Europe Organic Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Organic Food Market Trends & Summary

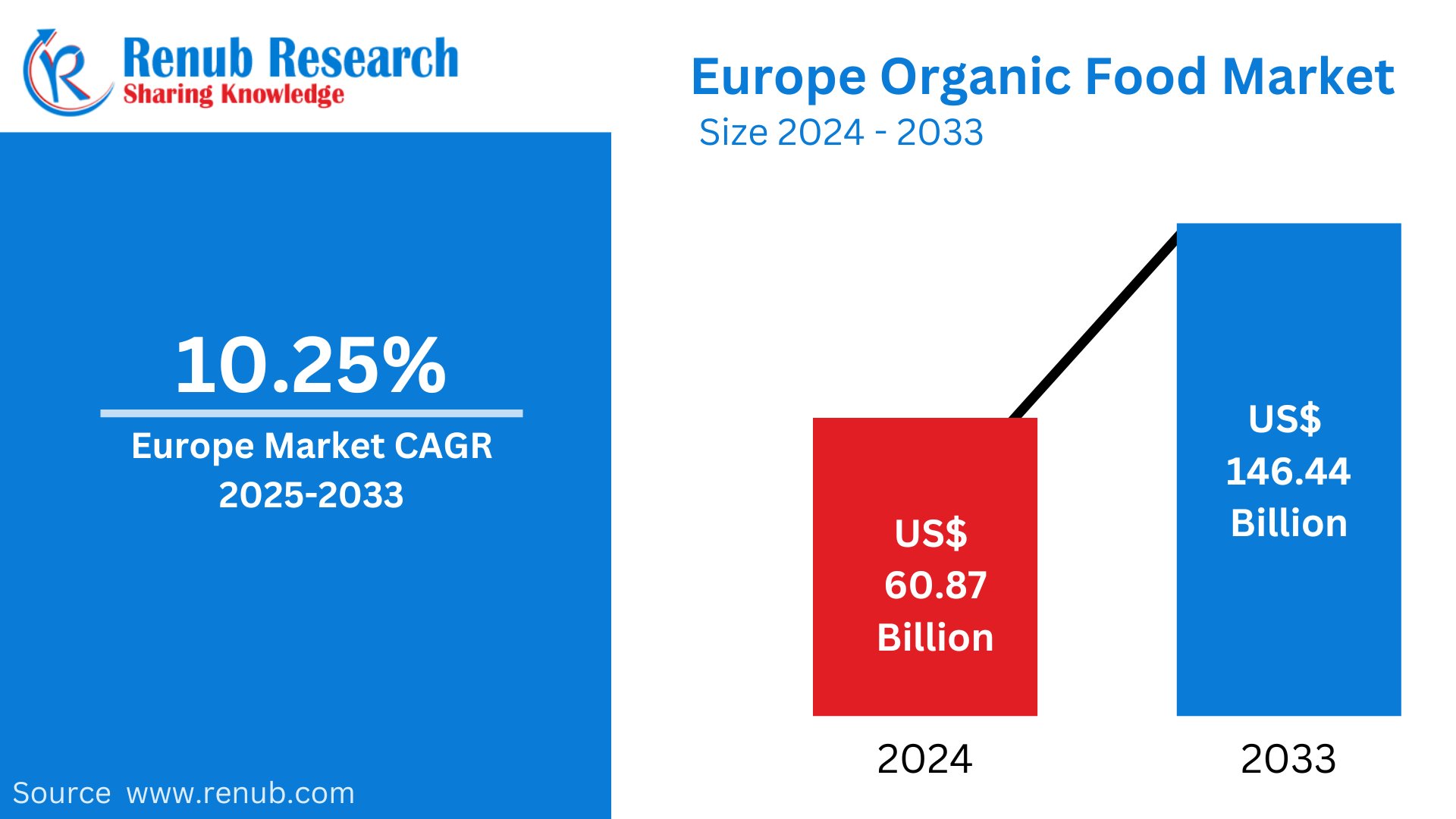

The organic food market in Europe is expected to reach US$ 146.44 Billion by 2033. It will grow from US$ 60.87 Billion in 2024 at a CAGR of 10.25% during the forecast period. This growth will be driven by increasing consumer health and sustainability awareness, increased demand for organic products, and positive government policies. This market reflects a very strong shift towards environmentally conscious and health-focused food consumption trends.

