Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Vitamin Fortified and Mineral Enriched Food & Beverage Market Trends & Summary

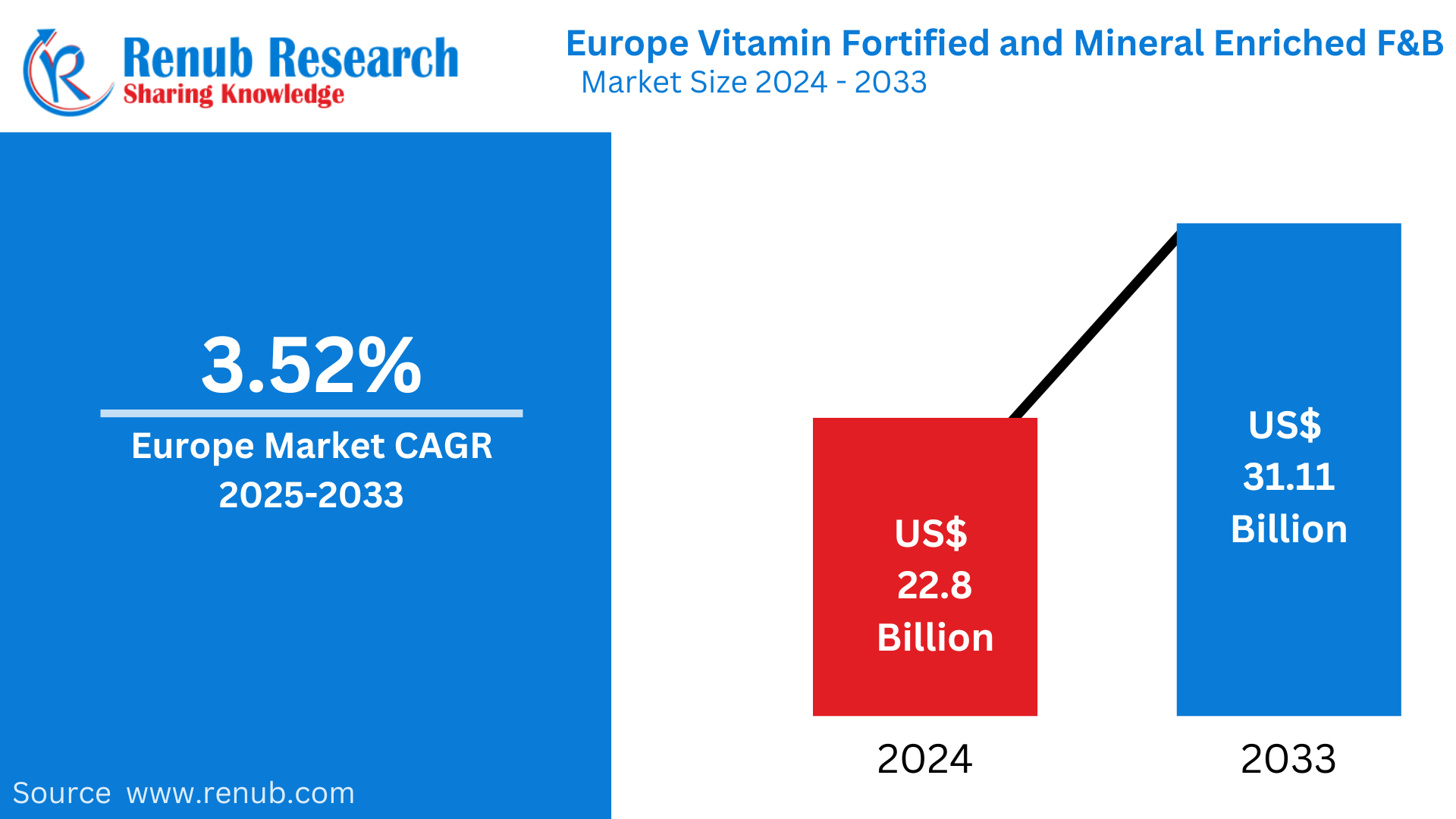

The Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market is anticipated to grow tremendously, with the estimated market size in 2024 being USD 22.8 billion. It is slated to reach USD 31.11 billion by 2033, growing at a CAGR of 3.52% over the forecast period (2025-2030). It is fueled by growing health consciousness, nutritional deficiencies, and enhanced demand for functional foods.

