Europe Sugar Confectionery Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Sugar Confectionery Market Trends & Summary

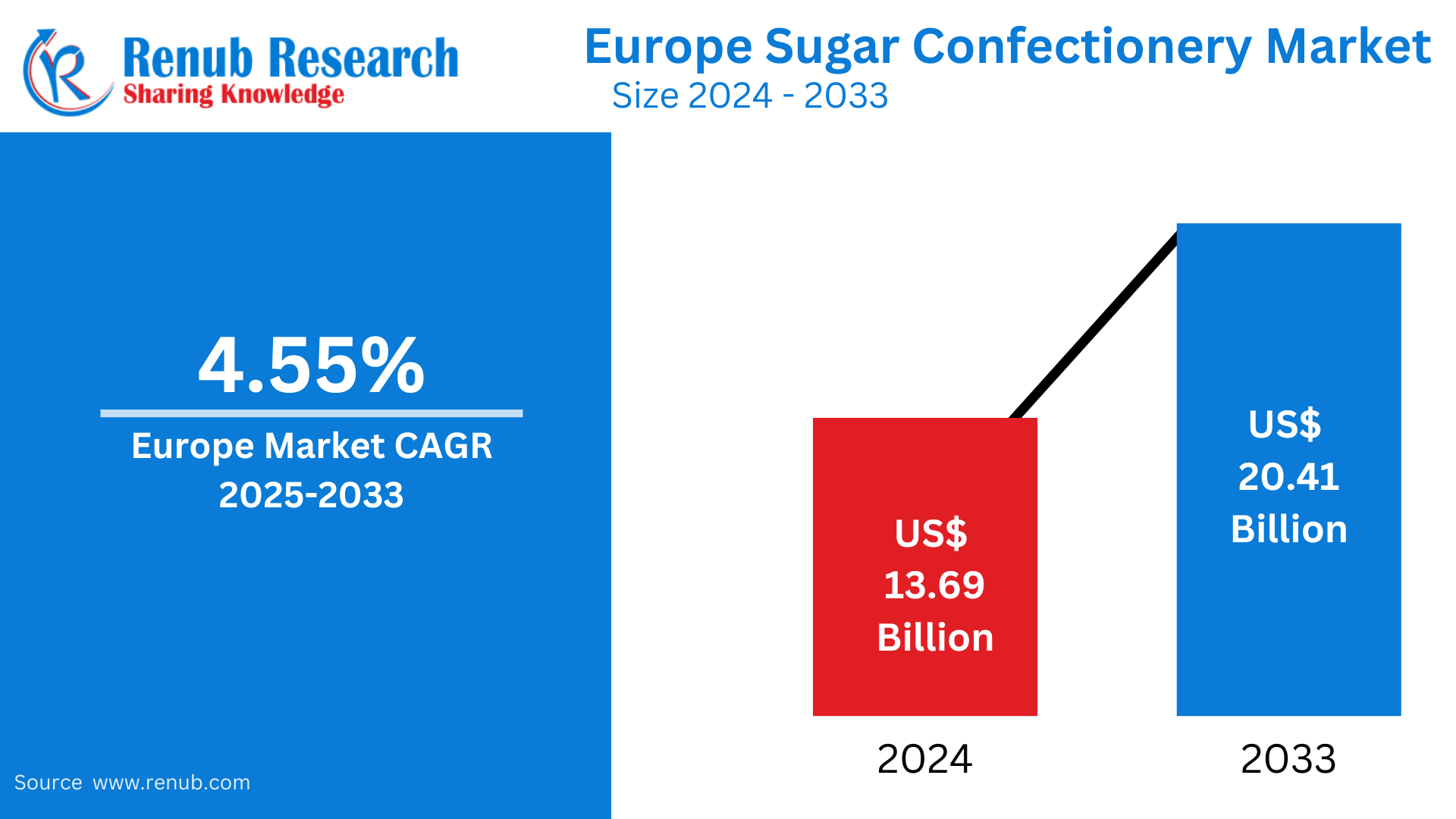

The Europe Sugar Confectionery Market was valued at US$ 13.69 billion in 2024 and is anticipated to reach US$ 20.41 billion in 2033, expanding at a CAGR of 4.55% during 2025-2033. The market is boosted by rising consumer demand for indulgent foods, new product offerings, and seasonal confectionery sales. Increasing trends for sugar-free and functional confectionery products are also influencing the market, with increasing retail and e-commerce distribution channels.

The report Europe Sugar Confectionery Market Forecast covers by Confectionery Variant (Hard Candy, Lollipops, Mints, Pastilles, Gummies, and Jellies, Toffees and Nougats, Others), Distribution Channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others), Country and Company 2025-2033.

Europe Sugar Confectionery Market Outlooks

Sugar confectionery is a broad category of sweet food products mostly consisting of sugar, such as candies, chocolates, toffees, gummies, lollipops, marshmallows, and hard-boiled sweets. These products have varied texture, flavor, and ingredients to suit the needs of consumers. Sugar confectionery may be flavored with fruits, nuts, caramel, and other elements to develop a variety of taste profiles.

