Food Enzymes Market by Types (Carbohydrase, Lipase, Prostate, and Others), Source (Microorganisms, Plants, and Animals), Application (Beverages, Bakery Products, Dairy Products, and Others), Region and Company Analysis 2025-2033

Buy NowFood Enzymes Market Size

Food Enzymes market is expected to reach US$ 3.93 billion by 2033 from US$ 2.33 billion in 2024, with a CAGR of 5.98% from 2025 to 2033. Some of the key reasons driving the market are the growing food processing industry and growing consumer awareness, biotechnology breakthroughs, the rise in the consumption of alcoholic and non-alcoholic drinks, and the creation of newer, more specialized, and efficient enzymes.

Food Enzymes Industry Overview

Specialized proteins called food enzymes serve as catalysts in a variety of food-related biological reactions. They can be added artificially during food processing to accomplish certain results, like enhancing taste, texture, and shelf life, or they can be found naturally in raw food. Larger molecules are broken down into smaller, more absorbable components by these enzymes, which accelerate chemical reactions. Lipase breaks down lipids, protease breaks down proteins, and amylase aids in the breakdown of carbohydrates. They are frequently used to make cheese, bread, and drinks like wine and beer. They are essential to contemporary food technology, improving food items' nutritional content and quality.

| Report Features | Details |

|

Base Year |

2024 |

|

Forecast Years |

2025 - 2033 |

|

Historical Years |

2020 - 2024 |

|

Market Size in 2024 |

US$ 2.33 Billion |

|

Market Forecast in 2033 |

US$ 3.93 Billion |

|

Market Growth Rate (2025-2033) |

5.98% |

Based on their chemical characteristics, food enzymes can be divided into three categories: lipase, protease, and carbohydrase. Lactase, cellulose, and amylase are all included in the carbohydrase category. The market for food enzymes is anticipated to be dominated by carbohydrase, followed by lactase. The market for food enzymes can be divided into three categories based on their sources: microorganisms, animals, and plants. Over the course of the forecast period, the food enzyme market is expected to develop due to decreased carbon emissions and raw material waste. Increased productivity and a shift in consumer preferences toward healthier food items are also anticipated to support the growth of the food enzyme market. The need for food enzymes is anticipated to increase as a result of rising per capita income and product penetration, which would further boost global market expansion.

The cooperation between BASF and Cargill was extended in January 2023 to provide animal protein producers with high-performance enzyme solutions. They are dedicated to creating unique value for animal feed consumers and introducing cutting-edge enzyme-based solutions to the market.

Growth Drivers for the Food Enzymes Market

Trends in Health and Wellbeing

Customers' awareness of the nutritional value of the food they eat is growing. By reducing complicated molecules into simpler, more absorbable forms, enzymes can aid in this process and improve the nutritious content of meals. People who are lactose intolerant can digest dairy products thanks to the enzyme lactase, which breaks down lactose. In a similar vein, fruits and vegetables' fiber can be broken down by enzymes like cellulase, improving their nutritional content and ease of digestion. Growing scientific studies that highlight the advantages of dietary enzymes for health support this trend. It is therefore a profitable industry for food manufacturers to invest in since health-conscious consumers are more inclined to buy meals that contain advantageous enzymes.

Consumer safety and regulatory support

The use of food enzymes is subject to strict regulations set by agencies such as the European Food Safety Authority in Europe and the Food and Drug Administration in the United States. These groups make sure that the enzymes used in food processing are both ecologically friendly and safe for human consumption. The regulatory certification boosts market trust by giving consumers and manufacturers a layer of security. For example, in order to keep the final product's organic certification, enzymes employed in the preparation of organic food frequently have to adhere to strict requirements. Because they offer a clear route for the creation and use of novel enzyme technologies and reassure customers regarding the safety and quality of their food, such regulatory frameworks can hasten market expansion.

