Europe Coffee Machine Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Coffee Machine Market Share & Summary

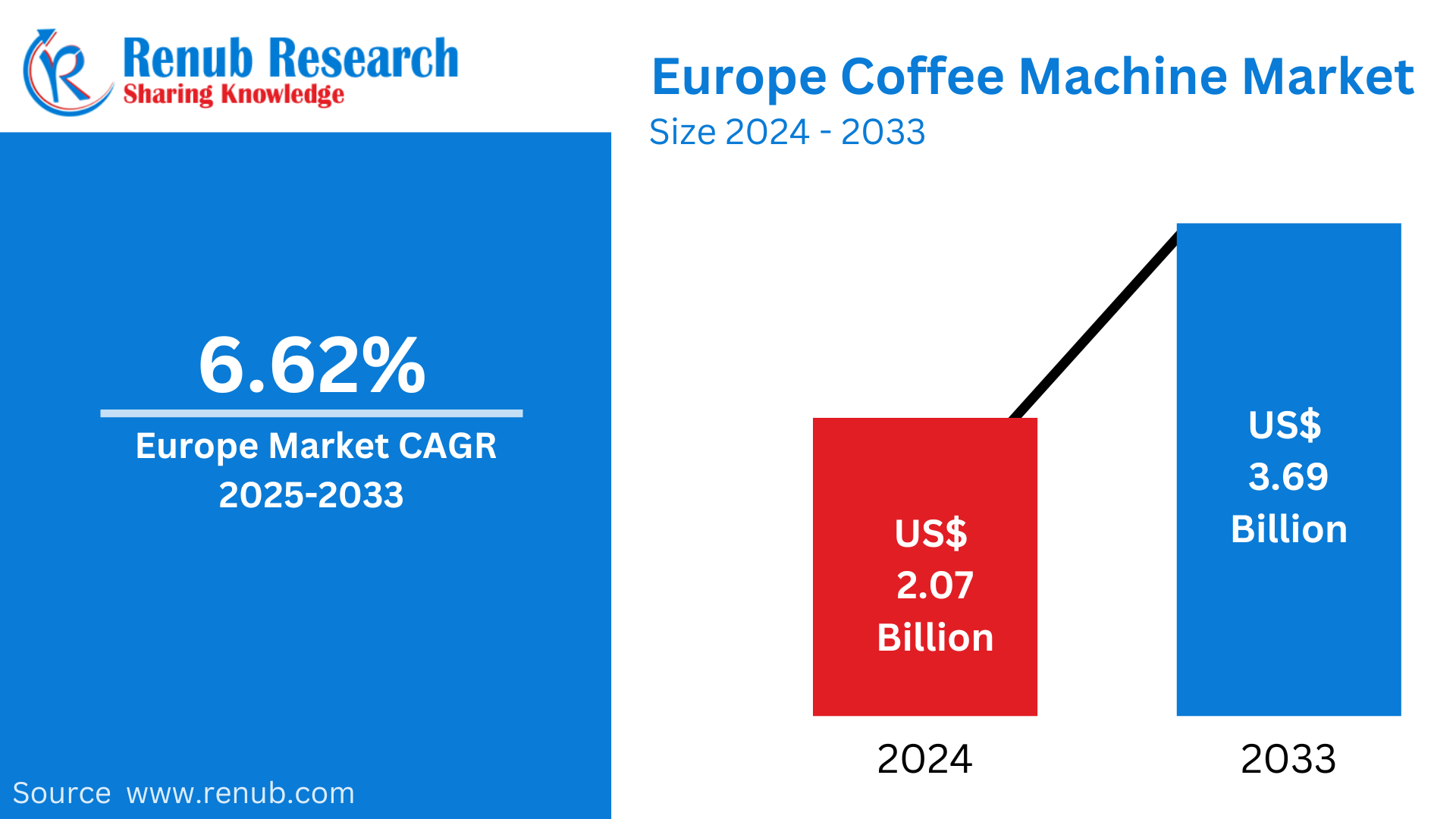

The Europe Coffee Machine Market is expected to grow from US$ 2.07 billion in 2024 to US$ 3.69 billion by 2033, registering a compound annual growth rate (CAGR) of 6.62% during the period. This growth is driven by increasing demand for specialty coffee, rising consumer preferences for high-quality coffee experiences, and the expansion of cafes, restaurants, and offices offering premium coffee solutions.