Sugar confectionery in Europe is a popular indulgence, gift, and festive seasonal treat, especially around Christmas, Easter, and Halloween. It is consumed by consumers as snacks, desserts, or social gathering foods. There is also an emerging trend in the industry for sugar-free, organic, and functional confectionery with the addition of vitamins or energy-supplementing ingredients to address new health-conscious fashions. Furthermore, confectionery is a key player in the tourism sector, with most European nations famous for their traditional sweets, including Belgian chocolates, French nougat, and German marzipan. The success of tradition, innovation, and robust retail presence remains the driving force behind the sugar confectionery market in Europe.

Drivers of growth in the Europe Sugar Confectionery Market

Robust Seasonal and Festive Demand

Europe boasts a rich heritage of celebrating festivals like Christmas, Easter, and Halloween with sugar confectionery products. Chocolates, toffees, and candies made of sugar are widely used as gifts, increasing seasonal sales. Moreover, limited-edition confectionery products during festive periods appeal to consumers and drive market demand. Confectionery companies take advantage of these periods by launching innovative packaging, flavors, and promotional campaigns, driving market growth further. This cultural preference for sweet foods renders seasonal demand a key driver of growth for the European sugar confectionery market.

Innovation in Flavors and Functional Ingredients

European consumers are looking for distinctive and exotic tastes in sugar confectionery. Companies are launching a range of new tastes, including tropical fruit, floral, and spice-based flavors, to meet changing tastes. There is also increased demand for functional confectionery, with the use of vitamins, collagen, and probiotics. Sugar-free, organic, and vegan confectionery is also on the rise, catering to health-conscious consumers. This emphasis on innovation assists brands in keeping consumers engaged and stimulating market growth.

Expanding E-Commerce and Retail Distribution

The growth of e-retailing and omnichannel distribution models is playing a critical role in propelling the expansion of the European sugar confectionery market. Online platforms allow consumers to easily access a large variety of confectionery offerings, including foreign and specialty products. Subscription boxes, direct-to-consumer offerings, and bespoke confectionery services are increasingly popular. Simultaneously, supermarkets, convenience stores, and specialty stores remain responsible for driving offline sales, making products easily available across wide areas and extending market reach.

Challenges in the Europe Sugar Confectionery Market

Growing Health Issues and Sugar Regulations

With increasing consciousness of health dangers from excessive consumption of sugar, governments in Europe are enforcing more stringent controls over the sugar levels in food items. Most countries have implemented taxes on sugar to check obesity and diabetes levels, affecting sales of traditional confectionery. Consumers are also increasingly opting for low-sugar or sugar-free variants, compelling producers to redevelop products. While research on substitutes for sugar is in progress, replicating the same taste and texture is still a challenge.

Competition from Healthier Alternative Snacks

The increasing demand for healthier snacking alternatives, like protein bars, dried fruits, and nut snacks, is threatening the traditional confectionery market based on sugar. Consumers, especially younger adults, are going for functional and healthy options as opposed to products with high levels of sugar. This change in consumption has been causing sales reductions in some of the traditional confectionery sectors, and so brands are following suit by creating sugar-free or natural ingredient confectionery variants.

Europe Sugar Lollipops Confectionery Market

Lollipops are a widely used sugar confectionery product in Europe, and both children and adults consume them. The industry is fueled by ongoing innovation in flavor, form, and packaging. Fruit-filled novelty lollipops with sour tastes and two-layer designs are of particular interest to consumers. Sugar-free and functional lollipops with added vitamins or herbal extracts are also gaining traction. The ease of single-serve individually wrapped lollipops has made them a popular item in retail outlets and impulse purchase sections.

Europe Sugar Toffees and Nougats Confectionery Market

The European toffee and nougat market is dominated by a combination of classic recipes and contemporary variations. France, Spain, and Italy are famous for their nougat sweets, whereas toffees are popular throughout the region. High-end and artisanal toffees using natural ingredients, nuts, and caramelized flavors attract gourmet consumers. Sugar-free and dairy-free variants are also growing, targeting lactose-intolerant and health-oriented consumers. Packaging innovations and luxury branding also contribute to market growth.

Europe Sugar Mints Confectionery Market

Sugar mints are a favorite among the European confectionery industry, with uses ranging from fresh breath and as sweets. The usage of sugar mints is prevalent in cities, with urban dwellers requiring handy and convenient confectionery items. Introductions such as mints infused with herbs, energy drinks, and sugar-free alternatives follow the changing lifestyles of consumers. Pocket packs and resealable packages that boost convenience further aid in market growth within this category.

