Europe Insulin Pump Market, Users, Reimbursement Policy, Countries (Germany, France, Netherlands, Switzerland, Sweden, and UK) Clinical Trials and Training Model Analysis

Buy NowGet Free Customization in This Report

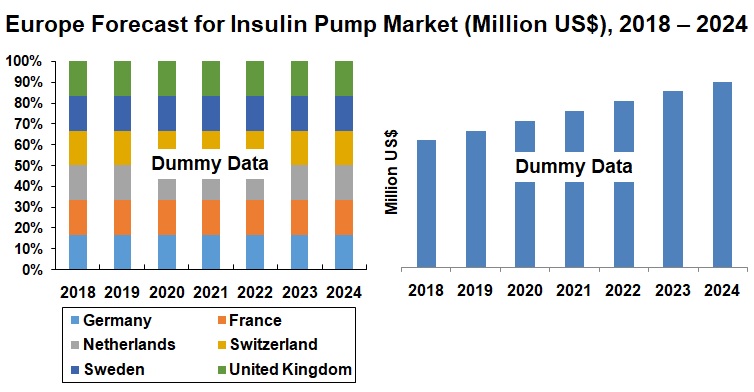

Europe insulin pump market is projected to be more than US$ 2.4 Billion by the end of year 2024. The numbers of factors contributing to the growth of insulin pump in Europe are growing ageing population, increasing prevalence of diabetes, rising awareness regarding benefits of insulin pump, increasing per capita disposable income and progressive diabetes infrastructure. Although potential of insulin pump market in Europe is very high due to its large diabetes population. Gradually advancement of insulin pumps and its skyrocket adoption among diabetes patient over conventional techniques are opening solid opportunities for insulin pump market in Europe. On contrary, high cost of insulin pump, inadequate reimbursement policies and availability of others substitutes are hindering the insulin pump market in Europe.

Europe is one of the best regions in world, where healthcare provider is well aligned and diabetes institutional network are properly scattered to capture the whole demography. Thus service is available for everyone in terms of diabetes training for healthcare certified professional (HCP), assistant staff and new patients. Moreover, there are large number of insulin pump manufacturer in Europe launching new products time to time with great advancement and features.

Request a free sample copy of the report: https://www.renub.com/contactus.php

Germany is one of the biggest markets for Insulin Pump in Europe

In Europe, Germany is one of biggest market for insulin pump due to its large number of diabetes patient, type 1 diabetes patient and improved reimbursement policies. The report covers following 6 European countries Diabetes insulin pump market, insulin pump users its growth forecast, Number of Type 1 and Type 2 diabetes population in each country.

Europe Insulin Pump Reimbursement Policies

This report covers in-depth analysis of Insulin pump reimbursement policy of 6 major countries in Europe (Germany, France, Netherlands, Switzerland, Sweden and United Kingdom). In this report we also covered diabetes national framework and priority of the government. In addition we mentioned what criteria are required to get insulin pump reimbursed.

Europe Insulin Pump Market, Users, Reimbursement Policy, Countries (Germany, France, Netherlands, Switzerland, Sweden, and UK) Clinical Trials and Training Model Analysis is the report published by Renub Research on Insulin Pump Market.

Client can purchase this report in sections through Purchase by Chapter Tab given above

Countries Covered

1. Germany

2. France

3. Netherlands

4. Switzerland

5. Sweden

6. United Kingdom

Scope of the Report

- Insulin Pump Market & Forecast: This report comprises of insulin pump market and volume of user of 6 countries. Market data from 2010 to 2017 and Forecast period from 2018 to 2024.

- Reimbursement Policy: Report covers the details of separate reimbursement policy for 6 countries including Insulin Pumps, Diabetes Supplies (Blood Glucose Devices, Test Strips, Lancets, Disposable Needles, Syringe, Ketone Urine Testing Strips, and Pen Delivery etc)

- Training Models: This topic shows through flow chart method, how a company provides training. This segment companies Training program for its staff includes physicians, Certified Diabetes Educators (including nurse educators, dietitians and exercise physiologists) and support staff with expertise in insulin pump therapy and Training program for patients have been described through flow chart method.

