Europe Microwave Oven Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Microwave Oven Market Trends & Summary

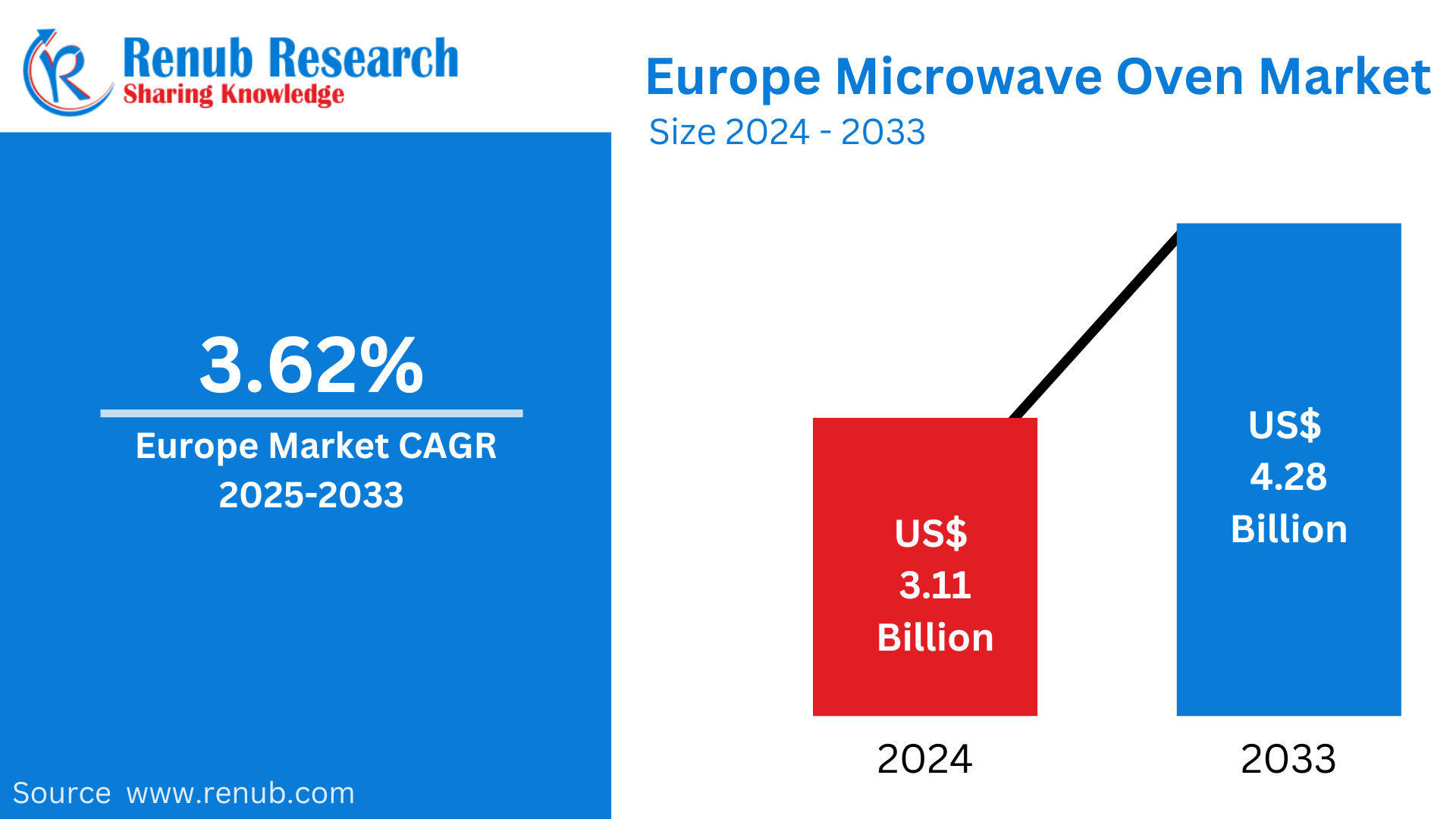

Europe Microwave Oven market had already reached US$ 3.11 Billion in 2024. Between 2025 and 2033, it was growing at an impressive CAGR of 3.62%. Increasing demand for convenience appliances and increasing disposable income have boosted demand. Further advancements in smart cooking technologies will make this a much-sought convenience product in kitchens by 2033. Thus, by then, the size of the Europe Microwave Oven market will reach the figure of US$ 4.28 Billion.

