Europe Confectionery Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Confectionery Market Trends & Summary

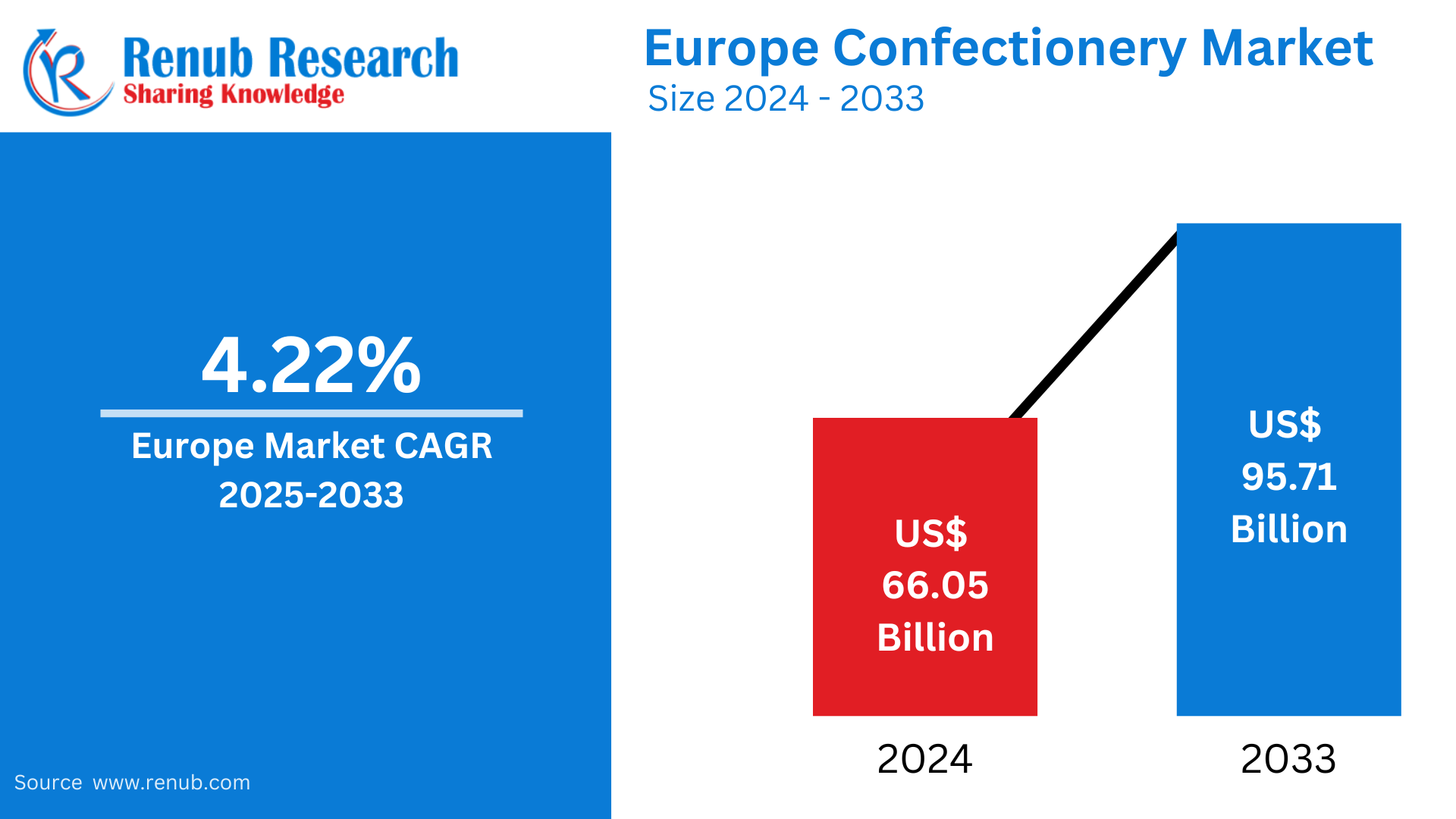

The European confectionery Market, valued at US$ 66.05 billion in 2024, is expected to grow significantly, reaching US$ 95.71 billion by 2033 with a CAGR of 4.22% from 2025 to 2033. This growth is due to growth in consumer preferences, innovation, and a rising demand for premium and healthier options.