- Differentiation Points of Insulin Pump Products: This report discusses about pros and cons of the insulin pumps: Animas Vibe, Medtronic 530G with Enlite, Insulet OmniPod, Tandem t:slim, Roche Accu-Chek Combo.

- Clinical Trials of Insulin Pumps: This report covers the details of clinical trials results for companies on Insulin Pumps. Following are the details of the companies associated with insulin pumps- Medtronic, Insulet Corporation, Tandem Diabetes Care, Roche and Animas Corporation.

- Growth Drivers for Insulin Pumps: This report tells about the factors which is helping the Insulin Pump industry to grow.

- Challenges for Insulin Pumps: This report covers the problems being faced by the insulin Pump industry.

1. Executive Summary

2. Europe Insulin Pump Users (2010 – 2024)

3. Europe Insulin Pump Market (2010 – 2024)

4. Market Share – Europe Insulin Pump (2010 – 2024)

4.1 Countries

5. Training Model for Patients & HCP – of Medtronic, Animas, Insulet Corp & Tandem Diabetes Care

5.1 Medtronic

5.1.1 Training Guidelines for Insulin Pump Therapy to New Patients

5.1.2 Training Model for HCP (HealthCare Professional)

5.2 Insulet Corporation

5.2.1 Training Structure for New Patients - Insulet Corporation

5.3 Animas Corporation

5.3.1 Training Modules for New Patients

5.3.2 Training Modules for HCP (Health Care Professional)

5.4 Tandem Diabetes Care

6. Differentiation Points of Insulin Pump Products

6.1 Animas Vibe

6.2 Medtronic 530G with Enlite

6.3 Insulet OmniPod

6.4 Tandem t:slim

6.5 Roche Accu-Chek Combo

7. United Kingdom – Diabetes Population (2010 – 2024)

7.1 United Kingdom – Total Diabetes Population

7.1.1 Type 1 Diabetes Population

7.1.2 Type 2 Diabetes Population

8. United Kingdom Insulin Pump Analysis (2010 – 2024)

8.1 Insulin Pump Users & Forecast

8.2 Insulin Pump Market & Forecast

8.3 Reimbursement Policies on Insulin Pump

9. Germany – Diabetes Population (2010 – 2024)

9.1 Germany – Total Diabetes Population

9.1.1 Type 1 Diabetes Population

9.1.2 Type 2 Diabetes Population

10. Germany Insulin Pump Analysis (2010 – 2024)

10.1 Insulin Pump Users

10.2 Germany Insulin Pump Market & Forecast

10.3 Reimbursement Policies on Insulin Pump

11. Netherlands – Diabetes Population (2010 – 2024)

11.1 Netherlands – Total Diabetes Population

11.1.1 Type 1 Diabetes Population

11.1.2 Type 2 Diabetes Population

12. Netherlands Insulin Pump Analysis (2010 – 2024)

12.1 Insulin Pump Users & Forecast

12.2 Insulin Pump Market & Forecast

12.3 Reimbursement Policies on Insulin Pump

13. Sweden – Diabetes Population (2010 – 2024)

13.1 Sweden – Total Diabetes Population

13.1.1 Type 1 Diabetes Population

13.1.2 Type 2 Diabetes Population

14. Sweden Insulin Pump Analysis (2010 – 2024)

14.1 Insulin Pump Users & Forecast

14.2 Insulin Pump Market & Forecast

14.3 Reimbursement Policies on Insulin Pump

15. France – Diabetes Population (2010 – 2024)

15.1 France – Total Diabetes Population

15.1.1 Type 1 Diabetes Population

15.1.2 Type 2 Diabetes Population

16. France Insulin Pump Analysis (2010 – 2024)

16.1 Insulin Pump Users & Forecast

16.2 Insulin Pump Market & Forecast