The report Europe Organic Food Market & Forecast covers by Product Types (Organic Fruits and Vegetables, Organic Meat, Poultry and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Cereal and Food Grains, and Others), Distribution Channel (Supermarkets/ Hypermarkets, Specialty Stores, Convenient Stores, Online Retail Stores, and Others), Country and Company Analysis 2025-2033.

Europe Organic Food Market Outlooks

Organic food is referred to as products produced or grown by using environmentally sustainable methods without synthetic pesticides, fertilizers, genetically modified organisms (GMOs), or artificial additives. Organic farming focuses on the health of soil, biodiversity, and animal welfare. These aim to produce healthier food for the consumer and have less negative effects on the environment.

Organic food consumption has grown significantly in Europe due to increased awareness of health benefits and environmental sustainability. European consumers are concerned about clean, chemical-free, and ethically sourced food, which drives demand for organic produce, dairy, meat, and packaged goods. Germany, France, and Italy are the leading markets for organic food, with expanding retail channels, including supermarkets and specialty stores, enhancing accessibility. Subsidies for organic farming and stringent clear labeling have driven growth further, and this has been a continuous shift in the direction of healthy and sustainable consumption of food across Europe.

Europe Organic Food Market Growth Drivers

Awareness and health consciousness among the consumers have seen a rise across Europe, hence becoming a huge growth driver in the market. This increases demand for organic alternatives that do not contain synthetic chemicals or artificial additives. With consumers more interested in a reduction of pesticide use, improvement of nutrition, and the encouragement of sustainable farming, these sales increase further. December 2023, A recent EU-funded study by ProVeg, Innova Market Insights, the University of Copenhagen, and Ghent University found that over half of European consumers (51%) have reduced their meat consumption. The study, which surveyed over 7,500 adults in 10 countries, highlights a growing trend towards more environmentally friendly diets.

Environmental Sustainability and Ethical Farming Practices

European consumers are increasingly prioritizing sustainable and eco-friendly food choices. Organic farming practices, which enhance soil health, biodiversity, and animal welfare, align with these values. Government incentives and consumer advocacy for ethical sourcing also push the demand for organic products. This focus on reducing environmental impact has further accelerated the adoption of organic food in Europe. Ending November 2022, in a partnership with Narayan Foods, an organic foods play, MeliBio, which claims to be the first ever to produce real honey without bees, announced that it raised an additional $2.2 million in funding and plans to sell its products in 75,000 European stores. According to the partnership, Narayan Foods announced plans to market plant-based MeliBio honey under its own Better Foodie brand, starting early 2023.

Expansion of Retail Channels and Accessibility

The growth of the market has been significantly contributed by the expansion of organic product offerings across various retail platforms. Supermarkets, specialty organic stores, online platforms, and food delivery services now provide easier access to organic food. With the convenience of purchasing organic products becoming more widespread, consumers are encouraged to integrate organic choices into their daily diets, driving market growth. A sustainable food system is at the heart of the European Green Deal. Under the Green Deal's Farm to Fork strategy, the European Commission has set a target of 'at least 25% of the EU's agricultural land under organic farming and a significant increase in organic aquaculture by 2030'.

Challenges in the Europe Organic Food Market

Higher Price Point and Affordability Issues

Organic foods generally carry a premium due to higher costs of production and rigorous certification. This has rendered it unaffordable for low-income consumers in general, especially for price-sensitive buyers in regions where disposable incomes are relatively low. High retail prices can prevent high-scale adoption and slow the pace of market expansion in competitive, low-cost segments.

Complexities in the Supply Chain and Distribution

The organic food supply chain is faced with logistics, certification standards, and the increasing demand for organic products. It is a challenge to ensure consistent supply, quality, and traceability of organic ingredients with such coordination across producers, distributors, and retailers. Moreover, different regulations in various European countries can create complications for smooth supply chain operations, which affects the overall market efficiency.

