Europe Fertilizer Market by Types (Nitrogen (Nitrates, Urea, UAN, Compound, and Others), Phosphorus, and Potassium), Form (Dry, and Liquid), Application (Agriculture, Horticulture, Gardening, and Others), Regions and Company Analysis 2025-2033

Buy NowEurope Fertilizer Market Size

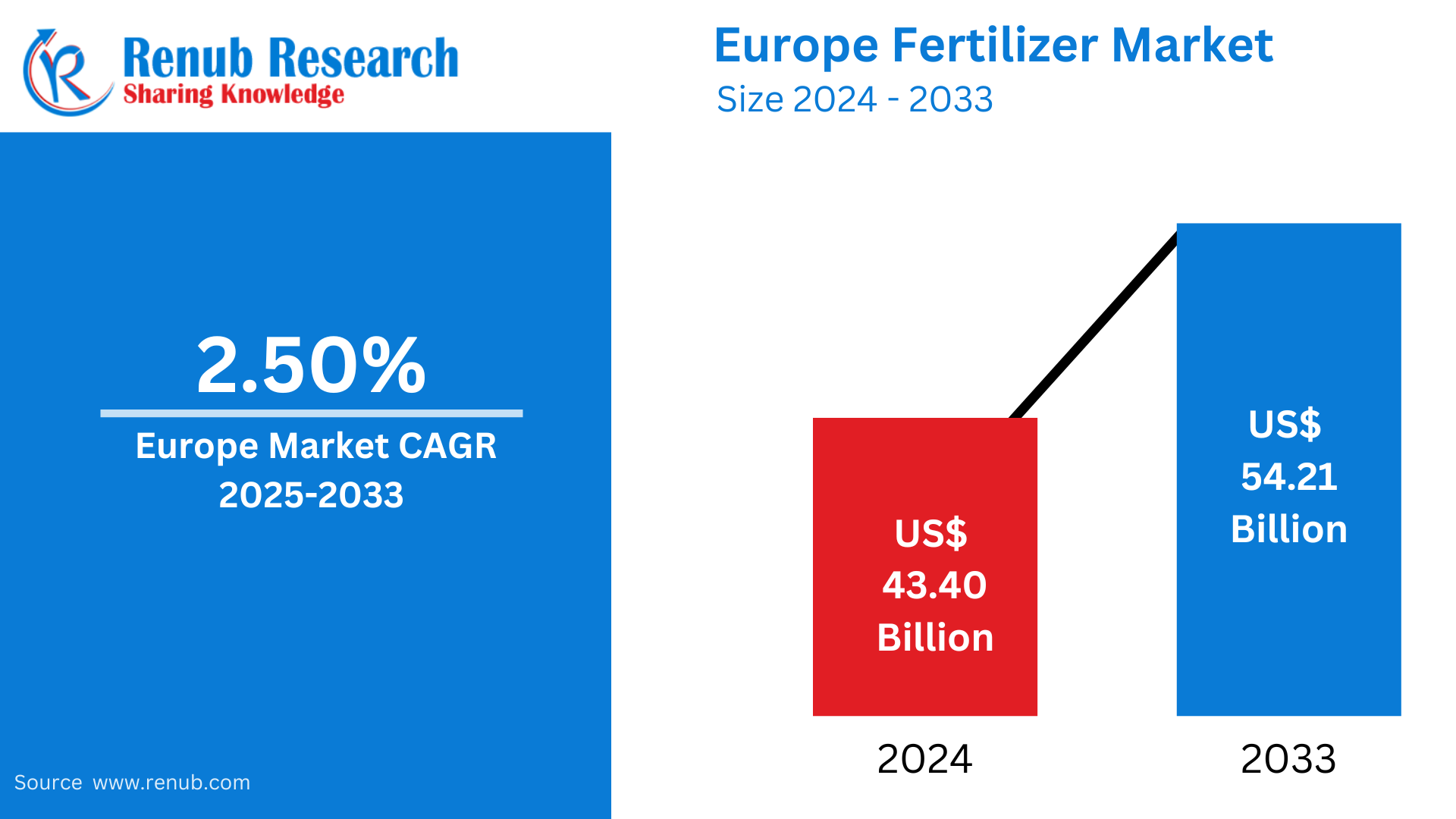

Europe Fertilizer market is expected to reach US$ 54.21 billion by 2033 from US$ 43.40 billion in 2024, with a CAGR of 2.50% from 2025 to 2033. Among the drivers propelling market growth throughout the region are the fast population growth, high food consumption, rising income levels, government policies and subsidies, increased R&D efforts, and the quick advancements in agricultural technology.

