Denmark Organic Food Market, Size, Forecast 2023-2028, Industry Trends, Growth, Impact of Inflation, Opportunity Company Analysis

Buy NowDenmark Organic Food Market

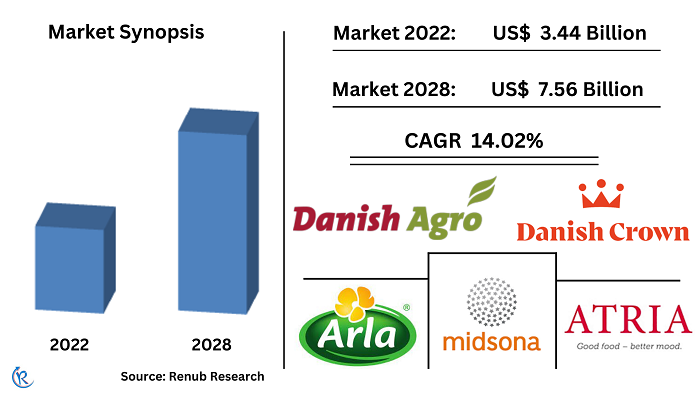

Denmark's Organic Food Market will grow US$ 7.56 Billion at a CAGR of 14.02% by 2028, According to Renub Research. The world's most pro-organic customers are from Denmark. As a result, Denmark boasts the greatest percentage of organic products worldwide and a thriving organic food industry. Sales of organic food in Denmark keep breaking records. The distinctive and officially recognized label has been crucial to the broad development of organic food items in Denmark. Denmark is once again setting the pace because it is the nation in the world where sales of organic products account for the largest share of all food sales.

The number of organic farms also continues to grow. In 2021, this number increased to more than 30,000 farms. It is expected that more farmers will continue to convert from conventional to organic farming, driven by economic and consumer demand. According to the Danish Agricultural Agency, when compared to traditional farming, organic agriculture improves the welfare of animals, prohibits the use of synthetic pesticides, and results in less nitrate runoff into the environment.

More than one-third of Danish Food Sales are made up of Organic Fruits and Vegetables

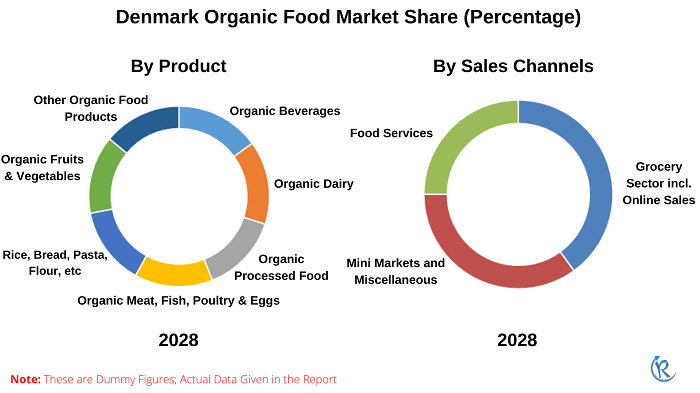

Based on Organic Food Products, Danish Market was divided into Organic Beverages, Organic dairy, Processed Food, Organic Meat, Fish, Poultry & Eggs, Organic Rice, bread, Pasta, flour, Organic Fruits & Vegetables, and other Organic products. Fruits and vegetables represent the greatest market for organic food items. This increase in organic retail sales may be attributable to Danes' increased spending on environmentally friendly fruit and vegetable selections in recent years. Retail chains have also greatly expanded their selection of organic products. In addition, growing public awareness of the negative consequences of synthetic chemicals used in food production has helped organic food become more popular in recent years.

Furthermore, dairy accounts for one-fifth of sales of organic products, coming in second place to fruits and vegetables. Danish organic milk producers have experienced a significant structural change, with production currently concentrated on a few large farms. According to our analysis, Denmark's organic food market will be worth $ 3.44 billion by 2022.

Groceries Trade, including Online Commerce, will capture most of the Market

Based on Sales Channels, Denmark’s organic food market was segmented into the Groceries trade, including online commerce, Foodservice, and Mini-Markets & Specialty shops. Groceries trade, including online transactions, will boom and make up the most significant revenue of the total organic sales in the Danish retail sector. Organic food companies are taking advantage of the growing demand for their category on e-commerce platforms and strategizing their growth plans keeping the trend in focus.

Danish organic sales through food service markets have grown, and this trend will continue in the forecast period. In addition, the Industrialization in Denmark was powered by strong and swift economic expansion, which also contributed to the emergence of a sizable middle-class with increased disposable money.