16.3 Reimbursement Policies on Insulin pump

17. Switzerland – Diabetes Population (2010 – 2024)

17.1 Switzerland – Total Diabetes Population

17.1.1 Type 1 Diabetes Population

17.1.2 Type 2 Diabetes Population

18. Switzerland Insulin Pump Analysis (2010 – 2024)

18.1 Insulin Pump Users & Forecast

18.2 Insulin Pump Market & Forecast

18.3 Reimbursement Policies on Insulin Pump

19. Companies - Insulin Pump Clinical Trials

19.1 Medtronic

19.2 Insulet Corporation

19.3 Tandem Diabetes Care

19.4 Roche

19.5 Animas Corporation

20. Growth Drivers

20.1 Benefits of Insulin Pump over Multiple Daily Injections

20.2 Lifestyle-Compatible Treatment Options and Technological Advancement in Insulin Pump Devices

21. Challenges

21.1 Safety Issues in Insulin Pump Devices

21.2 Difficulties Associated with the Pump

List of Figures

Figure 2-1: Europe – Insulin Pump Users (Number), 2010 – 2017

Figure 2-2: Europe – Forecast for Insulin Pump Users (Number), 2018 – 2024

Figure 3-1: Europe – Insulin Pump Market (Million US$), 2010 – 2017

Figure 3-2: Europe – Forecast for Insulin Pump Market (Million US$), 2018 – 2024

Figure 4-1: Europe – Insulin Pump Market Share (Percent), 2010 – 2017

Figure 4-2: Europe – Forecast for Insulin Pump Market Share (Percent), 2018 – 2024

Figure 7-1: United Kingdom: Diabetes Population (Thousand), 2010 – 2017

Figure 7-2: United Kingdom: Forecast for Diabetes Population (Thousand), 2018 – 2024

Figure 7-3: United Kingdom: Type 1 Diabetes Population (Thousand), 2010 – 2017

Figure 7-4: United Kingdom: Forecast for Type 1 Diabetes Population (Thousand), 2018 – 2024

Figure 7-5: United Kingdom: Type 2 Diabetes Population (Thousand), 2010 – 2017

Figure 7-6: United Kingdom: Forecast for Type 2 Diabetes Population (Thousand), 2018 – 2024

Figure 8-1: United Kingdom – Insulin Pump Users (Number), 2010 – 2017

Figure 8-2: United Kingdom – Forecast for Insulin Pump Users (Number), 2018 – 2024

Figure 8-3: United Kingdom – Insulin Pump Market (Million US$), 2010 – 2017

Figure 8-4: United Kingdom – Forecast for Insulin Pump Market (Million US$), 2018 – 2024

Figure 9-1: Germany: Diabetes Population (Thousand), 2010 – 2017

Figure 9-2: Germany: Forecast for Diabetes Population (Thousand), 2018 – 2024

Figure 9-3: Germany: Type 1 Diabetes Population (Thousand), 2010 – 2017

Figure 9-4: Germany: Forecast for Type 1 Diabetes Population (Thousand), 2018 – 2024

Figure 9-5: Germany: Type 2 Diabetes Population (Thousand), 2010 – 2017

Figure 9-6: Germany: Forecast for Type 2 Diabetes Population (Thousand), 2018 – 2024

Figure 10-1: Germany – Insulin Pump Users (Number), 2010 – 2017

Figure 10-2: Germany – Forecast for Insulin Pump Users (Number), 2018 – 2024

Figure 10-3: Germany – Insulin Pump Market (Million US$), 2010 – 2017

Figure 10-4: Germany – Forecast for Insulin Pump Market (Million US$), 2018 – 2024

Figure 11-1: Netherlands: Diabetes Population (Thousand), 2010 – 2017

Figure 11-2: Netherlands: Forecast for Diabetes Population (Thousand), 2018 – 2024

Figure 11-3: Netherlands: Type 1 Diabetes Population (Thousand), 2010 – 2017

Figure 11-4: Netherlands: Forecast for Type 1 Diabetes Population (Thousand), 2018 – 2024

