Europe Medical Ceramics Market Size and Share Analysis - Growth Trends and Forecast Report 2024-2032

Buy NowEurope Medical Ceramic Market Trends & Summary

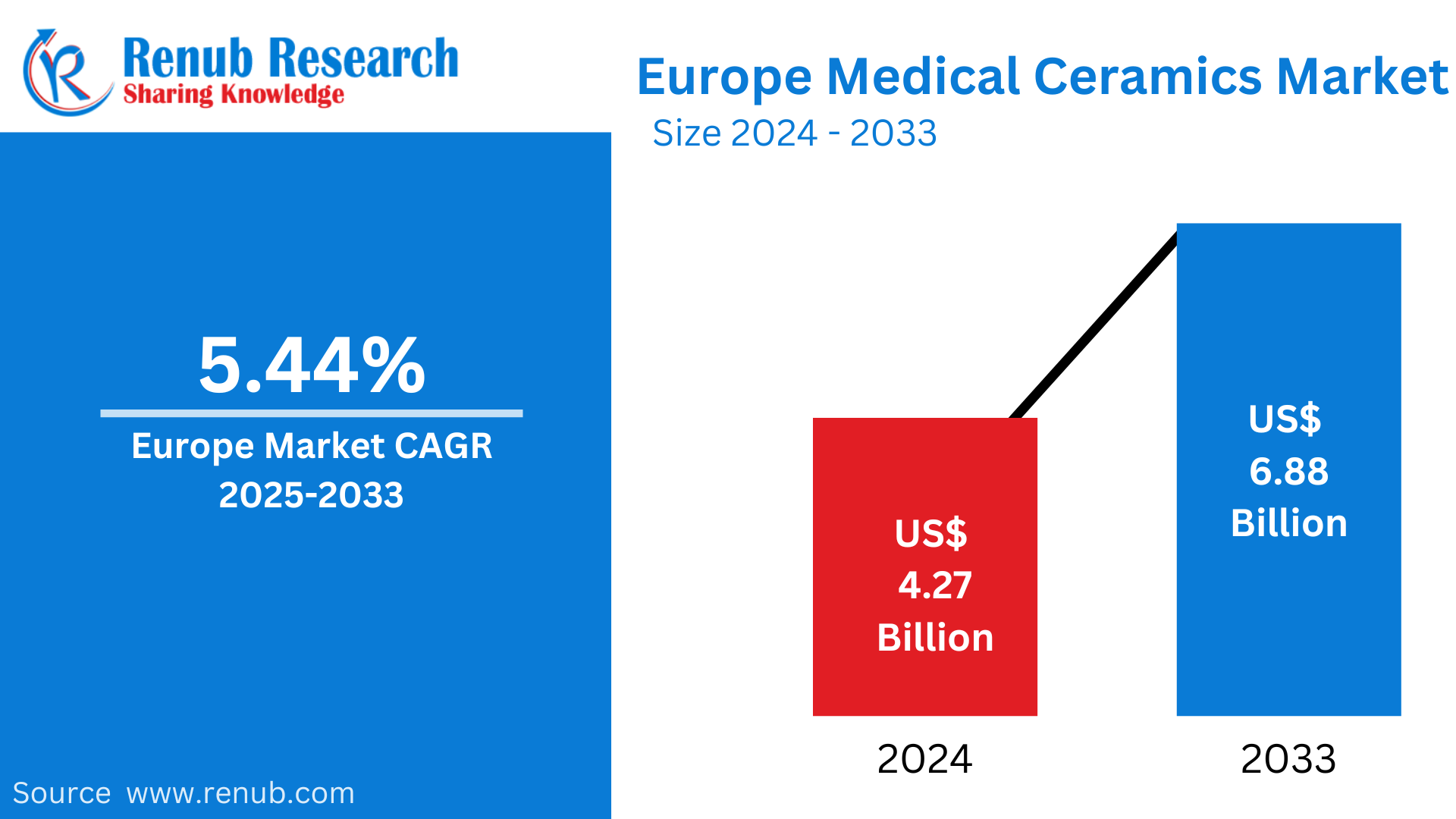

Europe medical Ceramic Market is estimated to reach US$ 6.88 billion by 2032 from the current US$ 4.27 billion in 2032, with a CAGR of 5.44% during 2024-2032. This growth is due to the higher utilization of Biodegradable polymers in dental and orthopedic implants because of their compatibility and toughness.

