure-06: China – Smart Home Penetration (Percent), 2017 – 2018

Figure-07: China – Forecast for Smart Home Penetration (Percent), 2019 – 2025

Figure-08: China – Smart Home Numbers (Million), 2017 – 2018

Figure-09: China – Forecast for Smart Home Numbers (Million), 2019 – 2025

Figure-10: China – Smart Home Market Share (Percent), 2017 – 2018

Figure-11: China – Forecast for Smart Home Market Share (Percent), 2019 – 2025

Figure-12: China – Smart Home Numbers Share (Percent), 2017 – 2018

Figure-13: China – Forecast for Smart Home Numbers Share (Percent), 2019 – 2025

Figure-14: China – Smart Home Penetration Share (Percent), 2017 – 2018

Figure-15: China – Forecast for Smart Home Penetration Share (Percent), 2019 – 2025

Figure-16: China – Energy Management Enable Smart Home Market (Million US$), 2017 – 2018

Figure-17: China – Forecast for Energy Management Enable Smart Home Market (Million US$), 2019 – 2025

Figure-18: China – Energy Management Enable Smart Home Penetration (Percent), 2017 – 2018

Figure-19: China – Forecast for Energy Management Enable Smart Home Penetration (Percent), 2019 – 2025

Figure-20: China – Energy Management Enable Smart Home Numbers (Million), 2017 – 2018

Figure-21: China – Forecast for Energy Management Enable Smart Home Numbers (Million), 2019 – 2025

Figure-22: China – Comfort and Lighting Enable Smart Home Market (Million US$), 2017 – 2018

Figure-23: China – Forecast for Comfort and Lighting Enable Smart Home Market (Million US$), 2019 – 2025

Figure-24: China – Comfort and Lighting Enable Smart Home Penetration (Percent), 2017 – 2018

Figure-25: China – Forecast for Comfort and Lighting Enable Smart Home Penetration (Percent), 2019 – 2025

Figure-26: China – Comfort and Lighting Enable Smart Home Numbers (Million), 2017 – 2018

Figure-27: China – Forecast for Comfort and Lighting Enable Smart Home Numbers (Million), 2019 – 2025

Figure-28: China – Home Entertainment Enable Smart Home Market (Million US$), 2017 – 2018

Figure-29: China – Forecast for Home Entertainment Enable Smart Home Market (Million US$), 2019 – 2025

Figure-30: China – Home Entertainment Enable Smart Home Penetration (Percent), 2017 – 2018

Figure-31: China – Forecast for Home Entertainment Enable Smart Home Penetration (Percent), 2019 – 2025

Figure-32: China – Home Entertainment Enable Smart Home Numbers (Million), 2017 – 2018

Figure-33: China – Forecast for Home Entertainment Enable Smart Home Numbers (Million), 2019 – 2025

Figure-34: China – Control and Connectivity Enable Smart Home Market (Million US$), 2017 – 2018

Figure-35: China – Forecast for Control and Connectivity Enable Smart Home Market (Million US$), 2019 – 2025

Figure-36: China – Control and Connectivity Enable Smart Home Penetration (Percent), 2017 – 2018

Figure-37: China – Forecast for Control and Connectivity Enable Smart Home Penetration (Percent), 2019 – 2025

Figure-38: China – Control and Connectivity Enable Smart Home Numbers (Million), 2017 – 2018

Figure-39: China – Forecast for Control and Connectivity Enable Smart Home Numbers (Million), 2019 – 2025

Figure-40: China – Security Enable Smart Home Market (Million US$), 2017 – 2018

Figure-41: China – Forecast for Security Enable Smart Home Market (Million US$), 2019 – 2025

Figure-42: China – Security Enable Smart Home Penetration (Percent), 2017 – 2018

Figure-43: China – Forecast for Security Enable Smart Home Penetration (Percent), 2019 – 2025

Figure-44: China – Security Enable Smart Home Numbers (Million), 2017 – 2018

Figure-45: China – Forecast for Security Enable Smart Home Numbers (Million), 2019 – 2025

Figure-46: China – Smart Appliances Enable Smart Home Market (Million US$), 2017 – 2018

Figure-47: China – Forecast for Smart Appliances Enable Smart Home Market (Million US$), 2019 – 2025

Figure-48: China – Smart Appliances Enable Smart Home Penetration (Percent), 2017 – 2018

Figure-49: China – Forecast for Smart Appliances Enable Smart Home Penetration (Percent), 2019 – 2025

Figure-50: China – Smart Appliances Enable Smart Home Numbers (Million), 2017 – 2018

Figure-51: China – Forecast for Smart Appliances Enable Smart Home Numbers (Million), 2019 – 2025

Figure-52: Licensed IoT Connections in China 2014 – 2018

Figure-53: Number of Pilot Smart Cities

List of Tables:

Table 7 1: China – Funding in Smart Home Market, 2019

Table 8 1: General Development Situation of China - Nov 2017

Table 8 2: The Total Pilot Status of Smart City in China – Nov 2017

Table 9 1: IoT-Related Development Plans

Table 10 1: Chuango Security Technology – Smart Home Products & Features, 2019

Table 10 2: Heiman – Smart Home Products & Features, 2019

Table 10 3: Sichuan Changhong Electric Co Ltd – Smart Home Products & Features, 2019

Table 10 4: Hisense Co., Ltd – Smart Home Products & Features, 2019

Table 10 5: Xiaomi Inc – Smart Home Products & Segments, 2019

Table 10 7: Alibaba – Smart Home Products & Features, 2019

Table 10 8: Haier Smart Home Products

Table 11 1: Building Energy Efficiency Requirement in Thirteenth Five Year Plan (FYP) (MoHURD, 2017)

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com