Europe Automotive Robotics Market Global Report Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Automotive Robotics Market Trends & Summary

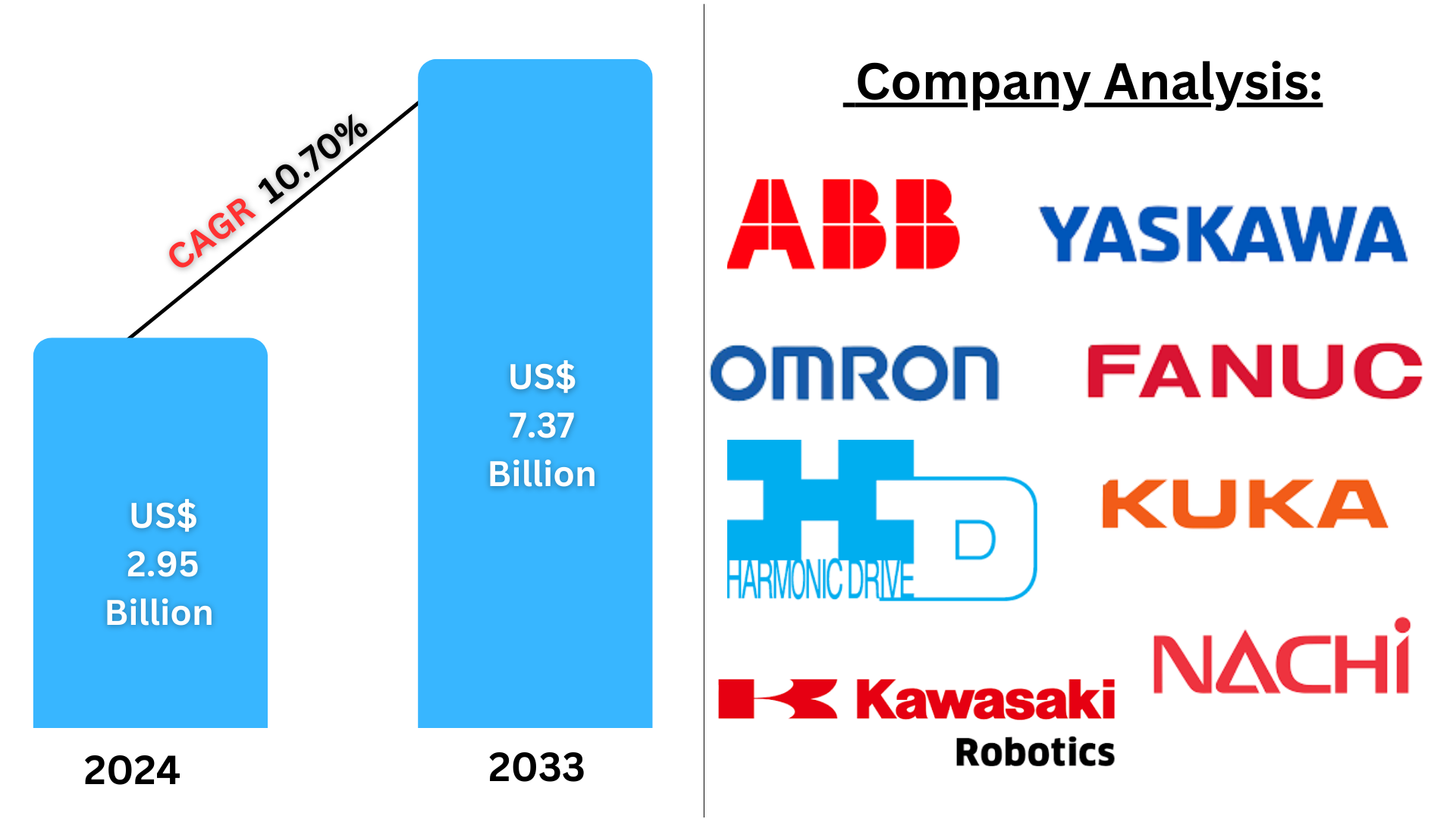

Europe automotive robotics market is expected to expand from US$ 2.95 billion in 2024 to US$ 7.37 billion by 2033, registering a strong CAGR of 10.70% during 2025-2033. The growth is fueled by the growing automation of vehicle production, AI and machine learning technologies, and the need for precision and efficiency in European automotive production processes.

