France Pet Food Market, Population by Animal Type, Products (Premium, Economy, Mid-priced,Treats, Mixers), Distribution, Product Launch, Company

Buy NowGet Free Customization in This Report

France, a developed country with an aging population, people are turning to cats and dogs for companionship while other than the age group, young people are living mostly single or childless view pets as a better alternative. Almost half of the French household owns pet including cats, dogs, birds, fish, rabbit, and others. Pet owners are increasingly taking care of their pet’s food as some pet foods may cause health allergies and deteriorate their pets’ general wellbeing or level of fitness. In France, pets are more seen as family members, and so the pet owners are gradually buying premium pet foods which are customized particularly for their pet’s breed and age. Hence, French pet owners spend more on their pet functional foods and their supplements. Also, French pet owners are especially looking out for the products that contain a best possible nutritional value for their pets, as they think it reflects their own values and lifestyle choice, which is further expected to drive the growth of France Pet Food Market immensely. France Pet Food Market is expected to be USD 5 Billion by the end of year 2025.

French pet owners increasingly want healthy food choices for their pet. On an estimate in the major EU5 market, nearly 5,000 pet food products were launched in a period of 2015 to 2018, of which more than 700 products were launched in France only. Witnessing the growing consumer demand, pet food manufacturers are increasingly focused to improve its products quality and expand its product portfolio in the region, which further provides traction to the France Pet Food Market to the years yet to come.

Renub Research report titled "France Pet Food Market, Population by Animal Type (Cat, Dog, Others) Products - Premium, Economy, Mid-priced (Food - Dry, Wet), Dog/Cat (Treats, Mixers), Distribution (Store-based Retailing, Online Selling, Veterinary Clinics), Product Launch (Claims, Nutritional Component, Flavors) Company (Mars Incorporated, Nestle Purina, Royal Canin, Hill's Pet Nutrition)” provides an all-encompassing analysis on the France Pet Food Market.

Animal Type – France Pet Food Market by Products & Sub-products

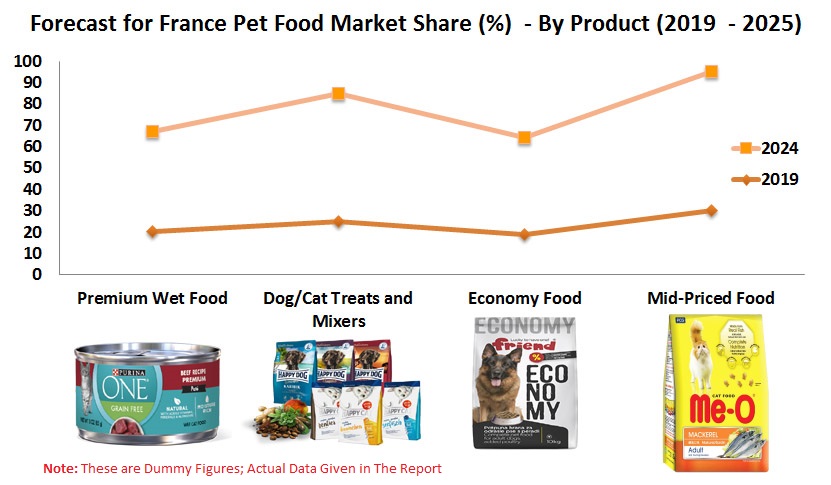

In this report we have divided Dog and Cat food market in 4 products and all these 4 products is further divided into 2 sub-products.

1) Premium Food, (Premium Dry Food, Premium Wet Food)

2) Dog/Cat Treats and Mixers (Dog/Cat Mixers, Dog/Cat Treats)

3) Economy Food (Economy Dry Food, Economy Wet Food)

4) Mid-Priced Food (Mid-priced Dry Food, Mid-priced Wet Food)

By distribution channel Online Market Is Growing

By distribution channel, we have segmented, Store-based Retailing, Non-Store Retailing (Online), Non-Retail Channels (Veterinary Clinics). In France pet food market, Non-Store Retailing (Online) is growing at a fast pace.

