Europe Snack Bar Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Snack Bar Market Trends & Summary

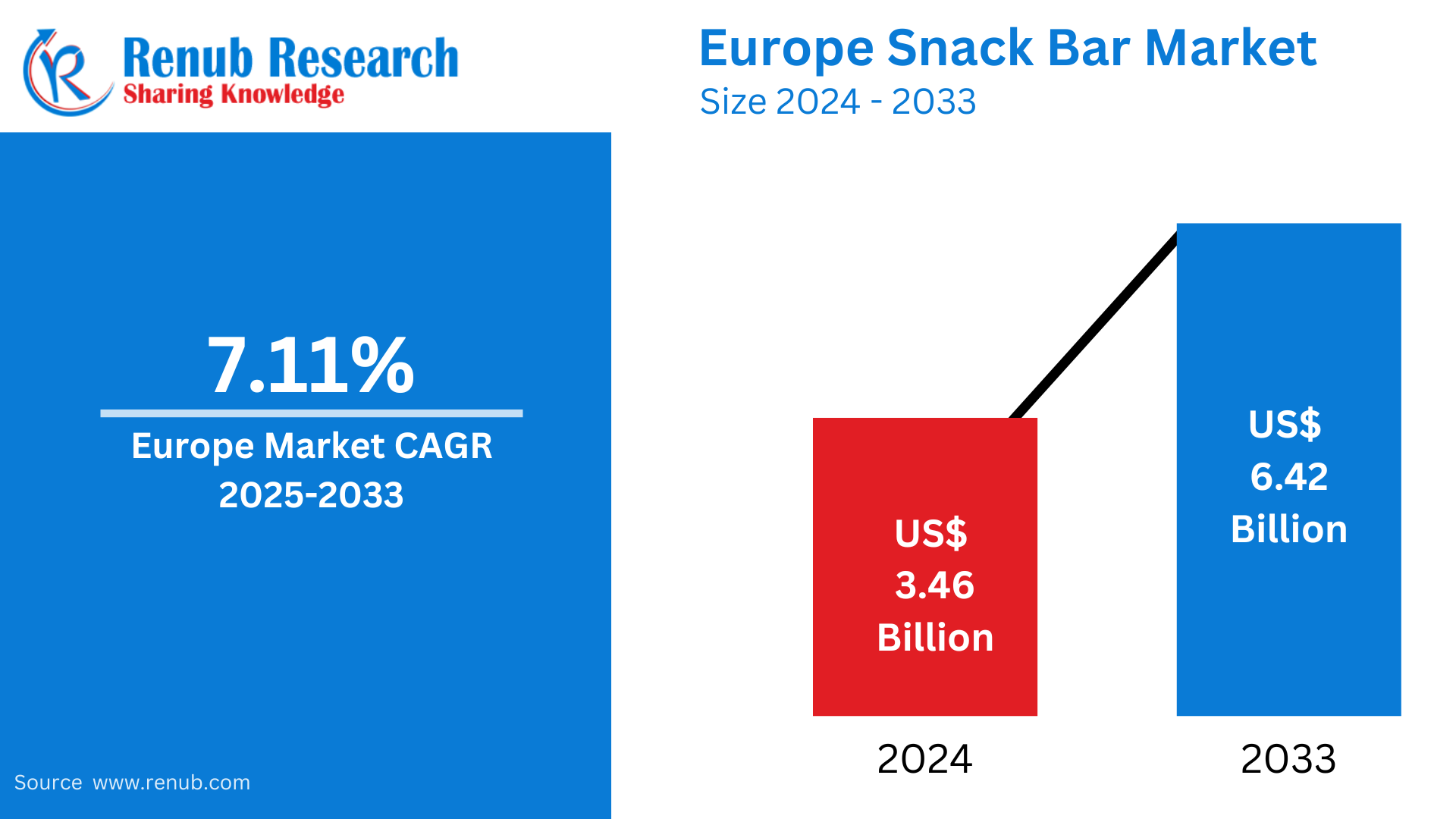

The Europe Snack Bar Market size was valued at US$ 3.46 billion in 2024 and is expected to reach US$ 6.42 billion by 2033, growing at a CAGR of 7.11% during the forecast period from 2025 to 2033. The market is propelled by increasing health awareness, hectic lifestyles, and a growing need for healthy, convenient snacks. Developments in protein, energy, and plant-based snack bars are driving growth, with widening retail and e-commerce channels improving availability.

