Global Diagnostic Imaging Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Diagnostic Imaging Market Trends & Summary

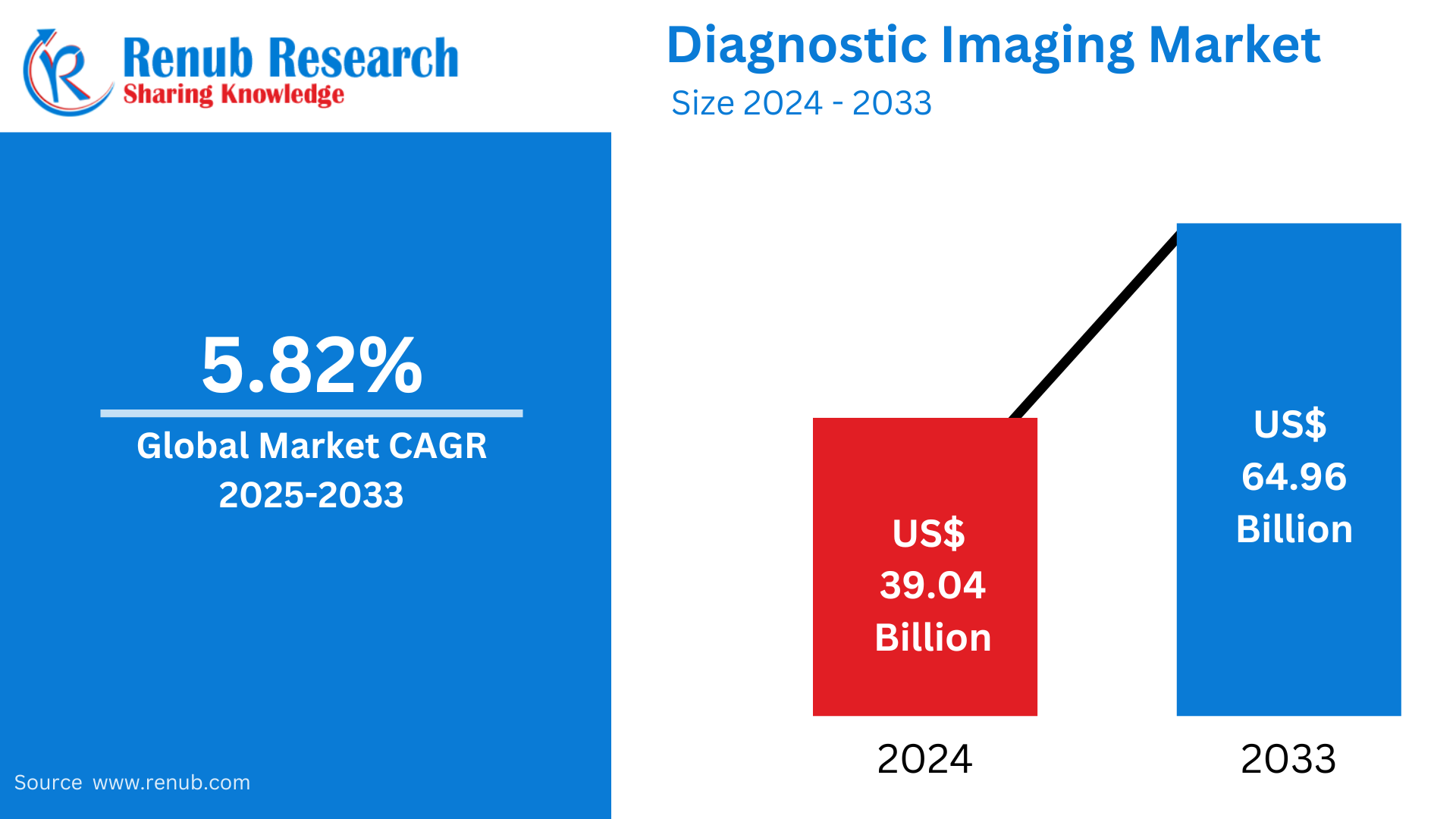

Diagnostic Imaging Market is expected to reach US$ 64.96 billion in 2033 from US$ 39.04 billion in 2024, with a CAGR of 5.82% from 2025 to 2033. Some of the main drivers driving the market are the aging population, the integration of modern technologies, and the increased prevalence of numerous chronic conditions, including cancer, diabetes, heart disease, stroke, and respiratory disorders.