In France, fast development of electronic commerce (e-commerce) and coverage of internet access is growing; consumers are more comfortable with online purchasing of pet food items. Companies like Amazon, Taobao.com, Petco etc were fastest growing online channels in France pet food market. Grocery stores, especially in supermarkets and hypermarkets are some of the preferred stores for France Pet owners.

Product Launched in France during 2015 to 2018

In this report, we have investigated, Product Claims, Nutritional Component, Flavors, and New Product Examples for Pet food. In addition, a total of 4,989 products were launched in 5 European countries, and in France 726 products were launched. Hello Cat Aliment (Mini Chicken Strips) Cat snacks and treats, Advance Veterinary Diets (Cat food dry) was launched in France from March 2015 to March 2018.

Company Analysis

In this report we have investigated key initiatives of companies such as Hill's Pet Nutrition, Mars Incorporated, Nestle Purina Pet Food and Royal Canin

Animal Type (Dog & Cat) – Products & Sub-products

• Premium Wet Food

o Premium Dry Food

o Premium Wet Food

• Dog/Cat Treats and Mixers

o Dog/Cat Mixers

o Dog/Cat Treats

• Economy Food

o Economy Dry Food

o Economy Wet Food

• Mid-Priced Food

o Mid-priced Dry Food

o Mid-priced Wet Food

By Distribution Channel

• Store-based Retailing

• Non-Store Retailing (Online)

• Non-Retail Channels (Veterinary Clinics)

Pet Food - Product Launched

• Product Claims

• Nutritional Component

• Flavors

• New Product Examples

Company Analysis

• Mars Incorporated

• Nestle Purina Pet Food

• Royal Canin

• Hill's Pet Nutrition

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Drivers

4.1.1 Humanization is Influencing the Purchase Decisions

4.1.2 Isolation Factor Rising in France

4.2 Challenges

4.2.1 Negative Impact of Product Recalls

4.2.2 Pet Food’s Role in Pet Obesity

5. Policies, Rules & Regulation – France Pet Food

5.1 Regulations Imposed on Pet Food

5.2 Objectives of FEDIAF’s Guidelines

5.3 Responsibilities of Companies in the Animal Feed Sector

5.4 Restrictions and Prohibition

6. France Pet Food Market

7. Market Share – France Pet Food

7.1 Dog Food Market Share Analysis by Products and Sub-Products

7.2 Cat Food Market Share Analysis by Products And Sub-Products

8. France dog Pet Food Market by Products And Sub Products

8.1 France Dog Pet Food Market by Products And Sub Products

8.2 France Cat Pet Food Market by Products And Sub Products

8.3 Others Pet Food Market

9. Animal Type – France Pet Population

9.1 Dog & Cat Pet Population

9.2 Other Pet Population

10. Number & Type of Product Launch

10.1 Product Claims

10.2 Nutritional Component

10.3 Flavors

10.4 New Product Examples

11. Distribution Channels – France Dog Food Market

11.1 Store-based Retailing

11.2 Non-Store Retailing (Online)

11.3 Non-Retail Channels (Veterinary Clinics)

12. Distribution Channels – France Cat Food Market

12.1 Store-based Retailing

12.2 Non-Store Retailing (Online)

12.3 Non-Retail Channels (Veterinary Clinics)

13. Mergers & Acquisitions

14. Company Analysis

14.1 Mars Incorporated

14.1.1 Overview

14.1.2 Initiatives & Strategy

14.2 Nestle Purina

14.2.1 Overview

14.2.2 Initiatives & Strategy

14.3 Royal Canin

14.3.1 Overview

14.3.2 Strategy

14.4 Hill's Pet Nutrition

14.4.1 Overview

14.4.2 Strategy

List of Figures:

Figure-01: France - Pet Food Market, 2013 – 2018

Figure-02: France - Forecast For Pet Food Market, 2019 – 2025

Figure-03: France - Dog Food Market By Store Based Retailing , 2013 – 2018

Figure-04: France – Forecast Dog Food Market By Store Based Retailing , 2019 – 2025