The report Europe Confectionery Market Forecast covers by Confections (Chocolate, Dark Chocolate, Milk and White Chocolate), Gums (Bubble Gum, Chewing Gum, Sugar Chewing Gum, Sugar-free Chewing Gum), Snack Bar (Cereal Bar, Fruit & Nut Bar, Protein Bar), Sugar Confectionery (Hard Candy, Lollipops, Mints, Pastilles, Gummies, and Jellies, Toffees and Nougats, Others), Distribution Channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others), Country and Company Analysis 2025-2033.

Europe Confectionery Market Overview

European confectionery market defines manufacturing and trading sweet foodstuffs like chocolates, candies, gum, biscuits, and other sweet snacks. It is among the largest and most varied of all the confectionery markets in the world, fueled by tradition and creativity in foodstuffs in various European nations. Consumer demand for upscale products, health-oriented fashions, and the increasing popularity of sugar-free and organic alternatives are some forces propelling this market's growth. Major European companies focus on creating unique tastes and packaging to meet a diverse set of tastes and regional preferences.

Furthermore, European confectionery items are luxury treats and fundamental parts of several cultural festivals. They play a pivotal role in celebrations, special events, and gift culture. The premiumization trend in the market also gets a boost as consumers pay higher prices for premium, high-quality, and artisanal items. Moreover, the increasing popularity of e-commerce has immensely promoted online sales as consumers can find a range of confectionery products throughout the region.

Growth Drivers in the Europe Confectionery Market

Health-Conscious Trends

With consumers becoming increasingly health-conscious, healthier confectionery products are in greater demand in Europe. Sugar-free, low-calorie, and organic versions are becoming more popular as individuals indulge without sacrificing their health. Firms concentrate on manufacturing sweets with natural sweeteners, less sugar, and vitamins or fiber fortified. These innovations address evolving eating patterns, with an increased number of consumers choosing products that support their health objectives, hence driving the market's growth. November 2024, The European health workforce is in crisis, with 20 EU countries reporting doctor shortages and 15 reporting nurse shortages in 2022 and 2023. There is an estimated shortage of about 1.2 million doctors, nurses, and midwives based on minimum staffing needs for universal health coverage.

Premiumization

Consumers in Europe are increasingly willing to spend more on high-quality, premium confectionery products. The increasing demand for artisanal chocolates, premium packaging, and unusual flavors has driven this trend. Premiumization is most prominent in the chocolate and candy categories, where luxury products like hand-made chocolates or limited-edition items are popular among high-end consumers. This movement toward premium products has driven market growth and motivated brands to innovate and provide unique, high-end offerings to satisfy the changing demand. October 2023, Mondelez World Travel Retail (WTR) rolls out Toblerone pralines as one of its moves to premiumize travel retail. These special packs of 380g come with a distinctive diamond-shaped outer pack and a cream praline center with nougat for added crunch. Their uniqueness is captured in their slogan "Diamond shaped, never square," placing them perfectly for a treat or high-end present for travelers on the go.

E-commerce Expansion

The growth of online shopping has greatly impacted the Europe confectionery market, as consumers are now able to easily access a variety of confectionery products. Online shopping platforms have enabled consumers to easily browse, compare, and buy local and global confectionery products, frequently with quicker delivery options. With increasing online purchases of sweets and snacks, manufacturers and retailers are making investments in digital marketing and focused promotions to draw in technology-enabled consumers, contributing further to market expansion. Online shopping, or buying goods and services over the internet, is integral to consumer behavior in the EU. In 2023, 75% of internet users between 16 and 74 years of age made purchases online, an increase from 53% in 2010—a 22 percentage point growth.

Challenges in the European Confectionery Market

Regulatory Pressure on Sugar Consumption

With increasing health issues, the European Union has implemented a number of policies aimed at decreasing sugar intake. These policies, including sugar taxes and product reformulation programs, put pressure on confectionery companies to innovate. Companies need to innovate in order to lower sugar levels in their products without compromising taste and texture, sometimes involving costly R&D. This pressure can extend to product pricing and profitability, especially for classic sugary foods, constraining the market's growth potential.

Sustainability and Environment Issues

As sustainability is becoming an urgent world issue, the confectionery business is being subjected to greater pressure to reduce its environmental footprint. Packaging waste, resource consumption, and carbon footprints are all major concerns. Companies have to implement sustainable packaging solutions, for example, biodegradable products or reusable packages, and also ensure ethical procurement of ingredients. Compliance with such sustainability levels may raise production costs and make manufacturing processes more complicated, placing firms in the position of weighing consumers' demand against environmental needs.