Public Institutions (Hospitals, Kinder Gardens, and Educational) Sector will grow Tremendous in Forecast Period

Denmark’s organic food market was classified into Public Institutions (Hospitals, Kinder gardens, and Educational), Public Sector Work Place, Private Sector Work Place, Hotels, Restaurants, Cafes, etc., and others. Public Institutions (Hospitals, Kinder gardens, Educational, etc.) have held the top market due to Government initiatives, and many people are adopting organic food and beverages. This is because the government planned for the public sector to lead the way.

Denmark’s efforts to promote organics are spread across many public institutions. The government strengthens collaboration between institutions to speed up the transition to organic production on publicly owned land and increase organics' use in public canteens. In addition, the Dane government promoting the organic food brand for restaurants, cafes, and canteens, meeting requirements for using organic raw materials.

Key Company

Some of the primary key players in organic food include Arla Foods Amba, Danish Crown, Midsona Danmark A/S, ATRIA DANMARK and DANISH AGRO. Arla Foods, the largest producer of organic dairy products in the world, is enhancing its organic offering by introducing 11 new criteria in four key areas for its organic milk production. This provides consumers with a current and innovative offering in European markets that is becoming more and more competitive.

Renub Research report titled “Denmark Organic Food Market by Products (Beverages, Dairy, Organic Processed Food, Organic Meat, Fish Poultry & Eggs, Rice, bread, Pasta, flour etc, Organic Fruits & Vegetables and Other Organic Food Products), Sales Channels (Groceries trade including online commerce, Foodservice and Mini-Markets,Specialty Shops), End Users (Public Institutions: Hospitals, Kindergardens, Educational, etc., Canteens in Public Sector Work Place, Canteens in Private Sector Work Place, Hotels, Restaurants, Cafes etc, Others), Company Analysis (Arla Foods Amba, Daish Crown, Midsona Danmark A/S, ATRIA DANMARK and DANISH AGRO)" provides a complete analysis of Denmark Organic Food Industry.

Product - Market breakup from 7 viewpoints

1. Organic Beverages

2. Organic Dairy

3. Organic Processed Food

4. Organic Meat, Fish, Poultry & Eggs

5. Rice, Bread, Pasta, Flour, etc

6. Organic Fruits & Vegetables

7. Other Organic Food Products

Sales Channels – Market breakup from 3 viewpoints

1. Grocery Sector incl. Online Sales

2. Mini Markets and Miscellaneous

3. Food Services

End Users – Market breakup from 5 viewpoints

1. Public Institutions (Hospitals, Kindergartens, Educational)

2. Canteens in Public Sector Work Place

3. Canteens in Private Sector Work Place

4. Hotels, Restaurants, Cafes etc

5. Others

Companies have been covered from 3 viewpoints

• Overview

• Recent Development

• Revenue Analysis

Company Analysis

1. Arla Foods Amba

2. Danish Crown

3. Midsona Danmark A/S

4. ATRIA DANMARK

5. DANISH AGRO

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Product, Sales Channel, and End User |

| Companies Covered | Arla Foods Amba, Daish Crown, Midsona Danmark A/S, ATRIA DANMARK and DANISH AGRO |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. Policy – Denmark Organic Food

6. Denmark Organic Food Market Analysis

7. Market Share – Denmark Organic Food

7.1 By Product

7.2 By Distribution Channels

7.3 By End Users

8. Product – Denmark Organic Food Market

8.1 Organic Beverages

8.2 Organic dairy

8.3 Organic Processed Food Market

8.4 Organic Meat, Fish Poultry & Eggs

8.5 Rice, bread, Pasta, flour etc.

8.6 Organic Fruits & Vegetables Market

8.7 Other Organic Food Products Market

9. Sales Channels – Denmark Organic Food Market

9.1 Groceries trade,including online commerce

9.2 Foodservice

9.3 Mini-Markets,specialty shops etc.

10. End Users – Denmark Organic Food Market

10.1 Public Institutions (Hospitals, Kindergartens, Educational, etc.)

10.2 Canteens in Public Sector Work Place

10.3 Canteens in Private Sector Work Place

10.4 Hotels, Restaurants, Cafes etc

10.5 Others

11. Mergers and Acquisitions

12. Company Sales – Denmark Organic Food Market

12.1 Danish Crown

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 ARLA FOODS AMBA

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 MIDSONA DANMARK A / S

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 ATRIA DANMARK

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 DANISH AGRO

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

List of Figures:

Figure-01: Denmark – Organic Food Market (Billion US$), 2018 – 2022

Figure-02: Denmark – Forecast for Organic Food Market (Billion US$), 2023 – 2028

Figure-03: Product – Organic Beverages Market (Million US$), 2018 – 2022

Figure-04: Product – Forecast for Organic Beverages Market (Million US$), 2023 – 2028

Figure-05: Product – Organic dairy Market (Million US$), 2018 – 2022

Figure-06: Product – Forecast for Organic dairy Market (Million US$), 2023 – 2028

Figure-07: Product – Organic Processed Food Market Market (Million US$), 2018 – 2022

Figure-08: Product – Forecast for Organic Processed Food Market Market (Million US$), 2023 – 2028

Figure-09: Product – Organic Meat, Fish Poultry & Eggs Market (Million US$), 2018 – 2022

Figure-10: Product – Forecast for Organic Meat, Fish Poultry & Eggs Market (Million US$), 2023 – 2028

Figure-11: Product – Rice, bread, Pasta, flour etc. Market (Million US$), 2018 – 2022

Figure-12: Product – Forecast for Rice, bread, Pasta, flour etc. Market (Million US$), 2023 – 2028

Figure-13: Product – Organic Fruits & Vegetables Market Market (Million US$), 2018 – 2022

Figure-14: Product – Forecast for Organic Fruits & Vegetables Market Market (Million US$), 2023 – 2028

Figure-15: Product – Other Organic Food Products Market Market (Million US$), 2018 – 2022

Figure-16: Product – Forecast for Other Organic Food Products Market Market (Million US$), 2023 – 2028

Figure-17: Sales Channel – Groceries trade,including online commerce Market (Million US$), 2018 – 2022

Figure-18: Sales Channel – Forecast for Groceries trade,including online commerce Market (Million US$), 2023 – 2028

Figure-19: Sales Channel – Foodservice Market (Million US$), 2018 – 2022

Figure-20: Sales Channel – Forecast for Foodservice Market (Million US$), 2023 – 2028

Figure-21: Sales Channel – Mini-Markets,specialty shops etc. Market (Million US$), 2018 – 2022

Figure-22: Sales Channel – Forecast for Mini-Markets,specialty shops etc. Market (Million US$), 2023 – 2028

Figure-23: End User – Public Institutions (Hospitals, Kindergartens, Educational, etc.) Market (Million US$), 2018 – 2022

Figure-24: End User – Forecast for Public Institutions (Hospitals, Kindergartens, Educational, etc.) Market (Million US$), 2023 – 2028

Figure-25: End User – Canteens in Public Sector Work Place Market (Million US$), 2018 – 2022

Figure-26: End User – Forecast for Canteens in Public Sector Work Place Market (Million US$), 2023 – 2028

Figure-27: End User – Canteens in Private Sector Work Place Market (Million US$), 2018 – 2022

Figure-28: End User – Forecast for Canteens in Private Sector Work Place Market (Million US$), 2023 – 2028

Figure-29: End User – Hotels, Restaurants, Cafes etc Market (Million US$), 2018 – 2022

Figure-30: End User – Forecast for Hotels, Restaurants, Cafes etc Market (Million US$), 2023 – 2028

Figure-31: End User – Others Market (Million US$), 2018 – 2022

Figure-32: End User – Forecast for Others Market (Million US$), 2023 – 2028

Figure-33: Danish Crown – Global Revenue (Billion US$), 2018 – 2022

Figure-34: Danish Crown – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-35: ARLA FOODS AMBA – Global Revenue (Billion US$), 2018 – 2022

Figure-36: ARLA FOODS AMBA – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-37: MIDSONA DANMARK A / S – Global Revenue (Million US$), 2018 – 2022

Figure-38: MIDSONA DANMARK A / S – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-39: ATRIA DANMARK – Global Revenue (Million US$), 2018 – 2022

Figure-40: ATRIA DANMARK – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-41: DANISH AGRO – Global Revenue (Billion US$), 2018 – 2022

Figure-42: DANISH AGRO – Forecast for Global Revenue (Billion US$), 2023 – 2028

List of Tables:

Table-01: Denmark – Organic Food Market Share by Product (Percent), 2020 – 2022

Table-02: Denmark – Forecast for Organic Food Market Share by Product (Percent), 2023 – 2028

Table-03: Denmark – Organic Food Market Share by Distribution Channel (Percent), 2020 – 2022

Table-04: Denmark – Forecast for Organic Food Market Share by Distribution Channel (Percent), 2023 – 2028

Table-05: Denmark – Organic Food Market Share by End User (Percent), 2020 – 2022

Table-06: Denmark – Forecast for Organic Food Market Share by End User (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com