Europe Food Safety Testing Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Food Safety Testing Market Trends & Summary

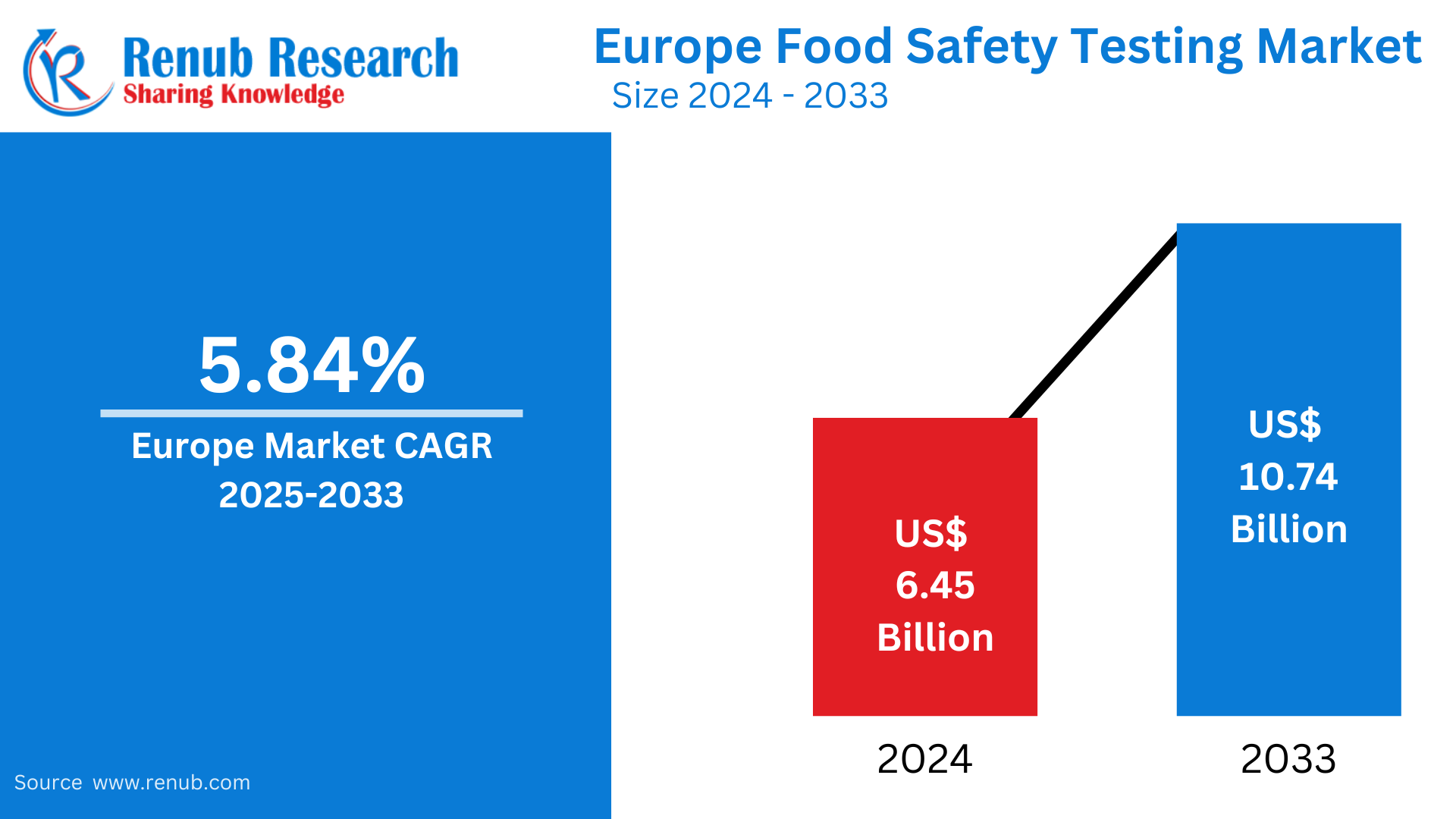

Europe Food Safety Testing market is expected to reach US$ 10.74 billion by 2033 from US$ 6.45 billion in 2024, with a CAGR of 5.84% from 2025 to 2033. Regulatory pressure, increased worries about food contamination, the need for traceability, technological developments in testing, the expansion of food exports, and customer preferences for transparency and quality in food items are the main drivers of the food safety testing market in Europe.