Europe Automotive Robotics Market Report By Component (Sensors, Controller, End Effector, Robotic Arm, Drive, Others), Types (Articulated, Cartesian, Scara, Cylindrical, Others, Application (Welding, Material Handling, Painting, Cutting, Others), Country (Germany, UK, France, Russia, Spain, Italy, Rest of Europe, and Company Analysis 2024-2032

Europe Automotive Robotics Market Outlooks

Automotive robotics applies automatic systems to its vehicle manufacturing and assembly operations, e.g., robotic arms and artificial intelligence-based equipment. The robots have several roles, including welding, painting, handling materials, and quality checking, enhancing the efficiency, accuracy, and safety of production. In Europe, automotive robotics plays an important role in developing smart manufacturing and Industry 4.0 projects. Major automobile companies, such as those in Germany, France, and Italy, are adopting robotic automation to improve productivity and minimize labor expenses. Collaborative robots (cobots) are also becoming increasingly popular, working in tandem with human employees to maximize workflow.

The need for energy-efficient, high-quality, and personalized vehicles fuels the use of robotics in Europe's automotive industry. Robotics also aids in sustainability by reducing material waste and maximizing energy consumption. As AI, machine learning, and sensor technologies continue to advance, the European automotive robotics market is poised to expand considerably, defining the future of smart and automated vehicle manufacturing.

Growth Drivers in the Europe Automotive Robotics Market

Advancements in AI and Machine Learning

Integrating artificial intelligence (AI) and machine learning in automotive robotics has revolutionized vehicle manufacturing. These technologies enhance robotic vision, precision, and predictive maintenance, ensuring smoother operations. AI-driven robots can self-optimize processes, reducing defects and improving efficiency. European manufacturers are increasingly investing in AI-powered robotic automation to stay competitive. With the advent of smart factories, AI-powered robotics powers the digitalization of the automotive industry, making manufacturing quicker, more precise, and economical. The trend is forecasted to power the long-term development of the European automotive robotics industry. February 2025, The European Commission has launched a €200 billion ($208.4bn) InvestAI initiative to accelerate AI deployment in strategic sectors, specifically automotive production. This project would set up AI gigafactories, revolutionizing automobile manufacturing, automation, and digitalization. The shift is a major leap towards embedding artificial intelligence in mainstream manufacturing systems.

Increasing Need for Electric Vehicles (EVs)

The transition to electric vehicles (EVs) has profoundly driven the demand for automobile robotics in Europe. Production of EVs demands specialized assembly methods and very high precision, which robotic automation can easily manage. Robots enable battery manufacturing, body assembly of vehicles, and component integration with low error rates. With the European Union driving tighter emission standards and incentives for EV uptake, automakers are stepping up investment in robotics to improve efficiency, lower costs, and address rising consumer demand for eco-friendly mobility solutions. September 2024, Leapmotor International and Stellantis have launched orders in Europe for its compact city car T03 and larger C10 SUV. The partnership will offer affordable, high-tech electric vehicles to capture the growing demand for clean mobility. It also reflects Stellantis' determination to strengthen its range of eco-friendly vehicles.

Industry 4.0 Growth and Smart Factories

Industry 4.0 is transforming European automotive production with digitalization and automation. Smart factories combine robotics with IoT, big data analytics, and cloud computing to enhance productivity. Automotive manufacturers utilize robotic automation for real-time monitoring, predictive maintenance, and adaptive manufacturing. Such developments enable greater flexibility in production lines, serving mass production and customized car manufacturing. European carmakers and suppliers are embracing Industry 4.0 technologies to sustain global competitiveness, with robotics becoming a crucial enabler for innovation and operational productivity in the car industry. June 2024, The UK Government is spending £4.5 billion to reduce carbon emissions and improve British manufacturing, of which £2 billion will go towards the automotive industry. The investment underlines the interdependence between the move to electric cars (EVs) and Industry 4.0 technologies. As automakers shift to EV manufacturing, the implementation of these technologies is essential in minimizing downtimes, enhancing safety, and product quality, and enabling mass customization and electrification of production processes.