Figure 11-5: Netherlands: Type 2 Diabetes Population (Thousand), 2010 – 2017

Figure 11-6: Netherlands: Forecast for Type 2 Diabetes Population (Thousand), 2018 – 2024

Figure 12-1: Netherlands – Insulin Pump Users (Number), 2010 – 2017

Figure 12-2: Netherlands – Forecast for Insulin Pump Users (Number), 2018 – 2024

Figure 12-3: Netherlands – Insulin Pump Market (Million US$), 2010 – 2017

Figure 12-4: Netherlands – Forecast for Insulin Pump Market (Million US$), 2018 – 2024

Figure 13-1: Sweden: Diabetes Population (Thousand), 2010 – 2017

Figure 13-2: Sweden: Forecast for Diabetes Population (Thousand), 2018 – 2024

Figure 13-3: Sweden: Type 1 Diabetes Population (Thousand), 2010 – 2017

Figure 13-4: Sweden: Forecast for Type 1 Diabetes Population (Thousand), 2018 – 2024

Figure 13-5: Sweden: Type 2 Diabetes Population (Thousand), 2010 – 2017

Figure 13-6: Sweden: Forecast for Type 2 Diabetes Population (Thousand), 2018 – 2024

Figure 14-1: Sweden – Insulin Pump Users (Number), 2010 – 2017

Figure 14-2: Sweden – Forecast for Insulin Pump Users (Number), 2018 – 2024

Figure 14-3: Sweden – Insulin Pump Market (Million US$), 2010 – 2017

Figure 14-4: Sweden – Forecast for Insulin Pump Market (Million US$), 2018 – 2024

Figure 15-1: France – Diabetes Population (Thousand), 2010 – 2017

Figure 15-2: France – Forecast for Diabetes Population (Thousand), 2018 – 2024

Figure 15-3: France – Type 1 Diabetes Population (Thousand), 2010 – 2017

Figure 15-4: France – Forecast for Type 1 Diabetes Population (Thousand), 2018 – 2024

Figure 15-5: France – Type 2 Diabetes Population (Thousand), 2010 – 2017

Figure 15-6: France – Forecast for Type 2 Diabetes Population (Thousand), 2018 – 2024

Figure 16-1: France – Insulin Pump Users (Number), 2010 – 2017

Figure 16-2: France – Forecast for Insulin Pump Users (Number), 2018 – 2024

Figure 16-3: France – Insulin Pump Market (Million US$), 2010 – 2017

Figure 16-4: France – Forecast for Insulin Pump Market (Million US$), 2018 – 2024

Figure 17-1: Switzerland: Diabetes Population (Thousand), 2010 – 2017

Figure 17-2: Switzerland: Forecast for Diabetes Population (Thousand), 2018 – 2024

Figure 17-3: Switzerland: Type 1 Diabetes Population (Thousand), 2010 – 2017

Figure 17-4: Switzerland: Forecast for Type 1 Diabetes Population (Thousand), 2018 – 2024

Figure 17-5: Switzerland: Type 2 Diabetes Population (Thousand), 2010 – 2017

Figure 17-6: Switzerland: Forecast for Type 2 Diabetes Population (Thousand), 2018 – 2024

Figure 18-1: Switzerland – Insulin Pump Users (Number), 2010 – 2017

Figure 18-2: Switzerland – Forecast for Insulin Pump Users (Number), 2018 – 2024

Figure 18-3: Switzerland – Insulin Pump Market (Million US$), 2010 – 2017

Figure 18-4: Switzerland – Forecast for Insulin Pump Market (Million US$), 2018 – 2024

List of Tables

Table 6‑1: Animas Vibe Differentiation Features

Table 6‑2: Medtronic 530G with Enlite Differentiation Features

Table 6‑3: Insulet OmniPod Differentiation Features

Table 6‑4: Tandem t:slim Differentiation Features

Table 6‑5: Roche Accu-Chek Combo Differentiation Features

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com