Europe Sleep Apnea Devices Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Sleep Apnea Devices Market Trends & Summary

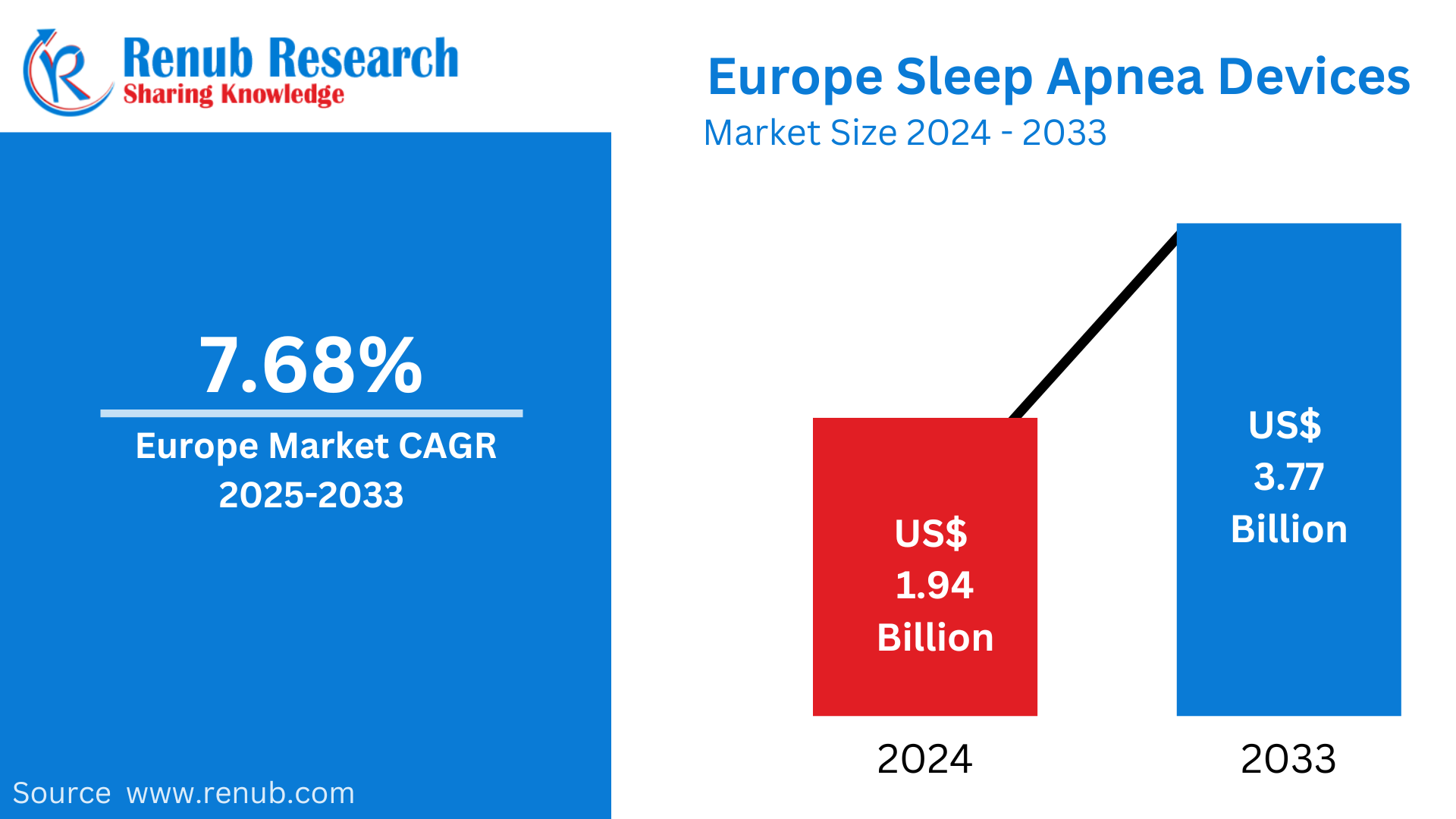

The Europe sleep apnea devices market was valued at US$ 1.94 billion in 2024 and is projected to reach US$ 3.77 billion by 2033, exhibiting a robust CAGR of 7.68% during the forecast period from 2025 to 2033. The market growth is driven by increasing awareness of sleep disorders, the rising prevalence of obstructive sleep apnea, and advancements in diagnostic and therapeutic technologies.