Demand for Processed Foods by Consumers

The demand for fast food and ready-to-eat meals has skyrocketed as lifestyles get busier. Proteases, amylases, and lipases are among the enzymes that are essential for extending the shelf life, boosting tastes, and increasing the texture of these meals. Enzymes can improve the juiciness of processed meats, soften bread, and extend the freshness of dairy goods. These characteristics increase the demand for food enzymes by making processed foods more enticing to consumers. Enzymes also shorten the time and resources required for production, increasing the effectiveness and economy of food processing. In the modern world, where there is an increasing need to produce more food with less resources, this efficiency is especially important. Food enzymes are therefore now essential for fulfilling customer demands for longevity, flavor, and quality as well as manufacturers' demands for cost-effectiveness and efficiency.

Challenges in the Food Enzymes Market

Regulatory Uncertainties to Prevent Market Growth

The safety regulatory framework for food enzymes is constantly evolving and improving as a result of their growing use as processing components in the food industry. Enzymes fall into two categories under food law: food additives and food processing aids. Food enzyme classification is essential since, in certain countries, only additives require pre-market approval, which includes a safety assessment. Additionally, different nations and regions have different definitions for additives and processing aids, which leads to regulatory ambiguities that hinder market expansion.

For example, Canada, the United States, and Japan regulate all food enzymes as food additives. However, only a small number of food enzymes are regarded as additives in the EU and Australia, where the majority are regarded as processing aids. The European Union (EU) member states also have quite different national laws regarding enzymes as aids in food preparation. There is a regional disparity because these enzymes are subject to the clearance process in France, Denmark, Poland, and Hungary, whereas a voluntary approval mechanism is in effect in the UK. Because the Asia Pacific region is so diverse, national authorities are in charge of enforcing food laws. It is currently unknown how safety rules pertaining to food additives in general and enzymes in particular will be harmonized regionally. The expansion of industrial enzymes in the local food market is anticipated to be adversely affected by a disorganized and fragmented approach to ingredient regulation.

Changes in temperature slow down the rate at which enzymes respond

Environmental conditions significantly influence the activity of dietary enzymes. The reaction is significantly slowed down by temperature, but thermal stimulation degrades the structure and renders the food enzyme inactive.

However, altering the pH outside of the enzyme's operating range reduces enzyme activity and may ultimately result in permanent denaturation. Although manufacturers of food enzymes are making great efforts to create enzymes that can operate throughout a broad pH and temperature range, it will be some time before enzymes are utilized in every step of the production of food and beverages.

The food enzymes market will be led by the carbohydrate segment

The food enzymes market forecasts the continued dominance of the carbohydrate segment. This anticipation underscores the sustained demand for enzymes that facilitate the breakdown of carbohydrates, aligning with diverse applications in the food industry. As consumer preferences drive the demand for various processed foods, carbohydrates are pivotal in enhancing product quality. With their huge use in sectors like baking, brewing, and dairy, the carbohydrate segment is anticipated to stay a key participant, responding to the evolving needs of the food industry and contributing to the market's enduring growth.

Bakery enzyme demand rises for healthier, tastier, convenient, textured food

The food enzymes market sturdy growth propelled with the aid of the global expansion of the bakery market. This surge reflects the growing customer demand for bakery products globally. The foods market is developing extensively due to different factors which include converting lifestyles, increasing disposable earning, and a choice for numerous and convenient food alternatives. The bakery sector's continuous innovation and an array of product offerings drive market expansion. This trend indicates the marketplace's responsiveness to evolving customer tastes and life-style styles, positioning the industry as a pivotal contributor to the overall increase and dynamics of the worldwide marketplace.

Microorganisms offer cost-effective, reliable alternatives to animal and plant enzymes

Microorganisms have emerged as cost effective and dependable alternatives to animal and plant enzymes in numerous industries. Their versatility makes them precious in meals processing, prescribed drugs, and biofuel production. With the advantage of scalability and efficient production tactics, microorganisms make contributions to sustainable and economically feasible enzyme application. This shift in the direction of microbial sources aligns with a emerging emphasis on sustainable practices, offering industries a dependable and aid-efficient option for enzyme manufacturing, fostering innovation, and meeting the evolving need of diverse sectors.

Food Enzymes Market Overview by Regions

By Country, Global Food Enzymes Market is split into North America (United States, Canada), Europe (Germany, United Kingdom, France, Italy, Spain, Switzerland), Asia Pacific (Japan, China, India, Australia, South Korea, Indonesia), South America (Mexico, Brazil, Argentina), Middle East & Africa (South Africa, Saudi Arabia, United Arab Emirates), and Rest of world.

