Europe Agriculture Equipment Market Size, Share & Forecast 2025-2033

Buy NowEurope Agricultural Equipment Market Size and Forecast 2025-2033

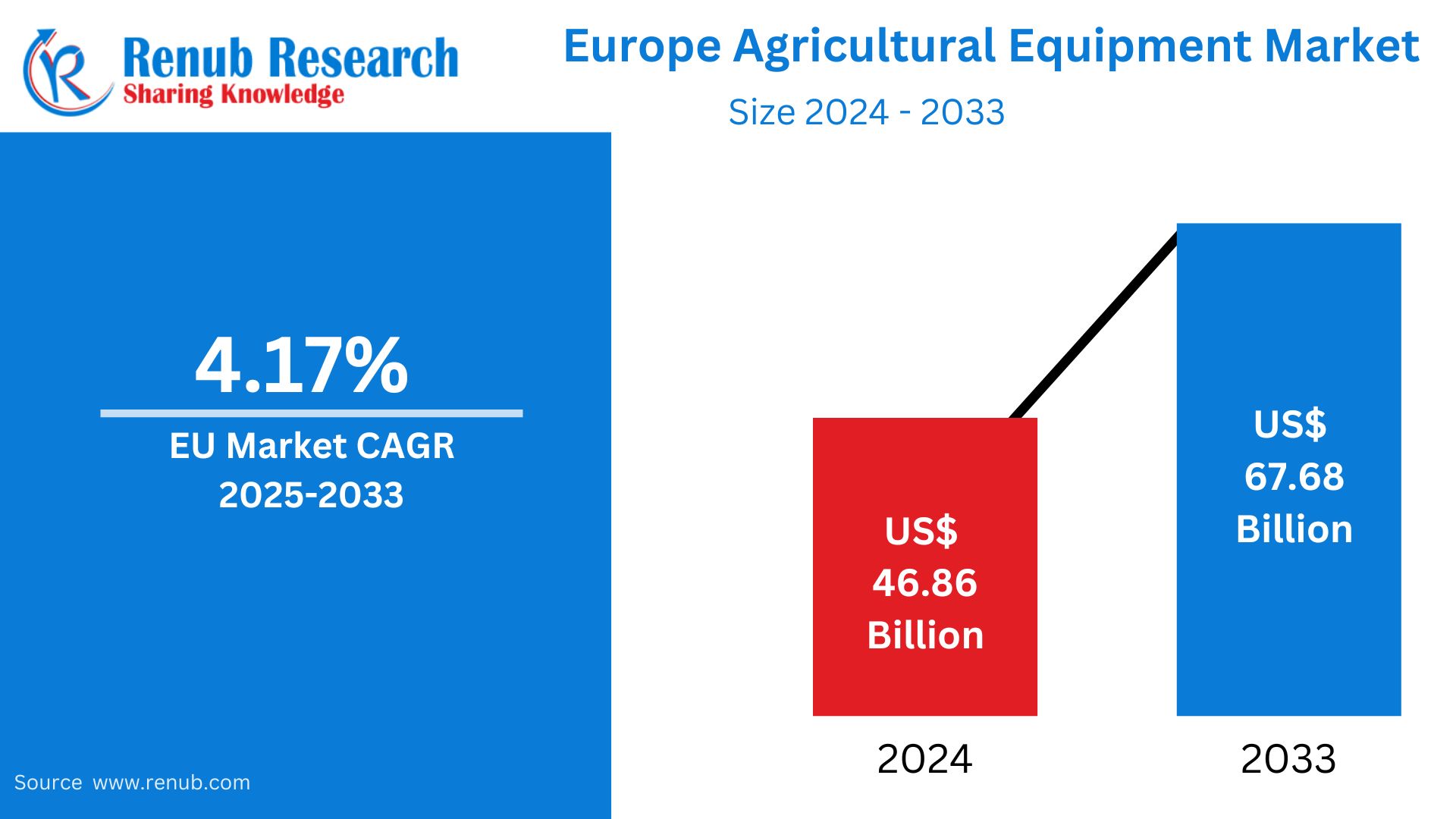

Europe Agricultural Equipment Market was valued at USD 46.86 billion in 2024 and is expected to grow to USD 67.68 billion by 2033 at a CAGR of 4.17% during the period from 2025 to 2033. The market is fueled by the increasing mechanization of farming operations, rising labor costs, and the expanding use of precision agriculture technologies.