The report Europe Snack Bar Market Forecast covers by Confectionery Variant (Cereal Bar, Fruit & Nut Bar, Protein Bar), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others), Country and Company 2025-2033.

Europe Snack Bar Market Outlooks

A snack bar is a small, ready-to-consume food item that is formulated to offer instant and convenient nutrition. Usually prepared with ingredients like nuts, grains, dried fruits, seeds, and protein sources, snack bars are a healthy substitute for conventional snacks. They are available in different forms, such as protein bars, energy bars, granola bars, and meal replacement bars, to suit different dietary requirements.

In Europe, snack bars are extensively utilized for convenience energy, meal supplementation, and recovery post-exercise. With hectic lifestyles, consumers need quick food that doesn't sacrifice nutrition. Fitness professionals prefer protein bars for muscle repair, whereas individuals watching their weight seek low-calorie or high-fiber bars. Snack bars are also favored by students and working professionals seeking a healthy substitute for sweet treats. With increasing health consciousness, demand for organic, plant-based, and clean-label snacking bars is increasing in Europe, and thus they have become a staple within convenience stores, supermarkets, and online platforms.

Growth Drivers in the Europe Snack Bar Market

Increasing Health Consciousness and Requirement for Healthy Snacks

Consumers in Europe are becoming more conscious about their health and well-being, resulting in the move away from high-sugar, processed snacks to healthier snack options such as snacking bars. Snack bars that contain proteins, fiber, vitamins, and natural ingredients are becoming increasingly popular among healthy individuals. Consumers look for products that maintain energy levels, support digestion, and promote well-being. Demand for organic, gluten-free, and reduced-sugar snack bars has also increased, leading manufacturers to launch cleaner-label products with natural sweeteners and functional ingredients to meet changing consumer tastes. Jan-2023, FMCG Gurus consumer intelligence points out that 60% of EMEA consumers have grown more health-conscious over the past two years. For 42% of European consumers, it is because their worries grew due to COVID-19. European Union, approximately 60 percent of consumers actively attempt to eat healthy. To others, it entails reducing meat intake, to some it entails eliminating artificial preservatives and flavors, and this barely scratches the surface.

Busy Lives and On-the-Go Consumption Patterns

Increased urbanization and hectic work cultures have led to European consumers demanding convenient, transportable, and healthy snacking. Snack bars provide an easy and filling option for busy people who don't have the time to eat meals. They are extensively used by professionals, students, and tourists as a grab-and-go option. The growth of retail channels, such as supermarkets, convenience stores, and online, has made snack bars readily available, further increasing their popularity in the European market. More than 75% of Europe's population resides in urban areas by 2024, increasing demand for quick-service restaurants to suit busy lifestyles. Convenience foods are gaining popularity, with Eurostat recording a 35% increase in fast-food sales in urban centers between 2022 and 2024. This trend is particularly prevalent among younger consumers, with more than 60% opting for fast food due to its convenience factor, cementing the fast-food industry's rise in major cities.

Innovation in Functional and Plant-Based Snack Bars

The demand for functional food and plant-based offerings has spurred great innovation in the snack bar segment. Companies are introducing snack bars that are enhanced with proteins, probiotics, superfoods, and adaptogens to deliver particular health benefits such as energy boosting, muscle repair, and gut health. Furthermore, the move towards veganism and dairy-free eating has propelled the expansion of plant-based snack bars made using alternative protein sources like pea, soy, and nuts. These innovations are expanding the consumer base and propelling market growth. May 2023: Nature Valley introduced a new depth of flavor with the launch of the first savory snack option in Nature Valley's savory nut crunch bars.

