Europe Biopsy Devices Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Biopsy Devices Market Size & Summary

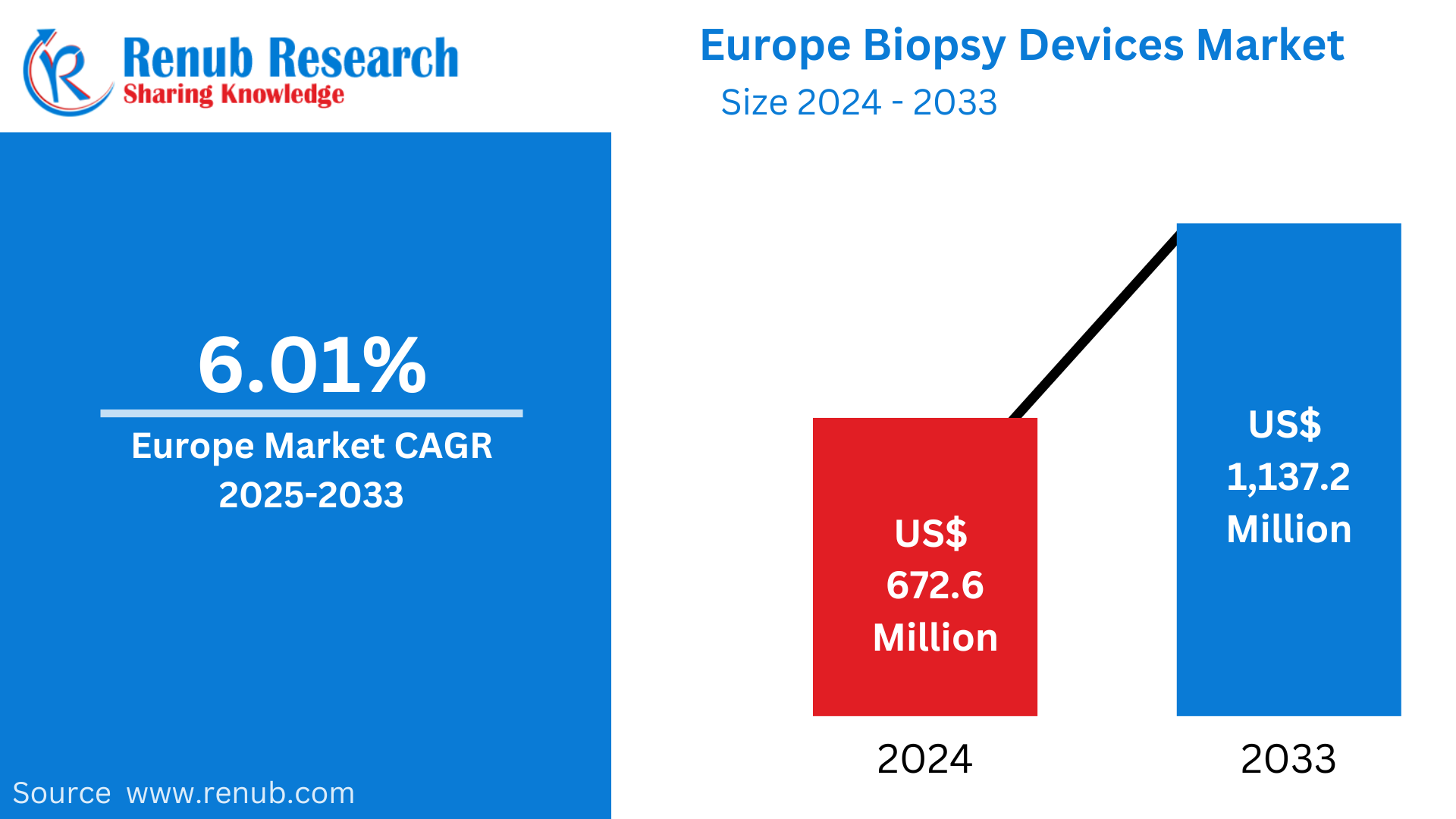

The European biopsy devices market is estimated to grow US$ 1,137.2 million in 2033, growing from US$ 672.6 million in 2024 at a CAGR of 6.01% from 2025 to 2033. The major driving factors for this market are incrementing cancer cases, advancements in biopsy technologies, and the increasing demand for minimally invasive procedures. Improvement in diagnostic accuracy and adopting image-guided biopsy methods also contribute to this market expansion.

