Drip Irrigation Market, Size, Global Forecast 2023-2028, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Buy NowGlobal Drip Irrigation Market Outlook

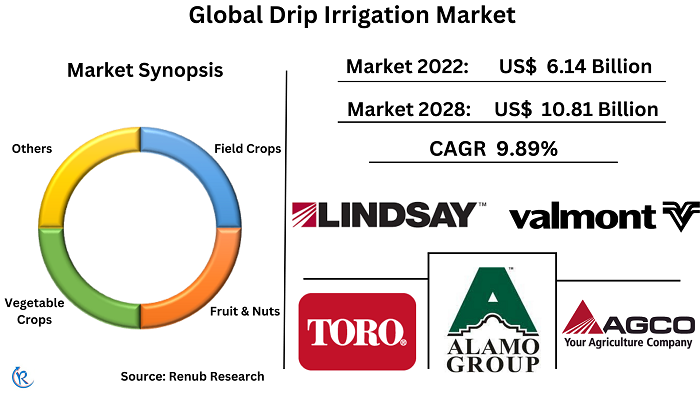

Global Drip Irrigation Market will be to US$ 10.81 Billion by 2028, according to Renub Research. Artificial methods of watering land are referred to as irrigation. Agriculture is heavily dependent on irrigation as natural water sources like floods or rain may be unreliable or limited. Drip irrigation is recognized as the most efficient technique as it allows for precise and uniform application of water and nutrients. Drip irrigation technology can help farmers adapt to climate change by enabling efficient water use. This is particularly useful in areas that are vulnerable to climate change impacts like seasonal droughts, where drip irrigation reduces water demand and evaporation losses. Moreover, the worldwide drip irrigation market is driven by the increasing adoption of micro-irrigation systems, technological advancements in the agriculture industry, and growing awareness of modern farming techniques and irrigation systems.

Global Drip Irrigation Companies News

Lindsay Corporation

On Jan 2024, Lindsay Corporation announced plans to invest more than US$ 50 Million in its largest global manufacturing facility over the next two years.

May 2023, Lindsay Corporation and Pessl Instruments, a global manufacturer and leading provider of advanced agricultural technology solutions under the METOS® brand, announce a strategic, global partnership that combines Pessl's field monitoring systems with Lindsay's FieldNET® remote irrigation management platform.

Toro Company

Jan 2024, Toro announced that Transpira™ has been awarded the 2023 New Product of the Year Award in the Agriculture Irrigation Category by the Irrigation Association. This recognition is a testament to Toro’s commitment to advancing innovation and sustainability within the agricultural industry.

In February 2022, Toro introduced ultra-low-flow options to its Aqua-Traxx Azul drip tape range, offering farmers a uniform and consistent delivery of water, nutrients, and inputs for improved irrigation uniformity.

FEB 2022, Toro has expanded its irrigation product line with its new Azul drip tape. The Azul line has a unique emitter design and multi-stage filters that offer greater filtration area, resulting in superior clog resistance. Toro is the first in the industry to provide ultra-low emitter flows at meager filtration requirement rates: 0.07 mph (140 mesh), 0.09 mph (120 mesh), and 0.10 mph (120 mesh).

Valmont Industries

In July 2023, Valmont® Industries, Inc. announced it had entered into a definitive agreement to acquire HR Products, a leading wholesale supplier of irrigation parts in Australia. This will expand the Company’s geographic footprint and grow its parts presence in a key agriculture market.

In January 2023, Valmont Industries signed a supply agreement to provide irrigation equipment and technology for African agricultural projects. The deal addresses food security concerns, meets global demand for efficient food production, and supports national agricultural investments.

Alamo Group

October 2023, Alamo Group Inc. has announced a significant stride in their expansion efforts with the acquisition of Royal Truck & Equipment, Inc. This strategic move promises to fortify Alamo's position in the highway safety equipment market, marking the beginning of an exciting new chapter.

AGCO

In May 2021, AGCO and Bosch BASF Smart Farming have started trials for Smart Spraying Solution, which targets spraying and provides digital tools to improve yields and efficiency for farmers.

In February 2023, SimplEbale is an electronic monitoring system for Massey Ferguson Hesston 1800 series small square balers. It streamlines hay-making tasks for operators of all skill levels, ensuring consistently high-quality hay. SimplEbale will be commercially available in 2025.

