Global Diesel Generator Market Size and Forecast 2025-2033

Buy NowDiesel Generator Market Forecast and Size 2025-2033

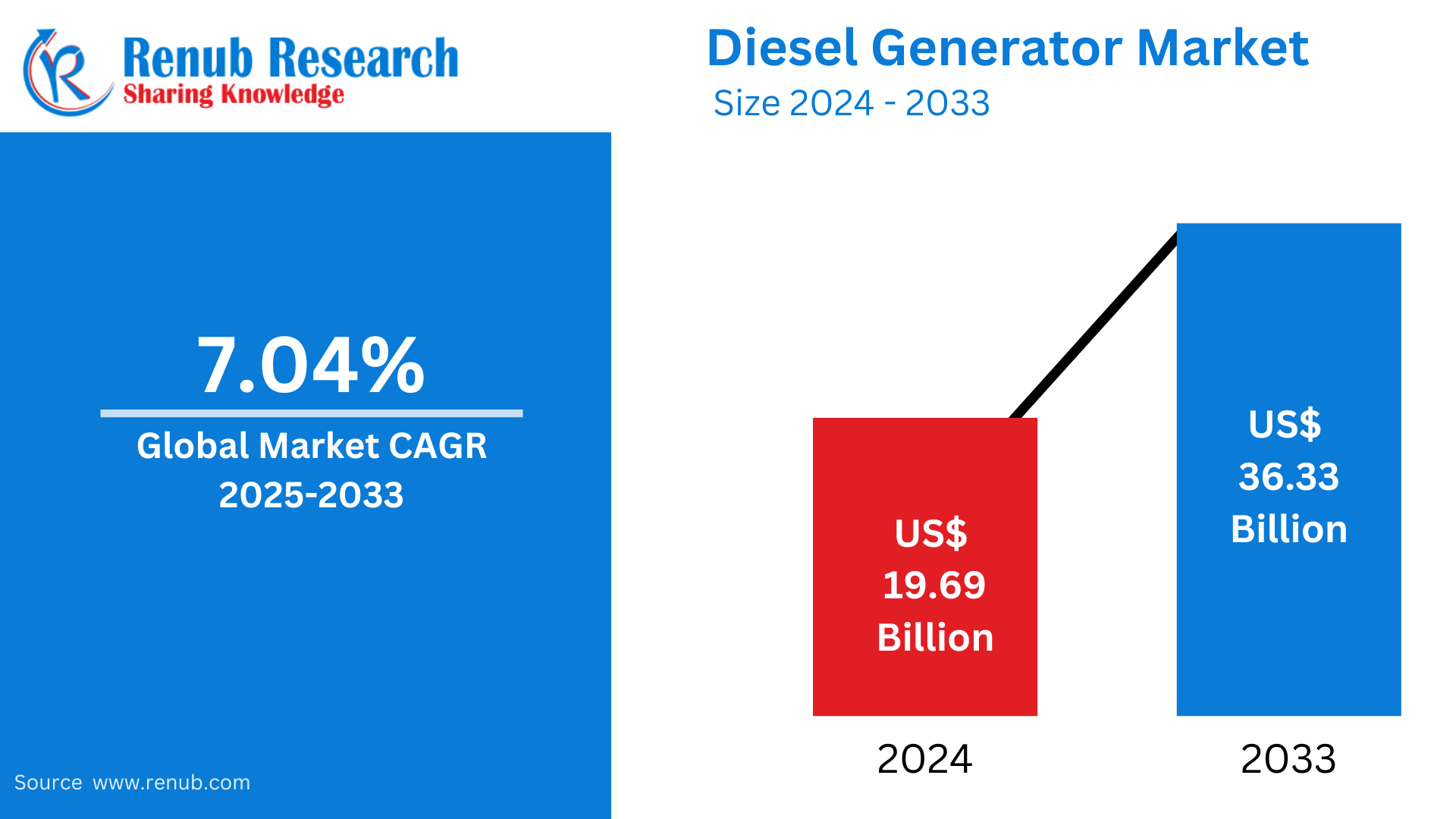

The global diesel generator market size was valued at USD 19.69 billion in 2024. It is expected to experience significant growth during the forecast period. The diesel generator market size is likely to grow from USD 36.33 billion in 2025 to USD 36.33 billion in 2033, with a compound annual growth rate (CAGR) of 7.04% during the period. Increasing energy demands, rapid industrialization, and reliable backup power solutions are boosting the market across the globe.

