China Vaccine Market, Size, Forecast 2023-2027, Industry Trends, Growth, Impact of Inflation, Opportunity Company Analysis

Buy NowChina Vaccine Market Outlook

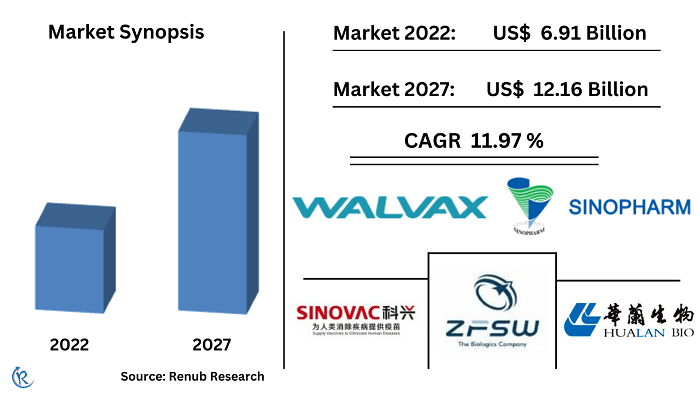

China Vaccine Market will surpass US$ 12.16 Billion by 2027 at a CAGR of 11.97 Percent according to Renub Research. Annually in China, approx. 700 million vaccine doses are produced; China is one of the world's largest producers of vaccines. As a result, China has drawn significant attention to the vaccine industry to play a representative role. In addition, it is a closed market with a solid local vaccine industry, access to which is challenging for Western players.

Category 1 & 2 Vaccines in China

In China, Vaccines are available through the government's Expanded Program on Immunization (EPI) at no charge for aged 14 years of children. These government-purchased vaccines are called Category 1 under the Regulations on the Administration of Vaccines and Vaccination. In contrast, private-sector also known as Category 2 vaccines, such as rabies vaccine, influenza vaccine (InfV), and Haemophilus influenza type b vaccine (Hib), are available but are usually paid for out-of-pocket, as they are included in neither the EPI system nor government health insurance. According to our research findings, the China Vaccine market was US$ 6.91 Billion in 2022.

Disease Type: Pneumococcal, Meningococcal Meningitis, and DTP Vaccines Controls Significant Portion of China Vaccines Industry

Meningococcal Meningitis, Pneumococcal, and DTP Vaccine market are expected to control a significant portion of China's vaccine market. The vaccine market in China is segmented into Meningococcal meningitis, Pneumococcal, DTP, Ebola, Rabies & Others. In Aug 2021, China formally revised its laws to allow parents to have up to three children to boost the birth rate. In part, thanks to the loosening of the second-child policy in China, the number is expected to increase. China’s vaccine industry has always been more petite and less mature than it’s US, European, or Indian counterparts. However, over the past decades, it has rapidly grown to become one of the only developing countries able to manufacture and supply most vaccines used in its domestic immunization program.

Product Insight: PCV13 has Highest Share in the Chinese Vaccine Industry

In terms of products, the Products included in this report are as follows: MCV4, MPSV4, MCV2-Hib, MCV2, MPSV2 and Men A, PCV13, and PPV23. PCV13 holds the maximum share of the China vaccine market. Therefore, it is predicted that PCV13 will also maintain its top place during the forecasting period. In addition, China is the most prominent vaccine consumer in the world. As a result, Chinese residents have become much more aware of preventive health care due to its impact, which has also driven the vaccination rate.

Key Company Insights

The major players covered in the report are Sinopharm Group, Hualan Biological Engineering Inc, Chongqing Zhifei Biological Products Co Ltd, Walvax Biotechnology Co Ltd, Beijing Tiantan Biological Products Corp Ltd, Sinovac Biotech, and Shenzhen Kangtai Biological Products Co Ltd. In addition, the R&D, clinical, and commercialization experience accumulated by the COVID-19 vaccine would help a group of outstanding domestic Chinese vaccine company’s snowball. Against this backdrop, the Chinese vaccine industry is expected to usher in a golden period. The next decade will be for China's biopharmaceuticals to move from catching up to surpassing a 'golden decade' for the Chinese vaccine industry.

