Global Electric Wheelchair Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Electric Wheelchair Market Trends & Summary

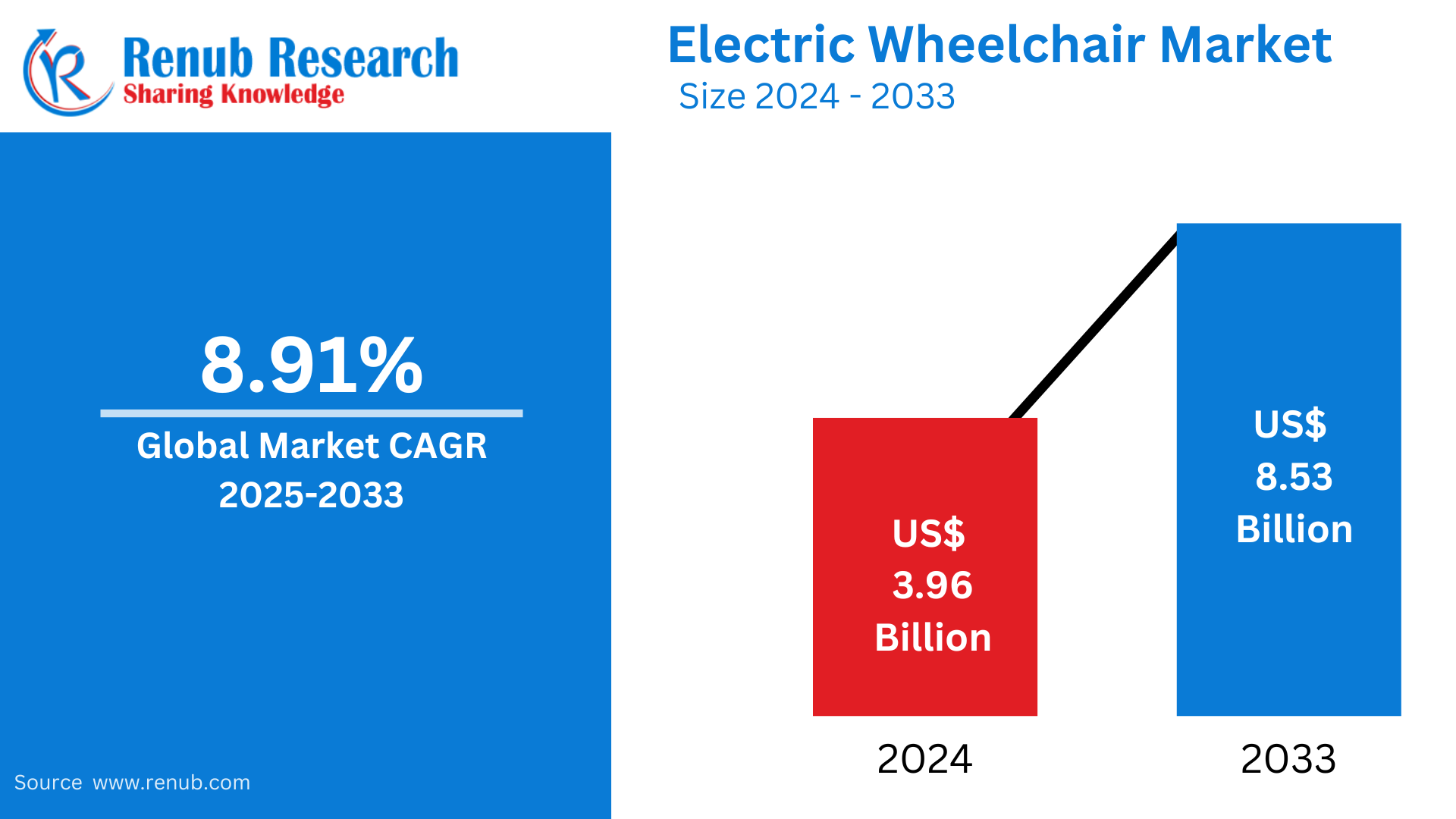

Electric Wheelchair Market is expected to reach US$ 8.53 billion in 2033 from US$ 3.96 billion in 2024, with a CAGR of 8.91% from 2025 to 2033. Increased healthcare awareness, the aging population, the prevalence of disabilities, technological advancements in mobility solutions, government support for assistive devices, and the growing desire for greater comfort, autonomy, and convenience are some of the factors driving the market for electric wheelchairs.

Electric Wheelchair Market Global Report by Product (Center Wheel Drive, Front Wheel Drive, Rear Wheel Drive, Standing Electric Wheelchair, and Others), Age group (Below 20 years, 21 to 60 years and Above 60 Years), End Users (Hospitals, Clinics and Care Homes), Countries and Company Analysis 2025-2033.

Electric Wheelchair Industry Overview

Electric wheelchairs, also referred to as motorized wheelchairs, provide non-ambulatory people with a way to move around. Electrical power sources, including sealed lead-acid (SLA) batteries, are used to push it. Beneath the seat is a power base that contains the wheels, motors, brakes, batteries, and wire harnesses. Additionally, it has headrests, backrests, and gel, molded foam, and air-filled bladder cushions. Typically, switches or joysticks are used to regulate the acceleration and movement of an electric wheelchair.