The report Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market Forecast covers by Product Type (Cereal-based Products, Dairy Products, Beverages, Infant Formulas, Other Product Types), Application (Foods, Beverages, Others), Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Pharmacy/Drug Store, Online Retail Store, Other), Country and Company Analysis 2025-2033.

Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market Outlooks

Vitamin-fortified and mineral-enriched food and beverages are foods and beverages that have added vital nutrients to improve their nutritional quality. Fortification is the process of adding vitamins and minerals that might not be naturally available in considerable quantities, whereas enrichment is the process of replacing lost nutrients during food processing. These foods and beverages prevent nutrient deficiencies, promote general well-being, and satisfy particular dietary requirements.

Common enriched and fortified foods are cereals, dairy, fruit juices, and plant-based milk alternatives. Common vitamins added are vitamin D, B vitamins, and vitamin C, with minerals such as calcium, iron, and zinc being common additions. These foods are especially useful for people with limited diets, children, and the elderly. Over the past few years, consumption of fortified and enriched foods has increased as health awareness and health concerns over the deficiency of certain nutrients have increased. Fortification programs are advocated by governments and health authorities as a measure to counter public health issues. Consumers are focusing more on functional food for improved health, and sales of such nutrition-fortified foods are witnessing growth worldwide.

Growth Drivers in the Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market

Rising Health Consciousness and Preventive Nutrition Trends

European consumers are increasingly health and wellness-conscious, which is stimulating demand for mineral-fortified and vitamin-enhanced food and beverages. Heightened consciousness regarding the preventive aspect of nutrition to ward off lifestyle diseases like obesity, diabetes, and cardiovascular conditions has motivated consumers to consume more nutritious food. Functional foods and drinks that contain added essential nutrients are in vogue among healthy consumers, sportspersons, and aging consumers. The requirement for immunity-enhancing and gut health products, specifically vitamin D, vitamin C, and probiotic-enriched ones, is also driving market growth further. Jan-2023, FMCG Gurus consumer trends indicate 60% of consumers in EMEA have become even more health-conscious over the past two years. Among 42% of European consumers, it is because their concerns grew due to COVID-19. European Union, approximately 60 percent of shoppers attempt to consciously eat healthy. For others it is reducing meat, for others reducing artificial flavorings and preservatives, and this is just the tip of the iceberg.

Government Initiatives and Regulatory Support

European governments and health authorities actively encourage food fortification as a means to fight against deficiencies in nutrients. Programs like mandatory fortification initiatives for flour, dairy, and infant nutrition foods guarantee proper consumption of key vitamins and minerals. The European Food Safety Authority (EFSA) enforces stringent guidelines to control the addition of fortified nutrients to ensure safety for consumers and authenticity of products. These regulations and sensitization campaigns reinforce consumer confidence, where producers are incentivized to innovate and introduce more fortified food and beverages. The EU Green Deal has the ambition of climate neutrality by 2050. The objective is to lower greenhouse gas emissions by at least 55% below 1990 levels by 2030. Aug 2024, The European Union has developed a regulatory framework to deliver food safety and public health. This handbook consolidates the key regulatory authorities in the EU, describing their functions and contributions to a secure food supply chain, which is crucial for food production professionals and compliance.

Increasing Demand for Functional and Fortified Drinks

The functional drink market is experiencing tremendous growth, with fortified beverages being a popular choice among European consumers. The marketplace is expanding due to growing demand for energy drinks, sports drinks, and plant-based beverages fortified with vitamins and minerals. Consumers seek convenient forms of nutrition that aid in hydration, immunity, and mental well-being. The increased trend of fortified dairy and non-dairy products, including oat and almond milk fortified with calcium and vitamin B12, is also fueling marketplace growth. This movement comes in line with the overall trend of consumption patterns driven by health. January 2022, Monster beverages has introduced a new flavor, Monster Energy Ultra Watermelon, which is already being sold in supermarkets and convenience stores throughout the UK and several parts of Europe.