Europe Sleep Apnea Devices Market Report by Types (Therapeutic Devices, and Diagnostic Devices), Therapeutic Devices (CPAP Sleep Apnea Therapeutic Devices, Auto CPAP Sleep Apnea Therapeutic Devices, BiPAP Sleep Apnea Therapeutic Devices, and Adaptive Servo-Ventilation (ASV)), Diagnostic Devices (Polysomnography Devices (PSG), Oximeter, Actigraphy Monitoring Device, Respiratory Polygraph, and Sleep Apnea Screening Device), End User (Sleep Laboratories, Clinics & Hospitals, and Home Care Settings/Individuals), and Company Analysis 2025-2033

Europe Sleep Apnea Devices Market Outlooks

Sleep apnea devices are medical equipment designed to diagnose and treat sleep apnea, a condition characterized by repeated interruptions in breathing during sleep. These devices include Continuous Positive Airway Pressure (CPAP) machines, Bi-level Positive Airway Pressure (BiPAP) machines, oral appliances, and adaptive servo-ventilation systems. They ensure an adequate and consistent flow of oxygen to prevent airway obstruction and improve sleep quality.

In Europe, the use of sleep apnea devices is growing due to the rising prevalence of obstructive sleep apnea caused by sedentary lifestyles, obesity, and aging populations. They are commonly used in hospitals, sleep clinics, and home settings. CPAP and BiPAP machines are the most widely used, helping patients maintain regular breathing patterns and prevent associated complications such as cardiovascular diseases and daytime fatigue. With increasing awareness of sleep health and advancements in portable devices, Europe is experiencing significant growth in adopting sleep apnea devices for better patient outcomes.

Growth Drivers in the Europe Sleep Apnea Devices Market

Rising Prevalence of Sleep Apnea

The increasing prevalence of sleep apnea across Europe is a key growth driver. Sedentary lifestyles, rising obesity rates, and aging populations contribute to the condition. Healthcare organizations' awareness campaigns about sleep disorders encourage more people to seek diagnosis and treatment. The growing recognition of sleep apnea as a contributor to other health complications, like heart disease and diabetes, further boosts demand for diagnostic and therapeutic devices. An estimated 175 million European adults, or 44% of the population, are projected to have sleep apnea, leading to increasing demand for diagnosis and home testing devices. The UK government report, "Future of an Older Population," forecasts that by 2040, nearly one in seven people may be over 75, with a predicted 161% rise in households led by those aged 85 and older by 2037. Additionally, the working-age population between 50 and state pension age is expected to increase from 26% in 2012 to 34% by 2050, adding over 5.5 million people. France is also experiencing significant growth in its elderly population, projected to rise from 15 million in 2012 to 24 million by 2060, contributing to market growth.

Technological Advancements in Devices

Technological innovations like portable and user-friendly CPAP and BiPAP devices drive European market growth. Integration of wireless connectivity, data monitoring, and advanced algorithms in sleep apnea devices has made them more efficient and patient-friendly. These innovations improve adherence to treatment and appeal to patients managing the condition at home. The availability of advanced diagnostic tools in sleep clinics has also improved early detection rates. Dec 2024, Nyxoah SA has launched its battery-free Genio neurostimulator for obstructive sleep apnea (OSA) in England. This hypoglossal neuromodulation system, controlled by a wearable, is now available through the NHS Specialised Services Devices Programme.

Government Initiatives and Reimbursement Policies

European governments promote awareness and early diagnosis of sleep disorders through public health campaigns and improved healthcare infrastructure. Favorable reimbursement policies for sleep apnea devices, especially in countries like Germany, France, and the United Kingdom, encourage patients to adopt these treatments. Investments in sleep clinics and research facilities further fuel growth, making diagnostic and therapeutic devices more accessible. European Union policymakers have embraced the concept of “Open Strategic Autonomy” (OSA) in recent years as a response to key challenges, following an approach originally aimed at enhancing the EU’s ability to act independently. The political momentum around OSA has broadened beyond its original scope of energy and defence, including now trace, technology and even industries affecting health provision.

Challenges in the European Sleep Apnea Devices Market

High Cost of Devices

The high cost of sleep apnea devices and incredibly advanced CPAP and BiPAP machines are significant barriers to adoption. While reimbursement schemes exist, they may not cover all costs, leaving patients to bear the financial burden. For middle- and low-income groups, the expense of diagnostic procedures and therapeutic devices limits market penetration, particularly in Eastern Europe and less-developed regions.