Global Drip Irrigation Market is estimated to grow with double digits CAGR of 9.89% from 2022 to 2028

Encouraging the adoption of drip irrigation systems can have several benefits, including promoting efficient water usage, reducing fertilizer requirements, and increasing soil productivity. This technique is particularly well-suited for areas that experience water scarcity, either permanently or seasonally, as farmers can select crop varieties that are adaptable to these conditions.

However, implementing drip irrigation systems will require investment in building workers' capacities to effectively manage maintenance and water flow control. For example, the drip tape or tubing needs to be carefully maintained to prevent leaks or blockages, and emitters require regular cleaning to avoid clogging from chemical deposits. Global Drip Irrigation Market was US$ 6.14 Billion in 2022.

Global Increase in adoption of Drip Irrigation Systems can be attributed to a range of Factors

- The issue of water scarcity has led to an uptick in the implementation of this irrigation method, as it delivers water directly to the roots of plants, thus minimizing water waste and conserving this vital resource.

- Drip irrigation systems have been shown to enhance crop yield and plant health, as they provide water and nutrients directly to the roots. This method of irrigation promotes environmental sustainability, as it curtails water waste and reduces carbon emissions, thereby contributing to energy conservation efforts.

- Drip irrigation systems are highly efficient and require less labor than traditional irrigation techniques, thereby improving efficiency and boosting productivity.

- Various governments across the world are offering incentives and support to encourage the uptake of drip irrigation systems, including subsidies, tax breaks, and technical assistance.

Field Crops will capture Highest Market Share in Global Drip Irrigation Market

By Crop Type, Drip Irrigation Market is segmented into Field Crops, Fruit & Nuts, Vegetable Crops and Others. Field crops may dominate the drip irrigation market share due to their characteristic of being grown on large and flat land areas, which are ideal for drip irrigation. Moreover, field crops are typically cultivated in areas with water scarcity or drought, making drip irrigation a practical and water-efficient option for farmers aiming to optimize their yield. However, the drip irrigation market is expansive and includes various crops like fruits, vegetables, landscaping, and turfgrass, among others. The market share for each crop would be influenced by factors such as soil type, regional climate, and local demand for specific crops.

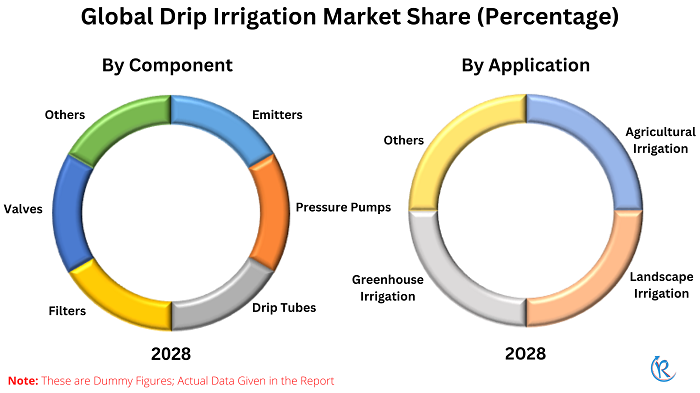

Drip Tubes have highest market share in year 2022

By Component, Drip Irrigation Market is divided into Emitters, Pressure Pumps, Drip Tubes, Filters, Valves and Others. Drip irrigation, a water-conserving method that delivers water slowly to plant roots, is extensively used in the agriculture industry, and drip tubes are an essential component of this system. These tubes are available in different materials and dimensions and have small emitters that drip water onto the soil surface or directly onto the plant root zone through pipes, valves, and tubing. As the need for sustainable irrigation solutions that reduce water bills rises, the demand for drip tubes is also increasing. Consequently, drip tubes are a significant player in the drip irrigation industry.

Agricultural Irrigation will grow in the upcoming years

By Application, Drip Irrigation Market is sub-segmented into Agricultural Irrigation, Landscape Irrigation, Greenhouse Irrigation and Others. Modern agriculture heavily relies on irrigation systems as they play a crucial role in enhancing crop yields, improving crop quality, sector in the global economy; there is an increasing demand for food to sustain the growing population. Consequently, farmers need to adopt advanced and efficient irrigation technologies to increase their productivity while conserving water resources.