Challenges facing the Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market

High Costs of Fortification and Production

Fortification of food and drinks with necessary nutrients entails sophisticated processing technologies, tight quality control, and adherence to regulatory requirements, thus incurring greater production expenses. The expense of obtaining quality vitamins and minerals, stability across various formulations, and product effectiveness contributes to the total cost. Small manufacturers will find it difficult to afford, thus restricting their capacity to compete with major brands. Price-conscious consumers will choose non-fortified products, affecting sales growth in some segments of the market.

Consumer Skepticism and Misinformation

Even with increasing health awareness, the effectiveness and safety of fortified foods and beverages are doubted by some European consumers. Fear of artificial additives, overconsumption of nutrients, and undesired side effects generates reluctance in acceptance. Lack of information on artificial fortification and its effect on natural food characteristics also influences consumer confidence. Companies need to spend on transparent packaging, scientific proof, and awareness-building marketing initiatives to overcome such fears and create awareness of the benefits of fortified products.

Europe Vitamin Fortified and Mineral Enriched Cereal-based Products Market

Cereal-based foods, such as breakfast cereals, granola bars, and fortified bread, are commonly found in Europe because of their convenience and nutritional advantages. They are frequently fortified with necessary vitamins like B-complex, vitamin D, and minerals like iron and calcium to make them more nutritionally valuable. Health-aware consumers, especially working professionals and families, like fortified cereals as an easy and healthy meal solution. With growing demands for high-fiber, whole-grain, and plant-based fortified cereals, manufacturers are launching new innovative products based on current dietary patterns and sustainability trends.

Europe Vitamin Fortified and Mineral Enriched Beverages Market

Europe's fortified drinks market is growing due to increasing consumer demand for functional beverages promoting immunity, energy, and hydration. Hot categories are fruit juices fortified with vitamins, water fortified with electrolytes, probiotic beverages, and plant-based milk. Fortified drinks that contain vitamin C, zinc, and antioxidants are very popular among shoppers looking for natural means of improving their immunity. As more consumers lead busy lifestyles, ready-to-drink fortified drinks are increasing in popularity across retail and e-commerce platforms, providing health-promoting and easy-to-consume hydration.

Europe Vitamin Fortified and Mineral Enriched Food Market

Europe's fortified food market spans across a broad spectrum of products like dairy, snacks, bakery, and infant nutrition. Fortified foods are becoming more popular with consumers as a means to overcome particular health-related issues like bone strength, digestion, and mental acuity. Manufacturers are launching products with improved nutritional values like protein-fortified snacks, dairy with enriched omega-3s, and bakery products with high fiber levels. The increasing requirement for natural and clean-label fortification techniques, such as plant-based components, is defining the innovation and growth of Europe's fortified food industry.

Europe Vitamin Fortified and Mineral Enriched Infant Formulas Market

Infant nutrition is an important segment in Europe's fortified food market, as parents choose premium, nutrient-rich formulas for infants. Fortified infant foods include vitamins and minerals like iron, calcium, DHA, and prebiotics that support infant growth and development during early childhood. Strict European laws guarantee the safety and effectiveness of these products, which enhance consumer confidence. The growing demand for organic and plant-based fortified infant foods is also fueling market growth as parents opt for premium, chemical-free products for their children.

Europe Vitamin Fortified and Mineral Enriched Convenience Stores Market

European convenience stores are emerging as leading retail channels for fortified food and beverage items, meeting the increasing demand for convenience nutrition. Customers look for quick and nutritious snack foods like fortified protein bars, vitamin-enhanced waters, and functional dairy substitutes. Retailers are increasing product lines to offer organic, plant-based, and allergen-free fortified products. The supply of small, single-serving fortified food packets is also on the rise, for busy professionals and travelers alike. Convenience stores are an important factor in making fortified foods widely available and accessible to more consumers.