Challenges in the Europe Automotive Robotics Market

High Initial Investment Costs

One of the biggest challenges in the European automotive robotics market is the high initial investment cost of buying, installing, and maintaining robotic systems. Small and medium-sized car companies may not be able to afford sophisticated robotics because of their limited budgets. Robotics has to be integrated into current manufacturing systems, which necessitates specialized skills and upgrading of infrastructure. Although automation promises long-term cost savings, the initial capital outlay can prove to be a major deterrent to adoption, slowing the rate of robotics implementation in the European automotive industry.

Workforce Displacement and Skill Gaps

The swift transition to automotive robots in Europe is causing fears over job displacement and reskilling. Automation is replacing traditional factory work, demanding that workers be skilled in the programming, servicing, and embedding of robots, as well as AI. Still, there's an emerging skill shortage in Europe's labor pool, with fewer trained professionals capable of running and maintaining sophisticated robot systems. This dilemma requires greater investment in worker training programs to allow for a seamless shift towards automation-based manufacturing.

Europe Automotive Robotics Sensors Market

Sensors are key in automotive robotics through enabling accurate movement, detection of objects, and real-time decision-making. The robotic sensors market in Europe is growing with the need for high-end vision, proximity, and force sensors that enhance the accuracy of automation. The sensors boost safety, efficiency, and flexibility in robot operations, thus being vital in car manufacturing.

Europe Automotive Robotics Controller Market

Robotic controllers are the minds of automation systems, controlling robotic movement, processing inputs, and carrying out commands. In Europe, the growing use of smart controllers with AI is enhancing efficiency in automotive production. The controllers enable smooth communication between robotic arms, vision systems, and production lines, maximizing factory operations and minimizing downtime.

Europe Automotive Robotics Articulated Market

With their flexibility along multiple axes, articulated robots are applied extensively in European automobile factories for painting, welding, and material handling. They have high accuracy and flexibility and hence are well-suited for sophisticated assembly operations. Articulated robotics is funded by European car manufacturers to maximize production rates and minimize defects in manufacturing.

Europe Automotive Robotics Cartesian Market

Cartesian robots, with their linear motion and high precision, are widely applied in European automotive production for part-handling, loading, and unloading operations. Cartesian robots are used in applications that need high precision and consistency. The market for Cartesian robots is increasing as producers need automation solutions for repetitive, high-precision operations.

Europe Automotive Robotics Welding Market

Welding is a vital process in car manufacturing, and robot welding systems are extensively used across Europe to enhance efficiency and precision. Robotic welding minimizes errors, increases worker safety, and provides high-quality vehicle assembly. As electric and hybrid vehicles gain popularity, European factories are demanding automated welding solutions.

Europe Automotive Robotics Cutting Market

Automotive robotics is revolutionizing the cutting process in vehicle production through increased accuracy and minimizing material waste. European automotive manufacturers employ robotic cutting systems in operations like metal component trimming, plastic part shaping, and etching vehicle components. These automatic systems maximize speed in production and uphold high quality standards.

Germany Automotive Robotics Market

Germany dominates the European automotive robotics market, spurred by its high-tech manufacturing industry and extensive base of big automakers such as Volkswagen, BMW, and Mercedes-Benz. The nation's investment in AI-driven robotics and Industry 4.0 drives automation adoption. Germany's emphasis on precision engineering and efficiency remains to make it a center of automotive robotics innovation. Jan 2025, Locus Robotics and The Quality Group (TQG) have joined forces to install the LocusOne mobile robotics platform at TQG's new 40,000 sqm Elsdorf, Germany, fulfillment center. Full deployment will begin in a few weeks, with the goal of scaling to address growing demand for TQG's high-quality, locally manufactured products.