The report Europe Food Safety Testing Market covers by Contaminant Testing (Pathogen Testing, Pesticide and Residue Testing, Mycotoxin Testing, GMO Testing, Allergen Testing, Other Types of Testing), Technology (Polymerase Chain Reaction (PCR), Chromatography and Spectrometry, Immunoassay-based, Other Technologies, Personal Care and Cosmetics), Application (Pet Food and Animal Feed, Food, Dairy, Fruits and Vegetables, Processed Food, Crops, Meat and Poultry, Other Foods), Countries and Company Analysis 2025-2033

Europe Food Safety Testing Industry Overview

Due to stricter regulations and rising customer demand for safe, high-quality food products, the food safety testing market in Europe has experienced tremendous growth. In order to ensure food safety, the industry is essential in identifying potential hazards including pollutants, pathogens, allergies, and hazardous additives. There is a need for thorough testing to meet European rules, including the General Food Law Regulation and the European Food Safety Authority's (EFSA) recommendations, which are some of the most stringent in the world. The market for food safety testing services is being further stimulated by the increased focus on transparency and traceability in food supply chains as consumers grow more health-conscious and worried about food safety.

Food safety testing is now far more accurate, quick, and reliable thanks to the quick development of testing technologies like mass spectrometry, PCR, and ELISA. These technologies make it possible to detect a variety of contaminants, including heavy metals, pesticide residues, and pathogens like Salmonella and E. coli. Additionally, the necessity for food safety testing has increased due to the rise in cross-border trade and food exports, especially for conformity with international standards. The market for food safety testing in Europe is anticipated to grow as the food sector develops further due to customer desire for transparency, technological advancements, and stricter food safety laws.

The accuracy, speed, and efficiency of food safety testing are being improved by modern analytical techniques. Because they can detect even minute amounts of pollutants and pathogens, advanced technologies like next-generation sequencing, mass spectrometry, and polymerase chain reaction (PCR) are becoming more and more popular. For example, QIAGEN expanded the use of digital PCR technology in food safety testing in November 2023 by introducing three new kits for their QIAcuity systems along with a major software update.

Chemical testing is also receiving increasing attention as a result of the growing demand for organic products. In accordance with national regulatory guidelines, businesses are carefully checking these organic products for traces of both listed and forbidden chemicals. The market for testing facilities is anticipated to grow as a result of this regulatory scrutiny, leading industry participants to expand the range of services they provide. To summarize, SGS SA, Eurofins Scientific SE, Intertek Group PLC, and TÜV SÜD are some of the major competitors in the highly competitive European food safety testing market. These businesses usually use tactics like expansion, creative approaches, and mergers and acquisitions to stay ahead.

Growth Drivers for the Europe Food Safety Testing Market

Rising Foodborne Illnesses

As contamination instances have increased awareness of food safety hazards, rising foodborne illnesses have become a major problem in Europe. Food safety testing is crucial because pathogens like Salmonella, E. Coli, and Listeria, as well as chemical pollutants, represent major health risks. High-profile foodborne illness outbreaks have highlighted how crucial it is to identify dangerous bacteria, poisons, and other contaminants as soon as possible. In order to safeguard the public's health, there is now a growing need for precise and trustworthy food safety testing. The food sector is implementing stricter testing procedures as a result of consumers' increased awareness of food safety. In order to prevent contamination, guarantee quality, and preserve consumer confidence in the food supply chain, reliable testing makes sure that food items fulfill safety regulations.

Global Trade and Exports

European manufacturers are under more and more pressure to adhere to international food safety requirements as commerce and food exports continue to grow. Comprehensive testing is necessary to ensure compliance with the various food safety requirements in different nations and regions. Every market has strict testing requirements for pollutants, pathogens, allergies, and other safety problems, regardless of whether it is in Asia, the US, or another location. As cross-border food trade has grown, European food producers must implement stringent testing procedures to satisfy international standards and steer clear of expensive trade restrictions, product recalls, and legal issues. throughout order to ensure that exports are safe and adhere to international rules, the need for food safety testing services is consequently expanding quickly throughout Europe.

