France In-Vitro Diagnostics Market, Size, Forecast 2023-2028, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Buy NowFrance In-Vitro Diagnostics Market Outlook

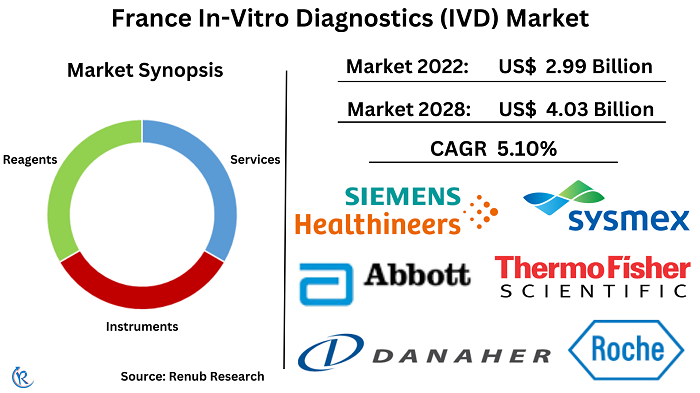

France In-Vitro Diagnostics Market will reach US$ 4.03 Billion in 2028, according to Renub Research. In vitro, diagnostics is a medical method used to identify diseases, conditions, or infections by examining samples like blood, urine, and tissue to analyze their diseased states. These examinations are primarily conducted in independent laboratories, hospital-based facilities, clinical labs, and point-of-care centers to diagnose various illnesses. IVD tests encompass diverse technologies, including polymerase chain reaction, which selectively duplicates specific DNA and RNA sequences in a test tube. Additional techniques involve isolating particular proteins through protein purification, in vitro fertilization, microarray methods, and sequencing technology.

The In-Vitro Diagnostics market is a dynamic segment within the medical industry in France. Presently, the sector is experiencing notable transformations. However, with the country facing the escalating financial pressures of an aging population and a comprehensive national healthcare system, the necessity to harness efficient diagnostics' cost/benefit advantages is becoming increasingly evident within the industry.

France In-Vitro Diagnostics Market shall grow at a CAGR of 5.10% from 2022 to 2028

The growth of France in-vitro diagnostics market is because of factors such as the increasing prevalence of chronic diseases, growing awareness and acceptance of personalized medicine and companion diagnostics, and expanding utilization of point-of-care (POC) diagnostics. The rising burden of chronic illnesses like infectious diseases, cardiovascular diseases, cancers, and others is a significant driver for the demand in the market.

For instance, according to IDF Atlas 10th edition, the number of individuals living with diabetes in France was around 3,942.9 thousand in 2021, projected to reach 4,184.9 thousand by 2030 and 4,225.7 thousand by 2045. Adopting point-of-care diagnostics in the country and initiatives to increase awareness and promote testing for chronic diseases also contribute to market growth. For instance, in March 2022, France launched a new colon-cancer testing system for individuals aged 50-74. Hence, the market value for France in-vitro Diagnostics Market was US$ 2.99 Billion in 2022.

There is a strong potential for substantial growth in the services segment of France in-vitro diagnostics market

France in-vitro diagnostics market comprises product segments such as Services, Instruments, and Reagents.The growth of services in the France IVD market can be due to the increasing complexity of diagnostics tests, the shift towards value-based healthcare, the emphasis on personalized medicine and companion diagnostics, the rising demand for point-of-care testing, and escalating prevalence of chronic diseases.

Advancements in medical technology have led to sophisticated tests requiring specialized expertise. Outsourcing diagnostics services helps optimize resources and improve outcomes. Personalized medicine and companion diagnostics drive the need for advanced testing. Point-of-care testing offers quick results and enhanced patient care. In addition, the growing burden of chronic diseases necessitates testing, monitoring, and management services.

Rapid tests are becoming increasingly popular in France In-vitro Diagnostics market

France in-vitro diagnostics market provides a diverse range of test types, including ELISA & CLIA, PCR, Rapid Test, Fluorescence Immunoassays (FIA), In Situ Hybridization, Transcription Mediated Amplification, Sequencing, Colorimetric Immunoassay, Radioimmunoassay (RIA), Isothermal Nucleic Acid Amplification Technology, and various others. Rapid tests provide quick results and eliminate the need for laboratory processing. They are ideal for point-of-care applications, aiding prompt diagnosis and treatment.