The report Europe Microwave Oven Market & Forecast covers by Type (Grill, Solo, and Convection), Application (Commercial and Household), Structure (Built-In and Counter Top), Distribution Channel (Online and Offline), Country and Company Analysis 2025-2033.

Europe Microwave Oven Market Overview

The microwave oven is one of the most versatile kitchen appliances, utilizing electromagnetic waves within the microwave frequency range to heat and cook food. It works by exciting water molecules in the food that will make it vibrate and then give out heat, thereby cooking the inside of the food. It is also faster at cooking than conventional ovens, making it a great alternative for homes with busy families.

Microwave ovens are highly used in Europe for various purposes. They are perfect for reheating leftovers, defrosting frozen foods, and cooking simple meals very fast. Many European homes install microwave ovens in their kitchen due to their compact size and multi-functionality. Some even have convection features for baking and roasting, which adds to their functionality. Microwaves are widely used by the youth and professionals due to their time-saving capability and efficiency in cooking. Though the traditional methods are certainly prized for specific recipes, the microwave is still an integral part of modern European culinary practices.

Growth Drivers in the Europe Microwave Oven Market

Convenience Cooking Demand Surging

European consumers have increasingly increasing busy lifestyles and rapid urbanization leading to a demand for appliances that simplify cooking processes. Microwave ovens provide fast cooking, reheating, and defrosting, making them a must-have in the kitchen. The increased consumption of ready-to-eat meals and frozen foods is driving the demand for microwave ovens. Compact designs and versatile features, such as grilling and convection, make them even more attractive. This trend is prominent among young consumers and working professionals, hence the steady growth in the market. January 2024: Samsung will strengthen business competitiveness to achieve carbon neutrality. In 2024, it will start a power supply and demand management project at Panasonic Manufacturing UK Ltd, a manufacturer of microwave ovens and other products.

Technological Developments and Smart Features

Advanced technologies, including IoT-enabled and smart microwave ovens, are the main drivers of growth. These appliances enable remote control and monitoring through smartphones, making life easier for consumers. Other features, such as voice control, sensor-based cooking, and energy efficiency, meet the needs of more technologically aware European consumers. Other areas that appeal to this region's green aspirations include the innovative design and materials for products. Manufacturers have shifted focus towards high-end products with added functionality to stimulate further demand and increase market penetration. July 2024 Euronext launches a new London-based microwave service, the Euronext Wireless Network, or EWIN. This service shall significantly improve order transmission speed between London and Euronext's core data centre located in Bergamo, Italy, benefiting members based out of London in terms of higher latency improvements.

Increased Disposable Income and Lifestyle

Increasing disposable income has led more and more customers to invest in premium kitchen appliances as lifestyle preferences across Europe take a turn upwards in the west and north of Europe. Lifestyle changes, the preference for more modern and modular kitchens, a growing demand for aesthetically designed microwave ovens, increasing health consciousness have led to home eating, resulting in the encouragement of advanced cooking appliances. Consumer demands for the microwave oven market include appliances that offer style, efficiency, and functionality. The International Monetary Fund (IMF) still estimates that the per capita income in the European Union is still expected to be around $45,240 in 2024 according to their World Economic Outlook report.

Issues in the European Market for Microwave Oven

Market Saturation is High

The European microwave oven market is saturated, as it is widely penetrated in developed regions like Western Europe. Most homes already have a microwave oven, so there's slow replacement activity. This saturation limits opportunities for new entrants and forces existing players to focus on innovation to differentiate their offerings. Moreover, some segments have price-sensitive consumers that lead to competition among manufacturers, which challenges the profit margins.