The report Europe Professional Machine Coffee Market & Forecast covers by Product (Espresso Machines, Bean-to-Cup Machines, Filter Coffee Machines, Others), End User (Hotels, Restaurants, Cafes/Catering, Others), Country and Company Analysis 2025-2033.

Europe Coffee Machine Industry Outlooks

Professional coffee is the term used to describe high-quality, well-prepared coffee designed for commercial use in cafes, restaurants, hotels, and offices. Professional coffee in Europe is prepared using the most advanced brewing techniques, such as espresso machines, specialty grinders, and precise extraction methods, to provide a consistent and superior flavor profile. It caters to the growing demand for premium coffee experiences, driven by an increasing preference for specialty coffee and a shift toward high-quality beverages.

In Europe, professional coffee is of paramount importance to complement the various hospitality and service industries. Professional-grade coffee in cafés and restaurants is an attractive tool to draw customers looking for something unique and flavorful. This is important for customer satisfaction and brand loyalty. Professional coffee services are also used in hotels and resorts as a means to give guests the premium experience the region offers as part of luxury and quality. Professional coffee solutions are quite widely adopted within office environments to foster increased productivity within employees and for a more enjoyable and comfortable space at work. In general, professional coffee has become an essential component of European life, particularly in the operation of businesses designed to meet these demands for finer beverages.

Europe Professional Coffee Machine Market Growth Drivers

Growing Need for Specialty Coffee

Specialty coffee, including single-origin beans and artisanal brewing methods, is fueling the need for advanced professional coffee machines in Europe. The demand for quality, customizable coffee experiences has compelled businesses to invest in premium machines that provide precise brewing and unique flavor profiles. In 2024, The Coffee, a Brazilian coffee chain, entered Austria and was to expand into other European countries.

Rise of Sustainability and Eco-friendly Solutions

In the European market, there is a high concern for sustainability. Companies have chosen eco-friendly coffee machines to minimize waste and reduce energy consumption. Machines using reusable filters, energy-efficient parts, and compostable pods are now popular. The solutions include aligning with environmental concerns and regulations. October 2024 Rhea, leading manufacturer of coffee break machines presented its solutions for HoReCa and vending sectors at Vendex North (Booth 53-54-55) in Leeds.

Technological Advances and Automation

The innovations brought about smart coffee machines equipped with AI and IoT integration for automation in the brewing process, ensuring that real-time monitoring, custom options, and smooth workflow are well taken care of. April 2024: The OPC Foundation and the European Vending & Coffee Service Association (EVA) announced a joint working group called the "OPC UA for Vending, Office Coffee Service & Automated Retail Working Group." The group will work on an OPC UA Information Model that will be used to connect vending machines with their peripherals as well as with company information systems. Vending machines are self-service, dispensing food including beverages like coffee and non-food products.

Headwinds of the Europe Commercial Coffee Machine Market

High installation costs

High-end professional coffee machines with premium features and more options for customizing come at a cost and this may make it hard to reach the entry point for low-budget businesses like small-scale ones and startups to install such costly machines.

Maintenance and Technical Support

Maintaining and servicing high-end professional coffee machines can be costly and time-consuming. As machines become more complex with advanced technologies, the need for skilled technicians for repairs and maintenance increases. This challenge can impact machine uptime and customer satisfaction if not addressed effectively.