The report Europe Biopsy Devices Market & Forecast covers by Product Biopsy (Needle Based Devices, Forceps, Localization Wire, and Others Products), Imaging Technology (CT scan, Stereotactic Guided, Ultrasound Guided, MRI Guided, and Others), End-User (Hospital and Clinics, Diagnostics Laboratories, and Other), Country and Company Analysis 2025-2033

Europe Biopsy Devices Market Outlooks

Biopsy devices are medical instruments that remove a small tissue sample from the body for diagnostic examination. These devices are crucial in diagnosing various conditions, including cancer, infections, and inflammatory diseases. Biopsy procedures can be performed using techniques such as fine needle aspiration, core needle biopsy, and surgical biopsy. Biopsy devices are typically made from high-quality materials to ensure precision and minimal discomfort to the patient.

Biopsy devices are important tools for diagnosing several diseases that plague Europe, most particularly cancer. The rate of cancer incidence-which is described to increase yearly among women especially for breast and lung cancer-is what drives the demand for biopsy devices. These devices ensure minimally invasive procedures whereby the doctor acquires tissue samples with low risks and quicker recovery times. Biopsy devices are used throughout hospitals, diagnostic clinics, and research institutions in Europe, driving innovation in precision medicine. Image-guided biopsy methods, such as ultrasound or MRI-guided biopsies, further improve the accuracy of diagnostics and patient care.

Growth Factors in the European Biopsy Devices Industry

Increasing Cancer Cases

The incidence of cancer in Europe is rising, which is one of the key growth factors for the biopsy devices industry. Rising cancer rates, particularly breast, prostate, and lung cancers, fuel the need for early diagnosis and tissue sampling. The detection of malignancies at an early stage enhances treatment outcomes. With a rapidly aging population and changing lifestyles, the prevalence of cancer-related conditions is expected to increase. Further demand in the European healthcare market will arise for innovative biopsy technologies.

Improvements in Biopsy Technology

The European market's growth is immensely influenced by the technological advancements of biopsy devices. Improved minimally invasive biopsy techniques, like core needle and image-guided biopsies, ensure more accuracy, reduced patient discomfort, and faster recovery times. Thus, these advanced benefits encourage the use of biopsy devices in healthcare settings-from hospitals to diagnostic clinics-and incorporation of advanced imaging technologies such as ultrasound, MRI, and CT scans for precision during diagnosis, and thereby drive the expansion of the market.

Increasing Adoption of Minimally Invasive Procedures

Minimally invasive procedures are increasingly adopted in Europe, mainly because they carry fewer risks, faster recovery, and less healthcare cost than traditional surgeries. Biopsy devices are among the most popular trends in this direction, allowing tissue collection with smaller incisions, less pain, and minimal complications. Patients and healthcare providers prefer these options, driving demand for advanced biopsy technologies. This is a great trend for fewer invasive diagnostic techniques especially to identify cancers and other serious diseases that propel the market of biopsy devices.

Obstacle in European Biopsy Devices Industry

Cost Expensive Latest Biopsy Equipment

High prices of the most advanced biopsy devices have posed to be the significant problem of the European market. Newer technologies, such as image-guided biopsy systems, are more accurate and comfortable for patients. However, they are expensive and not easily accessible in budget-constrained regions or public healthcare systems. The cost may limit their widespread use, especially in smaller healthcare facilities or less economically developed areas. Thus, manufacturers are challenged to come up with cost-effective solutions without compromising the precision and quality of the biopsy process.