Europe Organic Fruits and Vegetables Market

The Europe organic fruits and vegetables market is witnessing a substantial growth rate due to increasing awareness of health, sustainability, and environmental benefits among consumers. Organic produce, free from synthetic pesticides and fertilizers, aligns with the increasing demand for healthier and eco-friendly food options. Countries like Germany, France, and Italy are leading the market, supported by favorable government policies and the expansion of organic farming practices. Consumers are also attracted to the better taste and nutritional content of organic fruits and vegetables, which is driving market growth. The increasing availability of organic produce in supermarkets, specialty stores, and online platforms contributes to greater consumer access and higher market demand. MeliBio, the world's first company dedicated to producing honey without bees, is teaming up with Narayan Foods to introduce their products in 75,000 European stores. The first-of-its-kind partnership will bring MeliBio’s plant-based honey made without bees product line to store shelves under Narayan Foods’ Better Foodie brand, with products expected to begin their rollout in the first quarter of 2023.

Europe Organic Meat, Poultry and Dairy Market

The Europe organic meat, poultry, and dairy market is witnessing steady growth, driven by increasing consumer demand for natural, sustainable, and ethically sourced animal products. Consumers are increasingly health-conscious and are opting for organic options without antibiotics, hormones, or synthetic additives. Leading the charge are Germany, France, and the United Kingdom, where organic meat, poultry, and dairy products have been gaining traction based on quality perceptions and environmental factors. Besides, the support from government policies and certification standards has also made the production and distribution streamlined with constant supply for increasing demand by consumers. Sustainability remains at the forefront, and organic animal products are ready to thrive in Europe in the long run.

Europe Organic Food Supermarkets Market

The market for organic food supermarkets in Europe is growing very well due to consumer preference for organic, sustainably sourced products. Consumers are becoming increasingly health-conscious and environmentally aware, which is driving demand for organic options in mainstream retail channels. Supermarkets are a key channel for convenient access to organic fruits, vegetables, dairy, meat, and packaged goods. Leading supermarket chains across countries such as Germany, France, and the UK are expanding their organic product offerings, supported by growing consumer interest and favorable government policies. The trend toward wellness and sustainability further boosts the growth of organic food sections within supermarkets, making them a key distribution channel for organic products across Europe.

France Organic Food Market

The France organic food market is growing steadily, due to high consumers demand for better, environment-friendly, as well as ethically produced products. French consumers increasingly recognize the advantages of organic foodstuffs, from reduced chemical exposure to better nutritional quality. The government's support for sustainable agriculture and programs to promote organic farming have supported the growth of the market. Among the key products are fruits and vegetables, dairy, meat, and processed foodstuffs that are gaining traction in supermarkets, specialty stores, and online sites. This can be complemented by an increased number of restaurants and catering businesses providing organic-based foods, increasing demand in the market. June 1st, 2022. Roquette, global leader in plant-based ingredients and a pioneer of plant proteins, announces the launch today of its new range of organic textured proteins from pea and fava for European markets. This launch strengthens Roquette's leadership position within the overall protein market, acting as a key player in plant-based solutions and reinforcing the company's striving to be the best partner for customers who look forward to developing new and tasty plant-based foods.

Germany Organic Food Market

Germany organic food market is very large within Europe, driven primarily by growing awareness among consumers regarding health and sustainability and environmental benefits. More and more German consumers are opting for organic products including fruits, vegetables, dairy, meat, and processed foods in view of the risks associated with food safety, quality, and ethical production practices. Government initiatives in favor of sustainable agriculture and promoting organic farming have enhanced the production and distribution of these products. Supermarkets, health food stores, and online retailers provide easy access to organic products. Organic food in Germany will further increase, based on both production in the country and imports. Feb 2023, The company De Groene Weg B.V. is the biggest supplier of organic meat in the Netherlands and has long been an established partner for the German market and processing industry.