Europe Sugar Confectionery Convenience Store Market

Convenience stores play a crucial role in sugar confectionery sales, as they cater to impulse purchases and on-the-go consumers. The accessibility of individually packed candies, gum, and lollipops makes them a preferred snacking option. Convenience stores frequently run promotional offers and discounts, further encouraging purchases. Additionally, the expansion of self-checkout kiosks and grab-and-go sections in stores is making it easier for consumers to pick up confectionery products while shopping.

Europe Sugar Confectionery Online Retail Store Market

The internet-based consumer market for confectionery sugar is expanding significantly in Europe, driven by doorstep convenience and viewing of a vast variety of products. Customers can buy specialty confectioneries, imported products, and customized sweets online. Subscription boxes with monthly collections of candies and chocolates are also increasingly popular. Besides, online marketing and social media promotions have enabled the brands to reach out to younger consumers and drove sales online.

Germany Sugar Confectionery Market

Germany has a well-established sugar confectionery market, with a strong presence of both domestic and international brands. The country is known for its premium chocolates, marzipan, and gummy candies, with brands like Haribo leading the segment. German consumers are increasingly interested in organic and sugar-free confectionery options. Traditional confectionery products, such as gingerbread sweets, remain popular during festive seasons. The quest for new flavors and quality ingredients continues to spur market growth. August 2022: German manufacturer Haribo has opened its first brand store in Poland.

Russia Sugar Confectionery Market

Russia's confectionery market for sugar products is shaped both by local and global trends. Old Russian confectionery like caramel candies and chocolate-covered confectionery still finds broad appeal. But there has been a growing demand for sugar-free sweets in response to health awareness. Confectionery gifts sold during the New Year and other holidays have strong seasonal demand that is responsible for the sales. Growing expansion of supermarket chains and e-commerce is further increasing market access to urban and rural areas.

UK Sugar Confectionery Market

The UK sugar confectionery market is very dynamic, with a high affinity for traditional sweets as well as new innovations. The nation boasts a well-established candy culture, with candies like fudge, toffees, and boiled sweets being very popular. With the increasing concern for lowering sugar consumption, the demand for sugar-free and natural confectioneries has increased. The growth of vegan and plant-based sweets is also transforming the market. Supermarkets, convenience stores, and online channels continue to be major distribution channels. March 2023: Nestlé introduced a new chocolate bar blended with two tastes, i.e., the Purple One and Green Triangle. The chocolate bars can be found in United Kingdom supermarkets.

Europe Sugar Confectionery Market Segments

Confectionery Variant

- Hard Candy

- Lollipops

- Mints

- Pastilles, Gummies, and Jellies

- Toffees and Nougats

- Others

Distribution Channel

- Convenience Store

- Online Retail Store

- Supermarket/Hypermarket

- Others

Country

- Belgium

- France

- Germany

- Italy

- Netherlands

- Russia

- Spain

- Switzerland

- Turkey

- United Kingdom

- Rest of Europe

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Key Players Analysis

- August Storck KG

- Cloetta AB

- Ferrero International SA

- Lavdas SA

- Mars Incorporated

- Mondelēz International Inc.

- Nestlé SA

- Perfetti Van Melle BV

- Ricola AG

- Swizzels Matlow Ltd

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Confectionery Variant, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market value of the Europe Sugar Confectionery Market by 2033?

-

What is the projected CAGR for the market from 2025 to 2033?

-

Which key trends are driving the growth of the sugar confectionery market in Europe?

-

How are seasonal and festive demands influencing sugar confectionery sales in Europe?

-

What role does e-commerce play in the expansion of the European sugar confectionery market?

-

What are the major challenges faced by the sugar confectionery industry in Europe?

-

How are health concerns and sugar regulations impacting the market?

-

What are the most popular sugar confectionery variants in Europe?

-

Which countries have the largest market share in the European sugar confectionery industry?

-

Who are the key players dominating the Europe Sugar Confectionery Market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Sugar Confectionery Market

6. Market Share Analysis

6.1 By Confectionery Variant

6.2 By Distribution Channel

6.3 By Country

7. Confectionery Variant

7.1 Hard Candy

7.2 Lollipops

7.3 Mints

7.4 Pastilles, Gummies, and Jellies

7.5 Toffees and Nougats

7.6 Others

8. Distribution Channel

8.1 Convenience Store

8.2 Online Retail Store

8.3 Supermarket/Hypermarket

8.4 Others

9. Country

9.1 Belgium

9.2 France

9.3 Germany

9.4 Italy

9.5 Netherlands

9.6 Russia

9.7 Spain

9.8 Switzerland

9.9 Turkey

9.10 United Kingdom

9.11 Rest of Europe

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 August Storck KG

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Cloetta AB

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Ferrero International SA

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Lavdas SA

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Mars Incorporated

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Mondelēz International Inc.

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Nestlé SA

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Perfetti Van Melle BV

12.8.1 Overview

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 Ricola AG

12.9.1 Overview

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

12.10 Swizzels Matlow Ltd

12.10.1 Overview

12.10.2 Key Person

12.10.3 Recent Developments

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com