May 2022, Walvax Biotechnology Co., Ltd. announced the results for the immunogenicity and safety profile of PCV13, the 13-valent Pneumococcal Polysaccharide Conjugate Vaccine, administered as an infant series at 3, 4, and 5 months of age and a booster dose at 12-15 months of age in Chinese infants as part of the randomized, multi-center, double-blind, and positive-controlled phase 3 clinical trial in China to demonstrate the non-inferior immune responses and safety of PCV13 as compared to Pneumococcal 7-valent Conjugate Vaccine [Diphtheria CRM197 Protein] ("PCV7").

Renub Research report titled “China Vaccine Market & Doses Forecast By Sector (Private, Public), Disease Type (Meningococcal Meningitis, Pneumococcal, DTP, Ebola, Rabies, Others), Products (MCV4, MPSV4, MCV2-Hib, MCV2, MPSV2 and Men A, PCV13, PPV23, Others), Company (Sinopharm Group, Hualan Biological Engineering Inc, Chongqing Zhifei Biological Products Co Ltd, Walvax Biotechnology Co Ltd, Beijing Tiantan Biological Products Corp Ltd, Sinovac Biotech, and Shenzhen Kangtai Biological Products Co Ltd.)” provides a complete analysis of China Vaccine Market.

Sectors – Vaccine Market & Doses in China

• Public

• Private

Diseases –

1. Meningococcal Meningitis

2. Pneumococcal

3. DTP

4. Ebola

5. Rabies

6. Others

Products –

1. MCV4

2. MPSV4

3. MCV2-Hib

4. MCV2

5. MPSV2 and Men A

6. PCV13

7. PPV23

All the companies covered in the report has been covered from the following points

• Overview

• Recent Development

• Vaccine Pipeline

• Revenue Analysis

Key Company Covered

1. Sinopharm Group (China National Biotec Group Company Limited)

2. Hualan Biological Engineering Inc

3. Chongqing Zhifei Biological Products Co Ltd

4. Walvax Biotechnology Co Ltd

5. Beijing Tiantan Biological Products Corp Ltd

6. Sinovac Biotech

7. Shenzhen Kangtai Biological Products Co Ltd

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2017 - 2022 |

| Forecast Period | 2023 - 2027 |

| Market | US$ Million |

| Segment Covered | Sectors, Diseases and Products |

| Companies Covered | Sinopharm Group, Hualan Biological Engineering Inc, Chongqing Zhifei Biological Products Co Ltd, Walvax Biotechnology Co Ltd, Beijing Tiantan Biological Products Corp Ltd, Sinovac Biotech, and Shenzhen Kangtai Biological Products Co Ltd. |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. China Vaccine Market