Lack of Awareness and Diagnosis

Despite rising awareness in urban areas, many individuals in Europe remain undiagnosed or unaware of their sleep apnea condition. In rural and less affluent regions, limited access to healthcare facilities and sleep clinics hinders timely diagnosis and treatment. This gap in awareness, coupled with the stigma around sleep disorders, poses a challenge to market growth, especially for emerging players.

Europe CPAP Sleep Apnea Devices Market

The CPAP (Continuous Positive Airway Pressure) Market is the biggest part of Europe's sleep apnea devices market. CPAP machines provide a continuous flow of air pressure, avoiding airway closure while sleeping. CPAP devices are commonly prescribed for moderate and severe obstructive sleep apnea. With newer technologies such as quieter machines, portable models, and Bluetooth-capable devices, CPAP machines are gaining immense popularity. Adoption is highest in Germany and the UK because of high awareness and reimbursement programs.

Europe BiPAP Sleep Apnea Devices Market

The BiPAP (Bi-level Positive Airway Pressure) Market serves patients with more complicated respiratory requirements. BiPAP devices offer variable pressures for inhalation and exhalation, thus being appropriate for patients who cannot tolerate CPAP. The market is expanding with improvements in the functionality of the devices, including adjustable pressure settings and portability. Increasing central sleep apnea and comorbid conditions such as COPD are also boosting demand for BiPAP machines in Europe.

Europe Sleep Apnea Oximeter Devices Market

The Sleep Apnea Oximeter Devices Market targets devices that monitor oxygen saturation levels while sleeping. These non-invasive, portable devices diagnose sleep apnea and track the efficacy of treatment. Oximeters are used extensively in sleep clinics and at home because they are inexpensive and easy to use. As awareness of the need for ongoing monitoring grows, the oximeter market is growing, especially among patients who treat sleep apnea at home.

Europe Sleep Apnea Screening Devices Market

The Sleep Apnea Screening Devices Market consists of devices such as portable sleep monitors and polysomnography systems for timely diagnosis. These devices are instrumental in detecting patients with un-diagnosed sleep apnea. As more investments are being made in sleep clinics and better portable diagnostic equipment is now available, the market is seeing consistent growth. Easy-to-use and low-cost screening devices are especially useful in broadening the reach to diagnosis in remote areas.

Europe Sleep Apnea Devices Clinics & Hospitals Market

The Clinics & Hospitals Market is one of the major distribution channels for European sleep apnea devices. Sleep clinics and hospitals provide extensive diagnostic and therapeutic services, such as polysomnography and device fitting. This segment is supported by government investment in healthcare infrastructure and collaboration with manufacturers. Demand for hospital-based treatment continues to be strong for severe cases that need specialized treatment, while clinics deal with long-term monitoring and management.

United Kingdom Sleep Apnea Devices Market

United Kingdom Sleep Apnea Devices Market is propelled by high awareness, sophisticated healthcare infrastructure, and supportive reimbursement policies. The increasing prevalence of sleep apnea due to the aging population and growing obesity rates fuels demand for CPAP, BiPAP, and diagnostic devices. Government support for early diagnosis and treatment also fuels market growth. The UK market is expected to grow steadily with advancements such as portable and easy-to-use devices.

Germany Sleep Apnea Devices Market

Germany is among Europe's largest sleep apnea devices markets, propelled by sophisticated healthcare facilities and robust reimbursement systems. The widespread incidence of obstructive sleep apnea and the rising use of portable CPAP and BiPAP devices drive the market. Germany's emphasis on technology, such as smart sleep apnea devices with remote monitoring, makes it a central hub for innovation in this space. Dec. 20, 2024, Eli Lilly reported that the FDA approved Zepbound® (tirzepatide) as the first prescription medication for adults with moderate-to-severe obstructive sleep apnea and obesity. Zepbound can potentially improve sleep disorders when used with a reduced-calorie diet and increased physical activity.

France Sleep Apnea Devices Market

The France Sleep Apnea Devices Market is growing because of rising awareness of sleep disorders and robust government support for healthcare. Reimbursement policies promote the use of CPAP and BiPAP devices, especially among aging populations. France also spends on sleep disorder research and diagnostic facilities, improving early detection rates. Increasing demand for small and portable devices continues to propel the market in urban and rural settings. July 2024, Inspire Medical Systems, Inc. announced the publication of reimbursement for its novel therapy for obstructive sleep apnea in France.