Germany Vitamin Fortified and Mineral Enriched Food & Beverage Market

Germany ranks among Europe's top fortified food and drink markets, propelled by robust consumer attitudes toward healthy lifestyles and the existence of an advanced functional foods sector. Demands for fortified milk, organic grains, and energizing beverages are increasing among the health-oriented population and among aged consumers. Consumers in Germany value clean-label and natural types of fortification solutions, causing food producers to innovate fortified lines of products utilizing plant-based and non-GMO content. The nation's stringent regulatory environment guarantees quality standards, building confidence and consistent market growth. August 2022: Operate Drinks in Europe introduced its new sports drink, Operate Recovery. The firm asserts that the products are vitamin and mineral-enriched and come in two flavors: peach and green tea and raspberry and cranberry.

France Vitamin Fortified and Mineral Enriched Food & Beverage Market

The French fortified food and beverage market is growing, emphasizing organic, premium, and functional nutrition products. French consumers highly appreciate high-quality ingredients and turn to fortified foods that are well aligned with trends for wellness, including probiotics, omega-3, and fiber-enriched products. Increased awareness of the advantages of vitamin D, calcium, and iron fortification is driving shopping behavior, particularly among women and the elderly. The market is also witnessing growing demand for fortified plant-based options, as per France's growing demand for sustainable and green food options. April 2023: Kellogg's introduced its new breakfast: Rice Krispies cereals with vitamin D infused in fruity flavors. The company asserts that one bowl of these cereals contains 20% of the daily vitamin D intake. These products are initially being offered in Europe via online distribution channels.

UK Vitamin Fortified and Mineral Enriched Food & Beverage Market

The UK fortified food and beverage market is expanding at a fast pace because of rising health consciousness, vegan dietary trends, and government-supported campaigns encouraging food fortification. Trendy segments are vitamin-fortified breakfast cereals, fortified plant-based milk, and functional drinks. The market for fortified foods targeting vitamin D deficiency, especially during winter, is gaining momentum. UK consumers also prefer fortified protein foods for fitness and weight control. With robust retail distribution channels and growing online sales, the market for vitamin-fortified and mineral-enriched products remains buoyant. April 2023, Vitamin Well company introduced its new fortified drink with vitamins in the United Kingdom. The drink includes B12, folic acid, magnesium, and other nutritional elements.

Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market Segments

Product Type

- Cereal-based Products

- Dairy Products

- Beverages

- Infant Formulas

- Other Product Types

Application

- Foods

- Beverages

- Others

Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Pharmacy/Drug Store

- Online Retail Store

- Other

Country

- Germany

- United Kingdom

- France

- Spain

- Russia

- Italy

- Rest of Europe

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Financial Insights

Key Players Analysis

- Abbott Laboratories

- Kellogg Company

- Nestle SA

- PepsiCo Inc.

- Amway Corporation

- The Coca-Cola Company

- The Hain Celestial Group Inc.

- Danone SA

- Marks and Spencers

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Application, Distribution Channels and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market

6. Market Share Analysis

6.1 By Product Type

6.2 By Application

6.3 By Distribution Channels

6.4 By Country

7. Product Type

7.1 Cereal-based Products

7.2 Dairy Products

7.3 Beverages

7.4 Infant Formulas

7.5 Other Product Types

8. Application

8.1 Foods

8.2 Beverages

8.3 Others

9. Distribution Channel

9.1 Supermarket/Hypermarket

9.2 Convenience Stores

9.3 Pharmacy/Drug Store

9.4 Online Retail Store

9.5 Other

10. Country

10.1 Germany

10.2 United Kingdom

10.3 France

10.4 Spain

10.5 Russia

10.6 Italy

10.7 Rest of Europe

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Abbott Laboratories

13.1.1 Overview

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Kellogg Company

13.2.1 Overview

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Nestle SA

13.3.1 Overview

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 PepsiCo Inc.

13.4.1 Overview

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Amway Corporation

13.5.1 Overview

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 The Coca-Cola Company

13.6.1 Overview

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 The Hain Celestial Group Inc.

13.7.1 Overview

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Danone SA

13.8.1 Overview

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

13.9 Marks and Spencers

13.9.1 Overview

13.9.2 Key Person

13.9.3 Recent Developments

13.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com