Europe Baby Food and Infant Formula Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Infant Formula and Baby Food Market Trends & summary

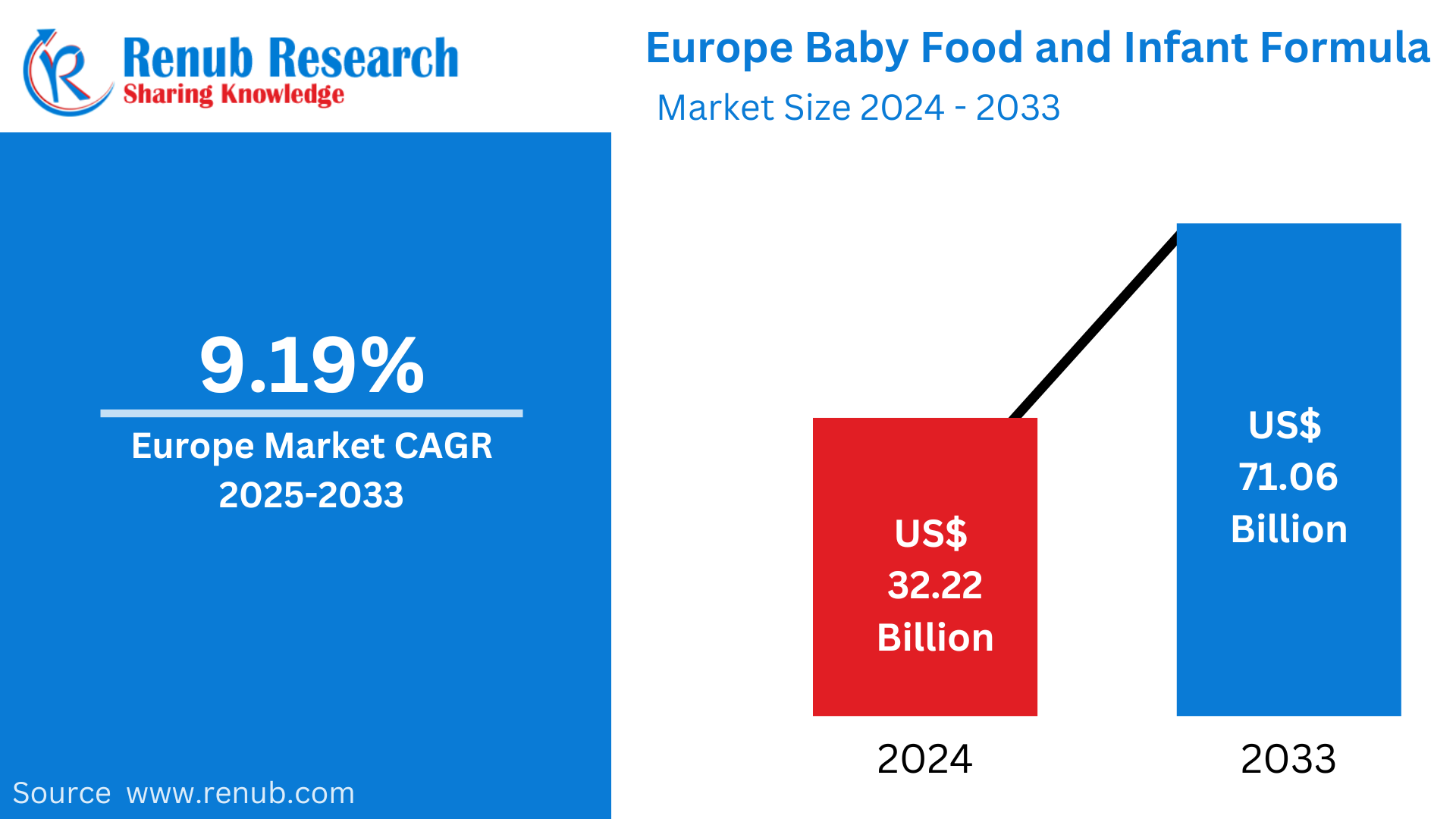

The size of the Europe infant formula and baby food market will be US$ 71.06 Billion by 2033, growing from US$ 32.22 Billion in 2024 at a CAGR of 9.19% between 2025 and 2033. The growth of the market is stimulated by a growing level of consciousness among parents regarding infant nutrition, rising demand for organic and premium food products, and growing retail and e-commerce channels in the region.