Italy Sleep Apnea Devices Market

The Italy Sleep Apnea Devices Market is aided by growing healthcare expenditure and greater awareness of sleep-related health hazards. Urban areas are at the forefront of embracing CPAP and BiPAP machines, whereas rural areas continue to lag behind due to inadequate access to healthcare services. Initiatives to enhance diagnostic strength and public health initiatives are providing opportunities for growth, especially in home-use sleep apnea devices. Dec 2024, The European Medicines Agency has authorized Eli Lilly to expand Mounjaro's label, which suggests it can treat a sleep disorder, although it has not been outright approved for that purpose. Lilly was asking for approval for Mounjaro to treat patients with obesity and moderate to severe obstructive sleep apnea.

Europe Sleep Apnea Devices Market Segments

Types – Market breakup from 2 viewpoints:

1. Therapeutic Devices

2. Diagnostic Devices

Therapeutic Devices

- CPAP Sleep Apnea Therapeutic Devices

- Auto CPAP Sleep Apnea Therapeutic Devices

- BiPAP Sleep Apnea Therapeutic Devices

- Adaptive Servo-Ventilation (ASV)

Diagnostic Devices

- Polysomnography Devices (PSG)

- Oximeter

- Actigraphy Monitoring Device

- Respiratory Polygraph

- Sleep Apnea Screening Device

End User

- Sleep Laboratories, Clinics & Hospitals

- Home Care Settings/Individuals

All the Key players have been covered from 5 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Key Players Analysis

-

Natus Medical Incorporated

-

ResMed Inc.

-

Somnomed

-

Apex Medical Corporation

-

Koninklijke Philips N.V.

-

Compumedics

-

Fisher &Paykel Healthcare

-

Nyxoah SA

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Products Types, By Therapeutics, By Diagnostics and By End User |

| Europe Countries Covered |

|

| Companies Covered | |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. Europe Sleep Apnea Devices Market

6. Market Share Analysis

6.1 By Products Types

6.1.1 By Therapeutics

6.1.2 By Diagnostics

6.2 By End User

7. Product Types

7.1 Therapeutic Devices

7.1.1 CPAP Sleep Apnea Therapeutic Devices

7.1.2 Auto CPAP Sleep Apnea Therapeutic Devices

7.1.3 BiPAP Sleep Apnea Therapeutic Devices

7.1.4 Adaptive Servo-Ventilation (ASV)

7.2 Diagnostic Devices

7.2.1 Polysomnography Devices (PSG)

7.2.2 Oximeter

7.2.3 Actigraphy Monitoring Device

7.2.4 Respiratory Polygraph

7.2.5 Sleep Apnea Screening Device

8. End User

8.1 Sleep Laboratories, Clinics & Hospitals

8.2 Home Care Settings/Individuals

9. Porter's Five Forces Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Competition

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threats

11. Key Players Analysis

11.1 Natus Medical Incorporated

11.1.1 Overviews

11.1.2 Key Person

11.1.3 Recent Developments

11.1.4 Product Portfolio

11.1.5 Revenue

11.2 ResMed Inc.

11.2.1 Overviews

11.2.2 Key Person

11.2.3 Recent Developments

11.2.4 Product Portfolio

11.2.5 Revenue

11.3 Somnomed

11.3.1 Overviews

11.3.2 Key Person

11.3.3 Recent Developments

11.3.4 Product Portfolio

11.3.5 Revenue

11.4 Apex Medical Corporation

11.4.1 Overviews

11.4.2 Key Person

11.4.3 Recent Developments

11.4.4 Product Portfolio

11.4.5 Revenue

11.5 Koninklijke Philips N.V.

11.5.1 Overviews

11.5.2 Key Person

11.5.3 Recent Developments

11.5.4 Product Portfolio

11.5.5 Revenue

11.6 Compumedics

11.6.1 Overviews

11.6.2 Key Person

11.6.3 Recent Developments

11.6.4 Product Portfolio

11.6.5 Revenue

11.7 Fisher &Paykel Healthcare

11.7.1 Overviews

11.7.2 Key Person

11.7.3 Recent Developments

11.7.4 Product Portfolio

11.7.5 Revenue

11.8 Nyxoah SA

11.8.1 Overviews

11.8.2 Key Person

11.8.3 Recent Developments

11.8.4 Product Portfolio

11.8.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com