The report Europe Medical Ceramics Market & Forecast covers by Material Types (Bioinert, Bioactive, Bioresorbable, Piezo Ceramics), Application (Surgical Instruments, Plastic Surgery, Orthopedic application, Dental Application) Countries and Company 2024-2032

Europe Medical Ceramic Market Outlooks

Medical ceramics are advanced ceramics that are employed in different healthcare applications and processes and are by and large bio compatible, strong and very durable. Being made from inorganic non-metallic compounds like alumina, zirconia and hydroxyapatite, these materials have been designed to cope up with the challenges of medical implants and devices. Wear resistance, corrosion resistance and mechanical strength are important for the medical ceramics that are used for implantation and should have long term functionality and should be safe to use for patients.

Across Europe, medical ceramics have been widely applied in a number of sensitive purposes. In dentistry, they are used mainly in crowns, bridges, and dental implants because of a beautiful appearance and the ability to withstand mechanical stress. Total hip and knee replacements incorporate medical ceramics to offer durable solutions, which experience low wear. Furthermore, Europe’s healthcare industry utilizes medical ceramics in minimally invasive surgical instruments and diagnostic imaging equipment; the high performance of ceramics affording better treatment to patients and enhanced surgical delicacy.

Growth Driver of the Europe Medical Ceramic Market

Advancements in Medical Technology

The European medical ceramic market is highly dynamic due to the ever-evolving developments of medical technologies. Advancements in materials sciences have seen high performance ceramics being developed with new characteristics like, biocompatibility, strength etc. These developments have allowed the development and fabrication of better and longer-lasting medical implants and devices, which overall enhances the patient’s welfare. The latest technologies such as 3D printing and other methods of production have opened up more uses of medical ceramics across the various sub specialties in medicine. For instance, a high-quality and long-wearing medical solution is a current global need, as the development of medical technologies remains a chief influence to market growth. April 2023, Aldena Therapeutics Inc. and Empa have received a CHF 600,000 from InnoSuisse to jointly work in research for the new skin delivery microneedle particles in dermatology.

Rising Geriatric Population in Europe

One of the major factors driving the medical ceramic market in Europe is the increased geriatric population. There is an increased demand for medical implants and devices as the aged population continues to grow due to various diseases which may include joint pullout, bone breakage among others. Orthopedic and dental implant applications are particularly important in the field of medical ceramics because of their high mechanical strengths and the bio-equivalent characteristics of several ceramics with human tissues. Increased numbers of surgical operations and replacement among elders involving such parts as hip and knee implants always keeps demand for high quality medical ceramics on the rise. The steady increase into the proportion of aged people in the population is supposed to contribute towards the flow of this market as stakeholders in the health industry adjust in an attempt to cater for this becoming population. According to the estimate made by Eurostat, in January 2023, the Population of Europe’s Union was 448.8 million people, significantly over one fifth (21.3%) were 65 years old and over.

Growing Prevalence of Chronic Diseases and diabetes in Europe

The rise in incidence of chronic ailments in the Europe has ensured that the medical ceramics market receives a tremendous boost. Chronic diseases like osteoporosis, arthritis, and cardiovascular diseases, for instance, necessitate complex treatment consisting of implants and prosthetics developed from medical ceramics. These materials are appreciated for their stability, non-toxicity and durability; therefore, they are appropriate for chronic diseases. Given this change, there is a stark need to both synthesize and apply sound medical ceramics to positively transform the health of patients suffering from extraordinary chronic diseases. Medical ceramics will increase in size as chronic diseases are on the rise; therefore, the trend will help the market to grow. Data on long-standing (chronic) health problems are based on the repeated-on health included; 36.1% of people in the EU had one or several long-standing (chronic) health problems in 2022.

Problems in the Europe Medical Ceramics Market

Strict Regulatory Framework and Problems in Compliance

This European market for medical ceramics faces stringent regulations from bodies such as the European Medicines Agency (EMA), with the rule of the Medical Device Regulation (MDR). Documenting high-level clinical testing is required for compliance, which increases the time taken and cost for entering the market. The transition from MDD to MDR further tightened the regulation, which is increasing approval time and is becoming impractical for smaller manufacturers in terms of competition. These compliance issues act as a significant roadblock to innovation and expansion within the European medical ceramics market.