Rapid tests are vital in controlling infectious diseases, enabling early detection and infection control. They also contribute to screening programs for early intervention and preventive care. Technological advancements have improved rapid test performance, including enhanced accuracy and multiplex capabilities. The growing demand for efficient and cost-effective diagnostics has led to the widespread adoption of rapid tests across medical specialties and healthcare settings in France.

Infectious diseases application is thriving in France In-vitro Diagnostics market

France market for in-vitro diagnostics encompasses various essential applications, including Infectious Diseases, Diabetes, Cardiology, Oncology, Nephrology, Autoimmune Diseases, Drug Testing, and several others. Public health concerns and the high prevalence of infectious diseases drive the demand for accurate and timely diagnostics in France. Rapid and precise diagnosis is crucial for disease detection, treatment, and preventive measures.

In addition, infectious disease diagnostics are vital during outbreaks and epidemics, guiding control measures and patient management. Regulatory support and initiatives further promote in-vitro diagnostics for infectious diseases. These factors contribute to the dominance of infectious disease diagnostics in the France IVD market.

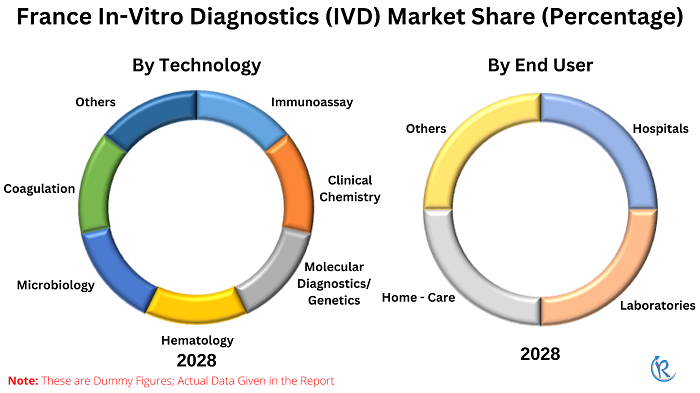

Immunoassay is dominant in the France in-vitro diagnostics market due to its versatility, sensitivity, and extensive range of applications

France in-vitro diagnostics market utilizes various technologies, including Immunoassay, Clinical Chemistry, Molecular Diagnostics/Genetics, Hematology, Microbiology, Coagulation, and other related technologies. Immunoassay technology offers high versatility and sensitivity, making it suitable for various diagnostic applications. It has proven particularly effective in diagnosing infectious diseases, autoimmune disorders, cancer biomarkers, and hormone imbalances. The reliability and accuracy of immunoassay results, its widespread availability, and established validation protocols further contribute to its dominance in the French IVD market. Additionally, the continuous advancements in immunoassay technology and the availability of a diverse range of immunoassay kits and reagents drive its widespread adoption and market dominance.

Hospitals continue to hold a dominant position in France In-vitro Diagnostics market

The end-users in France In-vitro diagnostics market consist of four categories: Hospitals, Laboratories, Home-Care, and Others. Hospitals are pivotal as primary healthcare centers, serving many patients requiring diagnostic tests. Their large testing volume, advanced infrastructure, and specialized facilities for complex procedures make hospitals the preferred choice for advanced testing.

With access to diverse medical specialists and healthcare professionals, hospitals effectively interpret and utilize diagnostic results. Integrating laboratory services within hospitals enables seamless coordination between diagnostics and treatment decisions—these comprehensive capabilities and resources position hospitals as dominant end-users in the France in-vitro diagnostics market.

Key Players

Prominent companies in France in-vitro diagnostics market include Roche Diagnostics, Abbott Diagnostics, Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific, Sysmex Corporation, and QIAGEN N.V.

- In November 2022: Roche Diagnostics introduced the BenchMark ULTRA PLUS system in France, a cutting-edge platform developed explicitly for staining histological or cytological samples on microscope slides. The system debuted at the prestigious Carrefour Pathologie 2022 event, which took place at the Palais des Congrès de la Porte Maillot in Paris.