United States Food Enzymes Market

The market for food enzymes in the US is expanding quickly due to rising consumer demand for more sustainable, convenient, and healthful food items. Baking, dairy, drinks, and processing all make extensive use of enzymes, which lower manufacturing costs while improving texture, flavor, and nutritional value. Proteases, lipases, amylases, and carbohydrase are important enzyme types; the manufacturing of convenience and bakery goods has led to a significant increase in the use of carbohydrase. Furthermore, the industry is moving toward enzyme solutions made from microbial sources rather than those produced from plants or animals due to consumer preference for clean-label and natural ingredients. The market is dominated by big companies like Novozymes, DSM, and DuPont. The continued growth of the food enzymes market in the United States is further supported by the move toward functional foods and plant-based substitutes.

The expansion of the wine industry throughout the region is one instance of the growth of the enzyme industry in that area. Since enzymes are commonly employed to produce wine, the market for enzymes is driven by the expansion of the wine industry. For example, the Wine Institute reports that wine sales at retail in the United States in 2021 were around USD 78.4 billion, more than the USD 66.8 billion sales in 2021. Innovation and technological advancement are also important drivers of the nation's market expansion. Additionally, it is predicted that the United States' changing consumer preferences and tastes would be fueled by the country's fast urbanization and rising living levels.

United Kingdom Food Enzymes Market

The market for food enzymes in the UK is expanding steadily due to rising customer desire for more sustainable, convenient, and healthful food options. Enzymes are widely employed to enhance texture, flavor, and shelf life in a variety of applications, including dairy, baked goods, drinks, and processed foods. Because they are used in the production of dairy products and baked goods, carbohydrases and proteases are especially in demand. The move to clean-label products is also helping the industry since consumers are choosing natural and plant-based components, which encourages producers to use microbial enzymes rather than more conventional ones produced from plants or animals. Important contributors include well-known companies like Novozymes, DSM, and DuPont. Furthermore, the market is anticipated to be further driven in the upcoming years by growing interest in plant-based diets, functional foods, and healthier formulations.

According to figures from the Federation of Bakers, the UK bakery market is valued at billions of dollars and constitutes a significant portion of the country's food economy. Currently, the total volume is just around 4 billion units, which is the same as nearly 11 million loaves and packets sold daily. Since the bakery industry has always been a significant sector in the UK and will remain so throughout the forecast period, the enzymes market in the UK is anticipated to grow during this time due to the fact that enzymes are natural proteins that serve as catalysts for biochemical reactions, improving the quality of baked goods in a variety of ways.

India Food Enzymes Market

The market for food enzymes in India is expanding significantly due to growing customer demand for convenient, processed, and healthful food items. In order to enhance texture, flavor, and nutritional value, enzymes are extensively utilized in the snack, dairy, beverage, and baking industries. The most widely used enzymes in India are amylases, carbohydrase, and proteases, which are in high demand from the expanding dairy and baking industries. Customers' growing preference for natural and plant-based components is also helping the market as clean-label products become more popular. The demand for functional food items is also being driven by growing food processing companies and increased awareness of health and wellness. The growth of the Indian food enzymes market is aided by major players like DuPont, Novozymes, and DSM.

Australia, India, and China are the primary drivers of the fastest-growing baked food market in Asia-Pacific. Restrictions on the use of chemical additives, particularly in the production of bread and other fermented products, have led to an increase in demand for food enzymes in bakery applications in Australia. India's exports of bread, cakes, and other bakery goods increased from USD 346.86 million in 2020 to USD 407.64 million in 2021, according to data from UN Comtrade.

Saudi Arabia Food Enzymes Market

The market for food enzymes in Saudi Arabia is growing as a result of rising consumer demand for processed meals, healthier substitutes, and ease of food preparation. In order to enhance texture, flavor, and shelf life, enzymes are frequently employed in dairy, snacks, beverages, and baking. Natural and plant-based enzymes, especially carbohydrase and proteases, are becoming more and more in demand as consumers' preferences for functional and clean-label foods develop. The nation's growing food processing sector and youthful, health-conscious populace are fueling market expansion. The use of food enzymes is also being aided by the growing popularity of ready-to-eat meals and snacks in cities. In order to meet the demand for premium enzyme solutions, major participants in the market include DuPont, DSM, and Novozymes.