Rising Incidents of Food Fraud

European food producers are investing in cutting-edge safety testing methods as a result of the rise in food fraud and adulteration cases. Food fraud puts customer trust and product integrity at serious risk through practices including ingredient replacement, mislabeling, and contamination with prohibited chemicals. Fraud scandals have brought attention to the food supply chain's susceptibility and the necessity of thorough testing to stop such activities. Because of this, producers are using sophisticated testing methods like spectroscopy, chromatography, and DNA analysis to confirm product claims, identify impurities, and authenticate ingredients. In order to guarantee that food products fulfill the highest standards of quality and authenticity, customers' increasing demands for transparency and food safety are driving this transition in addition to legislative obligations.

Challenges in the Europe Food Safety Testing Market

Complex Regulatory Environment

The intricacy of regulatory frameworks in many nations and areas presents difficulties for the European market for food safety testing. Individual nations may have extra or more particular standards, even if the European Union has consolidated rules through frameworks like the General Food Law Regulation. This makes it challenging for businesses who operate in several European markets to guarantee adherence to disparate rules concerning pollutants, labeling, allergens, and food traceability. Businesses must keep up with changes in food safety legislation since navigating this complex web of regulations may be expensive and time-consuming. Furthermore, differences in national rules can affect market access and profitability by causing delays, extra testing, or even rejected shipments, especially in the case of cross-border food trade.

Evolving Pathogens and Contaminants

Food safety testing in Europe is constantly challenged by the appearance of new pollutants and pathogens. The dangers of foodborne illnesses change along with the microorganisms. As viruses, new allergies, and bacteria like Salmonella, Listeria, and E. coli change all the time, testing techniques must also adapt. Advanced technologies must be developed and implemented by food safety testing providers in order to effectively detect these new and growing dangers. However, staying up to date with these advancements can be resource-intensive and necessitate large R&D expenditures. Additionally, it may be difficult to guarantee the efficacy of these novel testing techniques in a variety of food kinds and environmental conditions, necessitating ongoing adaptation to address new risks and preserve public health safety.

Europe Food Safety Testing Market Overview by Regions

By countries, the Europe Food Safety Testing market is divided into United Kingdom, France, Germany, Spain, Italy, Russia, Rest of Europe.

Germany Food Safety Testing Market

Due to strict food safety laws and a strong emphasis on consumer health, Germany has a thriving industry for food safety testing. Germany, one of Europe's biggest food markets, has stringent food safety laws that are enforced by both national and EU laws, guaranteeing the quality and safety of food. Comprehensive testing for pollutants like infections, allergies, pesticides, and heavy metals is required by this regulatory framework. Additionally, traceability and authenticity in food items are becoming more and more important as consumer demands for transparency and quality rise. Modern testing techniques are made possible by Germany's strong commitment to innovation and sophisticated technological infrastructure. As food producers, suppliers, and regulatory agencies work to guarantee the highest standards of food safety and quality, the industry is anticipated to keep expanding.

Pathogens can be present in meat without any outward symptoms of deterioration. On meat, microorganisms such as molds, yeasts, and bacteria can grow and cause spoiling. This process can be accelerated by improper handling and storage, making the meat dangerous. For example, the number of salmonellosis cases associated with fresh duck, chicken, turkey, and other meats increased from 8,220 in 2021 to 9,013 in 2022, according to Germany's Robert Koch Institute (RKI). Numerous papers highlight the advantages of examining chemical molecules linked to deterioration, particularly those originating from microbiological sources, in light of these situations. This highlights how much of a market there is for food testing methods. Techniques including fluorescence spectroscopy, biosensors, and electronic noses have been developed to quickly and precisely identify spoiling.

United Kingdom Food Safety Testing Market

Due to strict government and EU laws, as well as growing consumer awareness of food quality and safety, the UK food safety testing market is growing. In the UK, food safety testing is necessary to guarantee adherence to regulations concerning pollutants, allergies, pathogens, and chemical residues. UK food producers and suppliers are investing in cutting-edge testing technology, including as PCR and mass spectrometry, to increase detection speed and accuracy in response to growing worries about food fraud and foodborne illnesses. Additionally, companies are being pushed to improve their testing procedures by consumer demands for food items to be transparent and traceable. The UK market for food safety testing is changing to handle new pollutants as sustainability becomes more important, protecting the public and preserving food integrity.