Europe Baby Food and Infant Formula Market Report by Types – Europe Baby Food and Infant Formula Market (Milk Formula, Dried Baby Food, Prepared Baby Food, Others), Distribution Channel (Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Others), Country (Germany, France, United Kingdom, Italy, Spain, Others)and Company Analysis 2025-2033

Europe Baby Food and Infant Formula Market Outlooks

Baby food and infant formula are specially formulated nutrition products for infants and toddlers who are weaning from breast milk or need supplemental nutrition. Baby food consists of pureed fruits, vegetables, grains, and meats, as well as cereals and snacks. Infant formula, however, is a scientifically formulated alternative to breast milk that contains essential nutrients like proteins, vitamins, and minerals for proper growth.

In Europe, infant formula and baby food are essential in providing infants with balanced nutrition. Growing awareness of infant health, hectic lifestyles of parents, and rising demand for natural and organic products have helped fuel market expansion. Parents depend on these foods for convenience, particularly when breastfeeding is not feasible. Moreover, strict European legislation provides high standards of safety and quality in baby nutrition, increasing consumer confidence. With advances in formula content and baby food ingredients, the market keeps growing, addressing varied dietary requirements.

Growth Drivers in the European Baby Food and Infant Formula Market

Growing Demand for Organic and Natural Products

Parents in Europe are increasingly demanding organic and natural baby foods due to increased health awareness and concerns regarding artificial additives. The trend has brought about a boom in organic baby food products, and manufacturers have taken the challenge to innovate and increase their organic product offerings to cater to consumer demand. September 2024, Bobbie, the female-led and founded pediatric nutrition company, announced its retail availability of its USDA Organic certified and American-manufactured, European-style infant formulas at Whole Foods Market locations nationwide. Bobbie's Organic and Organic Gentle Infant Formulas will now be on the shelf in around 500 baby food stores to keep pace with growing demand for high-quality, USDA Organic infant formula.

Growing Number of Working Mothers

Increasing women's workforce participation in Europe has greatly affected the market for baby food. With reduced time available for breastfeeding and preparing home-based baby food, working mothers have been turning towards ready-to-consume baby food and infant formula. This move has fueled demand for convenient as well as wholesome feeding options and thus has caused the market to grow. March 2024, The male-female employment gap is termed as the divergence between the employments of both men and women in the working age group i.e. from 20 to 64. In 2019, the EU set a goal to halve the gender employment gap by 2030. However, according to Eurostat, in 2022, only one in five EU regions had already met the target set at 5.8 percentage points (pp) and only two EU regions registered a higher employment rate among women (The Capital Region of Lithuania and South Finland). The EU gender employment gap was 10.7 pp, just 0.2 pp lower than in 2021.

Advances in Product Formulation Technology

Food technology advances have made it possible to create baby food and infant formula products that closely resemble the nutritional composition of breast milk. Innovations like the addition of probiotics, prebiotics, and other functional ingredients have improved the nutritional quality of these products to meet the changing demands of health-aware parents. In July 2022, United Kingdom-based organic baby and toddler food company Organix launched 29 new lines and two new ranges called Baby Meals and Organix Kids and said that these will be launched first in Asda and the Organix Online Shop. It also said that it will launch additional additions to its existing finger food and snack ranges.

Challenges in the European Baby Food and Infant Formula Market

Tight Regulatory Requirements

The European baby food industry operates under tight rules to maintain the safety and quality of products. Although such measures are crucial in protecting consumers, they also levy high compliance charges on producers. Compliance with highly complicated regulatory schemes may be exceedingly difficult for medium and small companies, and consequently, it might discourage market entrance and innovation.

Consumer Mistrust and Safety Issues

High-profile scandals and controversies regarding baby food quality and safety have diminished consumer confidence in certain brands. Establishing and sustaining consumer trust is crucial to long-term success in the market. Manufacturers have to place great emphasis on transparency, quality control, and open communication to ensure safety and win back parents' trust.

European Baby Milk Formula Market

Milk formula continues to be a staple of infant nutrition in Europe, providing a well-balanced substitute for breast milk. The market is dominated by a range of formulations designed for various stages of infant development, ranging from starting milk, through follow-on milk, to toddler milk. Formulation advances have increased the nutritional profiles of these products, bringing them closer to the composition of breast milk.