5.1 Public

5.2 Private

6. China Vaccine Doses

6.1 Public

6.2 Private

7. China Vaccine Share Analysis

7.1 By Sectors Market Share

7.2 By Sectors Vaccine Doses Share

7.3 By Products Type Market Share

7.4 By Disease Type Market Share

8. Meningococcal Meningitis Vaccine Market & Doses Analysis

8.1 Meningococcal Meningitis Vaccine

8.1.1 Public

8.1.2 Private

8.2 Meningococcal Meningitis Doses

8.2.1 Public

8.2.2 Private

9. Pneumococcal Vaccines Market & Doses Analysis

9.1 Pneumococcal Vaccines

9.2 Pneumococcal Vaccines Doses

10. DTP Vaccine Market & Doses Analysis

10.1 DTP Vaccine Market

10.1.1 DTaP

10.1.2 DTcP

10.2 DTP Vaccine Doses

10.2.1 Public

10.2.2 Private

11. Rabies Vaccine Market

12. Ebola Vaccine Market

13. Product - China Vaccine Market

13.1 MCV4

13.2 MPSV4

13.3 MCV2-Hib

13.4 MCV2

13.5 MPSV2 and Men A

13.6 PCV13

13.7 PPV23

13.8 Others

14. The Vaccine Regulatory Authority of China

15. Required and Recommended Vaccinations for China Travel

16. Mergers & Acquisitions

17. Company Sales

17.1 Sinopharm Group (China National Biotec Group Company Limited)

17.1.1 Overview

17.1.2 Recent Initiatives

17.1.3 Net Sales

17.2 Hualan Biological Engineering Inc

17.2.1 Overview

17.2.2 Recent Initiatives

17.2.3 Net Sales

17.3 Chongqing Zhifei Biological Products Co Ltd

17.3.1 Overview

17.3.2 Recent Initiatives

17.3.3 Net Sales

17.4 Walvax Biotechnology Co Ltd

17.4.1 Overview

17.4.2 Recent Initiatives

17.4.3 Net Sales

17.5 Beijing Tiantan Biological Products Corp Ltd

17.5.1 Overview

17.5.2 Recent Initiatives

17.5.3 Net Sales

17.6 Sinovac Biotech

17.6.1 Overview

17.6.2 Recent Initiatives

17.6.3 Net Sales

17.7 Shenzhen Kangtai Biological Products Co Ltd

17.7.1 Overview

17.7.2 Recent Initiatives

17.7.3 Net Sales

List of Figures:

Figure-01: China – Public Vaccine Market (Million US$), 2017 – 2022

Figure-02: China – Forecast for Public Vaccine Market (Million US$), 2023 – 2027

Figure-03: China – Private Vaccine Market (Million US$), 2017 – 2022

Figure-04: China – Forecast for Private Vaccine Market (Million US$), 2023 – 2027

Figure-05: China – Public Vaccine Doses (Million), 2017 – 2022

Figure-06: China – Forecast for Public Vaccine Doses (Million), 2023 – 2027

Figure-07: China – Private Vaccine Doses (Million), 2017 – 2022

Figure-08: China – Forecast for Private Vaccine Doses (Million), 2023 – 2027

Figure-09: Public – Meningococcal Meningitis Vaccine Market (Million US$), 2017 – 2022

Figure-10: Public – Forecast for Meningococcal Meningitis Vaccine Market (Million US$), 2023 – 2027

Figure-11: Private – Meningococcal Meningitis Vaccine Market (Million US$), 2017 – 2022

Figure-12: Private – Forecast for Meningococcal Meningitis Vaccine Market (Million US$), 2023 – 2027

Figure-13: Public – Meningococcal Meningitis Vaccine Doses (Million), 2017 – 2022

Figure-14: Public – Forecast for Meningococcal Meningitis Vaccine Doses (Million), 2023 – 2027

Figure-15: Private – Meningococcal Meningitis Vaccine Doses (Million), 2017 – 2022

Figure-16: Private – Forecast for Meningococcal Meningitis Vaccine Doses (Million), 2023 – 2027

Figure-17: China – Pneumococcal Vaccines Market (Million US$), 2017 – 2022

Figure-18: China – Forecast for Pneumococcal Vaccines Market (Million US$), 2023 – 2027

Figure-19: China – Pneumococcal Vaccines Doses Doses (Million), 2017 – 2022

Figure-20: China – Forecast for Pneumococcal Vaccines Doses Doses (Million), 2023 – 2027

Figure-21: China – DTP Vaccine Market (Million US$), 2017 – 2022

Figure-22: China – Forecast for DTP Vaccine Market (Million US$), 2023 – 2027

Figure-23: China – DTaP Vaccine Market Market (Million US$), 2017 – 2022

Figure-24: China – Forecast for DTaP Vaccine Market Market (Million US$), 2023 – 2027

Figure-25: China – DTcP Vaccine Market Market (Million US$), 2017 – 2022

Figure-26: China – Forecast for DTcP Vaccine Market Market (Million US$), 2023 – 2027

Figure-27: DTP – Public Vaccine Doses (Million), 2017 – 2022

Figure-28: DTP – Forecast for Public Vaccine Doses (Million), 2023 – 2027

Figure-29: DTP – Private Vaccine Doses (Million), 2017 – 2022

Figure-30: DTP – Forecast for Private Vaccine Doses (Million), 2023 – 2027

Figure-31: China – Rabies Vaccine Market (Million US$), 2017 – 2022

Figure-32: China – Forecast for Rabies Vaccine Market (Million US$), 2023 – 2027

Figure-33: China – Ebola Vaccine Market (Million US$), 2018 – 2022

Figure-34: China – Forecast for Ebola Vaccine Market (Million US$), 2023 – 2027

Figure-35: Product – MCV4 Vaccine Market (Million US$), 2020 – 2022

Figure-36: Product – Forecast for MCV4 Vaccine Market (Million US$), 2023 – 2027

Figure-37: Product – MPSV4 Vaccine Market (Million US$), 2017 – 2022

Figure-38: Product – Forecast for MPSV4 Vaccine Market (Million US$), 2023 – 2027