Environmental Concerns and Regulations

Strict environmental regulations and sustainability concerns pose significant challenges in the European market. Microwave ovens often face scrutiny for energy consumption and waste generated during production and disposal. Governments and consumers demand eco-friendly appliances, compelling manufacturers to invest in costly sustainable technologies. Meeting energy efficiency standards, such as those mandated by the EU, can increase production costs. This regulatory pressure requires ongoing innovation to balance environmental compliance with affordability, adding complexity to market operations.

Europe Grill Microwave Oven Market

The Europe grill microwave oven market is witnessing steady growth due to rising consumer demand for versatile cooking appliances. Grill microwave ovens combine traditional microwaving with grilling functionality, making them ideal for preparing a variety of dishes. The growing popularity of home-cooked meals and multifunctional kitchen appliances is driving this market. Technological advancements, including smart features and energy-efficient models, further boost adoption. The Europe grill microwave oven market is likely to continue its upward trend in the coming years with increasing disposable incomes and a preference for modern kitchens.

Europe Household Microwave Oven Market

The Europe household microwave oven market is steadily growing due to increasing urbanization and busy lifestyles that emphasize convenience in cooking. Microwave ovens have become a must-have appliance in every kitchen, offering fast and efficient meal preparation, reheating, and defrosting options. The market is also experiencing growth due to increasing disposable incomes and the popularity of ready-to-eat and frozen food products. Technological advancements, such as smart ovens with IoT connectivity and eco-friendly features, are further enhancing demand. Additionally, compact and stylish designs cater to modern households, supporting the continued expansion of the market in Europe.

Europe Built-In Microwave Oven Market

The Europe built-in microwave oven market is growing at a robust rate, mainly due to the increasing adoption of modern kitchen designs and the growing preference for integrated appliances. Built-in microwave ovens save counter space and blend well with contemporary modular kitchen aesthetics, making them popular among urban households. Rising disposable incomes and demand for premium kitchen appliances further fuel this market. Technological advancements in the form of smart features, energy efficiency, and multi-functionality make products more attractive to consumers. Also, the concept of sustainable living is compelling manufacturers to come up with environment-friendly models, thereby ensuring a bright future for the Europe built-in microwave oven market.

France Microwave Oven Market

The France microwave oven market is growing steadily as consumer lifestyles evolve and the demand for convenient cooking solutions increases. Multifunctional microwave ovens that can be used for reheating, grilling, and baking are being taken home by French households to cater to various cooking needs. The demand is also fueled by rising disposable incomes and the preference for premium, energy-efficient kitchen appliances. Compact living spaces in urban areas are boosting demand for space-saving built-in microwave ovens. Moreover, innovations such as smart connectivity and eco-friendly design add to the benefits of this market, resonating with the country's idea of sustainability along with modernity in kitchen space.

Germany Microwave Oven Market

Germany microwave oven market is performing steadily. Convenience appliances for easy cooking have been demanding lately, coupled with multifunctionality solutions. People who have a desire for quality efficiency and technological advancement have a craze for the energy-efficient as well as the smart microwave ovens. Demand is fuelled by the tendency towards urbanization and compact living spaces that increase the demand for built-in and space-saving microwave models. Improved disposable incomes, together with emphasis on modern designs in the kitchen, will help propel growth in this market. Sustainability drives the efforts of German manufacturers in making environmentally friendly and energy-saving microwave ovens. July 25, 2024 Huawei XMC-80D Wins Red Dot Design Award and iF Design Award 2024 The award-winning next-generation 2T E-band outdoor unit Huawei XMC-80D. Huawei microwave products received the two prestigious awards consecutively, as the company did last year with its XMC-3E in 2021.