The report Europe Agricultural Equipment Market Forecast covers by European Agricultural Tractors Market by Horsepower, Soil working, sowing and fertilizing equipment, European Market of Harvesting Equipment, Garden and forestry machinery, Livestock Equipment, Haymaking Equipment, Irrigation and Crop Protection Equipment, Agricultural trailers and semi-trailers, Machines for cleaning and soring agricultural products, Country, European Hay-Making Machine, Country - Custom Data for Hay Making Machines and Company Analysis, 2025-2033.

Europe Agricultural Equipment Market Overview

Farm equipment is the extensive variety of machinery and implements employed by farmers to enhance efficiency, productivity, and sustainability. These include tractors, harvesters, plows, seeders, irrigation systems, and advanced technologies such as GPS- guided machines and autonomous devices. These devices facilitate farmers to conduct vital operations such as planting, tilling, harvesting, spraying, and moving produce faster and more precisely than by humans.

In Europe, farm equipment is critical to satisfying the continent's high standards of food production and maintaining large-scale agricultural operations. Germany, France, and Italy are among the nations with advanced farming equipment and robust manufacturing industries. The demand for farm equipment is increasing throughout the continent as a result of increasing labor costs, aging farm populations, and government subsidies that promote mechanization. Also, the emphasis on sustainable and precision agriculture farming has ensured greater use of smart equipment that minimizes waste and maximizes productivity. Consequently, Europe is still a dominant market for agricultural machinery innovation and adoption.

Growth Drivers of the Europe Agricultural Equipment Market

Increased Mechanization in Agriculture Practices

The transition from conventional farming to mechanized farming is a prominent growth driver in Europe. Farmers are increasingly using tractors, harvesters, and tilling equipment to enhance productivity and minimize labor dependence. This is driven by the aging population of farmers, labor scarcity, and the need for effective farming solutions. Mechanization increases speed and accuracy in farm operations, making it a necessity for commercial and large-scale farming. Governments and EU institutions also provide subsidies and incentives to promote the use of sophisticated farm machinery, further stimulating demand in Western and Eastern European nations. CAP 2023 to 2027 in the EU, which constitutes nearly one-third of the budget of the EU (EUR 386.6 billion), is the most influential public policy affecting the agricultural sector of the EU. Supporting the stopping and reversal of biodiversity decline, promoting ecosystem services and maintaining habitats and landscapes is one of the CAP's main aims.

Integration of Precision Agriculture Technologies

The implementation of intelligent technologies like GPS, IoT, sensors, and data analytics in agricultural machinery is revolutionizing farming throughout Europe. Precision farming equipment aids in maximizing the use of resources, reducing wastage, and increasing crop production. Latest machinery fitted with these technologies enables farmers to see the health of soil, water, and crops in real-time. Germany, France, and the Netherlands are leaders in implementing precision agriculture, which makes Europe the high-tech hub for farming. This revolution is playing a huge role in increasing the need for smart farm machinery and equipment. In July 2023, CLAAS introduced two range of compact tractors, the AXOS 230 and the AXOS 240, as dedicated machinery for mixed and special crop farms that have superior technical features in terms of performance, power transmission, and comfort. This trend toward specialized equipment follows the industry response to the complexity of farming operations and different agro-climates in European areas.

Supportive Government Policies and Subsidies

EU policies under the Common Agricultural Policy (CAP) give substantial support to farmers for investing in new machines. Schemes such as the European Agricultural Fund for Rural Development (EAFRD) support the easing of the cost burden of buying new machinery. Environmental standards promoting environmentally friendly farming also lead the transition towards low-emission, fuel-saving, and environmentally friendly machinery. These policy measures not only hasten the modernization of agriculture in Europe but also provide for easier market access to small and medium-sized farms. In 2022, the UK government launched a major 25 million pound grant scheme for Agri-Tech companies as part of DEFRA's farming investment fund to increase productivity through mechanization. The scheme provides big grants between USD 43,760 and USD 625,145, allowing growers and farmers to invest in cutting-edge agriculture equipment and robots. Likewise, the government of France has come strong with the initiative of providing a grant of USD 10 billion (Euro 9 billion) to the farming industry so it can make investment in mechanization equipment in the place of laborers.

Barriers to Entry in Europe Agriculture Equipment Industry

High Capital Requisite for Machinery Purchase and Repairs

Farm machinery may be costly, particularly advanced machinery with GPS and automation. For small farmers, the expense of buying, keeping, and replacing machines is a financial strain. Moreover, spare parts and repair costs can be high. These financial constraints are obstacles to adoption, especially in areas where there is limited access to government subsidies or credit. This is an impediment to the general mechanization of agriculture and can restrain growth in poorer rural areas.