Europe Fertilizer Industry Overview

The necessity to increase crop yields and guarantee food security has made the European manure industry a vital component of agricultural productivity. As farmers look to lessen their impact on the environment, the market is impacted by the growing demand for environmentally friendly and sustainable fertilizers. Precision and slow-release fertilizers are two examples of nutrient delivery innovations that are becoming more and more well-liked. Organic and bio-based manures are becoming more popular as a result of regulatory demands, such as the EU's Green Deal, to minimize the use of chemical fertilizers. Geopolitical issues, shifting raw material pricing, and worries about supply chain interruptions are further obstacles facing the sector.

The threat to crop yield in Europe has increased due to changing climate conditions, insufficient farming practices, and rising food demand brought on by population growth. The European Union Census Bureau predicts that there were 513.5 million people living in the region in January 2019; by 2030, that number is predicted to rise to 738 million. The expansion of the manure business in Europe is being driven by this trend, which demonstrates increased food requirements.

Plant food provide a significant return on investment and boost crop output, allowing farmers to produce more food on a smaller amount of land. For example, 9.3 tons of grains may be produced with 192 kg of nitrogen per hector, which is equivalent to 2.1 tons of grains without the use of nitrogen fertilizers. For the farmer, this produced a return on investment of about 790%. In addition to increasing crop output, plant food use enables farmers to increase their income streams through efficient farming practices.

Growth Drivers for the Europe Fertilizer Market

Programs for Soil Health and Restoration

By encouraging sustainable agricultural methods, initiatives centered on soil health and restoration are propelling the expansion of the European plant food business. Farmers are encouraged to use environmentally friendly fertilizers and soil management practices by the European Union's emphasis on improving soil fertility through programs like the Common Agricultural Policy (CAP). The need for organic and bio-based plant food is increased by these initiatives, which seek to improve soil health, lessen nutrient depletion, and prevent environmental harm. Furthermore, initiatives to restore soil health are in line with more general sustainability objectives like lowering carbon emissions and enhancing biodiversity. The demand for sophisticated fertilizers is rising as a result of increased investment in soil restoration initiatives in the European market.

Applying fertilizers that replenish soil nutrients is one of the many soil health initiatives the EU has started. According to reports, around 45 million hectares of European agricultural land need to have their nutrient recovery and quality improved. Projects worth up to $100 million will be awarded in 2024 for fertilizer application and soil restoration, guaranteeing long-term soil production.

Growing Need for Food Security

One of the main factors propelling the European market is the increased demand for food security. In order to maintain a steady supply of food, Europe must increase agricultural production in response to issues including population growth, climate change, and shifting eating habits. In order to maintain soil fertility and increase agricultural yields, manures are essential. Precision farming and organic fertilizers are two examples of more sustainable and effective fertilizer solutions that European farmers are using to meet these demands. Government regulations and technological investments encourage the use of cutting-edge fertilizers to increase production and lessen environmental effect as food security rises to the top of the priority list.

The desire to improve food security is driving growth in Europe's fertilizer sector. Fertilizers are crucial for increasing agricultural yields since, according to the European Union, more than 340 million people on the continent rely on local food supply for sustainable consumption. In order to address regional concerns about food security, it is anticipated that the demand for nitrogen and phosphorus fertilizers in the European food supply chain will reach 12 million metric tons by 2024.

Growth of Organic Agriculture Programs

The expansion of organic farming initiatives is a major factor propelling the fertilizer market in Europe. Organic farming practices that emphasize soil health and sustainability are becoming more and more popular among European farmers as consumer demand for organic food increases. In order to improve soil fertility without using artificial chemicals, organic fertilizers—such as compost, manure, and bio-based products—are becoming more and more popular. By providing subsidies and incentives, EU policies like the Common Agricultural Policy (CAP) encourage organic farming. These initiatives promote the use of eco-friendly compost, which propels the organic fertilizer market's expansion and supports sustainable farming methods throughout Europe.

Organic compost use has received a lot of money and assistance as part of the EU's Farm to Fork policy, which aims to increase the proportion of organic farms by 25% by 2030. The European Commission claims that more than $200 million has been set aside to promote organic manure. Approximately 2 million metric tons of organic fertilizers were used in the EU as of 2024, demonstrating their expanding use in agriculture.