Europe Chocolate Market

The Europe chocolate market is among the largest in the world, led by a high demand for premium, dark, and artisanal chocolates. Europe boasts legendary chocolate manufacturers in Switzerland, Belgium, and France, which are known for their quality products. Demand for high-end chocolates keeps growing as consumers demand more indulgent and luxurious choices. Furthermore, the movement towards healthier chocolates with reduced sugar content, organic materials, and plant-based substitutes is on the rise as health-aware consumers welcome new, innovative chocolate offerings.

Europe Bubble Gum Confectionery Market

The Europe bubble gum confectionery market is marked by its consistent demand across various regions. Popular particularly among young consumers, bubble gum provides a playful, nostalgic experience. With flavor, pack, and format innovation, the manufacturers are satisfying the changing taste of their target audience. With increasing demand for sugar-free and organic gum products, the trend is also fueled by European health-oriented trends. The market also competes with other sweet confectionery items such as candies and chocolates that are more versatile and tend to be favored over gum.

Europe Cereal Bar Confectionery Market

The market for Europe cereal bar confectionery has developed immensely as consumers increasingly demand quick, on-the-go snack solutions. Cereal bars are also seen as a healthier option than conventional confectionery, particularly when produced from whole grains, nuts, and dried fruits. Fitness and health trends have been responsible for boosting the popularity of high-protein and energy-providing cereal bars. Additionally, customizing and indulgent tastes, like chocolate or caramel, enable companies to serve health-oriented and indulgent consumers, stimulating the growth of the segment.

Europe Hard Candy Confectionery Market

The market for hard candy confectionery in Europe is propelled by both classic favorites and innovative new products. Hard candies appeal across a wide range, especially among younger consumers who appreciate multiple flavors, shapes, and sizes. With the growth of premium and functional confectionery, premium hard candies providing additional benefits like vitamin-fortified or sugar-free versions are sought after by consumers. Limited-edition flavors and seasonal products provide intrigue and stimulate purchases, growing the potential of the market and increasing brand loyalty.

Europe Convenience Store Confectionery Market

The European convenience store confectionery industry is central to the overall confectionery sector. Convenience stores provide a broad selection of on-the-go foods, such as chocolates, candies, and gum, to meet consumers' immediate demands. Convenience stores are favored by their proximity and fast service, and thus they are the first choice for impulse purchases. The industry keeps expanding because of the need for quick, inexpensive treats in urban and rural areas. Confectionery product range expansions are also gaining more attention among retailers to reach a more varied consumer base.

Belgium Confectionery Market

Belgium boasts a strong heritage in the confectionery industry with the country best known for premium chocolate. Domestic consumption and excellent international demand for Belgian chocolate propel the Belgian confectionery market. High-end products from renowned players such as Godiva and Neuhaus capture the market share. With an emphasis on innovation and luxury, Belgium is also seeing a move towards organic confectionery and healthier options. With high craftsmanship tradition fueling its market, the country is at the forefront for all chocolate lovers from around the world. Still, Belgium must meet the sustainability issue as well, with pressure growing to limit carbon emissions and waste from packaging. Oct 2024, GODIVA, the premium chocolate leader, has introduced the limited-edition Belgian Heritage Collection of 12 distinctive chocolates and confections created in Brussels. The special selection utilizes precious recipes and is available for the first time in the United States.

Germany Confectionery Market

Germany's market for confectionery is varied and expanding, influenced by consumer interest in traditional and contemporary confectionery. The nation is renowned for its marzipan items, gummy sweets, and chocolate, with Haribo and Lindt at the forefront. The trend for healthier alternatives can be seen in Germany, with a greater focus on organic, sugar-free, and functional sweets. Sustainability is increasingly becoming an issue, which has led to manufacturers paying attention to minimizing packaging waste and ethically sourcing ingredients. Germany dominates the international confectionery market in October 2023, shipping more than 100 million pieces annually to over 100 nations.

Spain Confectionery Market

The Spanish confectionery market is characterized by the blend of traditional sweets, including turrón (nougat), and increased demand for chocolates, candies, and biscuits. The confectionery culture of Spain is driven by regional tastes, particularly during festivals and holidays. In recent years, there has been a trend towards healthier options, such as organic and sugar-free confectionery, consistent with wider European health trends. Local, high-quality ingredients are also attractive to Spanish consumers, favoring premium and artisan confectionery. The market is likely to expand, stimulated by innovation and a long tradition of confectionery use. Jun 2024, Pink Albatross, a Spanish manufacturer of 100% plant-based ice cream, has launched a new range of "creamy, 100% natural, and delicious" ice creams.