Environmental and Regulatory Pressures

The high emphasis in Europe on sustainability and protecting the environment puts pressure on farm equipment makers to meet tight emission regulations and environmentally friendly rules. Producing machines that conform to them drives up production costs and restricts the variety of options that are affordable for farmers. In addition, regulations concerning soil conservation and sound pollution can inhibit the application of specific heavy machinery. These regulatory constraints can slow innovation and create complexity for manufacturers entering or expanding within the European market.

Europe Agricultural Tractor 100-120 HP Market

The 100-120 horsepower (HP) category is one of the most sought after in Europe because of its adaptability for medium-sized farming operations. The tractors are optimally between power and energy efficiency, which makes them suitable for plowing, seeding, harvesting, and transportation on varied terrains. With both Western and Eastern Europe experiencing growth in mechanization, this segment is expanding at a fast pace. Farmers are opting for these mid-range tractors because they are more affordable than higher HP models and can handle a variety of agricultural implements. In countries such as France and Poland, this segment is popular and is likely to grow steadily. In November 2023, CNH Industrial launched the CR11 New Holland combine, with a robust 775-horsepower C16 engine, 2x24-inch rotors, and a large 567-bushel grain tank capacity, showcasing the industry's focus on technological innovation. These technologies are revolutionizing conventional farming practices, allowing farmers to attain greater productivity while maximizing resource efficiency.

Europe Agricultural Ploughs Equipment Market

Ploughs continue to be an essential piece of equipment in European agriculture, employed for tillage and land preparation. The demand for agricultural ploughs is fueled by conventional farming practices and the requirement for soil aeration and weed control prior to seeding. Demand is high in cereal and grain farming regions like Central and Eastern Europe. Farmers are looking for more robust and efficient ploughs with adjustable blades and simple attachment systems. Technological advancements, including hydraulic systems and sensor-ploughs, are becoming increasingly popular for enhancing the precision of tilling and minimizing disruption of the soil.

Europe Agricultural Combine Harvesters Equipment Market

Combine harvesters play a crucial role in high-capacity harvesting of grains in Europe, where wheat, barley, and maize are key produce. The market is expanding with heightened demands for efficiency, labor shortages, and time pressures during harvesting seasons. Contemporary combines include precision farming functions such as GPS-steered steering, yield mapping, and automatic adjustment. Such functions enhance harvesting speeds and reduce crop loss. Western European nations such as Germany and France are major adopters, with the Eastern European countries catching up through government-sponsored modernization initiatives. Rental services also facilitate short-term access for small-scale farms.

Europe Agricultural Lawnmowers Equipment Market

Lawnmower business in Europe is not just confined to landscaping but also contributes to small-scale and urban agriculture. Small-sized agricultural lawnmowers are utilized to clear tracks, upkeep green belts, and prepare land in vineyards and orchards. The business is boosted by growing interest in gardening, organic agriculture, and eco-friendly land care. Technological innovations such as electric and robotic mowers are increasingly popular, particularly in nations that are committed to lowering emissions. Germany, the UK, and the Netherlands are key markets because of their urban-agricultural integration and need for aesthetic land management solutions.

Europe Feed Preparation Machines Equipment Market

Feed preparation equipment is essential for livestock farming throughout Europe. These machines assist in mixing, grinding, and distributing animal feed, providing balanced nutrition and enhancing livestock health. With increasing concern for animal welfare and productivity, European farmers are adopting automated feed mixers and precision feeding systems. The growth of dairy and poultry farming, particularly in nations such as the Netherlands and Denmark, drives this segment. Integration with digital systems for feed monitoring and inventory management is a trend that is on the rise, rendering the equipment more efficient and desirable for medium to large-scale farms.

Europe Mounted or Trailed Equipment Market

Mounted and trailed implements such as sprayers, spreaders, and seeders are common on European farms for their adaptability to tractors and operational convenience. These equipment increase productivity by enabling multi-tasking using a single source of power. The demand is increasing because of the need for low-cost and easily mounted machinery that facilitates a range of farming operations. Farmers demand equipment with low fuel needs and accurate seed, fertilizer, and pesticide application. This segment is strongest in row-crop agricultural areas, and innovation in hydraulic systems and precision application is further improving its market attractiveness.