France Food Safety Testing Market

The market for food safety testing in France is expanding due to stricter laws, growing consumer health concerns, and the requirement for food supply chain transparency. France, one of the biggest food markets in Europe, is governed by stringent food safety regulations set by the EU and the French government. These regulations cover pollutants such heavy metals, pesticides, allergies, and infections. There is a strong drive for sophisticated testing technology in response to the rise in food fraud and the increased public awareness of foodborne illnesses. To guarantee the safety and quality of their products, French food producers and manufacturers are investing in cutting-edge techniques like chromatography and DNA testing. Given that France places a high priority on sustainability, food safety, and customer trust in the marketplace, this trend is anticipated to continue.

Italy Food Safety Testing Market

The market for food safety testing is expanding in Italy due to the nation's strict food safety laws and rising consumer consciousness of food quality. Italy, a significant producer of agricultural and processed food items, complies with stringent EU food safety regulations, which provide for thorough testing for pollutants like allergies, pesticides, and viruses. As customers grow more health conscious and demand transparency and traceability in their food, there is an increasing demand for food safety testing. Advanced testing methods are being adopted by food makers as a result of the growing emphasis on sustainability, food fraud prevention, and quality control. In order to guarantee compliance and preserve product integrity, the market is adopting cutting-edge testing techniques including PCR, ELISA, and mass spectrometry, which is propelling expansion in Italy's food safety testing industry.

Europe Food Safety Testing Market Segments

Contaminant Testing – Market breakup in 6 viewpoints:

- Pathogen Testing

- Pesticide and Residue Testing

- Mycotoxin Testing

- GMO Testing

- Allergen Testing

- Others

Technology – Market breakup in 5 viewpoints:

- Polymerase Chain Reaction (PCR)

- Chromatography and Spectrometry

- Immunoassay-based

- Other Technologies

- Personal Care and Cosmetics

Application – Market breakup in 2 viewpoints:

- Pet Food and Animal Feed

- Food, Dairy, Fruits and Vegetables,

- Processed Food,

- Crops

- Meat and Poultry

- Other Foods

European Countries Food Safety Testing Market

- United Kingdom

- France

- Germany

- Spain

- Italy

- Russia

- Rest of Europe

Company Analysis

- ALS Limited

- Campden BRI

- NFS International

- SGS SA

- Eurofins Scientific

- Intertek Group PLC

- Tuv Sud

- Fera Science Limited

- INSTITUT Mérieux

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Contaminant Testing, By Technology, By Application and By Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the Europe Food Safety Testing market by 2033?

-

What is the expected CAGR of the Europe Food Safety Testing market from 2025 to 2033?

-

What are the main factors driving the growth of the European food safety testing industry?

-

How do stricter food regulations impact the demand for food safety testing in Europe?

-

What role does technological advancement play in improving food safety testing accuracy and speed?

-

How is the increasing global food trade influencing food safety testing requirements?

-

Which contaminants are most frequently tested in European food safety laboratories?

-

How are food fraud incidents shaping the demand for advanced testing methods in Europe?

-

Which country in Europe has the largest market share in food safety testing, and why?

-

Who are the leading companies in the European food safety testing industry?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Food Safety Testing Market

6. Market Share Analysis

6.1 By Contaminant Testing

6.2 By Technology

6.3 By Application

6.4 By Country

7. Contaminant Testing

7.1 Pathogen Testing

7.2 Pesticide and Residue Testing

7.3 Mycotoxin Testing

7.4 GMO Testing

7.5 Allergen Testing

7.6 Other Types of Testing

8. Technology

8.1 Polymerase Chain Reaction (PCR)

8.2 Chromatography and Spectrometry

8.3 Immunoassay-based

8.4 Other Technologies

8.5 Personal Care and Cosmetics

9. Application

9.1 Pet Food and Animal Feed

9.2 Food

9.3 Dairy

9.4 Fruits and Vegetables

9.5 Processed Food

9.6 Crops

9.7 Meat and Poultry

9.8 Other Foods

10. Country

10.1 United Kingdom

10.2 France

10.3 Germany

10.4 Spain

10.5 Italy

10.6 Russia

10.7 Rest of Europe

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 ALS Limited

13.1.1 Overview

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Campden BRI

13.2.1 Overview

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 NFS International

13.3.1 Overview

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 SGS SA

13.4.1 Overview

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Eurofins Scientific

13.5.1 Overview

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Intertek Group PLC

13.6.1 Overview

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Tuv Sud

13.7.1 Overview

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Fera Science Limited

13.8.1 Overview

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

13.9 INSTITUT Mérieux

13.9.1 Overview

13.9.2 Key Person

13.9.3 Recent Developments

13.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com