Europe Professional Filter Coffee Machines Market

The Europe professional filter coffee machines market is growing steadily, driven by the region's strong coffee culture and increasing demand for high-quality brewed coffee in commercial settings. Hotels, cafés, restaurants, and offices are major adopters of these machines, prioritizing efficiency and consistent flavor. Innovations such as programmable brewing systems, energy efficiency, and user-friendly designs are enhancing product appeal. Germany, France, and the UK are the primary markets, which are furthered by specialty coffee consumption and urbanization. Manufacturers moved toward sustainability with recyclable material handling and eco-friendly features. Espresso machine and single-serve systems are competing for the market; nevertheless, demand for traditional brewed coffee is very consistent that will perpetuate the growth forecast for the market.

Europe Professional Espresso Machines Market

The Europe professional espresso machines market is growing strongly, driven by the region's deep-rooted espresso culture and the increasing need for premium coffee experiences. Market growth is propelled by high adoption in cafés, restaurants, hotels, and specialty coffee shops, which has been supported by increasing urbanization and tourism. Technological advances, such as automatic and semi-automatic systems, energy-efficient designs, and digital controls, are changing the industry landscape. Italy, the United Kingdom, and Germany are leading markets, with growing interest in artisanal and specialty coffee creating increasing demand. Manufacturers focus on sustainability by incorporating environmentally friendly materials and features. While the threat of competition from capsule-based systems lingers, the universal persistence of authentic espresso continues to build a platform for tremendous growth. In January 2024, Bosch Home Appliances launched a new line of countertop Fully Automatic Espresso Machines, an Innovation Award Honoree in the smart home category. These machines provide premium coffee and a variety of beverage options from freshly ground beans, all at the touch of a button on a user-friendly display.

Germany Coffee Machine Market Share

The German Professional Coffee Market is flourishing in business due to the increasing demand for quality coffee in cafes, restaurants, hotels, and offices. Specialized coffee culture in Germany demands premium specialty coffee, forcing the demand for advanced brewing equipment like espresso machines, grinders, and automated systems. Specialty coffee, sustainability trends, and the demand for high-end beverages drive the growth of the market. New technological developments in coffee technology, like smart brewing solutions and customized coffee experiences, also play a part in shaping the market. In fact, the demand for customer satisfaction and unique experiences for coffee only expands the German professional coffee market further. Sept 2022 WMF, Germany's leading brand in household goods and professional coffee leader, has just launched the new fully automatic WMF Perfection coffee machine. This innovative machine was made for the refined coffee drinker, who would like to consume drinks of high quality, according to preference. Its sophisticated design, French manufacturing, and customization make it a more elevated experience of having coffee at home.

France Coffee Machine Market Share

Growth in the France Professional Coffee Market is quite robust because of this strong coffee culture and high-quality, specialty coffee demand in France. French consumers and businesses are valuing premium coffee experiences in cafes, restaurants, hotels, and offices. In this regard, brewing technology innovations that support the market include advanced espresso machines, automated brewing systems, and sustainable coffee solutions. Consumers increasingly opt for environmentally friendly coffee products, such as organic and ethically sourced beans, which reflects the trend towards sustainable and responsible consumption. The emphasis on personalized, high-quality coffee experiences continues to propel the professional coffee market in France. The Italian espresso machine manufacturer opened its Paris office in January 2023. This office is meant to be a center for specialty coffee knowledge and to support the growing coffee community in France.

United Kingdom Coffee Machine Market Share

The United Kingdom Professional Coffee Market is growing steadily, driven by increasing demand for specialty and high-quality coffee in both commercial and workplace environments. The booming café culture is driving business investment in state-of-the-art coffee solutions: espresso machines, automated brewing systems, and novel coffee technologies. Premium coffee offerings, such as ethically sourced beans and unique blends, have gained popularity and align with consumer desires for sustainable, customized coffee experiences. Moreover, the trend of the workplace to emphasize employee well-being has increased professional coffee solutions usage in offices and hospitality sectors that have furthered the growth of the market in the UK. In September 2022, Lavazza Professional launched Moments, a 24/7 self-serve micro café concept for UK businesses, featuring bean-to-cup coffee machines and smart fridges with vending food and cold beverages.