European Dried Baby Food Market

Dried baby food items, including infant cereals and purees, are in demand due to their convenience and long shelf life. The products are frequently fortified with important vitamins and minerals to nourish infant growth and development. The segment is witnessing growth because of the growing demand for quick and convenient meal options among parents.

European Baby Food and Infant Formula Pharmacies Market

Pharmacies are key in distributing infant formula and baby food, particularly specialized ones for babies with particular nutritional requirements. Parent confidence in pharmacies for health products drives the growth of the segment. Pharmacies tend to offer various alternatives, such as hypoallergenic and organic formulas, to cater to varied consumer demands.

European Baby Food and Infant Formula Convenience Stores Market

Convenience stores provide ready access to infant formula and baby food, which are convenient options for parents looking for quick and easy shopping. Ready-to-eat and easy-to-prepare baby food products in convenience stores meet the hectic lifestyles of contemporary parents. The segment is growing as convenience is a key concern for consumers.

Germany Baby Food and Infant Formula

Germany's infant formula and baby food market is dominated by a wide variety of products addressing the nutritional requirements of infants. The market is driven by factors like urbanization, rising disposable incomes, and lifestyle changes, resulting in consistent growth. The increasing number of working women and rising parental interest in infant nutrition are propelling the market. In 2022, Danone introduced a new plant and dairy blend baby formula that would lead to fulfilling the parent's wish to feed nutritional material to their babies. Danone introduced the formula for parents in need of vegetarian, plant-based meals and flexitarian infant food for their babies.

France Baby Food and Infant Formula

France's infant food and baby formula market is growing due to rising interest in infant nutrition and more working mothers. Organic and natural baby food are also fueling market growth. Companies are addressing the growth by providing a range of products that satisfy the sophisticated palate of French consumers.

United Kingdom Baby Food and Infant Formula

The UK infant formula and baby food market is driven by health awareness among parents and the growing proportion of working mothers. The regulatory authorities have suggested steps to make the market more transparent and affordable, with the aim of giving parents greater choices and improved information. Nov. 2023, ELSE NUTRITION HOLDINGS INC has launched its well-received, Plant-Based Complete Nutrition Toddler Drink in the United Kingdom ("UK"), securing its foundation with collaborations from major UK distributors. This accomplishment reflects the Company's deliberate measures to enter emerging foreign markets and the Company's first venture in the multi-billion-dollar European marketplace.

Italy Baby Food and Infant Formula

Italy's baby food and infant formula market is marked by a demand for organic and traditional products. The growing number of working women and increasing awareness about infant nutrition are fueling the demand for healthy and convenient baby foods. Marketers are concentrating on product innovation to keep pace with changing Italian consumer needs.

Europe Infant Formula and Baby Food Market Segments

Types

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

Country

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key persons

- Recent Development

- Revenue

Key Players Analysis

- Abbott Laboratories

- Nestle SA

- Danone SA.

- Hain Celestial Group

- Hipp GmbH & Co Vertrieb KG

- Organix Brands Company

- H. J. Heinz Company

- Ella's Kitchen (Hain Celestial Group)

- Oliver's Cupboard Brand Ltd

- Holle baby food GmbH

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Products, By Distribution Cannel and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Europe Baby Food and Infant Formula Market

6. Market Share Analysis

6.1 By Types

6.2 By Distribution Channel

6.3 By Country

7. Types

7.1 Milk Formula

7.2 Dried Baby Food

7.3 Prepared Baby Food

7.4 Others

8. Distribution Channel

8.1 Supermarkets and Hypermarkets

8.2 Pharmacies

8.3 Convenience Stores

8.4 Others

9. Country

9.1 Germany

9.2 France

9.3 United Kingdom

9.4 Italy

9.5 Spain

9.6 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Abbott Laboratories

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Nestle SA

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Danone SA.

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Hain Celestial Group

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Hipp GmbH & Co Vertrieb KG

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.6 Organix Brands Company

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.7 H. J. Heinz Company

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.8 Ella's Kitchen (Hain Celestial Group)

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.9 Oliver's Cupboard Brand Ltd

12.9.1 Overviews

12.9.2 Key Person

12.9.3 Recent Developments

12.10 Holle baby food GmbH

12.10.1 Overviews

12.10.2 Key Person

12.10.3 Recent Developments

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com