Regulatory and Compliance Issues

In the European market, the regulations are quite difficult to deal with. The rules and regulations formulated by the EMA and all the national health authorities are challenging. It also takes a great deal of time and money in terms of adherence to medical devices regulations, particularly the EU MDR. All these may contribute to delayed product releases, recalls, or even some form of ban on the sales of the biopsy devices. Besides this, the constantly changing regulatory environment requires continuous upgradation of systems, adding an extra layer of complexity to the companies in such a highly regulated environment.

Needle-Based Biopsy Devices Market

The market for needle-based biopsy devices is growing at a rapid pace, mainly due to their minimally invasive nature, which provides a reduced recovery time and lesser risk for the patients. These devices are widely used to obtain tissue samples for diagnostic purposes, particularly in detecting breast, prostate, and liver cancers. Needle-based biopsies, including fine needle aspiration (FNA) and core needle biopsies, are gaining popularity due to their ability to provide accurate results with less discomfort than traditional surgical biopsies. Advancements in technology, such as image-guided needle biopsies, further enhance precision and accuracy, contributing to the market's expansion.

CT Scan Biopsy Device Market

The demand for accurate and minimally invasive diagnostic procedures is increasing the CT scan biopsy devices market. CT scan-guided biopsy devices use imaging technology to locate and precisely target tissues for biopsy, ensuring high sample collection accuracy. These devices are handy for tumors located in hard-to-reach areas, such as the lungs, liver, and pancreas. The market is driven by advancements in imaging technology, the rising incidence of cancer, and the growing preference for minimally invasive procedures. As healthcare facilities adopt more advanced diagnostic tools, the CT scan biopsy devices market is expected to expand.

Hospital and Clinics Biopsy Device Market

The hospital and clinic biopsy devices market is experiencing significant growth, driven by the increasing need for accurate and early diagnosis of diseases, especially cancer. This range of biopsy instruments includes needle-based, surgical, and image-guided biopsy instruments, mainly within hospitals and clinics. Increasing needs for minimally invasive procedures and fast recovery combined with the greater diagnostic accuracy in recent years sustain growth in this market. An increased number of outpatient clinics operating high-end diagnostics facilities further augment the usage of biopsy devices worldwide. As the healthcare sector focuses on precision medicine, the market for biopsy devices in hospitals and clinics continues to grow.

United Kingdom Biopsy Devices Market Size

The United Kingdom's biopsy device market is growing steadily, driven by the increasing demand for early detection of diseases such as cancer, cardiovascular conditions, and infections. With the increased cases of cancer, especially breast, prostate, and colorectal cancers, there is an ever-increasing demand for exact diagnostic tools. All biopsy devices, such as the needle-based, core needle, and image-guided systems, are used in most hospitals, diagnostic centers, and research institutions. The health system of UK is primarily concerned with improving the early diagnosis and patients' outcomes. The enhancement of technological applications in biopsy devices through minimally invasive procedures and improved imaging technologies will lead to increased adoption. The market is also supported by a robust regulatory environment, ensuring the safety and efficacy of products.

Germany Biopsy Devices Market Size

The German biopsy device market is growing due to demand for early disease detection and advancements in medical technologies. As one of the biggest healthcare markets in Europe, Germany is steadily seeing an increase in cancer patients, which will continue to boost the demand for accurate diagnostic tools such as biopsy. The growing demand for fine needle aspiration (FNA) and core needle biopsies will be closely related to developments in image-guided biopsy systems that enhance accuracy in diagnosis. Germany's strong healthcare infrastructure, emphasis on minimally invasive procedures, and patient-centric care are further driving the growth of the market. Moreover, the growing emphasis on precision medicine and personalized treatment plans is driving the adoption of advanced biopsy devices in hospitals, research centers, and outpatient clinics across the country.