The report Diesel Generator Market & Forecast covers by Portability (Stationary, Portable), Power Rating (≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, > 750 kVA), Application (Standby, Peak shaving, Prime/continuous), End User (Residential, Commercial, Industrial), Country and Company 2025-2033.

Diesel Generator Market Overview

A diesel genset, or diesel generator set, is a combination of a diesel engine and an alternator that produces electricity. It acts as a backup power source by converting the mechanical energy produced by the diesel engine into electrical energy through the alternator. Diesel gensets are often used as backup power systems during power outages or in areas with limited access to the primary power grid. These gensets are widely used across various industries because of their durability, efficiency, and the fact that they can be run for extended periods. Some of the key applications of diesel gensets are hospitals, data centers, construction sites, manufacturing plants, and telecommunication facilities where the supply of power has to be continuous. These are also used in residential and commercial buildings as emergency power sources. Diesel gensets are installed remotely for off-grid power in mining, agriculture, and oil and gas exploration. Their reliability and adaptability make them an essential part of modern power solutions.

Key Growth Drivers off the Diesel Generator Market

Increased Need for Continuous Power Supply

Growing dependency on continuous power supply for vital sectors such as healthcare, data centers, and manufacturing has increased demand for diesel gensets. Constant power cuts, unstable grids, and increasing use of electronic devices call for backup power solutions that can be relied upon. Diesel gensets, efficient and long-lasting, serve the purpose, ensuring continuity of business operations and stability. Rapid industrialization in emerging economies and the expansion of remote projects further fuel market growth as they require robust power generation systems in areas with limited grid access. As outlined in the IEA World Energy Outlook, the proportion of electricity in final energy consumption has steadily climbed from 15% in 2000 to 20% today, with projections indicating a further increase to 24% by 2040 if current trends persist. Based on the goals of the Paris Agreement, the Sustainable Development Scenario puts a focus on increased electrification in all sectors; by 2040, this is projected to increase electricity's share of final energy consumption to 31%.

Infrastructure Development and Urbanization

Rapid urbanization and infrastructure development around the world are strong driving forces for diesel gensets. Large-scale developments in transportation networks, residential complexes, and commercial hubs require reliable energy sources to support construction activities and power equipment. Moreover, smart cities and new housing developments further increase the need for backup power solutions to ensure a seamless energy supply. Diesel gensets, which can provide steady power in any setting, are becoming a key component in the infrastructure boom. Currently, 4.4 billion people—just over half of the world's population—live in cities, according to the World Bank. However, the urban population is expected to double by 2050, when nearly 7 out of every 10 people will call cities home.

Growth in Renewable Energy Integration

The rise of renewable energy sources like solar and wind has also spurred the adoption of diesel genset. Being an intermittent source of renewable energy, the gensets on diesel help the system remain at a stable state during low outputs of renewable energies. This hybrid technology is mostly needed in remote regions where the deployment of hybrid power is done. Their flexibility and reliability are such that the existence of gensets in a hybrid power system can boost the growth in the market. March 2024 – The World Bank Board approved a landmark US$2 billion program that supports the use of more renewable energy to enhance energy security and affordability for emerging and developing economies in Europe and Central Asia.

Problems in the Diesel Gensets Industry

Tight Emission Regulations

Diesel-based engines are extremely carbon-intensive, forcing the government worldwide to impose significant restrictions. Nowadays, countries around the world adopt more stringent limits on emissions in diesel generators and this makes its entry into the manufacturing industry costlier and discouraging for smaller firms. The advancement towards alternative forms of power from sources like gas gensets or even renewable energy source affects the production of diesel genset and thus creates an obstacle towards market growth.

Prices of Diesels are Erratic

The Diesel Generator Market is vulnerable to fuel price variability. Diesel, being a non-renewable resource, sometimes experiences price uncertainty due to geopolitical situations, supply and demand imbalances, and other crude oil pricing changes. This increases the costs of operations for consumers, thereby pushing them toward more energy-efficient sources. In that regard, operational cost reduction with sustainable energy source adoption becomes another challenge to increasing market share because of uncertainty about diesel prices.