Challenges in the Europe Snack Bar Market

High Competition and Market Saturation

The European snack bar market is competitive, with many international and local brands competing with similar product offerings. Having established brands, private-label choices, and new entrants all the time makes it hard for companies to distinguish themselves. Price wars and discounting tactics also enhance competitiveness, making it hard for smaller or new brands to be noticed. Firms must invest in innovation, branding, and differentiation formulations to be competitive in this dense market.

Consumer Issues Regarding Sugar and Additives

In spite of their wholesome positioning, several snack bars include added sugars, artificial sweeteners, and preservatives, which are of concern to health-conscious consumers. Therefore, some consumers find snack bars too processed and hence will hesitate to consume them regularly. European regulatory authorities also have set stricter regulations on sugar levels and labeling openness. In order to counter this challenge, companies need to emphasize clean-label recipes, sugar reduction, and transparent communications regarding product benefits to ensure consumer trust.

Europe Cereal Bar Market

The European cereal bar market is expanding as consumers look for healthier breakfast options and convenient snacks. Composed of oats, grains, and dried fruits, cereal bars are high in fiber and essential nutrients, making them a favorite among weight-conscious and health-conscious consumers. Companies are launching fortified cereal bars with added vitamins, minerals, and proteins to boost their nutritional content. The growing need for organic and non-GMO cereal bars is further propelling growth in this category. Supermarkets and convenience stores continue to be major distribution channels for cereal bars in Europe.

Europe Protein Bar Market

Protein bars have become a common feature in the European fitness and wellness market, serving gym-goers, sportspeople, and those looking for muscle recovery or weight control. These bars contain high protein, which is frequently derived from whey, soy, or plant proteins. Protein bars are consumed after a workout or as a meal replacement because they have high satiety. The growth in vegan protein bars, sugar-free bars, and new and exotic flavors is increasing the consumer segment. The market for protein bars continues to grow with growing consciousness of protein's function in health and fitness.

Europe Snack Bar Convenience Stores Market

Convenience stores are the main drivers of snack bar sales as they provide quick, convenient nutrition to consumers with busy lifestyles. Convenience stores allow consumers to have easy access to snack bars at work commutes or during traveling. Convenience store retailers are widening their selection of snack bars that include protein bars, cereal bars, and energy bars targeting various dietary choices. The emergence of healthier snack bar alternatives, such as low-sugar and gluten-free, is building consumer demand. Convenience stores will remain an important channel of sales for snack bars in Europe.

Europe Snack Bar Specialty Stores Market

Specialty health and wellness retailers are becoming increasingly popular as consumers look for premium, organic, and functional snack bars. These retailers specialize in serving niche consumers, such as vegan, gluten-free, and keto shoppers. Specialty stores typically stock higher-end snack bar brands that feature clean-label ingredients, sustainability, and creative flavor options. Rising wellness trends across Europe have spurred greater demand for snack bars supporting certain dietary needs. Specialty stores offer a selective choice, making it easier for brands to tap into health-conscious consumers seeking high-end options.

Europe Snack Bar Online Stores Market

Online shopping is emerging as a leading channel for sales of snack bars in Europe, fueled by the convenience of home delivery and greater variety. E-commerce sites enable consumers to browse several brands, compare nutrition facts, and read reviews before buying. Subscription snack bar services are also expanding, providing individualized selections sent to consumers at regular intervals. The emergence of direct-to-consumer (DTC) brands is also redefining the online snack bar industry, enabling manufacturers to skip middlemen and interact directly with consumers via online marketing.