Spain Biopsy Devices Market Size

The Spain biopsy devices market is growing due to an increased focus on early diagnosis of diseases, especially cancer. There are rising cases of cancer types including breast, prostate, and lung cancer, resulting in a constant demand for the biopsy procedure. Spain's health care system also adopts advanced technology, such as needle-based biopsy devices and image-guided biopsy systems, ensuring higher accuracy while reducing patient suffering and faster recovery time. Increased aging population requires more precise diagnostics, which shall further fuel growth in the market. Support from the Spanish government toward innovative medical technologies and improvements in healthcare infrastructure is also contributing to the growth of the biopsy devices market. With patient awareness about early disease detection increasing, the demand for advanced biopsy devices in hospitals, clinics, and research centers is expected to increase.

Europe Biopsy Devices Market Segments

Product – Market breakup in 4 viewpoints:

1. Needle Based Biopsy Devices

2. Biopsy Forceps

3. Localization Wire

4. Others Products

Imaging Technology – Market breakup in 5 viewpoints:

1. CT scan

2. Stereotactic Guided

3. Ultrasound Guided

4. MRI Guided

5. Others

End-User – Market breakup in 3 viewpoints:

1. Hospital and Clinics

2. Diagnostics Laboratories

3. Other

Country – Market breakup of 5 Countries:

1. United Kingdom

2. France

3. Germany

4. Italy

5. Spain

6. Russia

7. Rest of Europe

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Becton, Dickinson and Company

2. Thermo Fisher Scientific Inc.

3. Bio-Rad Laboratories

4. Exact Sciences (Genomic Health)

5. Biocept

6. Roche Diagnostics

7. Myriad Genetics Inc.

8. Qiagen

9. NeoGenomics Laboratories

10. Quest Diagnostics Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Application and Countries |

| Countries Covered | 1. United Kingdom 2. France 3. Germany 4. Italy 5. Spain 6. Russia 7. Rest of Europe |

| Companies Covered | 1. Becton, Dickinson and Company 2. Thermo Fisher Scientific Inc. 3. Bio-Rad Laboratories 4. Exact Sciences (Genomic Health) 5. Biocept 6. Roche Diagnostics 7. Myriad Genetics Inc. 8. Qiagen 9. NeoGenomics Laboratories 10. Quest Diagnostics Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Biopsy Device Market

6. Market Share

6.1 By Products

6.2 By Imaging Technology

6.3 By County

6.4 By End User

7. Product

7.1 Needle Based Biopsy Devices

7.2 Biopsy Forceps

7.3 Localization Wire

7.4 Others Products

8. Imaging Technology

8.1 CT Scan

8.2 Stereotactic Guided

8.3 Ultrasound Guided

8.4 Mri Guided

8.5 Others

9. Country

9.1 United Kingdom

9.2 France

9.3 Germany

9.4 Italy

9.5 Spain

9.6 Russia

9.7 Rest of Europe

10. End User

10.1 Hospital and Clinics

10.2 Diagnostics Laboratories

10.3 Other

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Becton, Dickinson and Company

13.1.1 Overview

13.1.2 Recent Developments

13.1.3 Revenue

13.2 Thermo Fisher Scientific Inc.

13.2.1 Overview

13.2.2 Recent Developments

13.2.3 Revenue

13.3 Bio-Rad Laboratories

13.3.1 Overview

13.3.2 Recent Developments

13.3.3 Revenue

13.4 Exact Sciences (Genomic Health)

13.4.1 Overview

13.4.2 Recent Developments

13.4.3 Revenue

13.5 Biocept

13.5.1 Overview

13.5.2 Recent Developments

13.5.3 Revenue

13.6 Roche Diagnostics

13.6.1 Overview

13.6.2 Recent Developments

13.6.3 Revenue

13.7 Myriad Genetics Inc.

13.7.1 Overview

13.7.2 Recent Developments

13.7.3 Revenue

13.8 Qiagen

13.8.1 Overview

13.8.2 Recent Developments

13.8.3 Revenue

13.9 NeoGenomics Laboratories

13.9.1 Overview

13.9.2 Recent Developments

13.9.3 Revenue

13.10 Quest Diagnostics Inc.

13.10.1 Overview

13.10.2 Recent Developments

13.10.3 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com