High Production Costs and Lack of Scalability

Medical ceramics require specialized raw materials, advanced manufacturing processes, and high-precision engineering, all of which contribute to high production costs. Scaling up production while maintaining quality standards remains a challenge, particularly for bioactive and bioresorbable ceramics. Moreover, energy-intensive manufacturing processes further drive costs, making these products expensive for healthcare providers. This cost factor can limit the adoption of medical ceramics in Europe, especially in regions with budget constraints in public healthcare systems.

Europe Bioactive Medical Ceramics Market

Bioactive medical ceramics including hydroxyapatite and bio-glass have a significant share in orthopedic implants, dental applications, and tissue regeneration in Europe. These materials allow bone growth while naturally integrating into human tissues and are thus valuable for reconstructive procedures. This European market of bioactive ceramics is increasing day by day as the demand for biocompatible implants increases in regenerative medicine. However, problems like material brittleness and complicated manufacturing procedures are still present to be completely optimized for the use of medical applications.

European Bioresorbable Medical Ceramics Market

Bioresorbable medical ceramics are gaining more attention in Europe because they will dissolve naturally inside the body and not cause complications for a longer period. This material is extensively used in bone grafting, dental implants, and drug delivery systems. Europe’s growing aging population and rising demand for minimally invasive procedures are driving market growth. November 2024: Medtronic launched a bioresorbable orthopedic implant using advanced polyglycolic acid (PGA), aimed at supporting bone regeneration and reducing post-surgical risks for improved patient recovery outcomes.

Europe Plastic Surgery Medical Ceramics Market

Medical ceramics are increasingly being used in plastic and reconstructive surgeries across Europe due to their durability, biocompatibility, and aesthetic appeal. The application of ceramic implants in facial reconstruction, cosmetic dentistry, and bone augmentation is the main reason for the increasing demand in the market. Increasing demand for non-metallic, natural-looking materials in aesthetic procedures is also boosting the market. Improvements in ceramic coatings and 3D printing technology have enhanced the precision and customization of implants. The high cost of ceramic-based implants and limited reimbursement policies for cosmetic procedures are some of the key challenges to market expansion.

Germany Medical Ceramics Market

Germany is a prominent player in the medical ceramics market in Europe. This is as a result of a strong health infrastructure, advanced research facilities, and a high demand for implants in the country. The country leads the world in terms of developing bioactive and bioresorbable ceramics for orthopedic, dental, and cardiovascular applications. Improving mechanical properties and biocompatibility of ceramics is being tried with improved patient outcomes in mind by German manufacturers. Government initiatives towards medical research and innovation are driving the market growth. However, strict regulations and high-cost manufacturing are posing a challenge to companies operating in Germany. October 2024: KYOCERA Fineceramics Medical GmbH has announced a new facility in Stuttgart, Germany, making medical ceramics. The facility will become operational in September 2025. The new facility will manufacture ceramic ball heads for hip prostheses and other implants.

United Kingdom Medical Ceramics Market

The United Kingdom medical ceramics market is growing because of an increased requirement for more advanced biomaterials in dental and orthopedic procedures. Innovations in bioactive and bioinert ceramics are being driven by the UK's strong presence in medical research and the leading collaboration with universities. The increasing number of joint replacement surgeries and cosmetic procedures is also highly boosting the demand in the market. However, market growth could be affected by uncertainty over post-Brexit changes in regulations and funding constraints within the National Health Service (NHS). To overcome these, companies are looking to develop ceramic solutions that are cost-effective but high in performance. In 2024, CeramTec GmbH unveiled a new medical ceramic product known as Sinalit®. The product was launched in June 2024 at the PCIM Europe trade fair in Nuremberg.

France Medical Ceramic Market

France’s medical ceramic market is experiencing steady growth, bolstered by the country’s robust healthcare system and commitment to medical innovation. Medical ceramics, such as zirconia and alumina, are increasingly used in dental implants, orthopedic devices, and surgical tools due to their superior biocompatibility and mechanical strength. The market benefits from France’s strong emphasis on research and development, which fosters ceramic materials and applications advancements. Additionally, the rising prevalence of chronic diseases and an aging population contribute to increased demand for durable and effective medical solutions. France’s well-established medical device industry and its focus on integrating advanced technologies further support the expansion of the medical ceramic market, making it a significant player in Europe’s healthcare sector.

European Medical Ceramic Company News

In June 2024, CeramTec will introduce a new product called Sinalit®, coinciding with the PCIM Europe trade fair in Nuremberg. This new product is a silicon nitride-based substrate, expanding CeramTec's existing portfolio.