Portable Diesel Generator Market

Portable Diesel Generator Market is gaining tremendous momentum. This market is mainly driven by the need for on-site, reliable, and on-the-go power supply solutions across a number of industries. Construction, outdoor events, agriculture, and emergency backup applications rely highly on gensets because they are rugged, fuel-efficient, and portable. Advances in technology have enabled the production of newer gensets with low emissions, reduced noise, and better fuel efficiency, thereby making them a preference for green users. The increasing frequency of natural disasters as well as disruptions in power lines has furthered the demand of these gensets. Furthermore, increased requirements for off-grid or location-specific temporary solutions are driving the further growth of the market.

> 125 kVA - 200 kVA Diesel Generator Market

The 125 kVA - 200 kVA diesel genset market serves a medium-scale capacity requirement in production industries, including manufacturing, medical facilities, communications, and more. These gensets are ideal for dependable backup power and continued critical operation during an outage. They are versatile and suitable for both prime and standby power applications. Rise in industrialization, urbanization, and the demand for an uninterrupted supply of power is propelling the market growth. Moreover, upgrading in engine technology increased the efficiency of the fuel and reduction of emissions along the lines of sustainability goals. The adoption of gensets in developing regions where grid infrastructure is unreliable contributes to this market's growth.

Standby Diesel Generator Market

The market for standby diesel gensets is growing steadily because businesses and households are increasingly focusing on getting the best backup power solutions that address frequent power outages. These gensets are utilized primarily in critical applications, including hospitals, data centers, manufacturing facilities, and residential complexes, thereby ensuring seamless operations during grid failures. Key drivers include increasing power disruptions caused by natural disasters, aging infrastructure, and rising energy demands. Standby diesel gensets are valued for their rapid start-up capability, fuel efficiency, and durability. Technological advancements, such as remote monitoring and emission-reduction features, further enhance their appeal. Growing investments in infrastructure and energy reliability drive the expansion of this market.

Residential Diesel Generator Market

Residential diesel gensets have become a viable backup source of home power during grid failure or natural disasters. Increasing instances of grid failures in different parts of the world have made people rely on diesel generators to support constant power supply for critical appliances and heating appliances. The gensets are small, maintenance-free, and can be used for various equipment inside homes. Urge for modern and uninterrupted power supply among developing regions adds to this demand for residential diesel gensets. Their efficiency in satisfying household energy demands makes them an indispensable product in urban and rural markets.

Diesel Generator Market Overview by Regions

United States Diesel Generator Market

The United States Diesel Generator Market is dominated by high industry demand, which includes data centers, healthcare, and construction. Recurring power failures due to natural disasters such as hurricanes and winter storms are creating a demand for reliable backup power solutions. Aging power grid infrastructure in the country is also driving up demand. In addition, advancements in technology like gensets are integrated with the latest monitoring systems, which provide efficiency in their operations and therefore are in high demand. With constant industrialization and increasing dependency on the critical power systems, the U.S. market is anticipated to be solid. Oct 2024, Baudouin is pleased to introduce our diesel generator sets customized for the data center industry. With this achievement, we can further enlarge from engines to all-inclusive turnkey generator solutions. With years of experience, we take pride in delivering uninterrupted and reliable power to our data center customers.

United Kingdom Diesel Generator Market

The United Kingdom Diesel Generator Market is propelled by a rise in the demand for a backup power supply among the commercial and industrial sectors. Complementary systems such as diesel gensets are often used to manage intermittent power supply. This is because the country transitions towards renewable energy. The UK's aging grid infrastructure and rising electricity demand also necessitate reliable backup solutions. Diesel gensets are also usually used on large-scale infrastructure projects and outdoor events. Despite the challenges from emission regulations, advancements in cleaner diesel technologies are expected to support market growth in the region. May 2024, Trime is introducing a series of diesel gensets with power range from 6kVA to 670kVA, equipped with high-performance engines from Kohler Stage V, Yanmar, FPT Iveco, and Perkins.

India Diesel Generator Market

The Diesel Generator Market in India is growing rapidly due to the country's increasing industrialization, urbanization, and unreliable grid connectivity in rural areas. Construction, telecom, and healthcare are some of the industries that require diesel gensets for uninterrupted operations. Increasing infrastructure projects and government initiatives for electrification in remote regions boost demand. Diesel gensets are also used in agricultural irrigation applications. As the Indian market is focused on infrastructure and industrial growth, it makes a significant contribution to global demand for diesel gensets. March 2024: Recon Technologies Pvt Ltd, the authorized GOEM of Mahindra Powerol Genset, launched a CPCBIV+ compliant range of diesel generators at Taj Deccan, which is bringing out new upgrades in power solutions for Telangana and Andhra Pradesh.