Diagnostic Imaging Market Global Report by Product (X-Ray, CT, Ultrasound, Nuclear Imaging, Others), Application (Orthopedics, Cardiovascular, Neurology, Pelvic & Abdomen, Oncology), End User (Hospital, Diagnostic Center, Others), Countries and Company Analysis 2025-2033.

Diagnostic Imaging Industry Overview

Medical imaging, sometimes referred to as diagnostic imaging, encompasses a range of non-invasive techniques that enable physicians and other health care providers to view the inside of the body for both diagnostic and therapeutic objectives. It entails the production and interpretation of images using radiant radiation, such as radiofrequency waves, nuclear magnetic resonance, X-rays, gamma rays from radioactive materials, and ultrasonics. It helps in the planning and directing of medical and surgical therapies as well as the early detection of disorders. It aids in evaluating how an illness or condition develops over time and how the body reacts to therapy. In addition, it lowers the chances of infection and anesthesia-related problems that come with invasive diagnostic procedures.

The market is growing because of the growing number of elderly people worldwide, who are more vulnerable to a variety of illnesses. Additionally, the need for imaging solutions is being driven by the increased focus on early disease detection and preventative healthcare in order to improve patient outcomes and lower healthcare costs. In addition, the advancement of radiology software makes it possible to easily retrieve images from various modalities, decreases storage space, and does away with the necessity for manual film handling. Additionally, it helps with billing, scheduling, patient history monitoring, and data management. Additionally, governments throughout the world are concentrating on enhancing healthcare infrastructure, which is driving market expansion.

Growth Drivers for the Diagnostic Imaging Market

The development of the infrastructure for healthcare

The market is expanding as a result of the growing number of hospitals, clinics, and other healthcare facilities being built. Additionally, the availability and accessibility of diagnostic imaging services have significantly increased as a result of the global development and modernization of healthcare facilities. Furthermore, government agencies and businesses are making significant investments in the construction and renovation of clinics, hospitals, and diagnostic facilities—all of which inevitably have cutting-edge imaging departments. In addition, the need for innovative diagnostic imaging systems is being driven by the growing number of healthcare facilities. Additionally, remote diagnostic services are being supported by the growth of digital health platforms and telemedicine.

Medical Imaging Devices Powered by AI Will Increase Product Demand

One of the key factors driving market expansion is the development of technologically sophisticated imaging equipment. One of the main factors expected to contribute to the increased product demand throughout the projected period is the growing use of sophisticated AI-enabled diagnostic equipment for quick diagnosis and predictive analysis in developed nations.

The market is also expanding as a result of ongoing government assistance for the introduction of new goods. The FDA in the United States makes sure that every AI tool that is sold has a favorable risk-benefit ratio for patients.

According to a January 2024 FDA release, as of July 2023, 692 AI-enabled medical devices were authorized for the market, with over 75% of those devices being used in radiology.

The healthcare sector is now only receiving AI-enabled imaging technology from a small number of market participants.

For instance, GE HealthCare announced in November 2023 the launch of the MyBreastAI suite, a platform of AI apps that support imaging workflows and breast cancer diagnosis. Furthermore, the Medical Imaging Suite, a new solution to help with the accessibility and interoperability of radiology and other imaging data, was launched by Google Cloud in October 2022.

Introducing Cutting-Edge Systems to Drive Market Development

One of the main reasons for the increasing market usage of these devices is the increased R&D focus of major market participants to create and launch products with innovative technologies to meet the needs of the expanding population undergoing various imaging procedures. Another important reason driving the market's expansion is the growing number of product approvals and launches that use AI, machine learning, and other cutting-edge technologies.

For instance, Hyperfine, Inc. introduced the Swoop system, an AI-powered brain imaging program, in January 2024. The most recent software improves image quality and adds user-friendly features including real-time assistance for accurate patient loading and positioning.

Furthermore, the SCENARIA View Focus Edition system was introduced by Fujifilm Healthcare Americas Corporation, a supplier of enterprise and diagnostic imaging solutions, in December 2022. Cardio StillShot, a sophisticated cardiac motion correction feature on this CT scanner, enables medical professionals to take crisp pictures of the heart utilizing cutting-edge 4D motion estimation technology.

It is anticipated that the introduction of multiple new items will increase demand and drive market expansion.