France Automotive Robotics Market

France is witnessing consistent growth in the adoption of automotive robotics, especially for smart manufacturing and electric vehicle manufacturing. French automobile manufacturers are using robotics to improve efficiency in assembly lines, optimize material handling, and enhance welding. Government policies encouraging automation and sustainability in automotive manufacturing are further driving the robotics market. May 2024, GXO Logistics implemented large-scale robotics in Europe for a leading sporting goods retailer, improving order processing speed, seasonality agility for volume changes, and efficiency gains.

United Kingdom Automotive Robotics Market

The automotive robotics market in the UK is expanding as there is a growing need for automation in vehicle production and supply chain operations. British car manufacturers are incorporating robotics to improve production efficiency and comply with regulatory requirements for vehicle safety and emissions. The transition to electric cars and autonomous driving technologies is also propelling investments in robotics. November 2024, DPD is the first UK parcel delivery firm to roll out Ottonomy's autonomous locker robot, the Ottobot. With a 70kg payload capacity, it is larger than DPD's existing delivery robots. Ottobot has a four-wheel drive swerve drive and employs multiple sensors and software for autonomous mobility in complex scenarios.

Italy Automotive Robotics Market

Italy, famous for producing luxury cars and sports cars, invests in sophisticated robots to ensure top production quality. Ferrari and Lamborghini are taking up robotic automation for precision engineering and customized car assembly. The Italian automotive robotics industry is growing as companies concentrate on increasing efficiency, decreasing costs, and preserving craftsmanship in car manufacturing. June 2023, ADR Ventures has invested in Ottonomy Inc., a company that develops autonomous robots for contactless delivery. Ottonomy recently demonstrated a successful proof of concept at Rome's Fiumicino International Airport during an accelerator program.

Europe Automotive Robotics Market Segments

Component

- Sensors

- Controller

- End Effector

- Robotic Arm

- Drive

- Others

Types

- Articulated

- Cartesian

- Scara

- Cylindrical

- Others

Application

- Welding

- Material Handling

- Painting

- Cutting

- Others

Countries

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key persons

- Recent Development

- Revenue

Key Players Analysis

- ABB

- FANUC CORPORATION

- Yaskawa Electric Corporation

- Omron Corporation

- Kawasaki Robotics Inc.

- Harmonic Drive AG

- Nachi-Fujikoshi Corp.

- KUKA Robotics

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Component, By Type, By Application and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What is the projected market size of the Europe automotive robotics market by 2033?

- What is the expected CAGR of the Europe automotive robotics market from 2025 to 2033?

- What are the key factors driving the growth of the automotive robotics market in Europe?

- How is AI and machine learning impacting automotive robotics in Europe?

- What role do collaborative robots (cobots) play in European automotive manufacturing?

- How does the increasing adoption of electric vehicles (EVs) influence the demand for automotive robotics?

- What is the impact of Industry 4.0 and smart factories on the automotive robotics sector in Europe?

- What are the main challenges faced by the automotive robotics market in Europe?

- How does the high initial investment cost affect the adoption of robotics in European automotive manufacturing?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Europe Automotive Robotics Market

6. Market Share Analysis

6.1 By Types

6.2 By Components

6.3 By Application

6.4 By Country

7. Component

7.1 Sensors

7.2 Controller

7.3 End Effector

7.4 Robotic Arm

7.5 Drive

7.6 Others

8. Types

8.1 Articulated

8.2 Cartesian

8.3 Scara

8.4 Cylindrical

8.5 Others

9. Application

9.1 Welding

9.2 Material Handling

9.3 Painting

9.4 Cutting

9.5 Others

10. Country

10.1 Germany

10.2 UK

10.3 France

10.4 Russia

10.5 Spain

10.6 Italy

10.7 Rest of Europe

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 ABB

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 FANUC CORPORATION

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Yaskawa Electric Corporation

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Omron Corporation

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Kawasaki Robotics Inc.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Harmonic Drive AG

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Nachi-Fujikoshi Corp.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 KUKA Robotics

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com