Europe Smart Lighting Market Size & Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Smart Lighting Market Summary

The report Europe Smart Lighting Market Forecast covers by Offering (Hardware, Software, Services), Technology (Wireless, Wired), Installation Type (New, Retrofit), Light Source (LED, Fluorescent, Compact Fluorescent, High Intensity Discharge, Others), Application (Indoor, Outdoor), End User (Commercial, Residential, Public Infrastructure, Others), Country and Company Analysis 2025-2033

Europe Smart Lighting Market Size

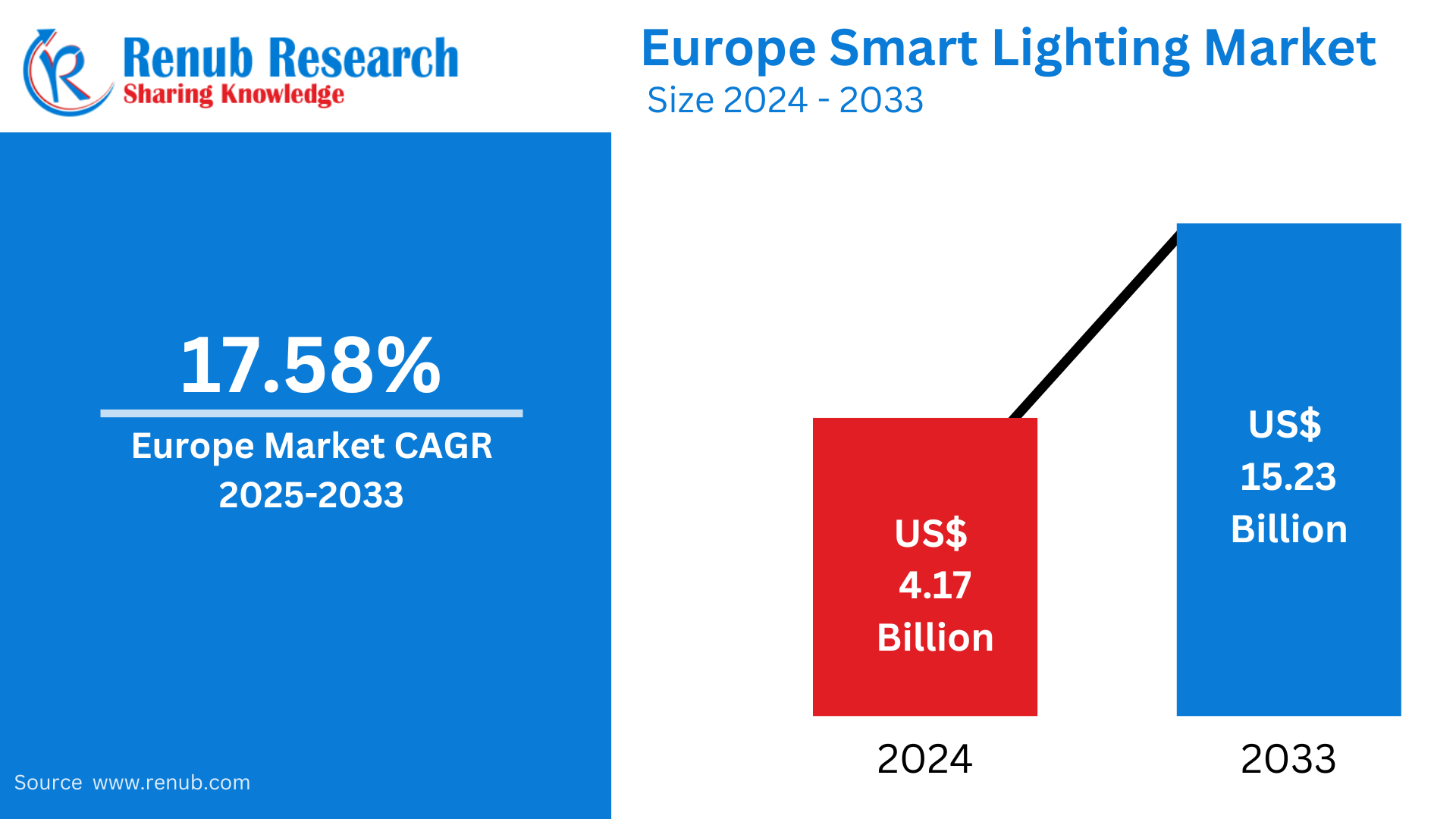

Europe smart lighting market valued at USD 4.17 billion in the year of 2025, is expected to have a tremendous growth rate and reach USD 15.23 billion by 2033. The compound annual growth rate between 2025 and 2033 for the market will be a spectacular 17.58%. Increase in demand for energy-efficient lighting solutions, ever-evolving IoT technologies, and the adoption of smart home systems across Europe are driving the growth of the market.