Italy Microwave Oven Market

The Italy microwave oven market is slowly moving upwards thanks to increasing popularity of convenient cooking solutions among consumers and a change in their lifestyle. Multifunctional microwave ovens with grill and convection features are finding a place in the Italian household. Compact and built-in models are in increasing demand, driven by the popularity of modern kitchen designs and smaller living spaces. In addition, growing disposable incomes and the desire for energy-efficient and environmentally friendly appliances favor market growth. The market in Italy also becomes competitive through technological innovation. Smart connectivity and touch-control interfaces are a further boost for microwave ovens. Apr. 2024: LG Electronics to Participate in Milan Design Week 2024 to Enhance Presence in the European Built-in Market. Exhibition: EuroCucina in Salone del Mobile booth; Signature Kitchen Suite Showroom display; collaboration with Moooi in their showroom.

United Kingdom Microwave Oven Market

The UK microwave oven market is growing steadily due to busier lifestyles and a demand for convenience in food preparation. There is an increasing preference for multifunctional appliances that offer cooking, defrosting, and reheating. Rising interest in smart technology, which enables remote operation and integration with home automation systems is also a trend. Health-conscious consumers are also opting for models that are designed for healthier cooking methods, such as steam or grill options, which makes them more attractive in a competitive market landscape. In April 2024, Regale launched the Panasonic NE-17521 commercial microwave oven in the UK. It operates at 60Hz, features 15 power levels, and includes 90 programmable memory pads, making it ideal for catering environments.

Europe Microwave Oven Market Segments

Type – Market breakup in 3 viewpoints:

1. Grill

2. Solo

3. Convection

Application – Market breakup in 2 viewpoints:

1. Commercial

2. Household

Structure – Market breakup in 2 viewpoints:

1. Built-In

2. Counter Top

Distribution Channel – Market breakup in 2 viewpoints:

1. Online

2. Offline

Country – Market breakup in 9 viewpoints:

1. France

2. Germany

3. Italy

4. Spain

5. United Kingdom

6. Belgium

7. Netherlands

8. Turkey

9. Rest of Europe

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Illinois Tool Works Inc

2. Sharp

3. LG Electronics

4. Whirlpool Corporation

5. GE Appliances

6. Panasonic Corporation

7. Samsung Electronics

8. Midea Group

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Application, Structure, Distribution Channel and Countries |

| Countries Covered |

1. France |

| Companies Covered |

1. Illinois Tool Works Inc |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Microwave Oven Market

6. Market Share

6.1 Type

6.2 Application

6.3 Structure

6.4 Distribution Channel

6.5 Country

7. Type

7.1 Grill

7.2 Solo

7.3 Convection

8. Application

8.1 Commercial

8.2 Household

9. Structure

9.1 Built-In

9.2 Counter Top

10. Distribution Channel

10.1 Online

10.2 Offline

11. Country

11.1 France

11.2 Germany

11.3 Italy

11.4 Spain

11.5 United Kingdom

11.6 Belgium

11.7 Netherlands

11.8 Turkey

11.9 Rest of Europe

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 Illinois Tool Works Inc

14.1.1 Overview

14.1.2 Recent Developments

14.1.3 Revenue

14.2 Sharp

14.2.1 Overview

14.2.2 Recent Developments

14.2.3 Revenue

14.3 LG Electronics

14.3.1 Overview

14.3.2 Recent Developments

14.3.3 Revenue

14.4 Whirlpool Corporation

14.4.1 Overview

14.4.2 Recent Developments

14.4.3 Revenue

14.5 GE Appliances

14.5.1 Overview

14.5.2 Recent Developments

14.5.3 Revenue

14.6 Panasonic Corporation

14.6.1 Overview

14.6.2 Recent Developments

14.6.3 Revenue

14.7 Samsung Electronics

14.7.1 Overview

14.7.2 Recent Developments

14.7.3 Revenue

14.8 Midea Group

14.8.1 Overview

14.8.2 Recent Developments

14.8.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com