Germany Snack Bar Market

Germany is a dominant market for snack bars in Europe, fueled by strong consumer interest in nutrition and health benefits. German consumers place a high value on organic, non-GMO, and clean-label products, which results in high demand for natural snack bars with low processing. The growing vegan population in Germany has fueled the demand for plant-based snack bars. Supermarkets, organic food stores, and online platforms are key distribution channels. The market is also witnessing increasing innovations in functional snack bars targeting immunity, digestion, and energy enhancement. April 2023: Ferrero bought a snack bar factory in Germany. This acquisition will support the Ferrero Group’s growth strategy in the ‘better-for-you’ snacks category.

Russia Snack Bar Market

The Russian market for snack bars is growing as consumers move towards healthier snack options in the face of increasing awareness of diet and health. Affordability, however, is a major issue, with most price-conscious consumers preferring affordable snack bars. Global brands are increasing their presence, and local players are experimenting with indigenous ingredients such as buckwheat and rye. The development of e-commerce and supermarket chains is increasing the availability of snack bars. Protein bars and energy bars are especially favored by health-conscious consumers, fueling market demand.

UK Snack Bar Market

The UK snack bar market is booming as a result of the rising demand for healthy and convenient snacks. British consumers are extremely open to new trends, resulting in a rise in demand for plant-based, gluten-free, and high-protein snack bars. The rise in the number of health-conscious consumers has fueled protein bar sales. Supermarkets, health food stores, and online websites are the predominant distributors. Brands in the UK are going green, utilizing recyclable packaging and ethically produced ingredients to appeal to environmentally friendly consumers. Clean-label and sugar-free snack bars are also popular in the UK market.

Europe Snack Bar Market Segments

Confectionery Variant

- Cereal Bar

- Fruit & Nut Bar

- Protein Bar

Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Country

- Belgium

- France

- Germany

- Italy

- Netherlands

- Russia

- Spain

- Switzerland

- Turkey

- United Kingdom

- Rest of Europe

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Key Players Analysis

- Abbott Laboratories

- Ferrero International SA

- General Mills Inc.

- Halo Foods Ltd

- Kellogg Company

- Mars Incorporated

- Mondelēz International Inc.

- Nestlé SA

- PepsiCo Inc.

- The Hershey Company

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Confectionery Variant, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the Europe Snack Bar Market by 2033?

-

What is the Compound Annual Growth Rate (CAGR) of the market from 2025 to 2033?

-

What are the key factors driving the growth of the snack bar market in Europe?

-

How are changing consumer preferences impacting the demand for snack bars?

-

Which types of snack bars are included in the market segmentation?

-

What are the major distribution channels for snack bars in Europe?

-

How is the rise of online shopping affecting snack bar sales?

-

What are some of the challenges faced by snack bar manufacturers in Europe?

-

Which country in Europe is the largest market for snack bars?

-

Who are the major players in the Europe Snack Bar Market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Snack Bar Market

6. Market Share Analysis

6.1 By Confectionery Variant

6.2 By Distribution Channel

6.3 By Country

7. Confectionery Variant

7.1 Cereal Bar

7.2 Fruit & Nut Bar

7.3 Protein Bar

8. Distribution Channel

8.1 Supermarkets and Hypermarkets

8.2 Convenience Stores

8.3 Specialty Stores

8.4 Online Stores

8.5 Others

9. Country

9.1 Belgium

9.2 France

9.3 Germany

9.4 Italy

9.5 Netherlands

9.6 Russia

9.7 Spain

9.8 Switzerland

9.9 Turkey

9.10 United Kingdom

9.11 Rest of Europe

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Abbott Laboratories

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Ferrero International SA

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 General Mills Inc.

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Halo Foods Ltd

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Kellogg Company

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Mars Incorporated

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Mondelēz International Inc.

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Nestlé SA

12.8.1 Overview

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 PepsiCo Inc.

12.9.1 Overview

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

12.10 The Hershey Company

12.10.1 Overview

12.10.2 Key Person

12.10.3 Recent Developments

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com