United Kingdom Agricultural Equipment Market

The United Kingdom agricultural equipment market is evolving quickly towards precision and sustainable agriculture. Post-Brexit policy changes have reformed subsidy regimes, compelling farmers to invest in effective machinery. Climate-smart agriculture focus in the country has encouraged demand for low-emission tractors, automatic sprayers, and battery-powered attachments. With a well-established agricultural sector, the UK experiences high demand for domestic and imported machinery. Nevertheless, labor shortages and shifting land use trends are encouraging additional mechanization. Leasing of equipment and government subsidies under the Environmental Land Management Scheme (ELMS) are also primary drivers of market expansion. For instance, in 2022, Case IH launched the LB 424 XLD model of large square baler that enhances bale quality, handling, and rotor cutter performance through the production of extra-dense 120 cm*70 cm bales by up to 10% of density.

France Agricultural Equipment Market

France possesses one of the strongest agricultural sectors in Europe and is thus one of the big markets for agriculture machinery. The nation focuses on sustainable farming, promoting the utilization of effective and environmentally friendly equipment. French agriculture receives active state assistance, such as subsidies for smart tools and new machinery in EU agricultural development programs. France's vast cereal and vineyard production necessitates high-performance tractors, harvesters, and mounted machinery. The nation's equipment makers also do lots of innovation with smart technology and exportation. Despite high demand, market challenges include rising equipment costs and regulatory compliance. According to the Food and Agriculture Organization, the wheat harvested area increased to 5.00 million hectares in 2023 from 4.94 million hectares in 2022.

Germany Agricultural Equipment Market

Germany is a technological leader in agricultural machinery manufacturing and usage. The country’s advanced infrastructure and focus on innovation make it a key hub for precision agriculture. German farms often employ GPS-guided tractors, autonomous equipment, and IoT-connected machinery. Government incentives for sustainable and organic agriculture also increase investment in advanced equipment. With a robust domestic machinery sector, Germany is also a leading exporter of farm equipment. The market is witnessing growing demand for automated harvesters, low-emission tractors, and robotic equipment. For instance, in 2022, Case IH launched the LB 424 XLD large square baler model, adding bale quality, handling, and rotor cutter performance by making extra dense 120 cm*70 cm bales with up to an extra 10% density.

Europe Agricultural Equipment Market Segments

Horsepower – Market breakup in 5 viewpoints:

- Agricultural tractors > 120 hp

- Agricultural tractors 100-120 hp

- Agricultural tractors 80-99 hp

- Agricultural tractors 50-79 hp

- Agricultural tractors <= 49 hp

Soil working, sowing and fertilizing equipment Market

- Soil working equipment (ploughs, harrows, cultivators, etc.)

- Sowing equipment

- Mineral or chemical fertilizer spreaders

- Manure spreaders

- Other soil working or cultivation machines, equipment, machinery

Harvesting Equipment

- Combine harvesters

- Self-propelled forage harvesters

- Other Harvesting equipment

Garden and forestry machinery

- Lawnmowers

- Forestry equipment

- Chainsaws H

- Hedge trimmers, lawn shears, electric lawn edging shears

Livestock Equipment:

- Livestock watering, feeding and rearing equipment

- Feed preparation machines and equipment

- Milking machines

- Other livestock equipment

Haymaking Equipment

- Mounted or Trailed

- Others haymaking

Irrigation and Crop Protection Equipment

- Sprayers, mounted or trailed

- Portable sprayers, with or without motor

- Mechanical irrigation systems

- Other crop protection sprayers

Agricultural trailers and semi-trailers Market

Machines for cleaning and sorting agricultural products Market

Europe Country – Market breakup in 20 viewpoints:

- France

- Germany

- Italy

- United Kingdom

- Poland

- Austria

- Netherlands

- Finland

- Romania

- Denmark

- Hungary

- Portugal

- Ireland

- Lithuania

- Greece

- Croatia

- Estonia

- Latvia

- Luxembourg

- Rest of Europe

European Hay-Making Machine Market

- France

- Germany

- Italy

- United Kingdom

- Poland

- Austria

- Netherlands

- Finland

- Romania

- Denmark

- Hungary

- Portugal

- Ireland

- Lithuania

- Greece

- Croatia

- Estonia

- Latvia

- Luxembourg

- Rest of Europe

Companies have been covered from 5 viewpoints

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Key Players Analysis

- John Deere

- AGCO

- CLAAS KGaA

- First Tractor Company Limited

- Kubota Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Equipment and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Agricultural Equipment Market