August 2023, Lithoz GmbH, Vienna, Austria, and Himed, New York, USA, have signed a research partnership to develop medical-grade bioceramics focusing on biocompatible calcium phosphates for additive manufacturing.

In July 2022, Surgeons in Europe now have access to Cerhum’s MyBone, a patient-specific 3D-printed bone, to treat patients with severe facial deformations. This 3D-printed bone is made of hydroxyapatite, a calcium phosphate that is the main mineral component of natural bone. MyBone is 3D printed with a porous structure created by Cerhum, a medical device company based in Liège, Belgium.

Europe Medical Ceramics Market Segments

Material Types – Market is divided into 4 Viewpoints

- Bioinert

- Bioactive

- Bioresorbable

- Piezo Ceramics

Application – Market is divided into 4 Viewpoints

- Surgical Instruments

- Plastic Surgery

- Orthopedic application

- Dental Application

Countries – Market is divided into 15 Viewpoints

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Bulgaria

- Portugal

- Rest of Europe

All the Key players have been covered from 3 Viewpoints:

- Overviews

- Key Person

- Recent Developments & Strategies

- Product Portfolio & Product Launch in Last 1 Year

- Revenue

Key Players Analysis

- CeramTec GmbH

- NGK Spark Plug Co.Ltd

- 3M

- Kyocera Corporation

- Morgan Advanced Materials

- DSM

- Straumann

- BioMérieux SA

Report Details:

| Report Features | Details |

| Base Year |

2023 |

| Historical Period |

2019 - 2023 |

| Forecast Period |

2024 - 2032 |

| Market |

US$ Billion |

| Segment Covered |

Material Types, Application and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What are the key growth drivers of the Europe medical ceramics market?

- What challenges does the Europe medical ceramics market face?

- How is the rising geriatric population influencing the demand for medical ceramics?

- What role do advancements in medical technology play in the market’s growth?

- How does the regulatory framework impact market expansion?

- What are the major material types used in medical ceramics?

- Which applications dominate the medical ceramics market in Europe?

- How are bioactive and bioresorbable ceramics contributing to market growth?

- Which European countries are leading in the medical ceramics industry?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Medical Ceramics Market

6. Market Share –Europe Medical Ceramics Market

6.1 By Material Types

6.2 By Application

6.3 By Countries

7. Material Types – Europe Medical Ceramics Market

7.1 Bioinert

7.2 Bioactive

7.3 Bioresorbable

7.4 Piezo Ceramics

8. Application –Europe Medical Ceramics Market

8.1 Surgical Instruments

8.2 Plastic Surgery

8.3 Orthopedic application

8.4 Dental Application

9. Countries – Europe Medical Ceramic Market

9.1 France

9.2 Germany

9.3 Italy

9.4 Spain

9.5 United Kingdom

9.6 Belgium

9.7 Netherlands

9.8 Russia

9.9 Poland

9.10 Greece

9.11 Norway

9.12 Romania

9.13 Bulgaria

9.14 Portugal

9.15 Rest of Europe

10. Porter's Five Forces Analysis

10.1 Threat of New Entry

10.2 The Bargaining Power of Buyer

10.3 Threat of Substitution

10.4 The Bargaining Power of Supplier

10.5 Competitive Rivalry

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Key Players Analysis

12.1 CeramTec GmbH

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments & Strategies

12.1.4 Product Portfolio & Product Launch in Last 1 Year

12.1.5 Revenue

12.2 NGK Spark Plug Co., Ltd.

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments & Strategies

12.2.4 Product Portfolio & Product Launch in Last 1 Year

12.2.5 Revenue

12.3 3M

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments & Strategies

12.3.4 Product Portfolio & Product Launch in Last 1 Year

12.3.5 Revenue

12.4 Kyocera Corporation

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments & Strategies

12.4.4 Product Portfolio & Product Launch in Last 1 Year

12.4.5 Revenue

12.5 Morgan Advanced Materials

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments & Strategies

12.5.4 Product Portfolio & Product Launch in Last 1 Year

12.5.5 Revenue

12.6 DSM

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments & Strategies

12.6.4 Product Portfolio & Product Launch in Last 1 Year

12.6.5 Revenue

12.7 Straumann

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments & Strategies

12.7.4 Product Portfolio & Product Launch in Last 1 Year

12.7.5 Revenue

12.8 BioMérieux SA

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments & Strategies

12.8.4 Product Portfolio & Product Launch in Last 1 Year

12.8.5 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com