North America is a Significant Player in the Global Drip Irrigation Market

By Region, Drip Irrigation Market is broken up in North America, Asia Pacific, Europe and Rest of the World. Although North America is a significant participant in the global drip irrigation industry, it does not hold the highest market share worldwide. The industry is rapidly expanding in various regions globally, fueled by the growing demand for water-efficient irrigation techniques in agriculture.

Apart from North America, other regions with a noteworthy market share in the drip irrigation industry are Asia-Pacific, Europe, and the Middle East. China, with its enormous population and sizeable agricultural sector, is a leading player in the drip irrigation market in the Asia-Pacific region. Similarly, India has one of the largest drip irrigation markets globally, attributed to its arid climate and the need to conserve water in agriculture. The Indian government has been promoting drip irrigation systems actively, leading to a surge in the industry's growth.

Company Analysis

There are several key players operating in the drip irrigation market, including Lindsay Corporation, Toro Company, Valmont Industries, Alamo Group, and AGCO. These companies provide a range of drip irrigation solutions, including drip tapes, drip emitters, and micro-sprinklers, among others.

Crop Type -

1. Field Crops

2. Fruit & Nuts

3. Vegetable Crops

4. Others

Component -

1. Emitters

2. Pressure Pumps

3. Drip Tubes

4. Filters

5. Valves

6. Others

Application -

1. Agricultural Irrigation

2. Landscape Irrigation

3. Greenhouse Irrigation

4. Others

Region -

1. North America

2. Asia pacific

3. Europe

4. Rest of the world

All the Companies have been studied from Three Points

• Overview

• Recent Developments

• Sales

Company -

1. Lindsay Corporation

2. The Toro Company

3. Valmont Industries

4. Alamo Group

5. Agco

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Crop Type, Component, Application, and Region |

| Region Covered | North America, Asia pacific, Europe and Rest of the World |

| Companies Covered | Lindsay Corporation, Toro Company, Valmont Industries, Alamo Group, and AGCO |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. SWOT Analysis

5.1 Strength

5.2 Weakness

5.3 Opportunity

5.4 Threat

6. Porter’s Five Forces

6.1 Bargaining Power of Buyers

6.2 Bargaining Power of Suppliers

6.3 Degree of Competition

6.4 Threat of New Entrants

6.5 Threat of Substitutes

7. Global Drip Irrigation Market

8. Market Share - Global Drip Irrigation Market

8.1 By Crop Type

8.2 By Component

8.3 By Application

8.4 By Region

9. Crop Type - Global Drip Irrigation Market

9.1 Field Crops

9.2 Fruit & Nuts

9.3 Vegetable Crops

9.4 Others

10. Component - Global Drip Irrigation Market

10.1 Emitters

10.2 Pressure Pumps

10.3 Drip Tubes

10.4 Filters

10.5 Valves

10.6 Others

11. Application - Global Drip Irrigation Market

11.1 Agricultural Irrigation

11.2 Landscape Irrigation

11.3 Greenhouse Irrigation

11.4 Others

12. Region - Global Drip Irrigation Market

12.1 North America

12.2 Asia pacific

12.3 Europe

12.4 Rest of the world

13. Key Players - Global Drip Irrigation Market

13.1 Lindsay Corporation

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 The Toro Company

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 Valmont Industries

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

13.4 Alamo Group

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue

13.5 Agco

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue

List of Figures:

Figure-01: Global – Drip Irrigation Market (Billion US$), 2018 – 2022

Figure-02: Global – Forecast for Drip Irrigation Market (Billion US$), 2023 – 2028

Figure-03: Crop Type – Field Crops Market (Million US$), 2018 – 2022

Figure-04: Crop Type – Forecast for Field Crops Market (Million US$), 2023 – 2028

Figure-05: Crop Type – Fruit & Nuts Market (Million US$), 2018 – 2022

Figure-06: Crop Type – Forecast for Fruit & Nuts Market (Million US$), 2023 – 2028

Figure-07: Crop Type – Vegetable Crops Market (Million US$), 2018 – 2022

Figure-08: Crop Type – Forecast for Vegetable Crops Market (Million US$), 2023 – 2028