Europe Smart Lighting Indusry Outlooks

It is an advanced technology that combines IoT to offer customizable, energy-efficient, automated lighting solutions. Users can control lighting systems remotely through smart devices or voice assistants and feature dimming, scheduling, and color. Smart lighting is equipped with sensors and connectivity that can respond to ambient conditions or occupancy/time of day, amplifying convenience, safety, and savings in terms of energy. Most are used in residential, commercial, and industrial zones and therefore fit within the profiles for sustainability and modern living.

In Europe, smart lighting usage has exploded rapidly because the region gives serious play to concerns about energy efficiency and green building initiatives. Consumers are increasingly adopting smart lighting solutions in attempts to curtail energy costs and reduce carbon footprints, largely due to government regulations and incentives for sustainable practices. In addition, the rise in popularity for smart home systems and automation technologies is driving adoption further- Germany, the UK, and France are among its key users. Businesses rely on connected lighting technology for optimal working practices and user experience, which has contributed to the growth of the European market.

Growth Driver for Europe Smart Lighting Market

Energy Efficiency-Driven Demand

Energy efficiency is an important driver of the connected lighting market in Europe. The strict regulations, including the European Green Deal and Energy Performance of Buildings Directive (EPBD), that have led to efforts toward reducing carbon emissions and energy consumption have given a boost to energy-efficient demands. Automated dimming, motion detection, and daylight harvesting are some of the features that allow smart lighting solutions to optimize energy usage in homes, offices, and public places. The increasing electricity cost with the rising awareness among consumers regarding sustainability is further forcing the adaptation of energy-efficient lighting, and smart lighting comes out as a preferred choice for the eco-concerned Europeans. According to EEA's early estimates, at primary energy consumption by end-users in the EU by 2023, that declined 3.8% against 2022, final energy consumption declined by 0.6%. Although the improvement is a trend away from historical trends in energy efficiency, substantial efforts are still in place toward attaining 2030 targets on energy efficiency, revised downwards in 2023.

Smart Home Systems Gain in Popularity

The increasing adoption of smart home systems in Europe has made an excellent impact on driving the connected lighting market. Smart consumers prefer integrated solutions that improve convenience, security, and lifestyle. Smart lighting, compatible with a voice assistant like Alexa and Google Assistant, seamlessly integrates into this ecosystem, enabling remote and automatic control. The techno-friendly population in Germany, the UK, and France is investing in smart home technologies. This trend is driven by innovation in IoT, better internet access, and rising disposable income, which are all encouraging smart lighting systems. In June 2023, Philips launched a few LED lights exclusively designed for outdoor utilization in gardens. This comes with strength to be used at multiple weather conditions. The LED outdoor lights comprise posts, spotlights, pedestals, and wall lights along with UltraEfficient Solar technology.

Government Incentives and Sustainability Targets

European governments encourage the use of connected lighting to succeed in energy-saving and sustainability targets. Huge financial incentives, subsidies, and tax rebates offered to energy-efficient technologies have driven residential and commercial users to switch to smart lighting. European Green Deal initiatives and smart city development schemes will give healthy demand for advanced lighting systems. These efforts grow the market while accelerating achievement of wider objectives for reducing greenhouse gas emissions and for environmental technologies and innovations, therefore making Europe a global leader in smart lighting adoption. The Council of the EU and the European Parliament reached an agreement on the provisional version of Net-Zero Industry Act (NZIA) on February 6, 2024, whereby the NZIA is likely to be adopted formally by the end of April 2024. Such measures are in addition to the European Critical Raw Materials Act that is supposed to be published soon. They complement the February 2023 "Green Deal Industrial Plan for the Net-Zero Age" (the Net Zero Plan). A part of the European Green Deal, the Net Zero Plan aims to make Europe the world's first climate-neutral continent by 2050.

France Smart Lighting Market

France is one of the key contributors to the European market with a strong emphasis on energy efficiency and sustainability. Government policies like the Energy Transition for Green Growth Act ensure that energy-saving solutions, such as smart lighting, are adopted by many. Smart lighting solutions form a part of developments in city centers and infrastructures, consistent with France's smart city concept. Consumers begin to install connected lighting solutions in homes to increase convenience and cut down on energy consumption. With solid environmental policies to reduce carbon emissions, France continues lighting innovation through the residential and commercial sectors. Sept 2024, Govee can't wait to launch its latest products at the IFA 2024 exhibition with two latest flagship LED strip light - Govee Strip Light 2 Pro and Govee COB Strip Light Pro, in addition to many other smart lighting solutions.