Figure-39: Product – MCV2-Hib Vaccine Market (Million US$), 2017 – 2022

Figure-40: Product – Forecast for MCV2-Hib Vaccine Market (Million US$), 2023 – 2027

Figure-41: Product – MCV2 Vaccine Market (Million US$), 2017 – 2022

Figure-42: Product – Forecast for MCV2 Vaccine Market (Million US$), 2023 – 2027

Figure-43: Product – MPSV2 and Men A Vaccine Market (Million US$), 2017 – 2022

Figure-44: Product – Forecast for MPSV2 and Men A Vaccine Market (Million US$), 2023 – 2027

Figure-45: Product – PCV13 Vaccine Market (Million US$), 2017 – 2022

Figure-46: Product – Forecast for PCV13 Vaccine Market (Million US$), 2023 – 2027

Figure-47: Product – PPV23 Vaccine Market (Million US$), 2017 – 2022

Figure-48: Product – Forecast for PPV23 Vaccine Market (Million US$), 2023 – 2027

Figure-49: Product – Others Vaccine Market (Million US$), 2017 – 2022

Figure-50: Product – Forecast for Others Vaccine Market (Million US$), 2023 – 2027

Figure-51: Sinopharm Group (China National Biotec Group Company Limited) – Global Revenue (Billion US$), 2017 – 2022

Figure-52: Sinopharm Group (China National Biotec Group Company Limited) – Forecast for Global Revenue (Billion US$), 2023 – 2027

Figure-53: Hualan Biological Engineering Inc – Global Revenue (Million US$), 2017 – 2022

Figure-54: Hualan Biological Engineering Inc – Forecast for Global Revenue (Million US$), 2023 – 2027

Figure-55: Chongqing Zhifei Biological Products Co Ltd – Global Revenue (Million US$), 2017 – 2022

Figure-56: Chongqing Zhifei Biological Products Co Ltd – Forecast for Global Revenue (Million US$), 2023 – 2027

Figure-57: Walvax Biotechnology Co Ltd – Global Revenue (Million US$), 2017 – 2022

Figure-58: Walvax Biotechnology Co Ltd – Forecast for Global Revenue (Million US$), 2023 – 2027

Figure-59: Beijing Tiantan Biological Products Corp Ltd – Global Revenue (Million US$), 2017 – 2022

Figure-60: Beijing Tiantan Biological Products Corp Ltd – Forecast for Global Revenue (Million US$), 2023 – 2027

Figure-61: Sinovac Biotech – Global Revenue (Million US$), 2017 – 2022

Figure-62: Sinovac Biotech – Forecast for Global Revenue (Million US$), 2023 – 2027

Figure-63: Shenzhen Kangtai Biological Products Co Ltd – Global Revenue (Million US$), 2017 – 2022

Figure-64: Shenzhen Kangtai Biological Products Co Ltd – Forecast for Global Revenue (Million US$), 2023 – 2027

List of Tables:

Table-01: China – Vaccine Market Share by Sectors (Percent), 2017 – 2021

Table-02: China – Forecast for Vaccine Market Share by Sectors (Percent), 2022 – 2027

Table-03: China – Vaccine Doses Share by Sectors (Percent), 2017 – 2021

Table-04: China – Forecast for Vaccine Doses Share by Sectors (Percent), 2022 – 2027

Table-05: China – Vaccine Market Share by Products Type (Percent), 2017 – 2021

Table-06: China – Forecast for Vaccine Market Share by Products Type (Percent), 2022 – 2027

Table-07: China – Vaccine Market Share by Disease Type (Percent), 2017 – 2021

Table-08: China – Forecast for Vaccine Market Share by Disease Type (Percent), 2022 – 2027

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com