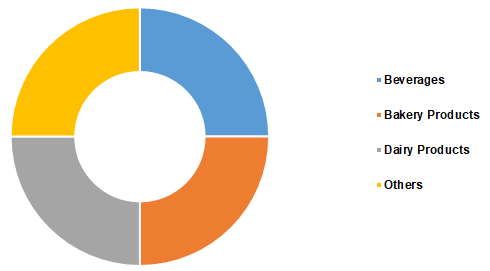

Global Food Enzymes Market Share, By Application (Percentage)

Note: The chart above shows dummy data and is only for illustration purposes. Please get in touch with us for the actual market size and trends.

By Types market has been covered from 4 viewpoints:

1. Carbohydrase

2. Lipase

3. Protease

4. Others

By Applications has been covered from 4 viewpoints:

1. Beverages

2. Bakery Products

3. Dairy Products

4. Others

By Source market has been covered from 3 viewpoints:

1. Microorganisms

2. Plants

3. Animals

Company- Market has been covered from 21 Country Food Enzymes Industry viewpoints:

1. North America

1.1 United States

1.2 Canada

2. Europe

2.1 Germany

2.2 United Kingdom

2.3 France

2.4 Italy

2.5 Spain

2.6 Switzerland

3. Asia Pacific

3.1 Japan

3.2 China

3.3 India

3.4 South Korea

3.5 Indonesia

3.6 Australia

4. Latin America

4.1 Mexico

4.2 Brazil

4.3 Argentina

5. Middle East & Africa

5.1 Saudi Arabia

5.2 United Arab Emirates

5.3 South Africa

6. Rest of World

Company Insights:

• Overview

• Company Initiatives

• Sales Analysis

Companies Covered:

1. Advanced Enzyme Technologies

2. Novozymes

3. DuPont Danisco

4. Kerry Group PLC

5. Associated British Foods Plc

6. Chr. Hansen Holding A/S

7. Enzyme Development Corporation (EDC)

8. Dyadic International In

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Lead Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Food Enzymes Market

6. Market Share

6.1 By Types

6.2 By Application

6.3 By Source

6.4 By Countries

7. Types

7.1 Carbohydrase

7.2 Lipase

7.3 Protease

7.4 Others

8. Application

8.1 Beverages

8.2 Bakery Products

8.3 Dairy Products

8.4 Others

9. Source

9.1 Microorganisms

9.2 Animals

9.3 Plants

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 Germany

10.2.2 United Kingdom

10.2.3 France

10.2.4 Italy

10.2.5 Spain

10.2.6 Switzerland

10.3 Asia Pacific

10.3.1 Japan

10.3.2 China

10.3.3 India

10.3.4 South Korea

10.3.5 Indonesia

10.3.6 Australia

10.4 Latin America

10.4.1 Mexico

10.4.2 Brazil

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 United Arab Emirates

10.5.3 South Africa

10.6 Rest of World

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 Advanced Enzyme Technologies

13.1.1 Overviews

13.1.2 Recent Developments

13.1.3 Revenues

13.2 Novozymes

13.2.1 Overviews

13.2.2 Recent Developments

13.2.3 Revenues

13.3 DuPont Danisco

13.3.1 Overviews

13.3.2 Recent Developments

13.3.3 Revenues

13.4 Kerry Group PLC

13.4.1 Overviews

13.4.2 Recent Developments

13.4.3 Revenues

13.5 Associated British Foods Plc.

13.5.1 Overviews

13.5.2 Recent Developments

13.5.3 Revenues

13.6 Chr. Hansen Holding A/S

13.6.1 Overviews

13.6.2 Recent Developments

13.6.3 Revenues

13.7 Enzyme Development Corporation (EDC)

13.7.1 Overviews

13.7.2 Recent Developments

13.7.3 Revenues

13.8 Dyadic International, Inc

13.8.1 Overviews

13.8.2 Recent Developments

13.8.3 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com