Organic Food Market in Italy

The Italy organic food market is growing at a very robust rate. Increasing consumer demand for healthier and sustainably produced products is one of the drivers behind this growth. Italian consumers have been increasingly educated about the advantages of organic farming, such as improved taste, nutritional value, and environmental impact. Organic products like fruits, vegetables, dairy, meat, and olive oil are in great demand, and the country boasts a strong tradition of high-quality food production. Government initiatives and certifications also play a crucial role in the promotion of organic agriculture. Focusing on sustainability and ethical food consumption, Italy's organic market is expanding further, providing both domestic producers and international brands with opportunities.

Spain Organic Food Market

The Italy organic food market is growing robustly, as consumers increasingly demand healthier, sustainably produced products. Italian consumers are growing more conscious of the advantages that organic farming brings in terms of improved taste, nutritional value, and environmental impact. High demand for fruits, vegetables, dairy, meat, and olive oil products is very much supported by a strong tradition of high-quality food production. Government initiatives and certifications also promote organic agriculture. Italy's organic market, which has focused on sustainability and ethical food consumption, is on the rise. Domestic producers, as well as international brands, have a wide open market there. October 2023 Nestle launches three new varieties of plant-based alternatives to white fish in several European countries: Germany, Spain, Italy, Austria, Poland, the Czech Republic, and Slovakia. These will include marine-style crispy filets and marine-style crispy nuggets, to be introduced in Europe under the Garden Gourmet brand.

Europe Organic Food Market Segments

Product Types – Market breakup in 6 viewpoints:

1. Organic Fruits and Vegetables

2. Organic Meat, Poultry and Dairy

3. Organic Processed Food

4. Organic Bread and Bakery

5. Organic Cereal and Food Grains

6. Others

Distribution Channel – Market breakup in 5 viewpoints:

1. Supermarkets/ Hypermarkets

2. Specialty Stores

3. Convenient Stores

4. Online Retail Stores

5. Others

Country – Market breakup of 9 Countries:

1. France

2. Germany

3. Italy

4. Spain

5. United Kingdom

6. Belgium

7. Netherlands

8. Turkey

9. Rest of Europe

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Danone S.A.

2. General Mills Inc.

3. Sprouts Farmers Market Inc.

4. The Hain Celestial Group Inc.

5. The Kroger Company

6. United Natural Foods Inc.

7. Dole Food Company Inc.

8. Newman's Own

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Distribution Channel and Countrieses |

| Countries Covered |

1. France |

| Companies Covered |

1. Danone S.A. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

What is the projected market size of the Europe organic food market by 2033?

What is the expected CAGR of the Europe organic food market from 2025 to 2033?

Which countries are the leading markets for organic food in Europe?

What are the main product categories in the Europe organic food market?

How do government policies influence the growth of the organic food market in Europe?

What are the major distribution channels for organic food in Europe?

What role does consumer health consciousness play in the growth of the organic food market?

How does environmental sustainability drive demand for organic food in Europe?

What are the biggest challenges faced by the Europe organic food market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Organic Food Market

6. Europe Organic Food Market Share Analysis

6.1 Product Type

6.2 Distribution Channel

6.3 Country

7. Product Type

7.1 Organic Fruits and Vegetables

7.2 Organic Meat, Poultry and Dairy

7.3 Organic Processed Food

7.4 Organic Bread and Bakery

7.5 Organic Cereal and Food Grains

7.6 Others

8. Distribution Channel

8.1 Supermarkets/ Hypermarkets

8.2 Specialty Stores

8.3 Convenient Stores

8.4 Online Retail Stores

8.5 Others

9. Country

9.1 France

9.2 Germany

9.3 Italy

9.4 Spain

9.5 United Kingdom

9.6 Belgium

9.7 Netherlands

9.8 Turkey

9.9 Rest of Europe

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Danone S.A.

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 General Mills Inc.

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Sprouts Farmers Market Inc.

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 The Hain Celestial Group Inc.

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 The Kroger Company

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 United Natural Foods Inc.

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Dole Food Company Inc.

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

12.8 Newman's Own

12.8.1 Overview

12.8.2 Recent Development

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com