Turkey Confectionery Market

The Turkish confectionery market is growing as a result of rising domestic demand and an expanding export market. Turkish delights, chocolate, and chewy sweets are among the most sought-after products in the country. The younger age group's preference for novelty and premium products steers the market. In addition, the Turkish market follows the trend of being healthy by presenting sugar-free, low-calorie, and functional confectioneries. The increasing cost of raw materials and global brand competition pose a challenge but the growth opportunity of the market still draws investment from local as well as international investors.

United Kingdom Confectionery Market

The United Kingdom confectionery market is among the largest in Europe, with chocolates, biscuits, and candies making up the majority. Large companies such as Cadbury, Mars, and Nestlé control the industry. There is an increasing consumer demand for high-quality, artisanal confectionery and increased demand for healthier confectionery products like sugar-free and organic sweets. Convenience retailing and e-commerce have increased accessibility, with consumers having easier access to confectionery items. Environmental concern is on the rise in the UK, with pressure mounting on manufacturers to become more environmentally friendly, including minimising plastic packaging.

Europe Confectionery Market Segments

Confections

- Chocolate

- Dark Chocolate

- Milk and White Chocolate

Gums

- Bubble Gum

- Chewing Gum

- Sugar Chewing Gum

- Sugar-free Chewing Gum

Snack Bar

- Cereal Bar

- Fruit & Nut Bar

- Protein Bar

Sugar Confectionery

- Hard Candy

- Lollipops

- Mints

- Pastilles, Gummies, and Jellies

- Toffees and Nougats

- Others

Distribution Channel

- Convenience Store

- Online Retail Store

- Supermarket/Hypermarket

- Others

Country

- Belgium

- France

- Germany

- Italy

- Netherlands

- Russia

- Spain

- Switzerland

- Turkey

- United Kingdom

- Rest of Europe

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Key Players Analysis

- August Storck KG

- Chocoladefabriken Lindt & Sprüngli AG

- Confiserie Leonidas SA

- Delica AG

- Ferrero International SA

- Mars Incorporated

- Meiji Holdings Company Ltd

- Mondelēz International Inc.

- Nestlé SA

- Perfetti Van Melle BV

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Confections, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the European confectionery market by 2033?

-

What is the expected CAGR of the European confectionery market from 2025 to 2033?

-

What are the major factors driving the growth of the European confectionery market?

-

How are health-conscious trends influencing the confectionery industry in Europe?

-

What role does premiumization play in shaping consumer preferences in the confectionery market?

-

How is e-commerce expansion impacting confectionery sales across Europe?

-

What are the key regulatory challenges affecting sugar consumption in confectionery products?

-

How are sustainability concerns influencing confectionery packaging and production in Europe?

-

Which European country dominates the confectionery market, and why?

-

Who are the leading companies in the European confectionery market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Confectionery Market

6. Market Share Analysis

6.1 By Confections

6.2 By Distribution Channel

6.3 By Country

7. Confections

7.1 Chocolate

7.1.1 Dark Chocolate

7.1.2 Milk and White Chocolate

7.2 Gums

7.2.1 Bubble Gum

7.2.2 Chewing Gum

7.2.3 Sugar Chewing Gum

7.2.4 Sugar-free Chewing Gum

7.3 Snack Bar

7.3.1 Cereal Bar

7.3.2 Fruit & Nut Bar

7.3.3 Protein Bar

7.4 Sugar Confectionery

7.4.1 Hard Candy

7.4.2 Lollipops

7.4.3 Mints

7.4.4 Pastilles, Gummies, and Jellies

7.4.5 Toffees and Nougats

7.4.6 Others

8. Distribution Channel

8.1 Convenience Store

8.2 Online Retail Store

8.3 Supermarket/Hypermarket

8.4 Others

9. Country

9.1 Belgium

9.2 France

9.3 Germany

9.4 Italy

9.5 Netherlands

9.6 Russia

9.7 Spain

9.8 Switzerland

9.9 Turkey

9.10 United Kingdom

9.11 Rest of Europe

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 August Storck KG

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Chocoladefabriken Lindt & Sprüngli AG

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Confiserie Leonidas SA

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Delica AG

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Ferrero International SA

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Mars Incorporated

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Meiji Holdings Company Ltd

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Mondelēz International Inc.

12.8.1 Overview

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 Nestlé SA

12.9.1 Overview

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

12.10 Perfetti Van Melle BV

12.10.1 Overview

12.10.2 Key Person

12.10.3 Recent Developments

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com