Renub Research report titled “France’s in-vitro Diagnostics Market Global Forecast by products (Services, Instruments, and Reagents), Test types (ELISA & CLIA, PCR, Rapid Test, Fluorescence Immunoassays (FIA), In Situ Hybridization, Transcription Mediated Amplification, Sequencing, Colorimetric Immunoassay, Radioimmunoassay (RIA), Isothermal Nucleic Acid Amplification Technology, and Others), Application (Infectious Diseases, Diabetes, Cardiology, Oncology, Nephrology, Autoimmune Diseases, Drug Testing, and Others), Technology (Immunoassay, Clinical Chemistry, Molecular Diagnostics/Genetics, Hematology, Microbiology, Coagulation, and Others), End-Users (Hospitals, Laboratories, Home - Care, and Others), Company Analysis (Roche Diagnostics, Abbott Diagnostics, Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific,Sysmex Corporation, and QIAGEN N.V)" provides a detailed analysis of France’s in-vitro Diagnostics Market.

Products – Market breakup from 3 Viewpoints:

1. Services

2. Instruments

3. Reagents

Test Types – Market breakup from 11 Viewpoints:

1. ELISA & CLIA

2. PCR

3. Rapid Test

4. Fluorescence Immunoassays (FIA)

5. In Situ Hybridization

6. Transcription Mediated Amplification

7. Sequencing

8. Colorimetric Immunoassay

9. Radioimmunoassay (RIA)

10. Isothermal Nucleic Acid Amplification Technology

11. Others

Application – Market breakup from 8 Viewpoints:

1. Infectious Diseases

2. Diabetes

3. Cardiology

4. Oncology

5. Nephrology

6. Autoimmune Diseases

7. Drug Testing

8. Others

Technology – Market breakup from 7 Viewpoints:

1. Immunoassay

2. Clinical Chemistry

3. Molecular Diagnostics/Genetics

4. Hematology

5. Microbiology

6. Coagulation

7. Others

End-Users – Market breakup from 4 Viewpoints:

1. Hospitals

2. Laboratories

3. Home – Care

4. Others

Company has been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue

Company Analysis:

1. Roche Diagnostics

2. Abbott Diagnostics

3. Siemens Healthineers

4. Danaher Corporation

5. Thermo Fisher Scientific

6. Sysmex Corporation

7. QIAGEN N.V

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Products, Test Types, Application, Technology, and End User |

| Companies Covered | Roche Diagnostics, Abbott Diagnostics, Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific, Sysmex Corporation, and QIAGEN N.V |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Porter’s Five Forces

5.1 Bargaining Power of Buyer

5.2 Bargaining Power of Supplier

5.3 Threat of New Entrants

5.4 Rivalry among Existing Competitors

5.5 Threat of Substitute Products

6. SWOT Analysis

6.1 Strengths

6.2 Weaknesses

6.3 Opportunities

6.4 Threats

7. France In-Vitro Diagnostics (IVD) Market

8. Market Share – France In-Vitro Diagnostics (IVD)

8.1 By Test Types

8.2 By Technology

8.3 By Products Types

8.4 By Application

8.5 By End User

9. Test Types – France In-Vitro Diagnostics (IVD) Market

9.1 ELISA & CLIA

9.2 PCR

9.3 Rapid Test

9.4 Fluorescence Immunoassays (FIA)

9.5 In Situ Hybridization

9.6 Transcription Mediated Amplification

9.7 Sequencing

9.8 Colorimetric Immunoassay

9.9 Radioimmunoassay (RIA)

9.10 Isothermal Nucleic Acid Amplification Technology

9.11 Others

10. Technology – France In-Vitro Diagnostics (IVD) Market

10.1 Immunoassay

10.2 Clinical Chemistry

10.3 Molecular Diagnostics/Genetics

10.4 Hematology

10.5 Microbiology

10.6 Coagulation

10.7 Others

11. Product Types – France In-Vitro Diagnostics (IVD) Market

11.1 Services

11.2 Instruments

11.3 Reagents

12. Application – France In-Vitro Diagnostics (IVD) Market

12.1 Infectious Disease

12.2 Diabetes

12.3 Cardiology

12.4 Oncology

12.5 Nephrology

12.6 Autoimmune Diseases

12.7 Drug Testing

12.8 Other Applications

13. End User – France In-Vitro Diagnostics (IVD) Market

13.1 Hospitals

13.2 Laboratories

13.3 Home - Care

13.4 Others

14. Government Rules & Regulation

15. Reimbursement

15.1 Public

15.2 Private & Insurance

16. Company Analysis

16.1 Roche Diagnostics

16.1.1 Overview

16.1.2 Recent Development

16.1.3 Revenue

16.2 Abbott Diagnostics

16.2.1 Overview

16.2.2 Recent Development

16.2.3 Revenue

16.3 Siemens Healthineers

16.3.1 Overview

16.3.2 Recent Development

16.3.3 Revenue

16.4 Danaher Corporation

16.4.1 Overview

16.4.2 Recent Development

16.4.3 Revenue

16.5 Thermo Fisher Scientific

16.5.1 Overview

16.5.2 Recent Development

16.5.3 Revenue

16.6 Sysmex Corporation

16.6.1 Overview

16.6.2 Recent Development

16.6.3 Revenue

16.7 QIAGEN N.V.

16.7.1 Overview

16.7.2 Recent Development

16.7.3 Revenue

List of Figures:

Figure-01: France – In-Vitro Diagnostics Market (Billion US$), 2018 – 2022

Figure-02: France – Forecast for In-Vitro Diagnostics Market (Billion US$), 2023 – 2028

Figure-03: Test Types – ELISA & CLIA Market (Million US$), 2018 – 2022

Figure-04: Test Types – Forecast for ELISA & CLIA Market (Million US$), 2023 – 2028

Figure-05: Test Types – PCR Market (Million US$), 2018 – 2022

Figure-06: Test Types – Forecast for PCR Market (Million US$), 2023 – 2028

Figure-07: Test Types – Rapid Test Market (Million US$), 2018 – 2022

Figure-08: Test Types – Forecast for Rapid Test Market (Million US$), 2023 – 2028

Figure-09: Test Types – Fluorescence Immunoassays (FIA) Market (Million US$), 2018 – 2022

Figure-10: Test Types – Forecast for Fluorescence Immunoassays (FIA) Market (Million US$), 2023 – 2028

Figure-11: Test Types – In Situ Hybridization Market (Million US$), 2018 – 2022

Figure-12: Test Types – Forecast for In Situ Hybridization Market (Million US$), 2023 – 2028

Figure-13: Test Types – Transcription Mediated Amplification Market (Million US$), 2018 – 2022

Figure-14: Test Types – Forecast for Transcription Mediated Amplification Market (Million US$), 2023 – 2028

Figure-15: Test Types – Sequencing Market (Million US$), 2018 – 2022

Figure-16: Test Types – Forecast for Sequencing Market (Million US$), 2023 – 2028

Figure-17: Test Types – Colorimetric Immunoassay Market (Million US$), 2018 – 2022

Figure-18: Test Types – Forecast for Colorimetric Immunoassay Market (Million US$), 2023 – 2028

Figure-19: Test Types – Radioimmunoassay (RIA) Market (Million US$), 2018 – 2022

Figure-20: Test Types – Forecast for Radioimmunoassay (RIA) Market (Million US$), 2023 – 2028

Figure-21: Test Types – Isothermal Nucleic Acid Amplification Technology Market (Million US$), 2018 – 2022

Figure-22: Test Types – Forecast for Isothermal Nucleic Acid Amplification Technology Market (Million US$), 2023 – 2028

Figure-23: Test Types – Others Market (Million US$), 2018 – 2022

Figure-24: Test Types – Forecast for Others Market (Million US$), 2023 – 2028

Figure-25: Technology – Immunoassay Market (Million US$), 2018 – 2022

Figure-26: Technology – Forecast for Immunoassay Market (Million US$), 2023 – 2028

Figure-27: Technology – Clinical Chemistry Market (Million US$), 2018 – 2022

Figure-28: Technology – Forecast for Clinical Chemistry Market (Million US$), 2023 – 2028

Figure-29: Technology – Molecular Diagnostics/Genetics Market (Million US$), 2018 – 2022

Figure-30: Technology – Forecast for Molecular Diagnostics/Genetics Market (Million US$), 2023 – 2028

Figure-31: Technology – Hematology Market (Million US$), 2018 – 2022

Figure-32: Technology – Forecast for Hematology Market (Million US$), 2023 – 2028

Figure-33: Technology – Microbiology Market (Million US$), 2018 – 2022

Figure-34: Technology – Forecast for Microbiology Market (Million US$), 2023 – 2028

Figure-35: Technology – Coagulation Market (Million US$), 2018 – 2022

Figure-36: Technology – Forecast for Coagulation Market (Million US$), 2023 – 2028

Figure-37: Technology – Others Market (Million US$), 2018 – 2022

Figure-38: Technology – Forecast for Others Market (Million US$), 2023 – 2028

Figure-39: Product Types – Services Market (Million US$), 2018 – 2022

Figure-40: Product Types – Forecast for Services Market (Million US$), 2023 – 2028