Challenges in the Diagnostic Imaging Market

Regular Product Recalls Will Slow Market Expansion

One of the main factors expected to impede the growth of the global imaging equipment market during the projected period is the frequency of product recalls. For example, 109 Incisive CT scanner systems were recalled by Koninklijke Philips N.V. in February 2021 in order to make urgent adjustments to medical devices.

This, together with the existence of a sizable and regulated market for reconditioned equipment, particularly in developing and profitable markets like China and India, has hindered the uptake of new and cutting-edge equipment in these nations. Numerous well-known domestic companies have joined this market, providing healthcare facilities around the world with affordable, reconditioned equipment. Because these refurbished gadgets have a greater total cost-benefit ratio for small and medium-sized healthcare facilities, the global market has adopted fewer new systems and equipment.

High costs of equipment and maintenance

The market is severely hampered by the high expenses of diagnostic imaging equipment and upkeep. Large upfront expenditures are necessary for advanced imaging technology such as MRI, CT, and PET scanners, which restricts access for low-resource settings and smaller healthcare practitioners. The cost of equipment upkeep, calibration, and upgrades can also be high, which increases the financial strain. Patients' capacity to afford imaging services may also be impacted by these expenses, particularly in underfunded healthcare systems.

Diagnostic Imaging Market Overview by Regions

Regional differences in the diagnostic imaging market are substantial. Because of its sophisticated healthcare system, significant demand for imaging services, and technical advancements, North America is the leader. Europe comes next, propelled by an elderly population and robust healthcare system. The Asia Pacific region is expanding quickly due to improved medical facilities, a rise in chronic diseases, and easier access to healthcare. Due to limited healthcare infrastructure and financial constraints, Latin America and the Middle East are experiencing slower growth.

United States Diagnostic Imaging Market

Advanced healthcare infrastructure, technical advancements, and rising demand for imaging services have made the US diagnostic imaging industry one of the biggest in the world. The aging population, increased prevalence of chronic diseases like cancer and cardiovascular ailments, and the use of minimally invasive procedures are all contributing factors to the market's expansion. Growth is also being aided by developments in imaging technology, such as AI-powered imaging systems.

At the European Congress of Radiology (ECR) in March 2023, Canon Medical unveiled the Aquilion Serve, an improved 80/160-slice CT scanner. This scanner improves diagnostic efficiency and accuracy by allowing simultaneous previews of axial, lateral, and AP views. Siemens Healthcare unveiled the Magnetom Viato, a brand-new portable magnetic resonance imaging scanner intended for use in a variety of healthcare environments, in November 2022. Healthcare providers can now offer imaging services in areas with restricted access to conventional MRI facilities thanks to this innovation's increased flexibility.

These technical developments make diagnostic imaging more widely available and effective, reflecting continuous efforts in the US market to enhance diagnostic capabilities and patient care.

Germany Diagnostic Imaging Market

Strong demand for cutting-edge technologies, a strong healthcare system, and an emphasis on premium imaging solutions define Germany's diagnostic imaging industry. The need for effective diagnostic imaging keeps growing as the population ages and the prevalence of chronic illnesses rises. With businesses creating state-of-the-art equipment to enhance patient care, Germany is leading the way in medical innovation.

The executive director of the Center for Prenatal Diagnosis and Human Genetics in Berlin suggested the recently released high-end ultrasound machine, the GE Healthcare Voluson Expert 22, in July 2022. Advanced graphics-based beamforming technology is incorporated into this next-generation ultrasound machine to improve image quality and facilitate more precise diagnosis.

Neoscan Solutions unveiled a smaller, lighter MRI scanner made especially for infants in May 2021. Young patients will have improved access to imaging thanks to this cutting-edge MRI scanner, which can be installed right in the children's ward. The first devices were set up in German hospitals after the debut, proving that it could take excellent pictures of newborns in a medical environment.

India Diagnostic Imaging Market

The market for diagnostic imaging in India is growing quickly as a result of improved access to healthcare, population growth, and an increase in the prevalence of chronic illnesses like cancer, heart disease, and neurological disorders. AI-based imaging technologies are among the technological developments that are improving therapeutic results and diagnostic precision. The government's efforts to develop infrastructure and implement healthcare reforms also contribute to market expansion. Furthermore, the demand for cutting-edge imaging technologies is being driven by India's expanding medical tourism industry. In rural and disadvantaged areas, the market is witnessing a growing uptake of mobile imaging devices and economical imaging systems due to heightened focus on cost-effective diagnostic solutions.