One of the main drivers supporting the market's growth is the rising incidence of neurological problems, which coincides with the aging population's increased susceptibility to orthopedic conditions. Additionally, people can move more easily and comfortably on grass, gravel, soft terrain, and rocky ground with the aid of electric wheelchairs. In addition, they help with pressure relief, posture control, and dependency reduction compared to their traditional equivalents. Additionally, the market is expanding favorably due to the emergence of electric wheelchairs that may be operated by voluntary motions such breath actuation, lower extremity control, and head and tongue movement. In addition, the market is expanding due to the growing number of people participating in Paralympic sports, the availability of advantageous reimbursement schemes, and customization opportunities.

Growth Drivers for the Electric Wheelchair Market

Increasing Number of Elderly People

One of the main factors propelling the market for electric wheelchairs is the aging population. The need for mobility aids, such as electric wheelchairs, is rising quickly as people live longer. The World Health Organization predicts that one-sixth of the world's population will be 60 years of age or older by 2030. The population of adults 60 and older is predicted to increase from 1 billion in 2020 to over 1.4 billion, and by 2050, it is predicted to reach 2.1 billion.

Furthermore, between 2020 and 2050, the number of people in the 80+ age bracket is predicted to treble, reaching almost 426 million. A growing number of people have mobility problems as a result of aging-related illnesses such arthritis, muscular weakness, or neurological impairments, which is a result of this demographic shift. Because they provide more mobility, freedom, and comfort, electric wheelchairs will therefore continue to be in high demand, which will push producers to create creative and approachable products for senior citizens.

Technological Advancement

The market for electric wheelchairs is expanding due in large part to technological improvements. Users can now experience greater mobility and independence thanks to advancements in battery technology, such as speedier and longer-lasting batteries. Additionally, electric wheelchairs are now easier to maneuver and more portable because to developments in lightweight materials like carbon fiber. More user-friendliness is provided by improved control mechanisms, such as voice-activated controllers and joysticks, particularly for people with weak hands. Furthermore, as customer needs change, smart features like app connectivity for tracking usage or changing settings help electric wheelchairs become more and more popular.

In Oct 2023, Sunrise Medical introduced the LECKEY MyWay+ Gait Trainer, a ground-breaking device intended to encourage children's independence and curiosity. With its simple, open-frame design, the MyWay+ helps kids stand up straight, improving stepping and offering lots of chances for involvement, discovery, and interaction.

Healthcare Awareness

One of the main factors propelling the market for electric wheelchairs is healthcare awareness. Advanced, comfortable, and accessible wheelchairs are becoming more and more in demand as more people realize the advantages of electric mobility options. Electric wheelchairs are viewed as an essential tool for improving independence and quality of life as the population ages and the number of disabilities increases. Increased acceptance results from healthcare facilities and professionals promoting these gadgets for better mobility. Furthermore, a greater understanding of aging, chronic illnesses, and rehabilitation has helped electric wheelchairs become more widely accepted and integrated into healthcare systems around the world.

Challenges in the Electric Wheelchair Market

Regulatory Hurdles

The market for electric wheelchairs is severely hampered by regulatory barriers because different nations have different requirements and laws. Manufacturers have to handle a number of intricate clearance procedures, including as quality assurance, safety certifications, and adherence to medical device laws. These regulations have the potential to impede market expansion and restrict users' access to cutting-edge mobility solutions globally by delaying product introductions, raising costs, and complicating foreign distribution.

Maintenance Complexities

In the market for electric wheelchairs, complex maintenance is a major obstacle. These gadgets frequently need specialist repairs, such as servicing of the motor, battery, and electronic components. Frequent maintenance might be expensive and may necessitate hiring qualified specialists, which isn't always possible, particularly in rural locations. Furthermore, users may find periodic maintenance to be inconvenient, which could affect their entire experience and prevent electric wheelchairs from becoming widely used.

Electric Wheelchair Market Overview by Regions

The demand for electric wheelchairs is high in North America, Europe, and Asia-Pacific, and the market is expanding globally. North America is in the lead because of its sophisticated healthcare system and aging population. Europe follows, propelled by increased government assistance and recognition of disabilities. Rapid urbanization and expanding access to healthcare are driving market expansion in Asia-Pacific, especially in nations like China and India. Emerging markets with rising demand for mobility solutions include the Middle East and Africa.

United States Electric Wheelchair Market

Due to factors like an aging population, growing healthcare awareness, and an increase in the prevalence of mobility disabilities, the US market for electric wheelchairs is among the biggest in the world. More than one in four adults in the United States (28.7%) have a handicap, with 12.2% having significant mobility issues, according to a July 2024 CDC study. This demonstrates the rising need for electric wheelchairs and other assistance technology. Medicare and other government programs encourage adoption, and improvements in comfort and technology accelerate market expansion. High expenses, difficult upkeep, and legal restrictions, however, continue to be obstacles.