Figure-41: Product Types – Instruments Market (Million US$), 2018 – 2022

Figure-42: Product Types – Forecast for Instruments Market (Million US$), 2023 – 2028

Figure-43: Product Types – Reagents Market (Million US$), 2018 – 2022

Figure-44: Product Types – Forecast for Reagents Market (Million US$), 2023 – 2028

Figure-45: Product Types – Infectious Disease Market (Million US$), 2018 – 2022

Figure-46: Product Types – Forecast for Infectious Disease Market (Million US$), 2023 – 2028

Figure-47: Application – Diabetes Market (Million US$), 2018 – 2022

Figure-48: Application – Forecast for Diabetes Market (Million US$), 2023 – 2028

Figure-49: Application – Cardiology Market (Million US$), 2018 – 2022

Figure-50: Application – Forecast for Cardiology Market (Million US$), 2023 – 2028

Figure-51: Application – Oncology Market (Million US$), 2018 – 2022

Figure-52: Application – Forecast for Oncology Market (Million US$), 2023 – 2028

Figure-53: Application – Nephrology Market (Million US$), 2018 – 2022

Figure-54: Application – Forecast for Nephrology Market (Million US$), 2023 – 2028

Figure-55: Application – Autoimmune Diseases Market (Million US$), 2018 – 2022

Figure-56: Application – Forecast for Autoimmune Diseases Market (Million US$), 2023 – 2028

Figure-57: Application – Drug Testing Market (Million US$), 2018 – 2022

Figure-58: Application – Forecast for Drug Testing Market (Million US$), 2023 – 2028

Figure-59: Application – Other Applications Market (Million US$), 2018 – 2022

Figure-60: Application – Forecast for Other Applications Market (Million US$), 2023 – 2028

Figure-61: End User – Hospitals Market (Million US$), 2018 – 2022

Figure-62: End User – Forecast for Hospitals Market (Million US$), 2023 – 2028

Figure-63: End User – Laboratories Market (Million US$), 2018 – 2022

Figure-64: End User – Forecast for Laboratories Market (Million US$), 2023 – 2028

Figure-65: End User – Home - Care Market (Million US$), 2018 – 2022

Figure-66: End User – Forecast for Home - Care Market (Million US$), 2023 – 2028

Figure-67: End User – Others Market (Million US$), 2018 – 2022

Figure-68: End User – Forecast for Others Market (Million US$), 2023 – 2028

Figure-69: Roche Diagnostics – Global Revenue (Billion US$), 2018 – 2022

Figure-70: Roche Diagnostics – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-71: Abbott Diagnostics – Global Revenue (Billion US$), 2018 – 2022

Figure-72: Abbott Diagnostics – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-73: Siemens Healthineers – Global Revenue (Billion US$), 2018 – 2022

Figure-74: Siemens Healthineers – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-75: Danaher Corporation – Global Revenue (Billion US$), 2018 – 2022

Figure-76: Danaher Corporation – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-77: Thermo Fisher Scientific – Global Revenue (Billion US$), 2018 – 2022

Figure-78: Thermo Fisher Scientific – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-79: Sysmex Corporation – Global Revenue (Million US$), 2018 – 2022

Figure-80: Sysmex Corporation – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-81: QIAGEN N.V. – Global Revenue (Million US$), 2018 – 2022

Figure-82: QIAGEN N.V. – Forecast for Global Revenue (Million US$), 2023 – 2028

List of Tables:

Table-01: France – In-Vitro Diagnostics Market Share by Test Types (Percent), 2018 – 2022

Table-02: France – Forecast for In-Vitro Diagnostics Market Share by Test Types (Percent), 2023 – 2028

Table-03: France – In-Vitro Diagnostics Market Share by Technology (Percent), 2018 – 2022

Table-04: France – Forecast for In-Vitro Diagnostics Market Share by Technology (Percent), 2023 – 2028

Table-05: France – In-Vitro Diagnostics Market Share by Products (Percent), 2018 – 2022

Table-06: France – Forecast for In-Vitro Diagnostics Market Share by Products (Percent), 2023 – 2028

Table-07: France – In-Vitro Diagnostics Market Share by Application (Percent), 2018 – 2022

Table-08: France – Forecast for In-Vitro Diagnostics Market Share by Application (Percent), 2023 – 2028

Table-09: France – In-Vitro Diagnostics Market Share by End User (Percent), 2018 – 2022

Table-10: France – Forecast for In-Vitro Diagnostics Market Share by End User (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com