6. Europe Agriculture Equipment Market share Analysis

6.1 By Equipment Market Share

6.2 By Country Market Share

7. Europe Agriculture Equipment by Machine Parts

8. European Agricultural Tractors Market by Horsepower

8.1 Tractors 120 hp

8.2 Agricultural tractors 100-120 hp

8.3 Agricultural tractors 80-99 hp

8.4 Agricultural tractors 50-79 hp

8.5 Agricultural tractors <= 49 hp

9. Soil working, sowing and fertilizing equipment Market

9.1 Soil working equipment (ploughs, harrows, cultivators, etc.)

9.2 Sowing equipment

9.3 Mineral or chemical fertiliser spreaders

9.4 Manure spreaders

9.5 Other soil working or cultivation machines, equipment, machinery

10. European Market of Harvesting Equipment

10.1 Combine harvesters

10.2 Self-propelled forage harvesters

10.3 Other harvesting equipment

11. Garden and forestry machinery Market

11.1 Lawnmowers

11.2 Forestry equipment

11.3 ChainsawsH

11.4 Hedge trimmers, lawn shears, electric lawn edging shears

12. Livestock Equipment Market

12.1 Livestock watering, feeding and rearing equipment

12.2 Feed preparation machines and equipment

12.3 Milking machines

12.4 Other livestock equipment

13. Haymaking Equipment Market

13.1 Mounted or Trailed

13.2 Others haymaking

14. Balers and pick-up balers

15. Irrigation and Crop Protection Equipment Market

15.1 Sprayers, mounted or trailed

15.2 Portable sprayers, with or without motor

15.3 Mechanical irrigation systems

15.4 Other crop protection sprayers

16. Agricultural trailers and semi-trailers Market

17. Machines for cleaning and sorting agricultural products Market

18. By Country – Europe Agriculture Equipment Market

18.1 France

18.2 Germany

18.3 Italy

18.4 United Kingdom

18.5 Poland

18.6 Austria

18.7 Netherlands

18.8 Finland

18.9 Romania

18.10 Denmark

18.11 Hungary

18.12 Portugal

18.13 Ireland

18.14 Lithuania

18.15 Greece

18.16 Croatia

18.17 Estonia

18.18 Latvia

18.19 Luxembourg

18.20 Rest of Europe

19. Market and Volume – European Hay-Making Machine

19.1 France

19.1.1 Market

19.1.2 Volume

19.2 Germany

19.2.1 Market

19.2.2 Volume

19.3 Italy

19.3.1 Market

19.3.2 Volume

19.4 United Kingdom

19.4.1 Market

19.4.2 Volume

19.5 Poland

19.5.1 Market

19.5.2 Volume

19.6 Austria

19.6.1 Market

19.6.2 Volume

19.7 Netherlands

19.7.1 Market

19.7.2 Volume

19.8 Finland

19.8.1 Market

19.8.2 Volume

19.9 Romania

19.9.1 Market

19.9.2 Volume

19.10 Denmark

19.10.1 Market

19.10.2 Volume

19.11 Hungary

19.11.1 Market

19.11.2 Volume

19.12 Portugal

19.12.1 Market

19.12.2 Volume

19.13 Ireland

19.13.1 Market

19.13.2 Volume

19.14 Lithuania

19.14.1 Market

19.14.2 Volume

19.15 Greece

19.15.1 Market

19.15.2 Volume

19.16 Croatia

19.16.1 Market

19.16.2 Volume

19.17 Estonia

19.17.1 Market

19.17.2 Volume

19.18 Latvia

19.18.1 Market

19.18.2 Volume

19.19 Luxembourg

19.19.1 Market

19.19.2 Volume

19.20 Rest of Europe

19.20.1 Market

19.20.2 Volume

20. Porter’s Five Forces

20.1 Bargaining Power of Buyer

20.2 Bargaining Power of Supplier

20.3 Threat of New Entrants

20.4 Rivalry among Existing Competitors

20.5 Threat of Substitute Products

21. SWOT Analysis

21.1 Strengths

21.2 Weaknesses

21.3 Opportunities

21.4 Threats

22. Key Players Analysis

22.1 John Deere

22.1.1 Overviews

22.1.2 Key Person

22.1.3 Recent Developments

22.1.4 Product Portfolio

22.1.5 Revenue

22.2 AGCO

22.2.1 Overviews

22.2.2 Key Person

22.2.3 Recent Developments

22.2.4 Product Portfolio

22.2.5 Revenue

22.3 CLAAS KGaA

22.3.1 Overviews

22.3.2 Key Person

22.3.3 Recent Developments

22.3.4 Product Portfolio

22.3.5 Revenue

22.4 First Tractor Company Limited

22.4.1 Overviews

22.4.2 Key Person

22.4.3 Recent Developments

22.4.4 Product Portfolio

22.4.5 Revenue

22.5 Kubota Corporation

22.5.1 Overviews

22.5.2 Key Person

22.5.3 Recent Developments

22.5.4 Product Portfolio

22.5.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com