Germany Electric Wheelchair Market

Germany has a large population of people 65 and older, which helps explain why it dominates the European market for electric wheelchairs. Germany leads the major European economy with 18.89 million seniors, while the UK has 12.71 million, France has 14.73 million, Italy has 14.33 million, and Spain has 9.93 million. Since many members of this elderly population have mobility issues and need such assistive equipment, the market for electric wheelchairs is driven by this demographic. The market's expansion has been further aided by the government's increased attention on healthcare infrastructure and assistive technologies as a result of Germany's aging population.

India Electric Wheelchair Market

An aging population, rising mobility limitations, and growing healthcare awareness are all contributing to India's electric wheelchair market's notable expansion. The need for mobility aids is increasing as a result of more individuals having access to healthcare services due to urbanization. Government programs to promote disability inclusion also drive the market. But there are still issues like exorbitant prices, restricted access to cutting-edge technologies, and ignorance in rural areas. Despite this, increased use is predicted to fuel the market for electric wheelchairs.

Saudi Arabia Electric Wheelchair Market

Saudi Arabia's electric wheelchair market is developing as a result of the country's aging population, greater awareness of impairments, and rising healthcare spending. The industry is growing as a result of government programs encouraging disability inclusion and better healthcare facilities. The need for electric wheelchairs is being driven by the incidence of mobility disabilities and the development of assistive technology. The market is expected to continue expanding in the upcoming years because to the growing emphasis on improving the quality of life for people with impairments.

Electric Wheelchair Market Segments

Product Type

- Centre Wheel Drive

- Front Wheel Drive

- Rear Wheel Drive

- Standing Electric Wheelchair

- Others

Age group

- Upto 20 years

- 21 to 60 years

- Above 60 Years

End Users

- Hospitals

- Clinics

- Home Care

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Rest of the World

All the Key players have been covered from 5 Viewpoints:

- Company Overview

- Key Persons

- Product Portfolio

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Invacare Corporation

- Dassault Systemes SA

- Sunrise Medical

- Karman Healthcare, Inc.

- Pride Mobility Products Corp.

- Permobil AB

- Sermax Mobility Ltd.

- Carex Health Brands, Inc.

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Products Type, By Age Group, By End User and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

-

What factors are contributing to the increasing demand for electric wheelchairs globally?

-

How is the aging population influencing the growth of the electric wheelchair market?

-

What technological advancements are driving the evolution of electric wheelchairs?

-

Which product types of electric wheelchairs are seeing the most demand?

-

How does the growing awareness of healthcare and mobility issues contribute to the market growth?

-

What are the primary challenges faced by the electric wheelchair market, such as regulatory and maintenance complexities?

-

Which regions are leading the electric wheelchair market, and why?

-

What is the impact of government support and funding on the electric wheelchair market?

-

How do healthcare providers and caregivers contribute to the adoption of electric wheelchairs?

-

What are the key players in the electric wheelchair market, and what strategies are they implementing to maintain market share?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth

4.2 Challenge

4.3 Opportunity

5. Global Electric Wheelchair Market

6. Market Share Analysis

6.1 By Products Type

6.2 By Age Group

6.3 By End User

6.4 By Countries

7. Product Type

7.1 Centre Wheel Drive

7.2 Front Wheel Drive

7.3 Rear Wheel Drive

7.4 Standing Electric Wheelchair

7.5 Others

8. Age group

8.1 Upto 20 years

8.2 21 to 60 years

8.3 Above 60 Years

9. End Users

9.1 Hospitals

9.2 Clinics

9.3 Home Care

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

10.6 Rest of the World

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1.1 Strength

12.1.2 Weakness

12.1.3 Opportunity

12.1.4 Threat

13. Key Players Analysis

13.1 Invacare Corporation

13.1.1 Company Overview

13.1.2 Key Persons

13.1.3 Product Portfolio

13.1.4 Recent Development & Strategies

13.1.5 Revenue Analysis

13.2 Dassault Systemes SA

13.2.1 Company Overview

13.2.2 Key Persons

13.2.3 Product Portfolio

13.2.4 Recent Development & Strategies

13.2.5 Revenue Analysis

13.3 Sunrise Medical

13.3.1 Company Overview

13.3.2 Key Persons

13.3.3 Product Portfolio

13.3.4 Recent Development & Strategies

13.4 Karman Healthcare, Inc.

13.4.1 Company Overview

13.4.2 Key Persons

13.4.3 Product Portfolio

13.4.4 Recent Development & Strategies

13.5 Pride Mobility Products Corp.

13.5.1 Company Overview

13.5.2 Key Persons

13.5.3 Product Portfolio

13.5.4 Recent Development & Strategies

13.6 Permobil AB

13.6.1 Company Overview

13.6.2 Key Persons

13.6.3 Product Portfolio

13.6.4 Recent Development & Strategies

13.7 Sermax Mobility Ltd.

13.7.1 Company Overview

13.7.2 Key Persons

13.7.3 Product Portfolio

13.7.4 Recent Development & Strategies

13.8 Carex Health Brands, Inc.

13.8.1 Company Overview

13.8.2 Key Persons

13.8.3 Product Portfolio

13.8.4 Recent Development & Strategies

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com