Challenges in the Europe Fertilizer Market

Growing Costs of Production

One major issue facing the European plant food business is rising production costs. The cost of producing fertilizer has gone up due to rising prices for raw materials like phosphate rock and natural gas, which are necessary for nitrogen fertilizers. Furthermore, Europe's unstable energy prices raise production costs even more. Fertilizer prices are rising as a result of these increased expenses being passed on to farmers, which may make them less affordable for small-scale growers. Farmers find it challenging to embrace new environmentally friendly, frequently more costly, alternatives as demand to strike a balance between cost-effectiveness and environmental sustainability increases. The agricultural industry is under financial hardship as a result of these reasons.

The market's production costs are impacted by the continually increasing cost of energy. For instance, the cost of producing ammonia-based fertilizers has increased by about 150 per ton due to natural gas pricing, making it difficult for businesses to stay profitable and competitive in a market where consumers are price conscious.

Tight Environmental Rules

As governments strive for lower nitrogen emissions, sustainable farming methods, and better nutrient management, strict environmental rules provide a serious obstacle to the European fertilizer sector. Farmers must use less compost and switch to more environmentally friendly options, such organic or slow-release manures, in order to comply with stricter regulations like the EU's Green Deal and the Nitrates Directive. These rules complicate the procedures involved in producing fertilizer and raise operating expenses, despite their stated goal of lessening their negative effects on the environment. Furthermore, some farmers find it challenging to comply with the shift to precision agricultural technology and sustainable fertilizers due to the high cost involved, especially in areas with a large reliance on conventional fertilizers.

The business may have to pay almost $1 billion a year to comply with the strict fertilizer emissions regulations mandated by the European Green Deal. In order to fulfill standards, manufacturers must now lower nitrogen oxide emissions, which results in significant compliance costs that affect profit margins and operational effectiveness.

Nitrogen dominates Europe's fertilizer market, enhancing crop productivity and efficiency

As an essential nutrient crucial for crop growth, nitrogen fertilizers contribute significantly to increasing agricultural yields. Europe's numerous agricultural landscapes, encompassing diverse soil types and vegetation, necessitates a bendy nutrient deliver, and nitrogen fertilizers satisfy this requirement effectively. Moreover, the adoption of tremendous farming practices within the location and the pursuit of high-performance manure reinforces the demand for nitrogen. Its massive use aligns with the European commitment to sustainable agriculture, addressing meals safety wishes at the same time as optimizing resource utilization and minimizing environmental outcomes.

Also, nitrates are famous inside the European nitrogen fertilizer market due to their immediate availability to plants and high solubility, making sure speedy nutrient absorption. This performance is vital in Europe's massive agricultural landscape, assisting an extensive variety of plants and soil types. Nitrates provide a brief and efficient nitrogen supply, fostering more valuable crop yields. Further, their applications aligns with sustainable agricultural practices, as they offer precise nutrient control, decreasing the risk of environmental outcomes and reflecting the region's commitment to accountable and efficient fertilizer use.

Liquid fertilizers grow in Europe due to easy application and rapid absorption

Liquid fertilizers provide flexibility in application strategies, foliar spraying and fertigation, permitting efficient nutrient distribution. This adaptability is vital in Europe's various agricultural settings. Furthermore, liquid fertilizers contribute to decreased environmental consequences through minimizing runoff and improving nutrient utilization. As European farmers increasingly prioritize sustainable and precise farming practices, the popularity of liquid paperwork continues to surge because of their effectiveness and environmental stewardship.

Horticulture dominates Europe's fertilizer market, driven by demand for high-quality produce

Fertilizers are pivotal in optimizing crop yields, improving satisfactory, and making sure the classy appeal of horticultural produce. The specialized dietary needs of several horticultural vegetation drive the adoption of tailor-made fertilizer formulations. As Europe witnesses a developing emphasis on sustainable and precision agriculture, fertilizers tailor-made for horticultural applications significantly contribute to the world's productivity and strong presence within the dynamic Europe fertilizer market.

Europe Movie Fertilizer Overview by Regions

By countries, the Europe Fertilizer Market is segmented into Germany, France, United Kingdom, Italy, Spain, Netherlands, Poland, Sweden, Austria, Finland, Turkey, Norway, Greece, Iceland, Switzerland, Belgium, Albania, Denmark, and Others. As the biggest customer of fertilizers in Europe, Germany's prominence within the Europe fertilizer market is pushed by its fame as the continent's largest economy.