Coffee Machine Market Share in Spain

The Spain Professional Coffee Market is experiencing tremendous growth due to the country's high coffee culture and increased demand for quality coffee experience. Spanish consumers and businesses are investing in the most advanced brewing equipment, including espresso machines and automated systems, to meet the increasing demand for specialty coffee. Furthermore, there is also an increasing desire for sustainability among markets, hence more demand for organic, fair-trade, and locally sourced coffee beans. The premium coffee market is growing in Spain in connection with cafes, restaurants, and offices extending high-quality solutions of coffee according to global standards about being more personalized and environmental-friendly when consuming coffee. January 2024, with a soothing beige color palette and natural light, warm sea breezes drift through the front door of Swallow in Alicante, Spain, creating a Mediterranean coffee haven.

Europe Coffee Machine Market Share Market Segments

Product – Market breakup in 4 viewpoints:

- Espresso Machines

- Bean-to-Cup Machines

- Filter Coffee Machines

- Others

End User – Market breakup in 4 viewpoints:

- Hotels

- Restaurants

- Cafes/Catering

- Others

Countries- Market breakup of 15 Countries covered in the Report:

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Turkey

- Rest of Europe

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Financial Insights

Key Players Analysis

- Nestle Nespresso SA

- Koninklijke Philips N.V.

- Illycaffe S.p.A.

- Dualit Limited

- AB Electrolux

- De'Longhi S.p.A.

- BSH Hausgeräte GmbH

- Schaerer AG

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product End User and States |

| States Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Europe Professional Coffee Market Overview

6. Market Share Analysis

6.1 By Product

6.2 By End User

6.3 By States

7. Market Segmentation

7.1 By Product

7.1.1 Espresso Machines

7.1.2 Bean-to-Cup Machines

7.1.3 Filter Coffee Machines

7.1.4 Others

7.2 By End User

7.2.1 Hotels

7.2.2 Restaurants

7.2.3 Cafes/Catering

7.2.4 Others

8. Countries

8.1 France

8.2 Germany

8.3 Italy

8.4 Spain

8.5 United Kingdom

8.6 Belgium

8.7 Netherlands

8.8 Russia

8.9 Poland

8.10 Greece

8.11 Norway

8.12 Romania

8.13 Portugal

8.14 Turkey

8.15 Rest of Europe

9. Porter’s Five Forces Analysis

9.1 Threat of New Entrants

9.2 Bargaining Power of Suppliers

9.3 Bargaining Power of Buyers

9.4 Threat of Substitutes

9.5 Competitive Rivalry

10. SWOT Analysis

10.1 Strengths

10.2 Weaknesses

10.3 Opportunities

10.4 Threats

11. Key Players Analysis

11.1 Nestle Nespresso SA

11.1.1 Overview

11.1.2 Key Persons

11.1.3 Recent Development

11.1.4 Financial Insights

11.2 Koninklijke Philips N.V.

11.2.1 Overview

11.2.2 Key Persons

11.2.3 Recent Development

11.2.4 Financial Insights

11.3 Illycaffe S.p.A.

11.3.1 Overview

11.3.2 Key Persons

11.3.3 Recent Development

11.3.4 Financial Insights

11.4 Dualit Limited

11.4.1 Overview

11.4.2 Key Persons

11.4.3 Recent Development

11.4.4 Financial Insights

11.5 AB Electrolux

11.5.1 Overview

11.5.2 Key Persons

11.5.3 Recent Development

11.5.4 Financial Insights

11.6 De'Longhi S.p.A.

11.6.1 Overview

11.6.2 Key Persons

11.6.3 Recent Development

11.6.4 Financial Insights

11.7 BSH Hausgeräte GmbH

11.7.1 Overview

11.7.2 Key Persons

11.7.3 Recent Development

11.7.4 Financial Insights

11.8 Schaerer AG

11.8.1 Overview

11.8.2 Key Persons

11.8.3 Recent Development

11.8.4 Financial Insights

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com