Germany Smart Led Market

The German smart led market is driven by continuous advancements in technologies and strong manufacturing bases within the country. Germany gained popularity and led in the adoption of smart home systems and IoT integration. With government support for energy efficiency practices and incentives for eco-friendly technologies, market growth was spurred. The commercial sectors, mainly offices and retail spaces, started adopting smart lighting solutions for cost efficiency and sustainability. Germany's proactive approach to digital transformation and environmental responsibility significantly contributes to the European smart lighting landscape. Feb 2024 - Casambi, a worldwide leader in smart lighting control solutions, will unveil a new addition to its portfolio at Light + Building 2024.

Italy Smart Lighting Market

Italy's smart lighting market is developing at a rapid pace. Urban cities are seeing increasing smart city developments and, thus, smart lighting adoption. Cities like Milan and Rome are implementing smart lighting systems in public spaces with the aim of promoting energy efficiency and minimizing maintenance costs. The residential market expands due to consumer adoption of smart home technologies for better convenience and savings from energy use. Government initiatives towards making the country a more sustainable and energy-efficient one, coupled with consumer awareness, feed demand. Italy's long-standing desire to blend tradition with modern technology creates a vibrant and distinct smart lighting market. In Jan 2024, Italian brand Twinkly unveiled the Matrix light curtain, with the highest LED density in its class and smart LED technology with advanced monitoring of color temperature and brightness. Utilizing precisely arranged LEDs to offer fluid graphics, it rediscovers ambient lighting. Its slim design fits anywhere seamlessly, providing a wide versatile canvas for creativity.

Smart Lighting Market in Spain

Smart lighting technologies are being applied by Spain as part of its smart city initiatives in cities such as Barcelona and Madrid. These systems are integral to the urban infrastructure, reducing energy consumption and enhancing public safety. The residential market is also escalating at a rapid pace due to rising demand for smart home solutions. Government incentives and energy-saving regulations further boost adoption. The smart lighting in Spain's increasingly popular tourism and hospitality sectors also supports customer experience improvement while keeping sustainability in mind, marking it as an important growth in the European market. March 2024: Telefónica Tech will digitalize the public lighting in Santiago de Compostela with Ferrovial and Endesa X. The initiative will utilize the intelligent lighting solution from Telefónica Tech to remotely control more than 10,000 LED luminaires equipped with NB-IoT connectivity.

United Kingdom Smart Led Market

The United Kingdom is a key player in the European smart led market. The growth of the smart lighting market is primarily fueled by smart home systems and energy-efficient solutions. The UK government supports sustainable technologies through financial incentives and policies to conserve energy. There has been increased uptake of smart lighting in both commercial and residential sectors. People are increasingly taking an interest in IoT-based solutions. It would see urban infrastructure projects and smart city initiatives stir up demand. Also, the UK's tech-inclined population and increasing awareness of sustainability are good enough to leave the country at the forefront of innovative smart lighting technology adoption. In June 2024, Signify, the leader in lighting, will launch the new Music Sync feature and expand its LED strip offerings for the WiZ smart lighting system, making it easy for users to sync their lights to music. The new products comprise the Smart Fairy Light, both for indoor and outdoor use; the Smart Dial Switch; and an outdoor wall light.

Offering- Market is divided into 3 viewpoints

- Hardware

- Software

- Services

Technology Wired- Market is divided into 2 viewpoints

- Wireless

- Wired

Installation Type- Market is divided into 2 viewpoints

- New Installation

- Retrofit Installation

Light Source- Market is divided into 5 viewpoints

- LED Lamps

- Fluorescent Lamps

- Compact Fluorescent Lamps

- High Intensity Discharge Lamps

- Others

Application- Market is divided into 2 viewpoints

- Indoor

- Outdoor

End User- Market is divided into 4 viewpoints

- Commercial

- Residential

- Public Infrastructure

- Others

Countries- Market is divided into 15 Countries

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Turkey

- Rest of Europe

Company Covered by 5 Viewpoints

- Overviews

- Key Person

- Recent Developments & Strategies

- Product Portfolio & Product Launch in Last 1 Year

- Revenue

Key Players Analysis

- Cree, Inc.

- Philips Lighting

- Honeywell International, Inc.