Germany Fertilizer Market

Germany's highly developed agricultural sector and high demand for crop yields have made it one of the largest fertilizer markets in Europe. Because nitrogen-based fertilizers are crucial for improving soil fertility and increasing crop output, they control the majority of the market. As environmental concerns grow, the industry is also seeing a trend towards more sustainable solutions, with a growth in demand for fertilizers that are organic and bio-based. Innovations in nutrient delivery systems, like slow-release fertilizers, and precision farming techniques are becoming more popular. More effective fertilizer use is being promoted by Germany's stringent environmental laws, which include initiatives to lower nitrogen emissions. Although supply chain interruptions and shifting raw material prices provide challenges, technological developments will continue to influence the fertilizer market's future.

With more than 57% of its area used for agriculture, Germany is the fourth-largest agricultural country in Europe. There are around 276,000 small farms in the nation, with an average size of 61 hectares. Farmers adjust their fertilizer use to address nutrient deficiencies and maximize crop growth and quality since different soil types exist. Fertilizer use has significantly increased in Germany in recent years. Due in great part to the nation's climate, fertilizer use increased by 2.9% in 2022 over the previous year. In order to ensure food security, farmers had to rely largely on fertilizers and crop protection chemicals while they battled heat waves and droughts.

United Kingdom Fertilizer Market

The requirement to guarantee excellent crop yields for both food production and ornamental horticulture is what drives the UK fertilizer market, which is a sizable portion of the nation's agricultural economy. Given their vital function in increasing soil fertility and plant growth, nitrogen-based fertilizers predominate. However, in response to environmental concerns and more stringent government laws, there is a growing desire for more environmentally friendly and sustainable options, such as organic and slow-release fertilizers. The market is changing as a result of UK government attempts to lower nitrogen emissions and enhance farming practices' sustainability. Technologies used in precision agriculture, which increase the effectiveness of fertilizer application, are likewise becoming more and more popular. Notwithstanding obstacles like shifting prices for raw materials and interruptions in the global supply chain, technological advancement and government backing are what keep the fertilizer market expanding.

France Fertilizer Market

France has one of the biggest agricultural industries in Europe, and the fertilizer business is a significant part of this sector. The market is dominated by nitrogen-based fertilizers because of how well they increase crop yields and improve soil fertility. However, a move toward organic and bio-based fertilizers is being pushed by growing environmental concerns as well as EU rules that aim to minimize nitrogen emissions and promote sustainable farming methods. Precision farming methods that maximize fertilizer use and minimize environmental impact while enhancing efficiency are being adopted by France more and more. In order to increase agricultural yield and reduce waste, there is also a growing need for slow-release fertilizers and customized nutrient delivery systems. Price fluctuations for raw materials are a problem for the market, yet sustainable practices and technology developments are influencing its future expansion.

Italy Fertilizer Market

Italy's varied agricultural industry, which comprises a broad range of commodities like cereals, fruits, vegetables, and vines for wine production, depends heavily on the fertilizer market. The most common kind of fertilizers are nitrogen-based ones, which are crucial for increasing soil fertility and agricultural production. However, a move toward more sustainable options, such organic and slow-release fertilizers, is being fueled by growing environmental concerns and EU legislation. Precision agriculture technologies that maximize fertilizer use, minimize waste, and boost crop productivity are also being adopted by Italy. Practices that lessen their negative effects on the environment, such as using less nitrogen, are being promoted by the Italian government and agricultural associations. The need for effective and ecological fertilizer solutions is still rising in the Italian market, despite obstacles like shifting raw material pricing and supply chain interruptions.

Type – Market breakup from 3 viewpoints:

1. Nitrogen (Nitrates, Urea, UAN, Compound Fertilizer, and Others)

2. Phosphorus

3. Potassium

Forms – Market breakup from 2 viewpoints:

1. Dry

2. Liquid

Application – Market breakup from 4 viewpoints:

1. Agriculture

2. Horticulture

3. Gardening

4. Others

Countries – Market breakup from 19 viewpoints:

1. Germany

2. France

3. United Kingdom

4. Italy

5. Spain

6. Netherlands

7. Poland

8. Sweden

9. Austria

10. Finland

11. Turkey

12. Norway

13. Greece

14. Iceland

15. Switzerland

16. Belgium

17. Albania

18. Denmark

19. Others

Crop – Volume

1. Wheat

2. Coarse grains

3. Oilseeds

4. Potatoes

5. Sugar beet

6. Other arable crops

7. Permanent crops

8. Fodder

9. Fertilized Grassland

All companies have been covered from 3 viewpoints:

• Overview

• Recent Development

• Revenue

Company Analysis:

1. Yara International ASA

2. K+S AG

3. CF Industries Holdings

4. GrupaAzoty S.A

5. ICL Group

6. OCI NV

7. Sociedad Quimica y Minera de Chile SA

8. BASF SE

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Forms, Application, and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in the Report

-

What is the current size and future forecast of the Europe Fertilizer Market from 2024 to 2033?