Figure-09: Crop Type – Others Market (Million US$), 2018 – 2022

Figure-10: Crop Type – Forecast for Others Market (Million US$), 2023 – 2028

Figure-11: Component – Emitters Market (Million US$), 2018 – 2022

Figure-12: Component – Forecast for Emitters Market (Million US$), 2023 – 2028

Figure-13: Component – Pressure Pumps Market (Million US$), 2018 – 2022

Figure-14: Component – Forecast for Pressure Pumps Market (Million US$), 2023 – 2028

Figure-15: Component – Drip Tubes Market (Million US$), 2018 – 2022

Figure-16: Component – Forecast for Drip Tubes Market (Million US$), 2023 – 2028

Figure-17: Component – Filters Market (Million US$), 2018 – 2022

Figure-18: Component – Forecast for Filters Market (Million US$), 2023 – 2028

Figure-19: Component – Valves Market (Million US$), 2018 – 2022

Figure-20: Component – Forecast for Valves Market (Million US$), 2023 – 2028

Figure-21: Component – Others Market (Million US$), 2018 – 2022

Figure-22: Component – Forecast for Others Market (Million US$), 2023 – 2028

Figure-23: Application – Agricultural Irrigation Market (Million US$), 2018 – 2022

Figure-24: Application – Forecast for Agricultural Irrigation Market (Million US$), 2023 – 2028

Figure-25: Application – Landscape Irrigation Market (Million US$), 2018 – 2022

Figure-26: Application – Forecast for Landscape Irrigation Market (Million US$), 2023 – 2028

Figure-27: Application – Greenhouse Irrigation Market (Million US$), 2018 – 2022

Figure-28: Application – Forecast for Greenhouse Irrigation Market (Million US$), 2023 – 2028

Figure-29: Application – Others Market (Million US$), 2018 – 2022

Figure-30: Application – Forecast for Others Market (Million US$), 2023 – 2028

Figure-31: North America – Drip Irrigation Market (Million US$), 2018 – 2022

Figure-32: North America – Forecast for Drip Irrigation Market (Million US$), 2023 – 2028

Figure-33: Asia pacific – Drip Irrigation Market (Million US$), 2018 – 2022

Figure-34: Asia pacific – Forecast for Drip Irrigation Market (Million US$), 2023 – 2028

Figure-35: Europe – Drip Irrigation Market (Million US$), 2018 – 2022

Figure-36: Europe – Forecast for Drip Irrigation Market (Million US$), 2023 – 2028

Figure-37: Rest of the world – Drip Irrigation Market (Million US$), 2018 – 2022

Figure-38: Rest of the world – Forecast for Drip Irrigation Market (Million US$), 2023 – 2028

Figure-39: Lindsay Corporation – Global Revenue (Million US$), 2018 – 2022

Figure-40: Lindsay Corporation – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-41: The Toro Company – Global Revenue (Million US$), 2018 – 2022

Figure-42: The Toro Company – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-43: Valmont Industries – Global Revenue (Million US$), 2018 – 2022

Figure-44: Valmont Industries – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-45: Alamo Group – Global Revenue (Million US$), 2018 – 2022

Figure-46: Alamo Group – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-47: Agco – Global Revenue (Million US$), 2018 – 2022

Figure-48: Agco – Forecast for Global Revenue (Million US$), 2023 – 2028

List of Tables:

Table-01: Global – Drip Irrigation Market Share by Crop Type (Percent), 2018 – 2022

Table-02: Global – Forecast for Drip Irrigation Market Share by Crop Type (Percent), 2023 – 2028

Table-03: Global – Drip Irrigation Market Share by Component (Percent), 2018 – 2022

Table-04: Global – Forecast for Drip Irrigation Market Share by Component (Percent), 2023 – 2028

Table-05: Global – Drip Irrigation Market Share by Application (Percent), 2018 – 2022

Table-06: Global – Forecast for Drip Irrigation Market Share by Application (Percent), 2023 – 2028

Table-07: Global – Drip Irrigation Market Share by Region (Percent), 2018 – 2022

Table-08: Global – Forecast for Drip Irrigation Market Share by Region (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com