- Wipro Limited

- Acuity Brands, Inc.

- Eaton Corporation Plc.

- Legrand S.A.

- General Electric (GE)

- OSRAM Licht AG

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2032 |

| Market |

US$ Billion |

| Segment Covered |

Offering, Technology, Installation Type, Light Source, Application, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the Europe Smart Lighting Market by 2033?

-

What is the expected Compound Annual Growth Rate (CAGR) of the smart lighting market from 2025 to 2033?

-

What are the key drivers fueling the growth of the smart lighting market in Europe?

-

How does IoT integration impact the adoption of smart lighting solutions?

-

What role do government regulations and sustainability targets play in the market expansion?

-

Which European countries are leading in smart lighting adoption?

-

What are the key technologies and installation types dominating the smart lighting market?

-

How is the commercial sector contributing to the growth of the smart lighting market?

-

Who are the top market players in the European smart lighting industry?

-

How does the rising demand for smart homes influence the market trends?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Smart Lighting Market

6. Market Share

6.1 By Offering

6.2 By Technology

6.3 By Installation Type

6.4 By Light Source

6.5 By Application

6.6 By End User

6.7 By Countries

7. Offering

7.1 Hardware

7.2 Software

7.3 Services

8. Technology

8.1 Wired

8.2 Wireless

9. Installation Type

9.1 New Installation

9.2 Retrofit Installation

10. Light Source

10.1 LED Lamps

10.2 Fluorescent Lamps

10.3 Compact Fluorescent Lamps

10.4 High Intensity Discharge Lamps

10.5 Others

11. Application

11.1 Indoor

11.2 Outdoor

12. End User

12.1 Commercial

12.2 Residential

12.3 Public Infrastructure

12.4 Others

13. Countries

13.1 France

13.2 Germany

13.3 Italy

13.4 Spain

13.5 United Kingdom

13.6 Belgium

13.7 Netherlands

13.8 Russia

13.9 Poland

13.10 Greece

13.11 Norway

13.12 Romania

13.13 Portugal

13.14 Turkey

13.15 Rest of Europe

14. Porter's Five Forces Analysis

14.1 Threat of New Entry

14.2 The Bargaining Power of Buyer

14.3 Threat of Substitution

14.4 The Bargaining Power of Supplier

14.5 Competitive Rivalry

15. SWOT Analysis

15.1 Strengths

15.2 Weaknesses

15.3 Opportunities

15.4 Threats

16. Key Players Analysis

16.1 Cree, Inc.

16.1.1 Overviews

16.1.2 Key Person

16.1.3 Recent Developments & Strategies

16.1.4 Product Portfolio & Product Launch in Last 1 Year

16.1.5 Revenue

16.2 Philips Lighting

16.2.1 Overviews

16.2.2 Key Person

16.2.3 Recent Developments & Strategies

16.2.4 Product Portfolio & Product Launch in Last 1 Year

16.2.5 Revenue

16.3 Honeywell International, Inc.

16.3.1 Overviews

16.3.2 Key Person

16.3.3 Recent Developments & Strategies

16.3.4 Product Portfolio & Product Launch in Last 1 Year

16.3.5 Revenue

16.4 Wipro Limited

16.4.1 Overviews

16.4.2 Key Person

16.4.3 Recent Developments & Strategies

16.4.4 Product Portfolio & Product Launch in Last 1 Year

16.4.5 Revenue

16.5 Acuity Brands, Inc.

16.5.1 Overviews

16.5.2 Key Person

16.5.3 Recent Developments & Strategies

16.5.4 Product Portfolio & Product Launch in Last 1 Year

16.5.5 Revenue

16.6 Eaton Corporation Plc.

16.6.1 Overviews

16.6.2 Key Person

16.6.3 Recent Developments & Strategies

16.6.4 Product Portfolio & Product Launch in Last 1 Year

16.6.5 Revenue

16.7 Legrand S.A.

16.7.1 Overviews

16.7.2 Key Person

16.7.3 Recent Developments & Strategies

16.7.4 Product Portfolio & Product Launch in Last 1 Year

16.7.5 Revenue

16.8 General Electric (GE)

16.8.1 Overviews

16.8.2 Key Person

16.8.3 Recent Developments & Strategies

16.8.4 Product Portfolio & Product Launch in Last 1 Year

16.8.5 Revenue

16.9 OSRAM Licht AG

16.9.1 Overviews

16.9.2 Key Person

16.9.3 Recent Developments & Strategies

16.9.4 Product Portfolio & Product Launch in Last 1 Year

16.9.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com