Saudi Arabia Diagnostic Imaging Market

Technological developments, growing healthcare demand, and a greater emphasis on healthcare infrastructure are driving the diagnostic imaging market's steady rise in Saudi Arabia. Investment in diagnostic imaging technology including MRI, CT, and ultrasound systems is encouraged by the Kingdom's Vision 2030 plan, which intends to modernize the healthcare industry.

The Advanced Safety Training Seminar, organized in conjunction with the Dubai Health Authority (DHA) in Dubai, was the first event of the Saudi Arabian corporation AZDEF's October 2022 MRI safety awareness campaign. This program improves patient safety and increases awareness among medical personnel by highlighting the significance of safety precautions in MRI treatments. The Sanad Charitable Association of Saudi Arabia began a campaign to raise awareness of children cancer in January 2022 with the tagline "Sanad for Our Children." The program's goal is to increase early diagnostic imaging and screenings by educating families on how to identify childhood cancer signs early. By increasing demand for imaging services to identify diseases early and improve outcomes, this awareness is having a beneficial effect on the diagnostic imaging market.

These programs support market expansion by reflecting Saudi Arabia's increasing focus on enhancing healthcare accessibility and awareness.

Diagnostic Imaging Market Segments

Product

- X-Ray

- CT

- Ultrasound

- Nuclear Imaging

- Others

Application

- Orthopedics

- Cardiovascular

- Neurology

- Pelvic & Abdomen

- Oncology

End User

- Hospital

- Diagnostic Center

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key Persons

- Product Portfolio

- Recent Development & Strategies

- Financial Insight

Key Players Analysis

- FUJIFILM VisualSonics Inc.

- Canon Medical Systems Corporation

- Bruker Corporation

- PerkinElmer Inc.

- Hitachi

- Hologic

- Radnet

- Koninklijke Philips

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Application, By End User and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

-

What is the projected market size and CAGR of the global diagnostic imaging market from 2025 to 2033?

-

What are the primary factors driving the growth of the diagnostic imaging market globally?

-

How is the aging population influencing the demand for diagnostic imaging services?

-

What role does artificial intelligence (AI) play in the advancement of diagnostic imaging technologies?

-

What are the major challenges limiting the growth of the diagnostic imaging market?

-

How are healthcare infrastructure developments impacting market expansion?

-

Which diagnostic imaging product segments (X-Ray, CT, Ultrasound, etc.) are experiencing the most growth?

-

How are regional markets such as the United States, Germany, India, and Saudi Arabia contributing to global market trends?

-

What are some of the recent innovations and product launches in diagnostic imaging?

-

How is the adoption of refurbished imaging equipment affecting the demand for new devices?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Diagnostic Imaging Market

6. Market Share Analysis

6.1 By Product

6.2 By Application

6.3 By End User

6.4 By Countries

7. Product

7.1 X-Ray

7.2 CT

7.3 Ultrasound

7.4 Nuclear Imaging

7.5 Others

8. Application

8.1 Orthopedics

8.2 Cardiovascular

8.3 Neurology

8.4 Pelvic & Abdomen

8.5 Oncology

9. End User

9.1 Hospital

9.2 Diagnostic Center

9.3 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 FUJIFILM VisualSonics Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Product Portfolio

13.1.4 Recent Development & Strategies

13.1.5 Financial Insight

13.2 Canon Medical Systems Corporation

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Product Portfolio

13.2.4 Recent Development & Strategies

13.2.5 Financial Insight

13.3 Bruker Corporation

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Product Portfolio

13.3.4 Recent Development & Strategies

13.3.5 Financial Insight

13.4 PerkinElmer Inc.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Product Portfolio

13.4.4 Recent Development & Strategies

13.4.5 Financial Insight

13.5 Hitachi

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Product Portfolio

13.5.4 Recent Development & Strategies

13.5.5 Financial Insight

13.6 Hologic

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Product Portfolio

13.6.4 Recent Development & Strategies

13.6.5 Financial Insight

13.7 Radnet

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Product Portfolio

13.7.4 Recent Development & Strategies

13.7.5 Financial Insight

13.8 Koninklijke Philips

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Product Portfolio

13.8.4 Recent Development & Strategies

13.8.5 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com