-

What are the major growth drivers propelling the Europe Fertilizer Market forward?

-

How are rising production costs and environmental regulations impacting the fertilizer industry in Europe?

-

Which fertilizer type (Nitrogen, Phosphorus, or Potassium) dominates the market, and why?

-

How is the form of fertilizer (Dry vs. Liquid) influencing application trends across different European regions?

-

Which application segments (Agriculture, Horticulture, Gardening, Others) are witnessing the highest demand and why?

-

How are initiatives like the EU Green Deal and CAP shaping sustainable fertilizer practices in Europe?

-

What role do organic and bio-based fertilizers play in the current and future European market landscape?

-

Which countries in Europe (e.g., Germany, France, UK, Italy) are leading the fertilizer market, and what are their specific market dynamics?

-

Who are the key players in the Europe Fertilizer Market, and what strategies are they employing to stay competitive?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Fertilizer Market and Volume

5.1 Market

5.2 Volume

6. Market Share

6.1 By Type

6.1.1 By Nitrogen

6.2 By Form

6.3 By Application

6.4 By Countries

7. Volume Share

7.1 By Type

7.1.1 By Nitrogen Fertilizers

7.2 By Crop

8. Type – Market and Volume

8.1 Nitrogen Fertilizers

8.1.1 Market

8.1.2 Volume

8.2 Phosphate Fertilizers

8.2.1 Market

8.2.2 Volume

8.3 PotashFertilizers

8.3.1 Market

8.3.2 Volume

9. Nitrogen Fertilizers

9.1 Nitrate

9.1.1 Market

9.1.2 Volume

9.2 Urea

9.2.1 Market

9.2.2 Volume

9.3 UAN

9.3.1 Market

9.3.2 Volume

9.4 Compound Fertilizer

9.4.1 Market

9.4.2 Volume

9.5 Others

9.5.1 Market

9.5.2 Volume

10. Form

10.1 Dry

10.2 Liquid

11. Application

11.1 Agriculture

11.2 Horticulture

11.3 Gardening

11.4 Others

12. Countries

12.1 Germany

12.2 France

12.3 United Kingdom

12.4 Italy

12.5 Spain

12.6 Netherlands

12.7 Poland

12.8 Sweden

12.9 Austria

12.10 Finland

12.11 Turkey

12.12 Norway

12.13 Greece

12.14 Iceland

12.15 Switzerland

12.16 Belgium

12.17 Rest of Europe

13. Crop – Volume

13.1 Wheat

13.2 Coarse grains

13.3 Oilseeds

13.4 Potatoes

13.5 Sugar beet

13.6 Other arable crops

13.7 Permanent crops

13.8 Fodder

13.9 Fertilized Grassland

14. Porter’s Five Forces Analysis

14.1 Bargaining Power of Buyers

14.2 Bargaining Power of Suppliers

14.3 Degree of Rivalry

14.4 Threat of New Entrants

14.5 Threat of Substitutes

15. SWOT Analysis

15.1 Strength

15.2 Weakness

15.3 Opportunity

15.4 Threat

16. Key Players Analysis

16.1 Yara International ASA

16.1.1 Overview

16.1.2 Recent Development

16.1.3 Revenue

16.2 K+S AG

16.2.1 Overview

16.2.2 Recent Development

16.2.3 Revenue

16.3 CF Industries Holdings

16.3.1 Overview

16.3.2 Recent Development

16.3.3 Revenue

16.4 GrupaAzoty S.A

16.4.1 Overview

16.4.2 Recent Development

16.4.3 Revenue

16.5 ICL Group

16.5.1 Overview

16.5.2 Recent Development

16.5.3 Revenue

16.6 OCI NV

16.6.1 Overview

16.6.2 Recent Development

16.6.3 Revenue

16.7 Sociedad Quimica y Minera de Chile SA

16.7.1 Overview

16.7.2 Recent Development

16.7.3 Revenue

16.8 BASF SA

16.8.1 Overview

16.8.2 Recent Development

16.8.3 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com