Figure-05: France - Dog Food Market By Non-Store Based Retailing , 2013 – 2018

Figure-06: France – Forecast Dog Food Market By Non-Store Based Retailing, 2019 – 2025

Figure-07: France - Dog Food Market By Non-Retail Channels , 2013 – 2018

Figure-08: France – Forecast Dog Food Market By Non-Retail Channels, 2019 – 2025

Figure-09: France – Cat Food Market By Store Based Retailing, 2013 – 2018

Figure-10: France – Forecast Cat Food Market By Store Based Retailing, 2019 – 2025

Figure-11: France – Cat Food Market By Non-Store Based Retailing, 2013 – 2018

Figure-12: France – Forecast Cat Food Market By Non-Store Based Retailing, 2019 – 2025

Figure-13: France - Cat Pet Food Market By Total Distribution Channels , 2013– 2018

Figure-14: France - Forecast Cat Pet Food Market By Total Distribution Channels , 2019 – 2025

List of Tables:

Figure-01: France - Dog Pet Food Market Share by Products and Sub-Product (in Percent) 2013- 2018

Figure-02: France – Forecast for Dog Pet Food Market Share by Products and sub-products in (Percent) 2019 - 2025.

Figure-03: Cat Pet Food - Market Share by Products and Sub-Products (Percent), 2013 - 2018

Figure-04: Cat Pet Food - Forecast for Market Share by Products and Sub-Products (Percent), 2019 - 2025

Figure-05: France - Dog Pet Food Market By Products and Sub-Products, (in Million US$) 2013 – 2018

Figure-06: France - Forecast Dog Food Market by Products and Sub Products (in Million US$), 2019 – 2025

Figure-07: France - Cat Pet Food Market By Products and Sub Products in Million, 2013– 2018

Figure-08: France - Forecast Cat Pet Food Market By Products and Sub Products in Million, 2019 – 2025

Figure-09: France – Other Pet Food Market (Million US$), 2013 – 2018

Figure-10: France – Forecast for Other Pet Food Market (Million US$), 2019 – 2025

Figure-11: France - Pet Population Dogs and Cats (In Thousand), 2013 – 2018

Figure-12: France - Forecast for Pet Population by Dogs and Cats In Thousand, 2019 – 2025

Figure-13: France - Pet Population by Others (In Thousand) , 2013 – 2018

Figure-14: France - Forecast for Pet Population by Others In Thousand, 2019 – 2025

Figure-15: Top Five European Markets - Number of Launches, Between March 2015 and March 2018

Figure-16: Top Five European Markets - "Functional Pet" Claims Associated With Pet Food Products, Number of Launches, Between March 2015 and March 2018

Figure-17: Other Top Claims ,Top Five European Markets, Between March 2015 and March 2018

Figure-18: France - Nutritional Component Of Pet Food Products, Percentage Of Products launched From 2015 to 2017

Figure-19: France - Ingredient Preparation of Pet Food Products, Percentage of Products Launched between 2015 to 2017

Figure-20: France - Number of Launches by Flavor Component, from 2015 to 2017

Figure-21: France - Top Flavors And Varieties For Dog And Cat Food, From 2015 to 2017

Figure-22: France - Number Of launches By Flavor Component, From 2015 to 2017

Figure-23: SSP - Hello Cat Aliment Complémentaire Pour Chats (Mini Chicken Strips)

Figure-24: Saint Bernard- Tooky Oreille de Boeuf Séchée (Dry Beef Ear)

Figure-25: Bob Martin - Clear Snacks Pour l'Hygiène Intestinale (Snacks For Intestinal Hygiene)

Figure-26: MultiFit Tiernahrung- Pet Balance Medica (Cat Dry Food)

Figure-27: Affinity Pet Care- Advance Veterinary Diets Aliment Complet pour Chat Obésité (Obesity Complete Cat Food)

Figure-28: Yarrah Organic Petfood- Yarrah Aliment Complet Pour Chiens Bio (Organic Dog Food With Rosehips)

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com