Saudi Arabia Diesel Generator Market

Saudi Arabia Diesel Generator Market is primarily backed by the numerous infrastructure projects that have been initiated by the government and additional large-scale mega-projects such as NEOM. Diesel gensets power many remote operations in the oil and gas industry. In other places, the severe weather conditions or low connectivity of the grid require more reliable backup sources. As the government is investing more in infrastructure and construction, the demand for diesel gensets will also rise. Yet, growing environmental awareness promotes more environmentally friendly, efficient genset technologies in this region. Dec 2024, Tide Power successfully delivered three 413kVA diesel generators to a valued customer in Saudi Arabia, marking a positive outcome from our collaboration with local partners.

Diesel Generator Market Segments

Portability

- Stationary

- Portable

Power Rating

- ≤ 50 kVA

- 50 kVA - 125 kVA

- 125 kVA - 200 kVA

- 200 kVA - 330 kVA

- 330 kVA - 750 kVA

- 750 kVA

Application

- Standby

- Peak shaving

- Prime/continuous

End User

- Residential

- Commercial

- Industrial

Regional Market Analysis

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Person

- Recent Development

- Revenue

Competitive Landscape

- Aggreko

- Atlas Copco AB

- Ashok Leyland

- Caterpillar

- Cummins, Inc.

- Cooper Corp.

- Greaves Cotton Limited

- Deere & Company

- Kirloskar

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Portability, Power Rating, Application, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What was the global diesel generator market size in 2024?

-

What is the projected market size of the diesel generator industry by 2033?

-

What is the expected CAGR of the diesel generator market from 2025 to 2033?

-

What are the key factors driving the growth of the diesel generator market?

-

How does rapid urbanization contribute to the demand for diesel generators?

-

What are the major challenges faced by the diesel generator industry?

-

Which applications primarily use diesel generators for backup power?

-

How does the integration of renewable energy impact the diesel generator market?

-

What are the major regions covered in the diesel generator market report?

-

Which key players are leading the diesel generator market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Diesel Generator Market

6. Market Share Analysis

6.1 By Portability

6.2 By Power Rating

6.3 By Application

6.4 By End User

6.5 By Countries

7. Portability

7.1 Stationary

7.2 Portable

8. Power Rating

8.1 ≤ 50 kVA

8.2 > 50 kVA - 125 kVA

8.3 > 125 kVA - 200 kVA

8.4 > 200 kVA - 330 kVA

8.5 > 330 kVA - 750 kVA

8.6 > 750 kVA

9. Application

9.1 Standby

9.2 Peak shaving

9.3 Prime/continuous

10. End User

10.1 Residential

10.2 Commercial

10.3 Industrial

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 Australia

11.3.5 South Korea

11.3.6 Thailand

11.3.7 Malaysia

11.3.8 Indonesia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 South Africa

11.5.2 Saudi Arabia

11.5.3 UAE

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Key Players Analysis

14.1 Aggreko

14.1.1 Overview

14.1.2 Key Person

14.1.3 Recent Development

14.1.4 Revenue

14.2 Atlas Copco AB

14.2.1 Overview

14.2.2 Key Person

14.2.3 Recent Development

14.2.4 Revenue

14.3 Ashok Leyland

14.3.1 Overview

14.3.2 Key Person

14.3.3 Recent Development

14.3.4 Revenue

14.4 Caterpillar

14.4.1 Overview

14.4.2 Key Person

14.4.3 Recent Development

14.4.4 Revenue

14.5 Cummins, Inc.

14.5.1 Overview

14.5.2 Key Person

14.5.3 Recent Development

14.5.4 Revenue

14.6 Cooper Corp.

14.6.1 Overview

14.6.2 Key Person

14.6.3 Recent Development

14.6.4 Revenue

14.7 Greaves Cotton Limited

14.7.1 Overview

14.7.2 Key Person

14.7.3 Recent Development

14.7.4 Revenue

14.8 Deere & Company

14.8.1 Overview

14.8.2 Key Person

14.8.3 Recent Development

14.8.4 Revenue

14.9 Kirloskar

14.9.1 Overview

14.9.2 Key Person

14.9.3 Recent Development

14.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com